For self-employed individuals, handwritten templates for receipts can simplify the process of keeping track of transactions. It’s an efficient way to ensure you have proper documentation for both your clients and your financial records.

Start with a basic format for your receipts. Include the client’s name, the date, the service or product provided, and the total amount charged. Make sure to leave space for both your signature and any notes you need to add, such as payment terms or references.

Ensure clarity in the details. A clear receipt helps both parties avoid misunderstandings and serves as proof of the transaction. Double-check that the total is correct and that all fields are filled out completely before handing over the receipt.

By creating a template, you’ll save time on future transactions. You can adjust it for each new client, making the process seamless while maintaining professionalism in your record-keeping.

Self Employed Handwritten Templates for Receipts

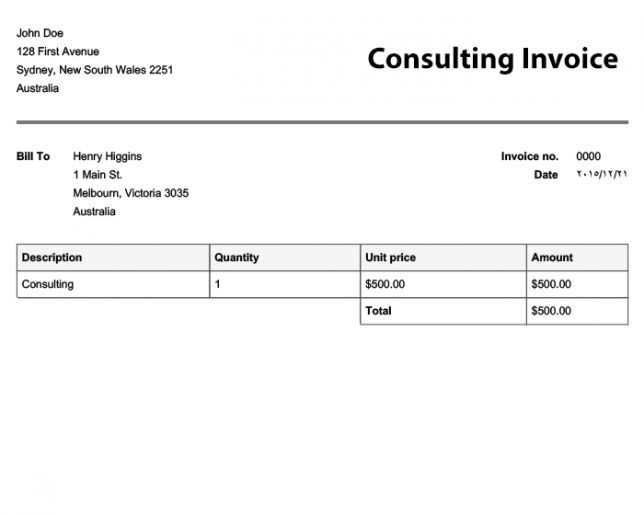

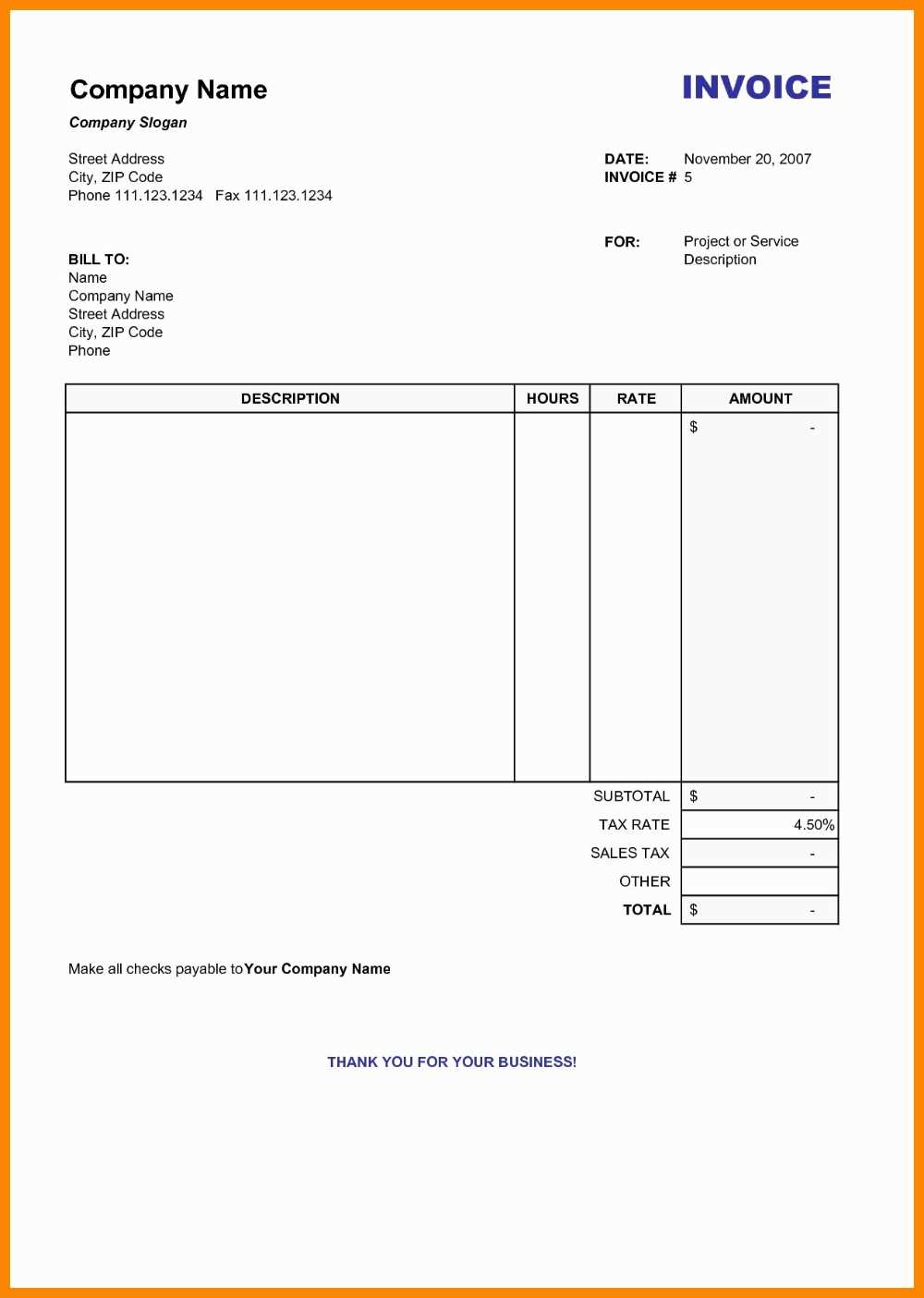

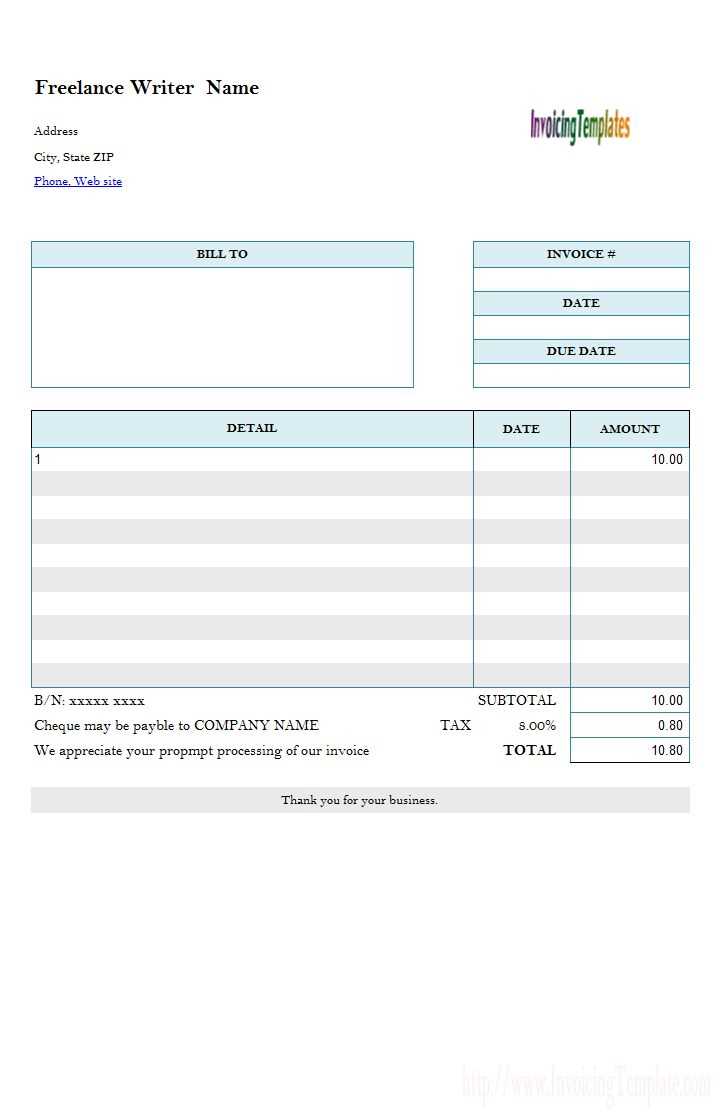

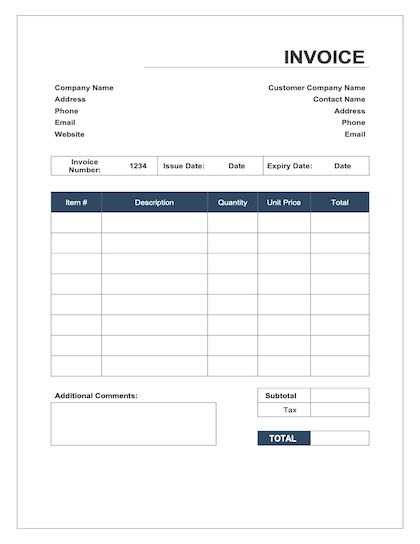

To streamline your receipts, use clear and concise templates. Create a simple, structured format that includes key details such as the date, your business name, a breakdown of the services or goods provided, and the total amount paid. Ensure each line is legible and properly spaced for clarity. Consider adding a section for any taxes or discounts applied. This will make your receipts easily understandable and help with bookkeeping.

Include the following information in your template:

- Date of transaction

- Your business name and contact details

- Description of the item/service

- Total amount received

- Payment method (e.g., cash, check, etc.)

- Any applicable tax rates

Design your template with consistency in mind. A neat, uniform layout improves professionalism and ensures all the necessary information is included. Create a few blank lines under each heading to fill in the details. Consider numbering receipts if you generate a high volume, as this will help with future reference and organization.

Lastly, keep your handwritten receipts legible. Avoid clutter and ensure the text is easy to read. Use consistent handwriting, or print if necessary, to maintain uniformity in your records.

How to Create Custom Handwritten Receipt Templates

Begin by deciding on the key elements to include in your handwritten receipt. At a minimum, the template should cover the following details:

- Business name or logo

- Customer name

- Purchase date

- Items purchased, including quantity and price

- Total amount

- Method of payment

- Signature line or space for any notes

Design Layout

Sketch the layout on paper, ensuring it is easy to read and includes all necessary fields. Leave enough space for writing neatly. Consider dividing the page into clear sections, such as customer details, transaction details, and payment methods. You can use lines or boxes to separate each section. The more organized the template, the easier it will be to fill out during each transaction.

Personalize Your Template

To give your receipts a more personalized touch, consider adding your business colors, unique fonts, or a special logo. Use templates or grids to ensure uniformity in your handwriting. Additionally, think about adding a small note of gratitude or a reminder of your business’s return policy to enhance customer experience.

Once your template is ready, practice writing it out a few times to ensure it remains clear and readable. Keep your template on hand for all transactions, and make adjustments as needed based on customer feedback or any changes in your business.

Legal Considerations When Issuing Handwritten Receipts

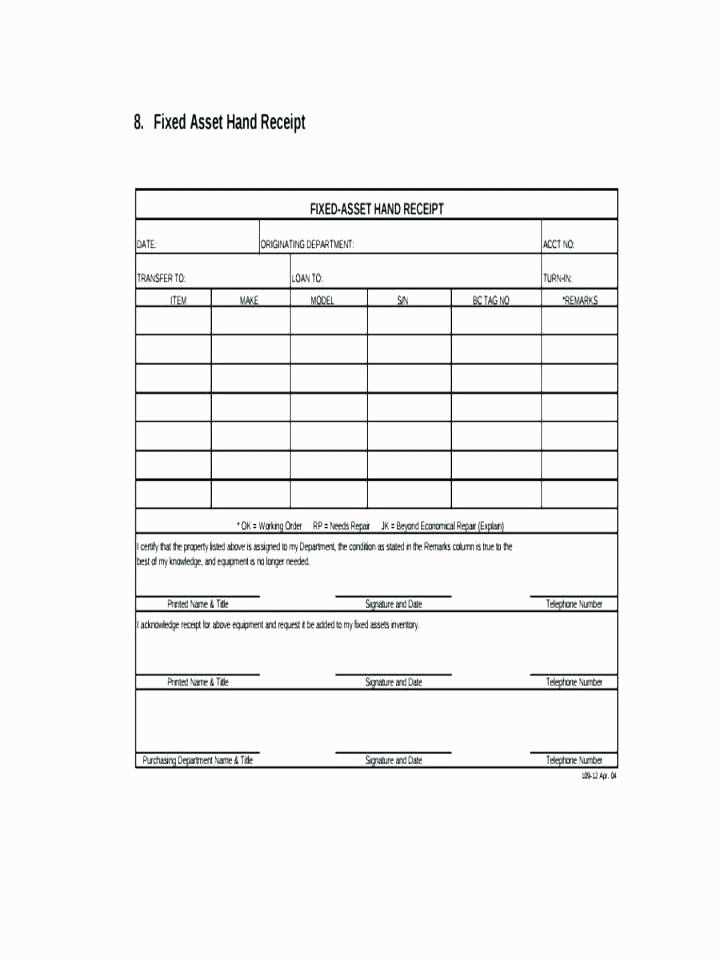

Ensure that each handwritten receipt includes key details such as the date, amount, and a clear description of the goods or services provided. This is necessary for compliance with local tax regulations and for maintaining accurate financial records.

Always include both the seller’s and buyer’s names, along with any contact information if applicable. This helps to verify the transaction in case of disputes or audits.

Clearly state the payment method, whether cash, check, or another form, to avoid confusion later. Keep a copy of each receipt for your records, as this can serve as proof of income for tax purposes.

Ensure that the receipts are legible and free of any alterations. If a correction is necessary, make sure it is clearly noted and initialed by both parties.

Check if there are any specific local or industry regulations that apply to the type of service or product you offer, as some areas may require additional documentation or certification for certain types of transactions.

Stay aware of your responsibilities under consumer protection laws, which may vary depending on the jurisdiction. Having written receipts can help protect both parties if there are issues related to returns or refunds.

Organizing and Storing Handwritten Receipts for Tax Purposes

Separate receipts by type–business expenses, supplies, travel, etc. Use labeled folders or envelopes to keep them organized. Label each category clearly to make retrieval easier during tax filing.

Keeping Track of Dates and Amounts

Write down the date, total amount, and purpose of each receipt on the back. This helps avoid confusion later, especially when reviewing multiple receipts from the same vendor or for similar expenses.

Storage Methods

Store receipts in a fireproof box or drawer to protect them from damage. For long-term storage, consider using acid-free folders or envelopes to avoid degradation of the paper. If you prefer digital records, take clear photos and back them up regularly.