A well-structured receipt can streamline your financial record-keeping and improve transparency with clients. A clear, easy-to-read receipt ensures both you and your clients understand the details of any transaction, which is key for tax filing and legal purposes.

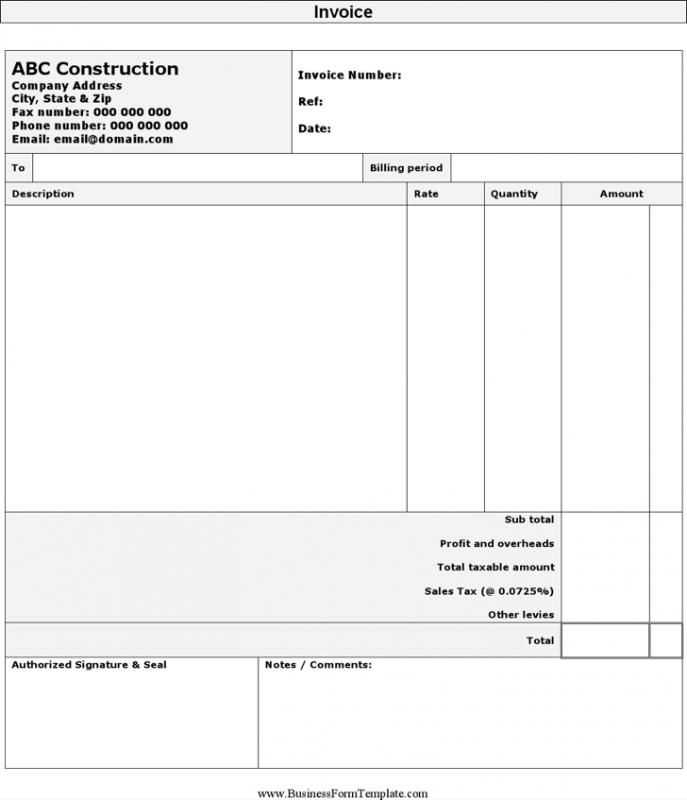

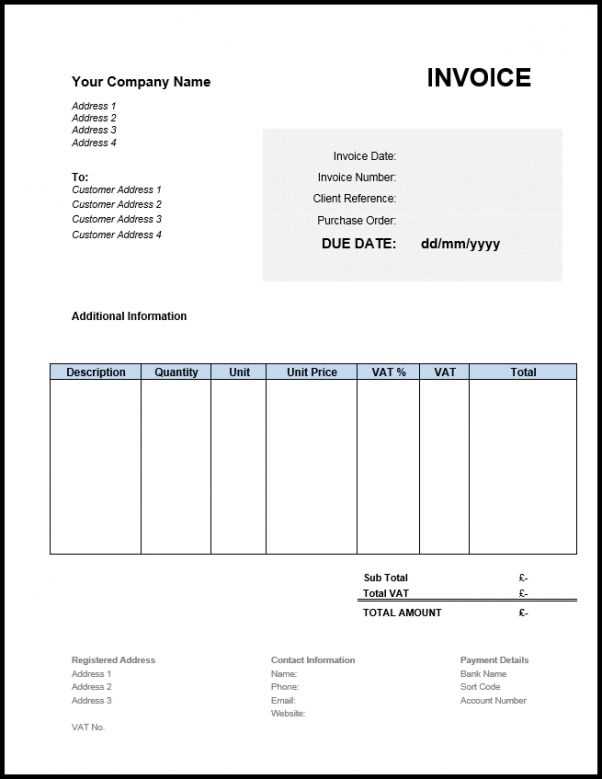

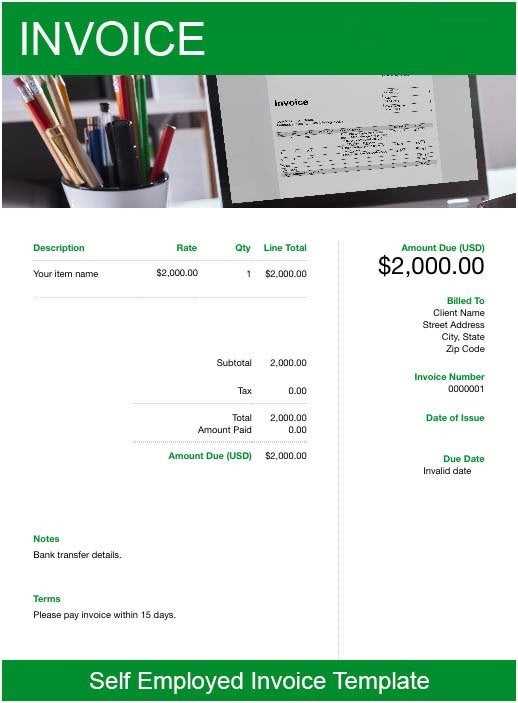

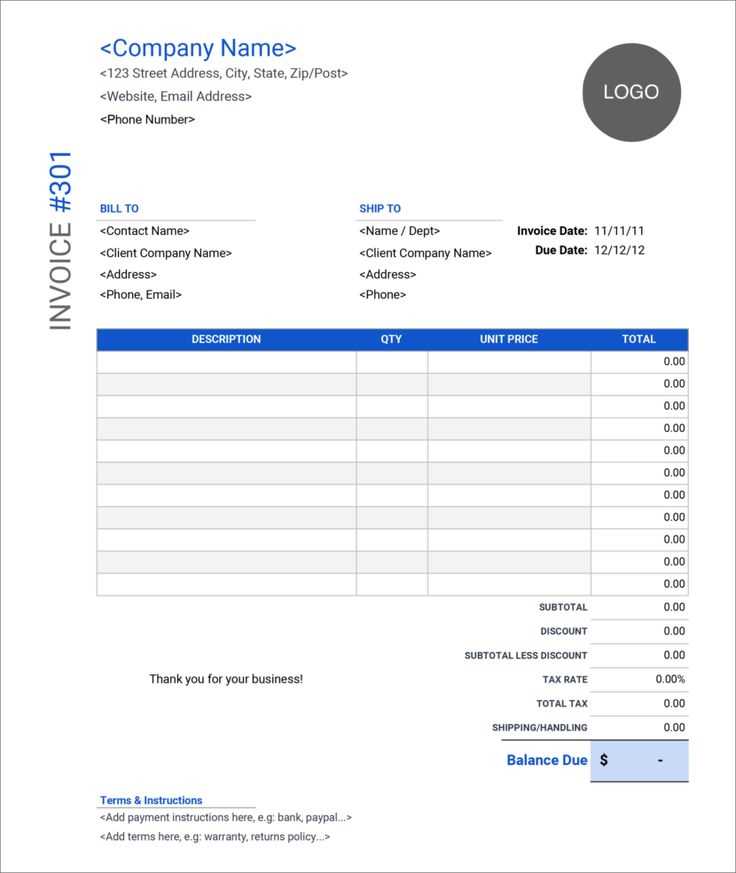

Use a simple, customizable receipt template that includes key information: your business name, contact details, the date of the transaction, a breakdown of services or goods provided, the total amount paid, and the payment method. Make sure the template allows for clear separation of these elements so clients can easily verify each part of the transaction.

By using a standardized format for receipts, you can maintain consistent documentation. This practice not only helps with tax reporting but also provides a professional image to clients. It’s also beneficial for tracking payments and reconciling financial statements efficiently.

Self Employed Receipt Template: Practical Guide

A self-employed receipt should contain specific information to ensure clarity for both you and your client. Include the date of the transaction, your full name or business name, and contact details. Clearly state the service or product provided, along with the amount charged. Also, ensure to list any taxes separately if applicable, and indicate the total amount due.

Use a professional format with easy-to-read fonts and structured fields. This helps prevent any confusion and serves as clear documentation for both parties. For simplicity, a receipt template can be divided into sections: your contact info, the client’s details, itemized charges, and totals. This way, every receipt will be uniform and clear.

Ensure that your receipt is signed by both parties to authenticate the transaction. You may also include a unique reference number for record-keeping, making it easier to track payments. If you’re using digital receipts, consider including a QR code or a payment link to further streamline the process.

Once completed, send the receipt promptly to your client. Whether printed or digital, a well-organized receipt builds trust and helps you maintain proper financial records for tax purposes.

How to Structure a Self Employed Receipt Template

Include clear details to ensure your receipt is both professional and functional. First, list your business name and contact details at the top. This provides clients with your information for future reference or inquiries.

Key Components

Start with the receipt number for easy tracking. Follow it with the date of the transaction. Then, clearly describe the service provided, including the quantity and any applicable rates. Specify the total cost of the service, any taxes, and payment method (cash, credit card, etc.).

Additional Information

For transparency, include your tax identification number (TIN) if required. A space for client details can also be added, especially for long-term contracts. Ensure the total amount due is easily distinguishable at the bottom of the receipt for clarity.

Choosing the Right Format for Your Receipt Template

Choose a format that suits both your business and your customers’ needs. A clean, straightforward layout ensures that all necessary information is clearly displayed. Here’s how to pick the right format for your receipt template:

Consider the Type of Transaction

If you’re providing a service, include details like hours worked, rates, and a breakdown of the service provided. For product sales, include the item description, quantity, price, and any applicable taxes. Tailor the receipt to the specific nature of the transaction to avoid clutter.

Keep It Simple

- Limit the number of fonts and colors.

- Use standard fonts like Arial or Times New Roman for easy readability.

- Organize information in a logical order, such as date, item description, total amount, and payment method.

A simple design not only looks professional but also minimizes confusion for both parties.

Choose the Right Software

If you’re creating receipts digitally, ensure the software you use supports customization and is compatible with your accounting systems. Many online tools offer receipt templates that can be easily edited to match your business branding. If you prefer offline tools, use word processors or spreadsheets with templates designed for invoicing or receipts.

Include Required Legal Information

- Your business name, address, and contact information

- Tax identification number (if required)

- Terms and conditions or return policy, if necessary

Make sure your receipt format meets any legal requirements in your region.

Legal and Tax Considerations for Self Employed Receipts

Always issue receipts for every transaction, regardless of the payment method, to maintain transparency and comply with tax regulations. A clear and detailed receipt ensures accurate record-keeping and makes it easier to manage taxes. Make sure each receipt includes the following: the date, description of the service or product provided, amount charged, and the client’s name or business name.

For tax purposes, receipts serve as proof of income. Retain copies of all receipts, even for small transactions, as they are required during tax audits. You should also record any expenses related to your business, as they may be deductible from your taxable income.

Self-employed individuals must track income and expenses separately to avoid tax issues. Keep receipts for both personal and business-related purchases distinct to ensure accurate reporting. Depending on your location, you may need to comply with specific local tax rules that require particular information on receipts, such as tax identification numbers or VAT registration details.

Using electronic invoicing tools can help simplify this process. Ensure that digital receipts include all necessary information and are properly archived. These receipts must be easily accessible for at least a few years, as required by law for tax reporting and audits.

Lastly, be aware of any tax thresholds and filing requirements in your area. Some regions may have specific income thresholds that trigger additional tax filings. Always consult with a tax professional to ensure you are following local rules and maximizing your deductions.