Key Components of a Salvage Receipt

A well-structured salvage receipt ensures clear records and simplifies legal and financial processes. Include these essential elements:

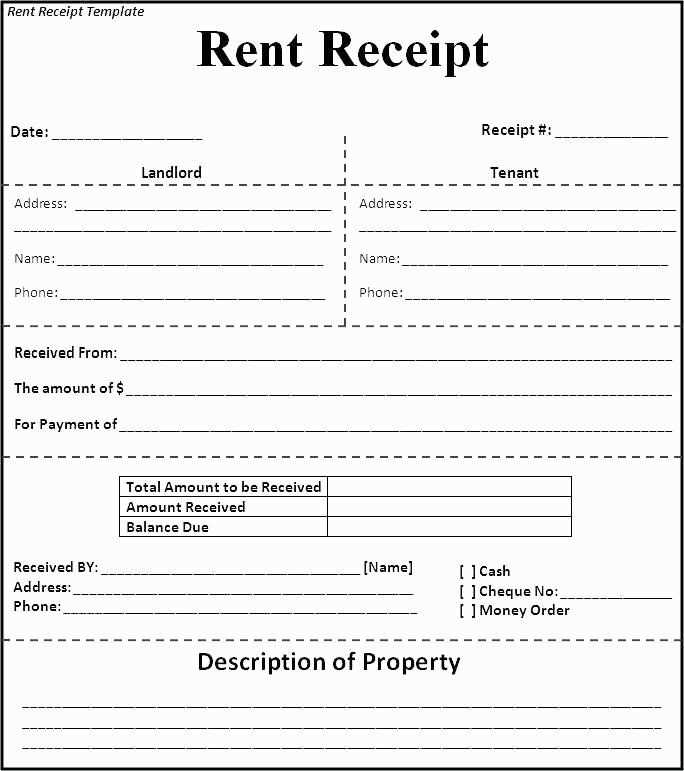

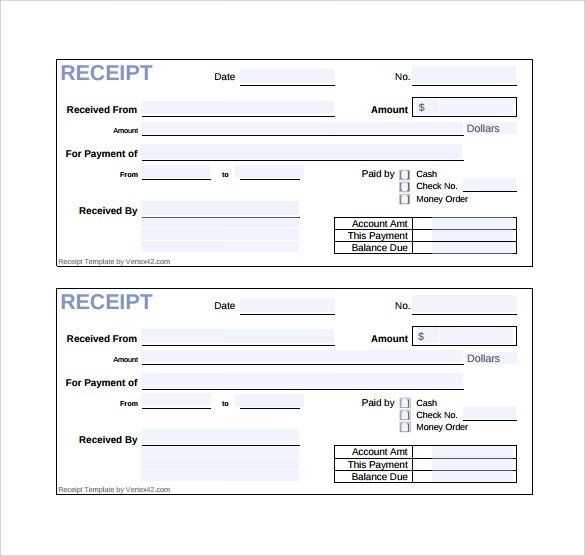

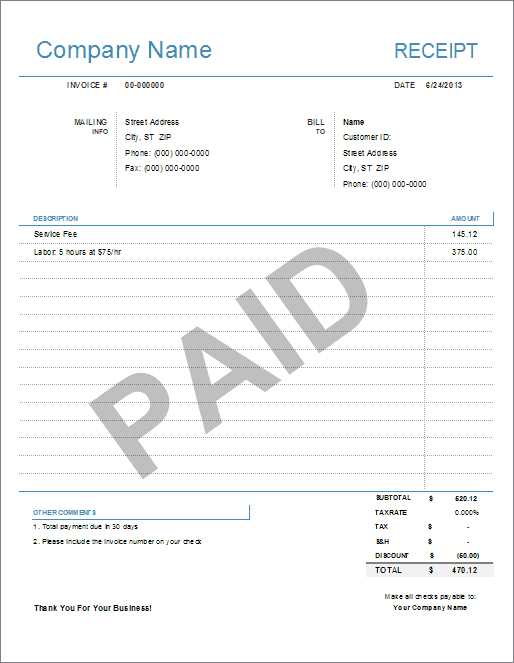

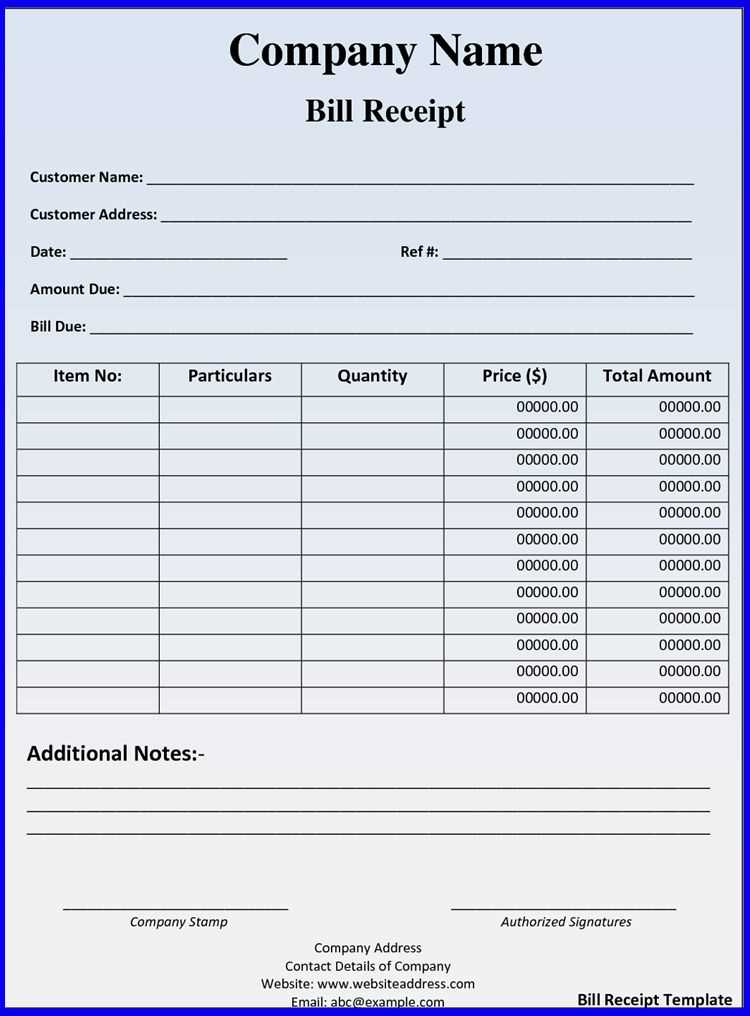

- Date and Time: Specify when the transaction occurred.

- Seller and Buyer Details: Include names, addresses, and contact information.

- Description of Salvaged Items: List materials, condition, and estimated value.

- Transaction Amount: Indicate the agreed price.

- Payment Method: Specify cash, check, or other forms.

- Signature Section: Require signatures from both parties.

Why a Salvage Receipt Matters

Clear documentation prevents disputes and provides proof of ownership transfer. Businesses handling salvage materials benefit from organized records for tax and audit purposes.

Template Example

Use this format as a reference:

| Field | Details |

|---|---|

| Date | [Insert Date] |

| Seller Name | [Insert Name] |

| Buyer Name | [Insert Name] |

| Description | [List Salvaged Items] |

| Amount | [Insert Amount] |

| Payment Method | [Specify] |

| Signatures | _________________________ |

Maintaining detailed receipts supports compliance and streamlines financial tracking. Ensure every transaction is properly recorded for smooth operations.

Salvage Receipt Template

Key Elements to Include in a Salvage Document

How to Structure a Receipt for Legal Compliance

Common Mistakes to Avoid When Creating This Document

Key Elements to Include in a Salvage Document

Ensure the receipt contains identifiable details about the salvaged goods, such as serial numbers, descriptions, and condition reports. Include the date of transaction, the buyer and seller’s full names, and contact information. A statement confirming the transfer of ownership is necessary for legal protection.

How to Structure a Receipt for Legal Compliance

Use a clear format with labeled sections. Start with a title, followed by transaction details, item descriptions, and payment terms. Add a clause stating that the sale is final and the goods are salvaged. Ensure both parties sign and date the document for validity.

Common Mistakes to Avoid When Creating This Document

Avoid vague descriptions that could lead to disputes. Never omit signatures, as this can render the receipt invalid. Ensure the document specifies whether taxes or additional fees apply. Double-check for missing details, as incomplete receipts may not hold up in legal disputes.