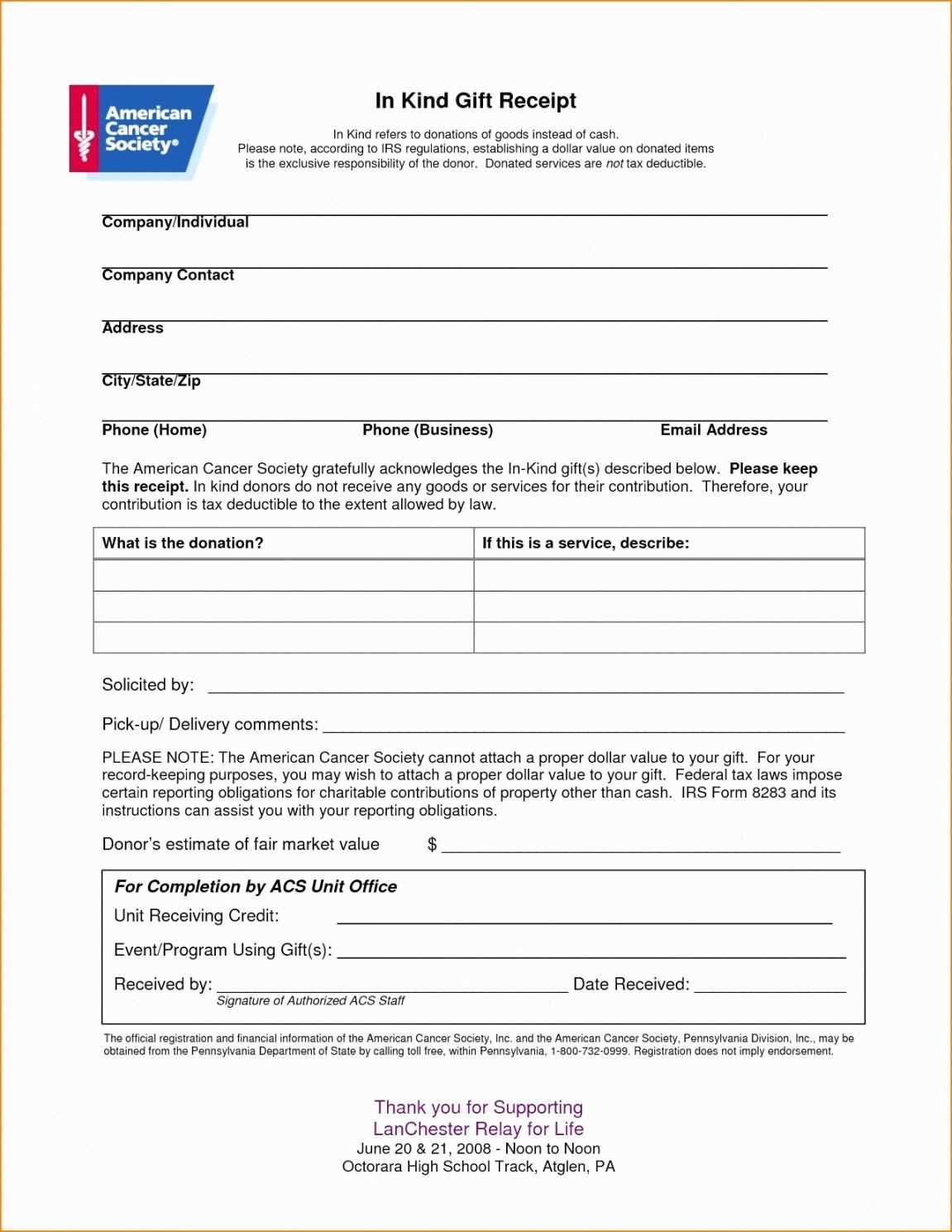

To properly document your donations to The Salvation Army, use a structured receipt template. A well-designed receipt helps both donors and organizations maintain clear records for tax purposes. It should include key details such as the donor’s name, donation date, item descriptions, estimated values, and the organization’s tax-exempt status.

Start with a clean layout that includes The Salvation Army’s official name and contact details. Clearly state that the receipt serves as a record of a charitable contribution and does not assign a monetary value to donated items–this is the donor’s responsibility. Include a section for a signature or an acknowledgment statement to confirm receipt of the donation.

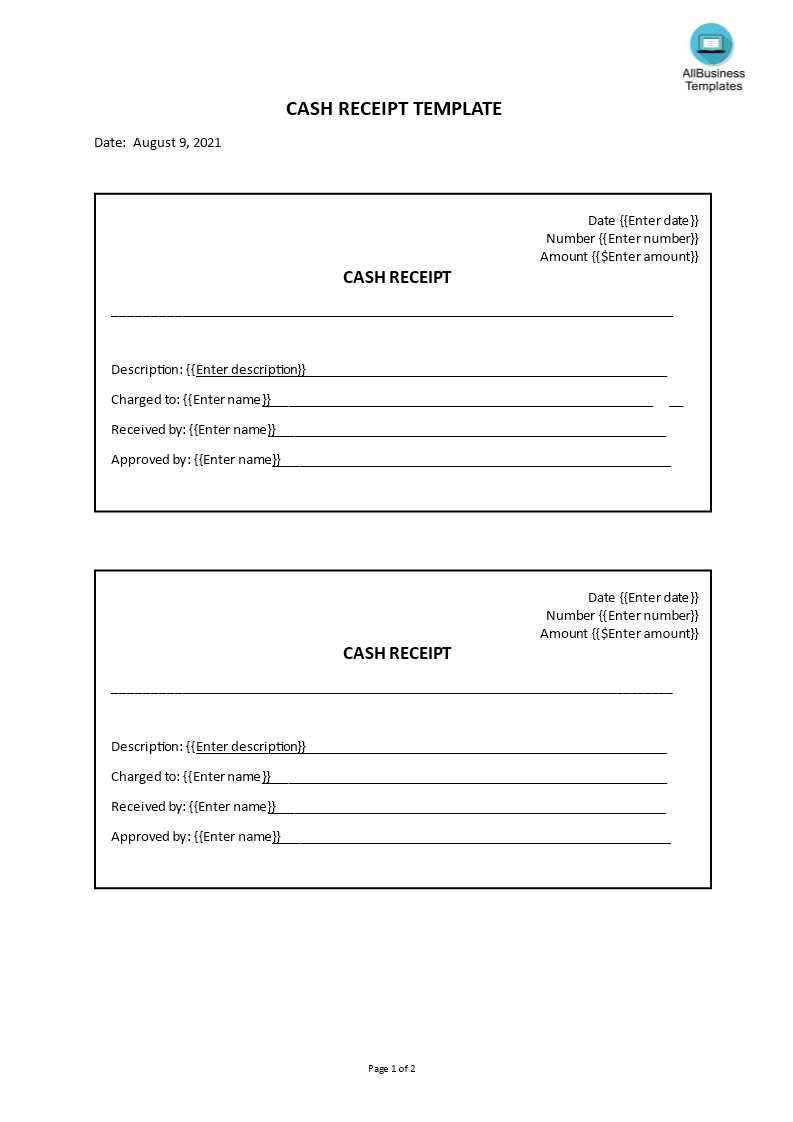

For digital convenience, consider using a fillable PDF or a customized Word template that donors can easily download and complete. This approach ensures consistency and makes record-keeping easier for both parties. If you’re managing donations frequently, integrating a digital tracking system with auto-generated receipts can save time and reduce errors.

By using a structured template, you simplify tax reporting and provide donors with the documentation they need. Whether for individual or bulk donations, a standardized receipt streamlines the process and keeps financial records accurate.

Here is the revised version without redundant word repetitions:

For creating a Salvation Army receipt template, it’s key to include the necessary components clearly. Start with the donor’s name, address, and the date of the donation. Then, specify the items donated or the monetary amount. If applicable, include an itemized list with a brief description and condition. Acknowledge the donation with a thank you message and make sure to mention the Salvation Army’s tax-exempt status. Always sign the document and include contact details for further inquiries.

For accuracy, ensure the format follows standard practices and keeps all information readable. Verify that the donation value is correctly estimated for both goods and cash. This makes the receipt valid for tax purposes and builds trust with donors.

- Salvation Army Receipt Template: Practical Guide

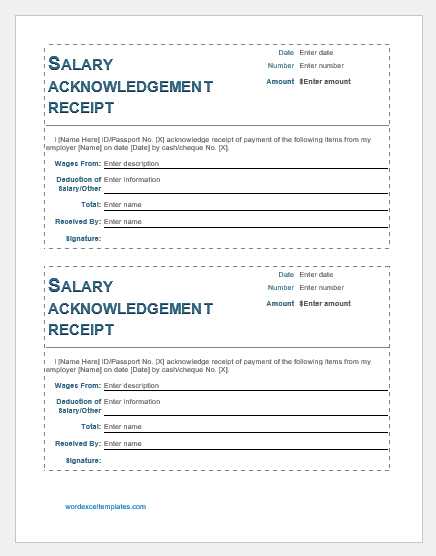

To create a Salvation Army receipt, use their official template to ensure accuracy and consistency. The template should include the following key details:

1. Donor Information: Clearly list the donor’s name and address. If available, include their contact number and email.

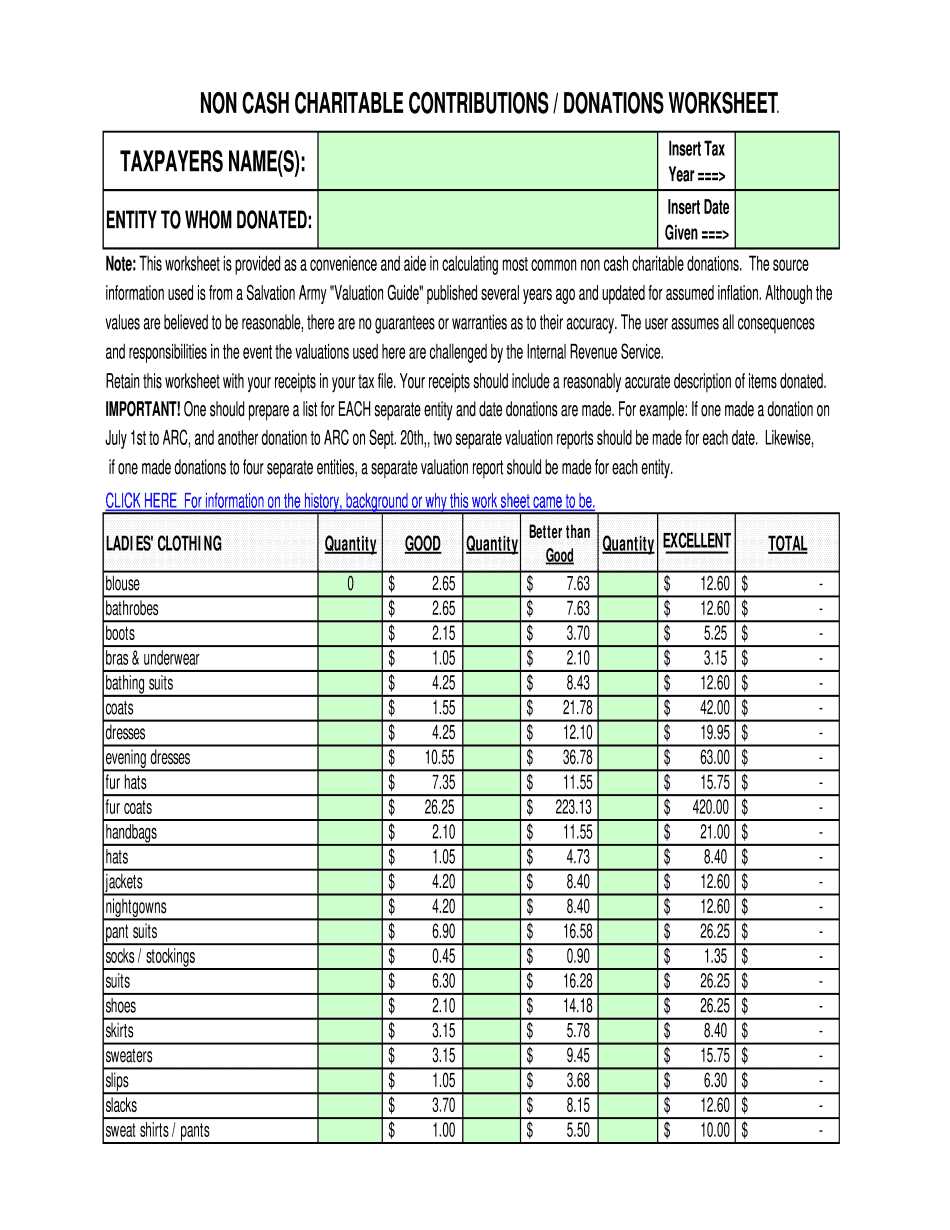

2. Donation Details: Include a description of the items donated or the amount of money contributed. If the donation includes multiple items, itemize them individually with a brief description. Be sure to specify if it is a monetary or in-kind donation.

3. Estimated Value: For in-kind donations, provide an estimated value of the items based on their condition or comparable retail prices. It’s important that both the donor and the Salvation Army agree on these values.

4. Date of Donation: The date should be clearly mentioned to indicate when the donation was made. This helps both the donor and the organization for tax purposes.

5. Acknowledgment Statement: A statement acknowledging the donation and specifying that no goods or services were provided in exchange for the contribution. This is crucial for tax deduction purposes.

6. Signature: The receipt should be signed by a Salvation Army representative to verify the donation.

To ensure the template is used correctly, customize it with your local Salvation Army branch’s contact details. You can find official templates on their website or use an online tool designed for charity receipt generation. Always check that the information is up-to-date and accurate for proper tax filing purposes.

To receive a donation receipt from the Salvation Army, simply follow their clear process. After making a donation, ensure you request a receipt at the time of giving. You can ask for a physical receipt if you drop off items in person or request a digital one if you donate online. For in-person donations, receipts are typically provided at the donation site, often at the counter or through the staff present.

If you donate items and need a receipt later, contact the Salvation Army location where you dropped off your donation. Provide details such as the date of the donation and the nature of the items. Some locations may require you to complete a simple form to process the receipt request. If you’re donating online, your receipt should be emailed automatically after the transaction is completed.

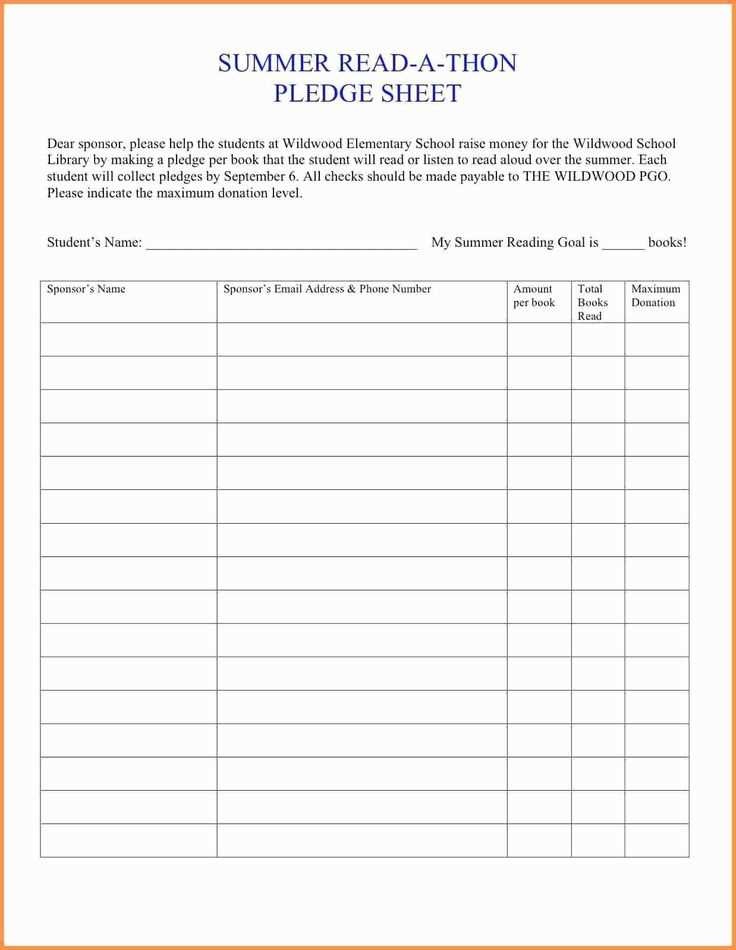

For larger donations or those that require itemized lists, ensure you itemize your donations on the receipt form. This is particularly helpful for tax purposes, as the Salvation Army can assist you in providing a detailed account of the donated goods.

If you’re uncertain about the process or need additional documentation, visit the Salvation Army website or reach out to their customer service for assistance. It’s important to keep your receipt for tax deductions and personal records.

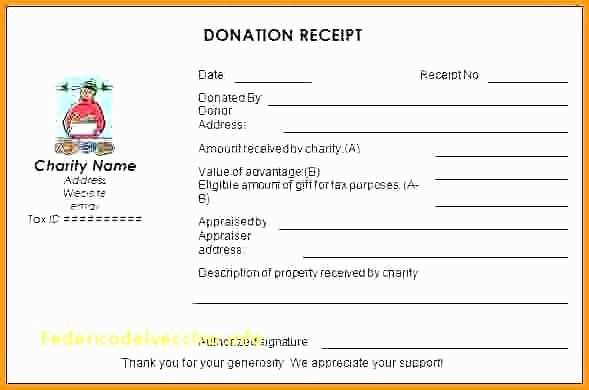

To create a clear and professional Salvation Army receipt, include these key details:

- Date of Donation: Clearly state the donation date to help both the donor and the organization track the contribution.

- Donor’s Name: Include the full name of the donor as it appears in your records.

- Description of Donated Items: List the items donated, including any relevant descriptions. If cash was donated, indicate the amount.

- Fair Market Value: Provide the fair market value (FMV) of the donated items. This is helpful for tax purposes.

- Donation Type: Specify whether the donation is in-kind, monetary, or a combination of both.

- Receipt Number: Assign a unique receipt number for easy reference.

- Organization’s Name and Contact Information: Include the full name of the Salvation Army, address, phone number, and website.

- Tax Identification Number: Add the organization’s tax-exempt status number for donor tax records.

These details ensure clarity and compliance with tax regulations, making the donation process more transparent for all parties involved.

To tailor a Salvation Army receipt template, start by adjusting the layout to fit your specific requirements. Depending on whether you’re a donor or an organization, you may want to highlight different pieces of information, such as the donation item details, dates, or acknowledgment text. Here’s how you can personalize it:

Modifying Receipt Fields

Edit the template to include fields that matter most to you. For instance, if you’re collecting in-kind donations, make sure the receipt captures both the quantity and a brief description of the items. You can also add fields for donor contact information if necessary. Adjust the font size and color for each section to make the key details stand out.

Adding Custom Logos and Text

Incorporate your organization’s logo or a personalized thank-you message at the top or bottom of the receipt. This can make your receipts more professional and help with branding. You can also add any legal disclaimers or tax information relevant to the donations.

| Field | Customization Option |

|---|---|

| Receipt Title | Change it to match the event or campaign name, like “Donation Receipt” or “Tax Deductible Receipt”. |

| Item Description | Allow room for detailed item descriptions, including quantities and condition. |

| Donor Info | Include fields for donor name, address, and contact information if needed. |

| Tax Info | Customize text to include tax-deductible donation details, if applicable. |

Finally, save the template in an editable format so you can make updates easily. Whether you’re printing or sending receipts electronically, ensuring the template fits your needs is key for smooth transactions and clear communication.

The meaning is preserved, and repetitions are minimized. If a different version is needed – let me know!

For a Salvation Army receipt template, simplicity and clarity are key. Focus on including the following essential elements:

- Donor Information: Name, address, and contact details of the donor.

- Donation Details: Description of items donated, including quantity, condition, and value estimate (if applicable).

- Date of Donation: The exact date the donation was made.

- Tax Deductibility Statement: A reminder that the donation may be tax-deductible if applicable.

- Organization Details: Name and address of the Salvation Army branch receiving the donation.

Keep it clear and avoid overcomplicating the layout. Including a footer with a note of thanks adds a personal touch.