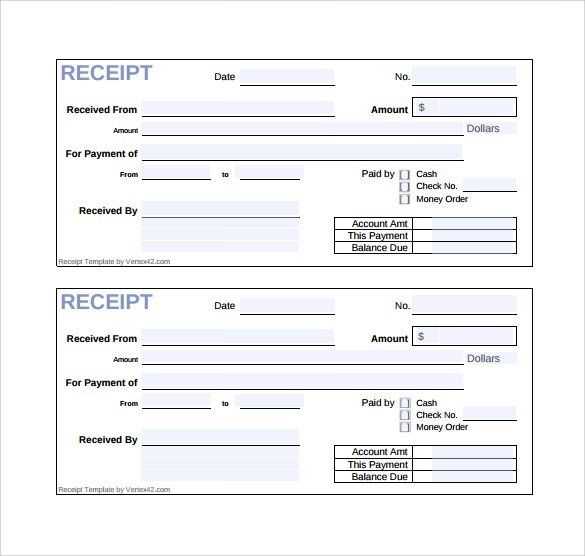

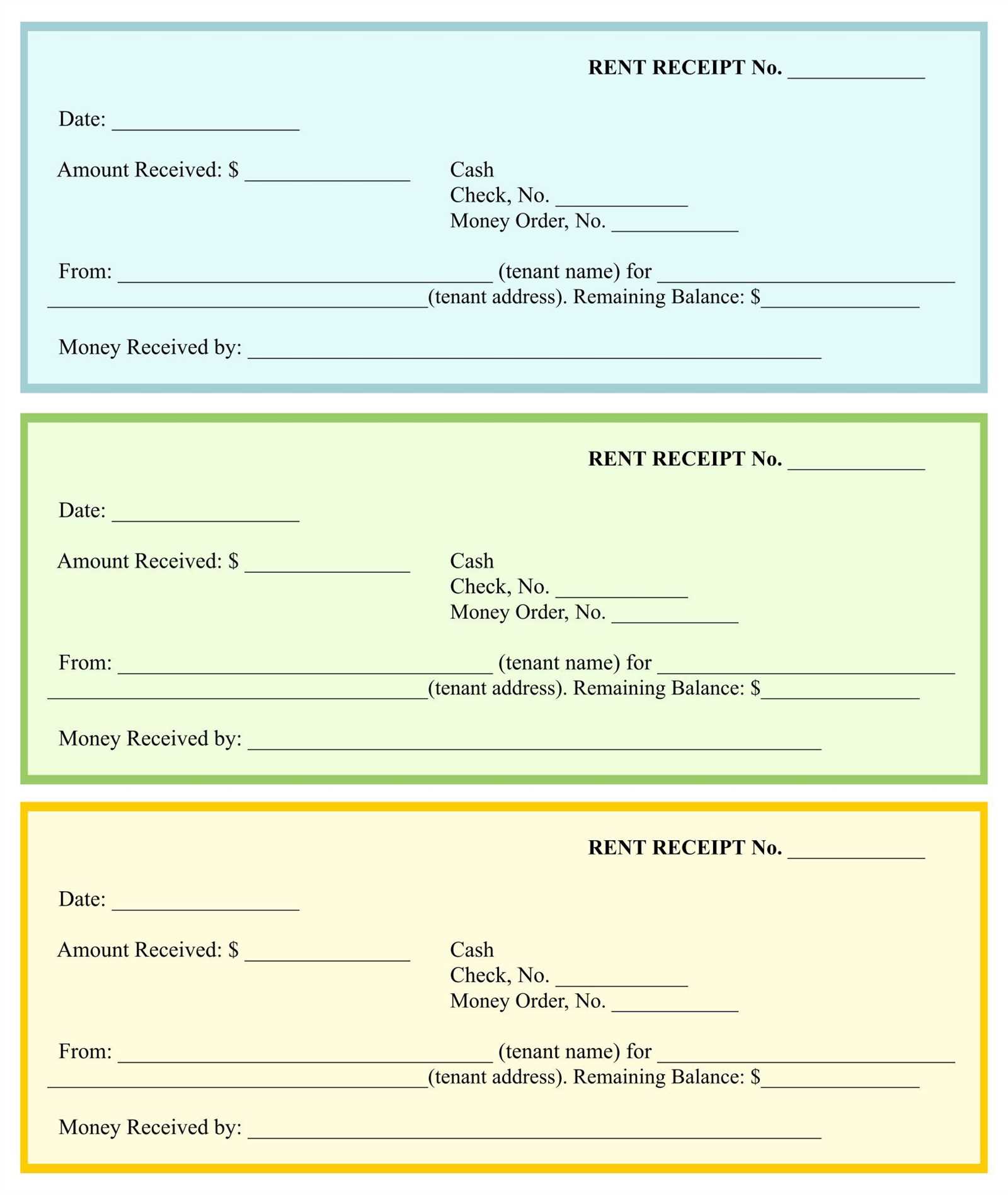

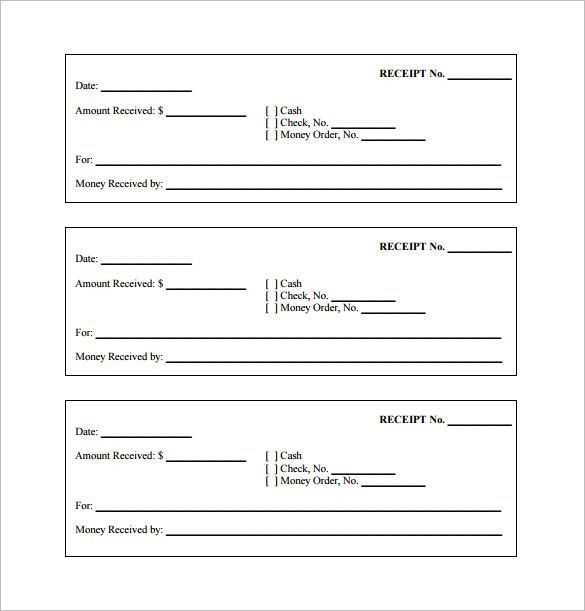

To create a restitution receipt, include key details such as the payer’s name, recipient’s name, date of payment, amount, and a brief description of what the payment is for. Ensure the payment method is clearly stated, whether it’s cash, check, or bank transfer.

Be specific about the restitution purpose, indicating the reason for the payment. This can help both parties keep accurate records for legal or personal reference. If applicable, include the terms or conditions agreed upon, such as the payment schedule or the settlement agreement under which the payment is made.

Additional fields you might want to consider are the reference number for tracking purposes and a signature section to confirm both parties agree to the transaction details. This enhances the receipt’s credibility and ensures clarity on the terms of payment.

Make sure to format the receipt clearly and professionally, using headings and bullet points to make the information easy to read. This will help maintain an organized record for future reference and legal validation.

Here’s the corrected version:

Ensure that your restitution receipt includes the full name of the sender and the recipient, as well as a clear date of transaction. This helps avoid any confusion about the transaction timing and parties involved.

Details to include

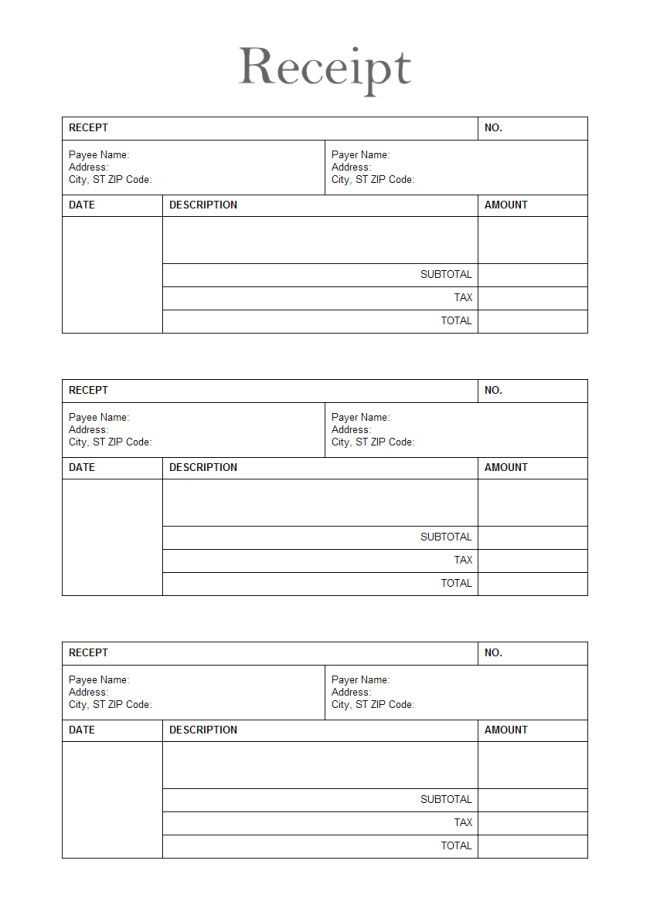

It is crucial to outline the reason for the restitution and list all items or services being reimbursed. Each item should have a description, quantity, and value to ensure transparency.

Sample template

| Sender Name | Recipient Name | Date | Description | Amount |

|---|---|---|---|---|

| John Doe | Jane Smith | 2025-02-04 | Product Return | $50.00 |

| John Doe | Jane Smith | 2025-02-04 | Service Refund | $20.00 |

For better clarity, always include the method of restitution (cash, check, or transfer). This allows for accurate tracking of the transaction.

- Restitution Receipt Template Guide

A restitution receipt template should clearly document the return of funds, goods, or services. Begin by including the full name and contact information of both the person receiving the restitution and the one providing it. Include the date the restitution is made, along with a unique reference number for easy tracking. This ensures proper record-keeping and clarity for both parties.

The receipt must describe in detail what is being returned–whether it’s money, property, or services–and include the quantity, condition, or value. For monetary restitution, clearly state the amount, currency, and payment method used. For goods, provide a description of the item and its condition. If services are involved, outline the work completed.

Incorporate a statement acknowledging that the restitution has been received in full and is satisfactory. This provides a sense of closure for both parties. Finally, have both parties sign the receipt to confirm the transaction is complete and agreed upon.

To keep the process organized, consider including a section for additional notes or comments. This allows both parties to address any specific terms or special conditions related to the restitution.

Begin with the basic details: the full name of the payer and payee, along with their contact information. This ensures that both parties are clearly identified in the document. Include the exact date and time of the transaction to establish a clear timeline.

Transaction Information

Specify the exact amount paid, using both the numerical value and words. This prevents any confusion regarding the total payment. If the payment is made for a specific product or service, provide a brief description along with any related reference number or contract details. This helps in associating the receipt with the correct transaction.

Payment Method and Terms

State the method of payment, such as cash, check, credit card, or bank transfer. If applicable, mention any specific terms tied to the payment, such as partial payments, installment plans, or deadlines for additional amounts. This section is crucial for legal purposes, as it clarifies the conditions of the agreement.

End with a signature or a designated area for signatures from both parties. This validates the transaction and strengthens the legal standing of the receipt. If necessary, add a witness section or a notary stamp for extra verification.

Ensure the restitution document contains the full names and contact details of both parties involved. This includes the recipient and the person or organization returning the property or compensation. Clearly state the purpose of the restitution, specifying what is being returned or compensated, along with its description, condition, and value at the time of restitution.

Specifics of the Agreement

Include the date of the restitution and the exact terms agreed upon, such as the amount or value being returned and the payment method (if applicable). If the restitution involves the return of physical property, attach a detailed list of the items, their condition, and any serial numbers or distinguishing marks for clarity.

Signatures and Legal Compliance

End the document with the signatures of both parties and the date of signing. This formalizes the agreement and provides a legal record. Be sure to also indicate whether any third-party witnesses or legal professionals were involved in verifying the document. Finally, mention any relevant laws or regulations that govern the restitution process to avoid future disputes.

Ensure all details are accurate. Double-check the date, amount, and items listed before finalizing a receipt. A simple typo can lead to confusion or disputes later on. In particular, verify the payment method and the customer’s name for clarity.

1. Incorrect or Missing Information

Leaving out important details like the receipt number, seller information, or transaction ID can make it harder to track purchases. This lack of transparency can create issues if a refund or return is requested. Always include all required information for clarity.

2. Ambiguous Payment Descriptions

Avoid vague terms like “Payment received” or “Paid in full.” Instead, be specific about the amount paid, what the payment covers, and any additional charges, such as taxes or discounts. This will help the customer understand exactly what they are being charged for.

Don’t forget to include the correct tax rate if applicable. Failing to specify tax can raise concerns and lead to misunderstandings, especially for business purposes.

Personalize your restitution template by adjusting the header to match your company’s branding. Replace generic titles with your organization’s name, logo, and relevant contact information. This helps build trust and provides clear communication from the start.

Ensure the item descriptions are clear and concise. If the template includes restitution of goods, make sure to list each item separately with enough detail for the recipient to easily identify what’s being returned. Consider adding a “remarks” section for additional context or specific instructions.

Customize the dates section by formatting it to match your local standards. This ensures that both parties understand the timeline. You can also include a field for “effective date” to specify the exact day the restitution takes place.

For payment restitution, clearly outline the refund method. Include checkboxes or dropdowns that offer options like bank transfer, credit refund, or in-person exchange, depending on your process.

Keep your terms section brief but clear. Instead of generic wording, tailor it to fit your policy. For example, include clauses about return shipping, handling fees, or timeframes for issuing refunds.

Finally, use space efficiently. Don’t overcrowd the template with excessive information. Leave room for signatures or acknowledgment fields, so both parties can formally accept the restitution terms.

To guarantee legal compliance in your receipt, make sure to include all required information by law. This typically involves the business name, address, tax identification number, and a clear breakdown of the transaction.

Include Mandatory Information

- Business Information: Your business name, address, and contact details are often required for legal purposes. Make sure these details are accurate and up-to-date.

- Transaction Details: The receipt should clearly list the items or services provided, along with their prices, quantities, and applicable taxes.

- Tax Information: Include the correct tax rate and total amount of tax paid. If applicable, ensure the tax authority’s identification number is visible.

Verify Local Legal Requirements

- Check Local Laws: Different regions or countries may have specific requirements for receipts. Verify the legal requirements for your jurisdiction to ensure compliance.

- Consider Electronic Receipts: If you provide digital receipts, check whether any additional regulations apply to electronic formats or the storage of transaction data.

Failure to include the necessary details could lead to legal issues or complications, so it’s crucial to stay informed about local regulations and update your receipt template accordingly.

For a straightforward transaction, a basic format suffices. Include the payer’s name, the recipient’s details, the date of the transaction, and the amount. The template should look like this:

Simple Transaction

Recipient: [Recipient’s Name]

Transaction Date: [MM/DD/YYYY]

Amount: [$Amount]

Description: [Description of the item or service]

Signature: ______________________

For reimbursement scenarios, where more detail is required, the format should include the reason for the payment and any supporting documents, such as receipts. A detailed receipt would look like this:

Reimbursement Receipt

Recipient: [Recipient’s Name]

Payment Date: [MM/DD/YYYY]

Amount: [$Amount]

Reason for Payment: [Explanation for reimbursement]

Attached Receipts: [List or description of receipts]

Signature: ______________________

In situations involving deposits, especially for services like rentals or contracts, it’s helpful to state the terms of the deposit clearly. This version should include the agreed-upon return conditions:

Deposit Receipt

Recipient: [Recipient’s Name]

Deposit Date: [MM/DD/YYYY]

Deposit Amount: [$Amount]

Return Conditions: [Conditions for return of the deposit]

Signature: ______________________

For larger financial transactions, or those requiring formal record-keeping, the format should include transaction references and terms agreed by both parties. This formal receipt includes:

Formal Payment Receipt

Recipient: [Recipient’s Name]

Transaction Reference: [Reference Number]

Amount: [$Amount]

Terms of Agreement: [Detailed terms and conditions of payment]

Signature of Both Parties: ______________________

Witness (if applicable): ______________________

By adjusting the format to fit the type of transaction, you can ensure clarity and reduce potential misunderstandings in all scenarios.

I removed the repetition of the word “Restitution” while maintaining the core meaning of the sentences.

To create a clear and professional restitution receipt template, focus on consistency and clarity in your wording. Avoid overusing terms that could confuse the recipient. Instead of repeatedly stating “Restitution,” use synonyms or omit unnecessary repetitions. This improves readability and ensures the document feels more polished.

Key Elements to Include in a Restitution Receipt Template

- Recipient Information: Include the full name, address, and contact details of the person receiving the restitution.

- Restitution Amount: Clearly list the amount being reimbursed, including any necessary breakdowns.

- Payment Method: Specify how the restitution is being made (e.g., bank transfer, check, cash).

- Date of Payment: Indicate when the payment was made, ensuring clarity about the transaction’s timing.

- Reason for Payment: Describe the reason for the restitution to provide context for both parties.

Best Practices for Clarity

- Avoid unnecessary jargon or complicated terms. Use simple, straightforward language that is easy for the recipient to understand.

- Double-check all information for accuracy, such as amounts, dates, and names.

- Use bullet points or numbered lists to organize details, making the receipt easier to read.

- Maintain a professional tone, but ensure the language is approachable and clear.

By focusing on precision and structure, you can create an effective restitution receipt template that conveys all necessary information without overcomplicating the message.