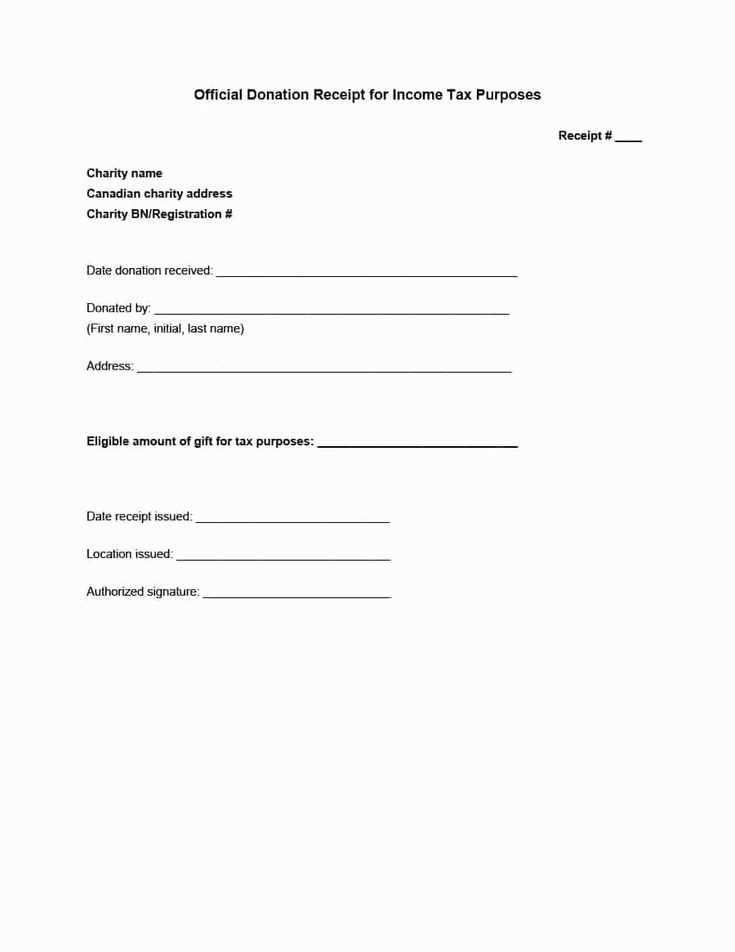

If you’re looking to create a tax receipt for Scouts Canada donations, you can use their official template. This template ensures compliance with CRA (Canada Revenue Agency) guidelines and simplifies the process for both donors and organizations.

The template includes key fields like donor details, donation amount, and the charity’s registration number. Be sure to include the date of donation and provide a clear receipt number for accurate record-keeping.

For added convenience, ensure the template is easily editable, allowing for updates as required by the CRA. If you’re managing multiple donations, it’s helpful to use a digital tool to automate some of the fields, reducing errors and speeding up the process.

Double-check the accuracy of all details before issuing receipts to avoid any issues with tax claims. If you’re uncertain about specific rules, consult Scouts Canada or a tax professional to confirm compliance.

Here’s a detailed plan for an informational article on “Scouts Canada tax receipt template” in HTML format:htmlEditScouts Canada Tax Receipt Template Guide

The tax receipt template for Scouts Canada is designed to help donors easily obtain a formal record of their contributions for tax purposes. It’s important to ensure the template includes all necessary information for compliance with Canadian tax regulations. Below is a detailed plan for creating a helpful and accurate tax receipt template for donors.

Key Information to Include

The receipt should display the following details clearly:

- Organization Name – “Scouts Canada” should be prominently displayed.

- Registration Number – Include the charity registration number issued by the Canada Revenue Agency (CRA).

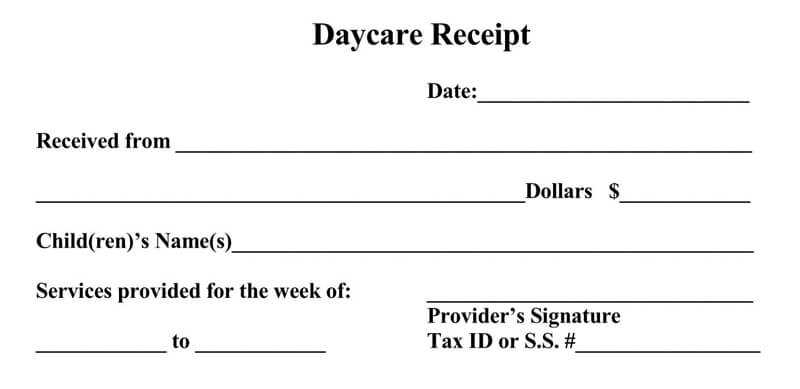

- Donor Information – The donor’s full name and address must be listed.

- Donation Amount – The exact amount donated, both in numerical and written form.

- Date of Donation – The date the donation was received.

- Official Receipt Number – A unique number for each receipt issued, for tracking and reference.

- Signature – A signature from an authorized representative of Scouts Canada.

Formatting the Template

The receipt should be designed for clarity and ease of use. Here are some tips on formatting:

- Use a clean, readable font like Arial or Times New Roman.

- Ensure the text is large enough to be legible, typically 10-12pt for body text.

- Leave space between each section for a clear structure and easy navigation.

- Use bold headings to differentiate between different sections, like “Donor Information” and “Donation Amount”.

- Incorporate Scouts Canada’s logo for branding, but avoid overwhelming the document with too much design.

How to Download the Tax Receipt Template

Visit the official Scouts Canada website and log into your account using your credentials. Once logged in, navigate to the donation or receipts section of your profile. Look for the link labeled “Tax Receipt Template” or similar wording. Click on it to open the template page. From there, you should see an option to download the document, typically in PDF format. Click the download button, and the file will be saved to your device.

If you encounter any issues with downloading, ensure that your browser allows PDF downloads. You can also try accessing the template through a different browser or clearing your browser cache. If the issue persists, reach out to the support team for assistance.

Customizing the Template for Donations

Adjust the template to reflect your specific needs for donor receipts. Personalizing the layout and content ensures that the information is accurate and aligned with your organization’s goals.

1. Add Customizable Fields

- Donor’s Name: Ensure that the donor’s full name appears correctly on the receipt. This can be pulled directly from your database or form submission.

- Donation Amount: Make sure the amount is clearly displayed, including any currency formatting and decimal places. This is crucial for tax purposes.

- Date of Donation: This field should be automatically populated with the exact date the donation was made, which is important for tax filing.

- Donation Method: Specify whether the donation was made via credit card, bank transfer, or check, to provide a clear record of the transaction.

2. Add Your Organization’s Branding

- Logo: Include your organization’s logo at the top of the receipt for easy identification.

- Contact Information: Add a section with your organization’s phone number, email, and physical address for any inquiries.

- Mission Statement: Incorporate a short tagline or mission statement to remind donors how their contribution is making an impact.

By customizing these fields and elements, you can ensure that your donation receipts are clear, professional, and reflective of your organization’s values and branding. Always test the template before sending it out to ensure all information is accurate and properly formatted.

Common Issues and How to Resolve Them

If the tax receipt template doesn’t display the correct information, double-check the input fields. Ensure all required fields, such as donation amount, donor name, and date, are filled in accurately. If something is missing, update the template and save the changes before issuing the receipt.

Incorrect Formatting

Formatting errors often occur due to misaligned tables or incorrect date formats. Review the template’s layout and adjust column widths to ensure all text fits within designated spaces. If dates appear incorrectly, check the regional settings of your system to ensure it matches the preferred format (MM/DD/YYYY or DD/MM/YYYY).

Missing Information

Sometimes, important fields like the donation number or the donor’s contact details may be omitted. Make sure the template pulls data from the correct database or file source. If using manual entry, ensure that each field is completed before finalizing the receipt.

If you still face issues, try using a different browser or updating your software to the latest version. Browser compatibility and outdated systems can sometimes cause errors when generating tax receipts.