Creating a clear salary receipt template is straightforward, but it’s key to include specific details that make the document professional and easy to understand. Start by listing the employee’s name and position, along with the payment date. This ensures the recipient knows exactly which salary the receipt is for.

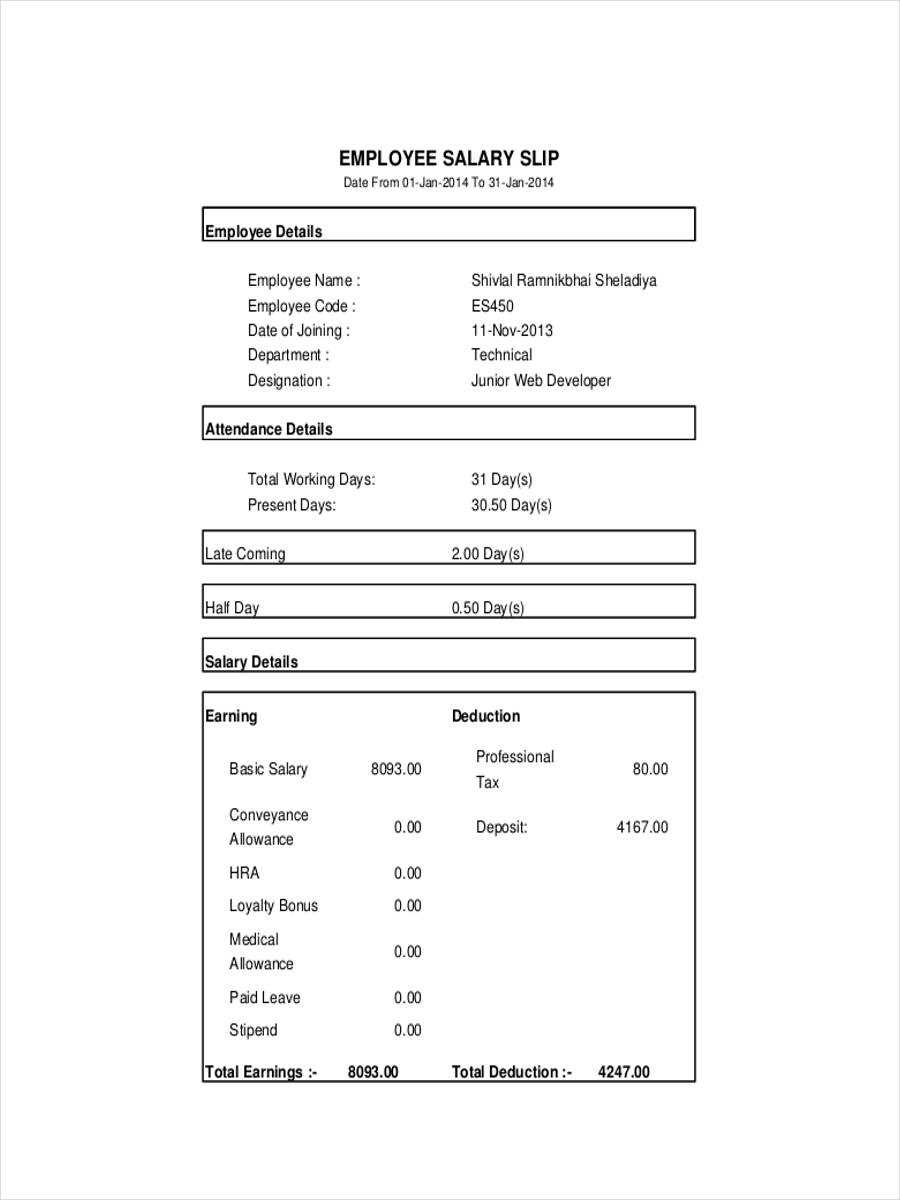

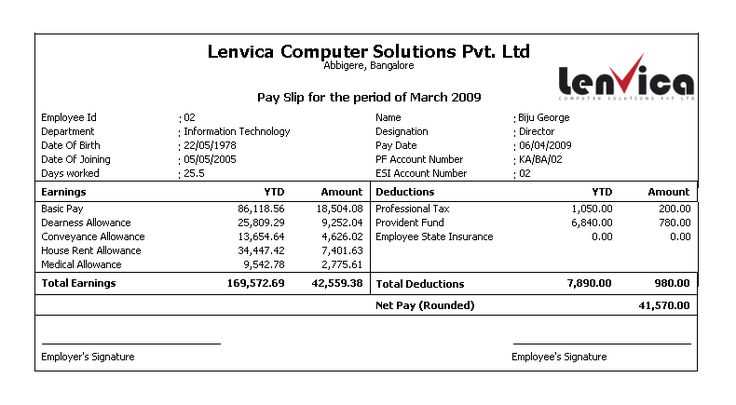

Break down the salary components in an organized way. Include base salary, bonuses, overtime, and deductions like taxes or retirement contributions. Each component should be clearly labeled so that the employee can easily verify the figures. For transparency, it’s a good practice to display gross salary and net salary, showing the deductions that led to the final amount.

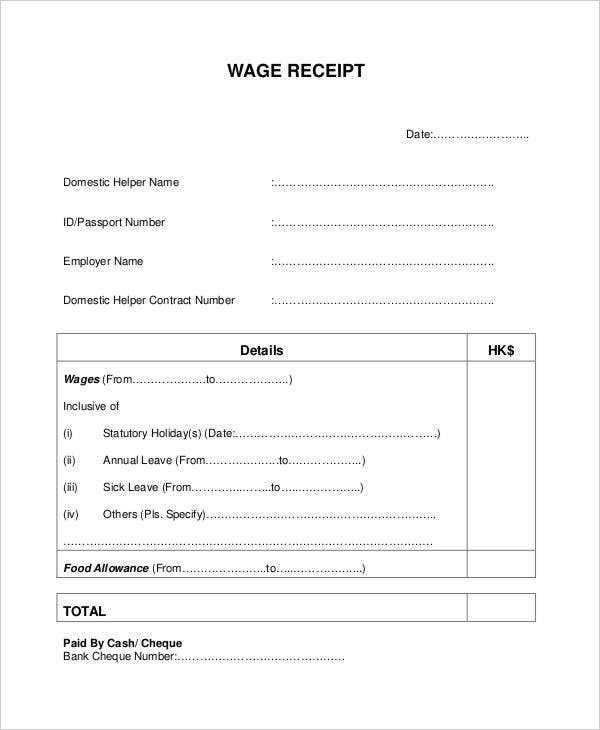

Additional details such as the pay period (weekly, bi-weekly, monthly) should also be included. This helps avoid any confusion regarding which time frame the payment covers. Make sure the receipt also includes the company’s contact information for any follow-up questions.

Finally, use a clean and simple design. Ensure the font is readable, and avoid cluttering the receipt with unnecessary graphics. The focus should be on clarity and accuracy, making it easy for employees to review and store the document. This approach ensures the salary receipt serves as a functional and reliable record.

Steps to Create a Salary Receipt Template

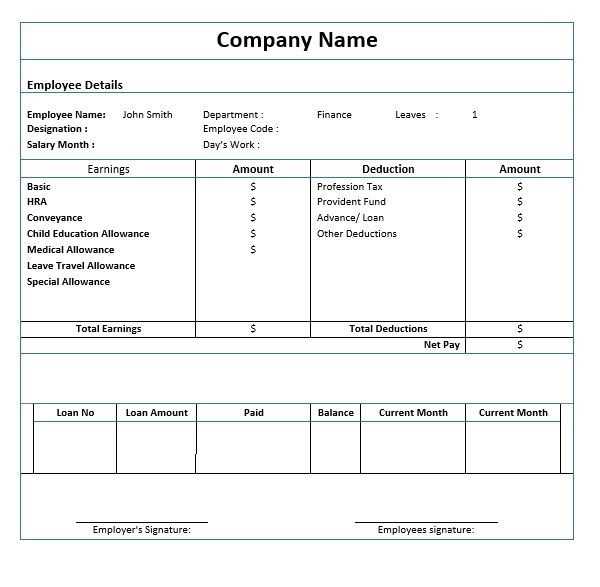

Begin with setting up a clear header. Include the company’s name, address, and contact details. This helps ensure the document looks official and easily identifiable.

Include Employee Information

Next, list the employee’s name, position, and employee ID. This makes it clear who the salary receipt is for and provides an easy reference in case of any discrepancies.

Detail Salary Breakdown

Provide a detailed breakdown of the salary. Include the base salary, bonuses, allowances, and deductions. Ensure each section is clearly labeled to avoid confusion. For example, you can add Basic Salary, HRA, Taxes, and Other Deductions.

Incorporate the payment period and the net amount payable after deductions. This clarifies the employee’s exact earnings for the given period.

Include Payment Method

Specify how the salary was paid–whether by cheque, bank transfer, or another method. This adds transparency to the process and helps with future reference.

End the template with the company’s authorized signature or seal to validate the document.

Key Elements of a Salary Receipt

A salary receipt should clearly display the total earnings, deductions, and net salary. Make sure to include the employee name, payment period, and date of payment. These details help verify the receipt and keep accurate records.

List all earnings, including base salary, overtime, bonuses, and any other compensation. Provide specific figures for each category to ensure transparency.

Include all deductions made from the salary, such as tax withholdings, insurance premiums, and retirement contributions. These deductions must be broken down so the employee understands the amounts being withheld.

The net salary should be calculated after all deductions, and clearly stated at the bottom of the receipt. This is the amount the employee will receive after all deductions have been applied.

Ensure that the employer’s details (name, address, and registration number) are included. This provides authenticity to the document and makes it easier to trace any necessary clarifications.

Lastly, include any additional notes that may be relevant, such as payment methods, bonuses, or specific agreements between the employer and employee. This section helps keep the record complete and ensures both parties have the same understanding.

Customizing a Salary Receipt Template for Different Needs

Adjust your salary receipt template to reflect specific information relevant to your company, local regulations, or employee preferences. Start by ensuring it includes the necessary data like gross salary, deductions, and net income. Customize fields for bonuses, overtime, and commissions to suit various roles.

Incorporating Tax Details

For compliance with tax regulations, ensure the template includes the correct tax codes and percentage deductions. It may also be helpful to provide a breakdown of social security, health insurance, and retirement contributions. This provides transparency and helps employees understand their deductions clearly.

Personalizing Employee Information

Adding customizable fields for employee-specific details–such as job title, department, and hire date–helps tailor each receipt. Use an employee’s full name and unique identification number to avoid confusion when handling multiple receipts. Additionally, consider including a section for accrued leave or paid time off balances to keep employees informed about their benefits.