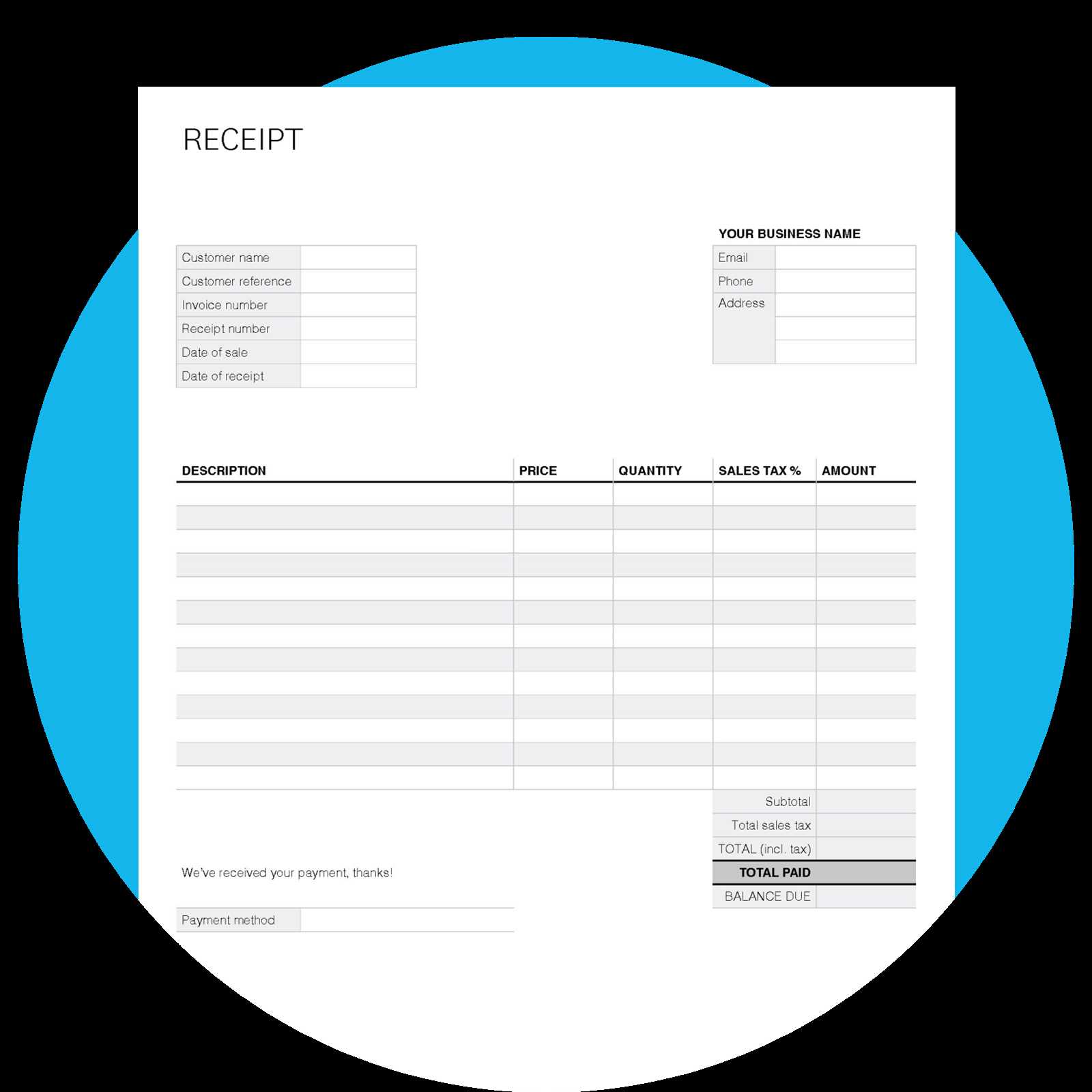

For clear and professional receipts, start by selecting a template that includes essential details such as the store name, contact information, and transaction date. These elements make it easier for customers to reference their purchases and for your business to track sales efficiently.

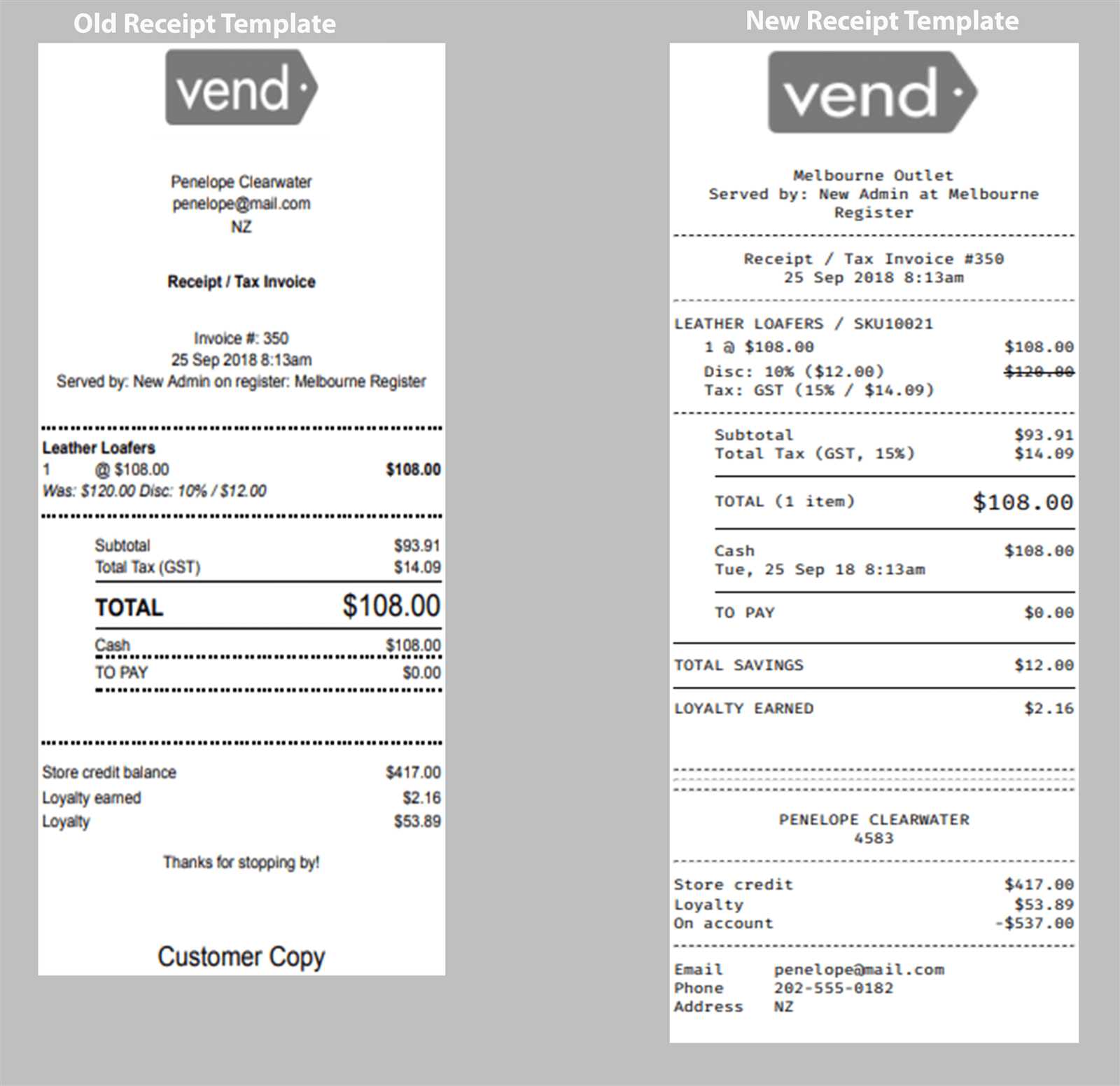

Ensure that item descriptions are precise and include quantities, unit prices, and totals. This transparency minimizes misunderstandings and improves customer satisfaction. Tax breakdowns and discounts should also be clearly displayed to keep everything transparent.

Another important aspect is incorporating a unique receipt number for each transaction. This practice simplifies bookkeeping and aids in resolving potential disputes. Including a personalized thank-you message at the bottom of the receipt can also leave a positive impression on your customers.

Finally, consider saving digital templates in formats such as PDF for easy sharing and archiving. A thoughtfully designed receipt template not only enhances professionalism but also streamlines daily operations.

Here’s the Corrected Version of the Text Without Redundancies:

To create a practical and user-friendly retail receipt template, focus on the following essential elements:

- Header Information: Include the store’s name, address, and contact details at the top.

- Transaction Details: Display the date, time, receipt number, and cashier identifier clearly.

- Itemized List: Provide a detailed breakdown of purchased items, including product names, quantities, unit prices, and subtotal amounts.

- Tax and Discounts: Show applicable taxes and any discounts applied, with clear labels for transparency.

- Total Amount: Highlight the final total amount prominently for quick reference.

- Payment Method: Specify how the transaction was completed, such as by card, cash, or mobile payment.

- Return Policy: Briefly outline refund or exchange terms, if applicable.

- Footer Message: Add a thank-you note or promotional message to enhance customer engagement.

By adhering to these points, your receipt will remain concise, informative, and professionally structured.

- Retail Receipt Template: Practical Insights and Solutions

To create a clear and professional retail receipt, prioritize readability and accurate information placement. Key components include transaction details, payment method, and return policy.

Key Elements for an Effective Template

| Section | Details to Include |

|---|---|

| Header | Business name, logo, contact information |

| Transaction Details | Date, time, unique receipt number |

| Itemized List | Product names, quantities, unit prices, total |

| Payment Summary | Subtotal, tax, total amount, payment method |

| Return Policy | Clear conditions for refunds or exchanges |

Practical Tips for Efficient Use

Include barcodes to streamline refunds or exchanges. Digital copies of receipts can reduce paper waste and improve customer convenience. Ensure compliance with local tax regulations by automatically calculating applicable charges.

Begin by using a structured grid system to organize key elements such as store details, itemized purchases, and payment information. This approach ensures clarity and consistency.

Highlight essential information by using bold text for totals, tax amounts, and payment methods. Keeping these sections visually distinct makes it easier for customers to locate critical data at a glance.

Align text elements consistently. For example, list product names on the left and prices on the right, maintaining uniform spacing to create a clean appearance.

Incorporate white space between sections to reduce clutter and improve readability. Avoid cramming too much information in one area, as this can overwhelm the reader.

Finally, ensure that fonts are legible and professional. Choose a size that balances readability with space efficiency, aiming for a harmonious and polished look.

Business Information: Include the official business name, physical address, and contact details. This helps customers identify where the purchase was made and simplifies communication if needed.

Transaction Date and Time: Always display the exact date and time of the purchase to provide a clear record for both the customer and the business.

Itemized List of Purchases: Break down each product or service, including names, quantities, and prices. This transparency prevents disputes and clarifies what was paid for.

Payment Details

Total Amount: Show the sum payable, clearly separating taxes and any discounts applied. This ensures accuracy in the financial record.

Payment Method: Indicate how the payment was made, such as cash, credit card, or digital wallet. Include partial payment information if applicable.

Additional Information

Return and Refund Policies: Provide a brief statement outlining return conditions. This builds trust and reduces misunderstandings.

Receipt or Invoice Number: Assign a unique identifier to each receipt for easier tracking and record-keeping.

Ensure that all sales receipts comply with local tax regulations by clearly displaying applicable tax rates and amounts. This includes specifying whether taxes are included in or added to the listed prices. Failure to do so may lead to penalties or audits by tax authorities.

Maintain accurate customer information when required by law, particularly for high-value transactions. This can help with refund processing and supports anti-fraud measures mandated by financial regulations.

Receipts must contain identifiable details about the transaction, such as the retailer’s full business name, address, and registration number if applicable. Without this information, receipts may not meet legal requirements for both taxation and consumer protection.

Below is an example of a compliant retail receipt format:

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Wireless Headphones | 1 | $150.00 | $150.00 |

| Sales Tax (10%) | – | – | $15.00 |

| Total Amount | $165.00 | ||

By maintaining transparency and accuracy in receipts, retailers not only comply with legal requirements but also build trust with customers.

Ensure readability by choosing clear fonts and appropriate sizes for both printed and digital receipts. Fonts like Arial or Helvetica work well for easy legibility.

Digital Receipts

- Use PDF format for a polished look and easy accessibility across devices.

- Incorporate clickable links for websites or customer service, allowing quick access to further support.

- Limit the text on the receipt. Avoid overwhelming customers with unnecessary details–focus on transaction essentials.

- Consider adding a QR code that leads to digital invoices or promotional content for an interactive experience.

- Ensure receipts are mobile-friendly and display well on both phones and tablets.

Printed Receipts

- Use high-quality paper to prevent smudging and fading, especially for long-lasting receipts.

- Keep text size balanced. It should be large enough for easy reading but not take up excessive space.

- Prioritize critical transaction information such as product names, prices, taxes, and store contact details.

- Incorporate a simple, clean design that complements the brand without overwhelming the customer.

- Print only what’s necessary. Avoid excessive wording or unimportant details that might clutter the receipt.

Customize receipt templates to fit your business’s specific requirements. Focus on the details that matter most for your operations, whether it’s for retail, hospitality, or service industries. Begin with adjusting the layout to reflect your brand’s identity, such as logos, color schemes, and fonts. Make sure the template aligns with your customers’ expectations by providing clear and concise information.

Tailoring for Different Industries

For retail businesses, prioritize product descriptions, pricing, and taxes in the template. Including a breakdown of sales taxes or discounts applied can make the receipt more informative. In the hospitality sector, include details like the table number, server name, and tips received. For service-based industries, highlight the service type, duration, and any special notes about the transaction.

Scalability and Custom Fields

Adjust the receipt format for scalability as your business grows. Add custom fields like customer loyalty points, membership information, or order reference numbers to enhance tracking and personalization. Consider integrating automation tools to generate receipts that cater to various transaction types or locations within your business.

Designing receipt templates requires tools that allow for precise control over layout, typography, and data formatting. One of the best tools for this is Adobe InDesign, which offers advanced control over text and image placement, making it ideal for creating visually appealing and functional receipt templates. Its rich set of features allows designers to customize receipts according to brand requirements while ensuring readability and clarity.

For users who need something more user-friendly and affordable, Canva provides a simple interface for designing receipts. It comes with pre-made templates that can be customized quickly, and users can export designs as PDFs or image files. While less feature-heavy than Adobe InDesign, Canva is great for small businesses looking for a fast and easy solution.

Another versatile option is Microsoft Word, which is widely available and familiar to many. Word offers basic receipt template functionality and allows for easy text adjustments, table formatting, and barcode integration. While it lacks advanced graphic design features, it can be sufficient for simple receipt creation.

If you need more flexibility with coding and automation, open-source tools like GIMP and Inkscape allow for high levels of customization. These tools are best suited for users with some technical knowledge, as they offer extensive control over graphical elements and templates. They also support various file formats and can be used for batch processing receipts if needed.

Lastly, for businesses looking to automate receipt generation, specialized software such as QuickBooks or Square provides built-in receipt template options. These tools integrate with point-of-sale systems, making receipt creation seamless for daily transactions without requiring any manual input. Their templates ensure consistency and compliance with financial regulations, saving time and effort for businesses.

Use an organized structure for the list items in a retail receipt template. Make sure to clearly separate each item, including product names, quantities, prices, and totals. This ensures that customers can easily verify their purchase details.

Item Details

List each item with a brief description, including any variations like size or color. If applicable, include SKU or barcode numbers to make it easier to process returns or exchanges.

Transaction Summary

Include a clear breakdown of totals, taxes, discounts, and the final amount due. Make sure the subtotal, tax, and total are easily distinguishable to avoid confusion.