If you’re self-employed, you need to keep track of your income and expenses. One of the simplest ways to do this is by using a self-employment receipt template. This template helps you document each transaction clearly and professionally, ensuring you stay organized and can easily provide proof of your earnings when necessary.

The key elements of a self-employment receipt include the date, a description of the service provided, the amount charged, and the payment method. It’s also a good idea to include your business name and contact information to create a formal and consistent document. With this structure, you will make it easy to track your financials and maintain accurate records for tax purposes.

Customize your template according to your specific needs. You can adjust it to include additional details such as hours worked, materials used, or any applicable taxes. By doing so, you can tailor the receipt to reflect your unique business operations. This simple yet effective tool helps ensure that all your transactions are transparent and professionally documented.

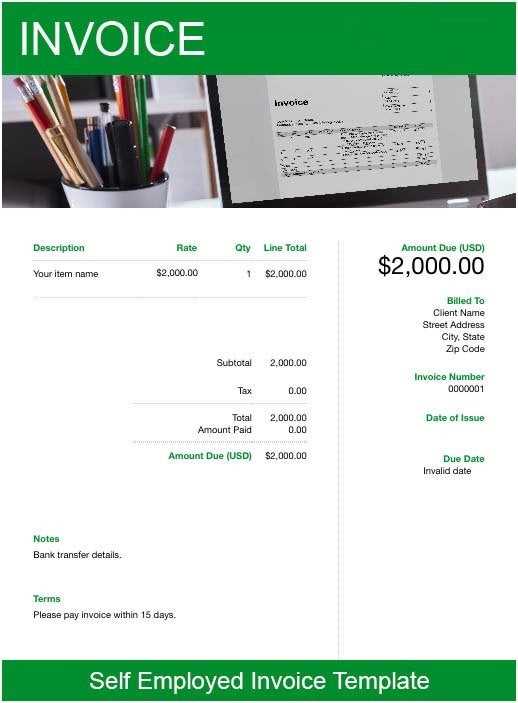

Self Employment Receipt Template

Use a self-employment receipt template to create clear and professional receipts for your clients. This template should capture essential transaction details for both your records and the client’s reference.

Key Components of a Self Employment Receipt

A standard self-employment receipt includes the following:

- Receipt Number: A unique identifier for each transaction.

- Business Name: The name of your business or trade.

- Client Information: Full name and contact details of the client.

- Transaction Date: The date when the service was completed or payment received.

- Description of Services: A detailed list of services provided or items sold.

- Total Amount: The total sum paid, including applicable taxes.

- Payment Method: Specify whether payment was made by cash, credit card, or other methods.

Template Example

Here’s a simple structure for your self-employment receipt:

| Receipt Number | Date | Client Name | Service Description | Amount | Payment Method |

|---|---|---|---|---|---|

| #001 | 2025-02-12 | John Doe | Web Design Service | $500.00 | Credit Card |

| #002 | 2025-02-14 | Jane Smith | Consulting | $200.00 | Cash |

Once you’ve customized the template for your business, print or send it electronically as proof of the transaction. Keeping a copy of each receipt helps with tax reporting and tracking payments.

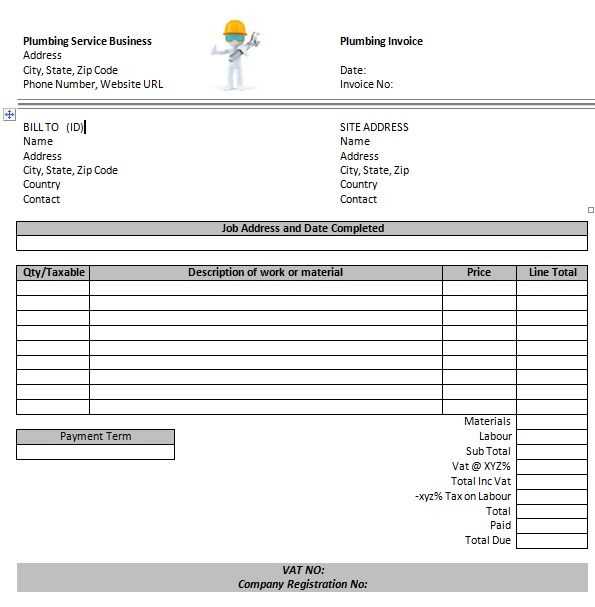

How to Structure a Basic Self Employment Receipt

A self-employment receipt should include several key elements to ensure clarity and professionalism. First, provide your business name, address, and contact information at the top. If you are using a trade name, include it as well. This helps the client identify who the payment is going to. Next, the receipt should clearly state the date the transaction took place.

Include Detailed Payment Information

Describe the services rendered or products provided in detail. List the quantity, rate, and any applicable taxes, followed by the total amount. Ensure that each service is broken down individually if there are multiple items or tasks. This transparency avoids confusion for both parties.

Invoice Number and Payment Terms

Assign a unique invoice number to each receipt for record-keeping. This makes tracking payments easier. Mention payment terms, such as the due date, and any late fees if applicable. This ensures both you and the client are clear on expectations moving forward.

Finally, include your signature or business seal, which adds authenticity to the receipt. Keep a copy for your records, and provide one to the client for their reference.

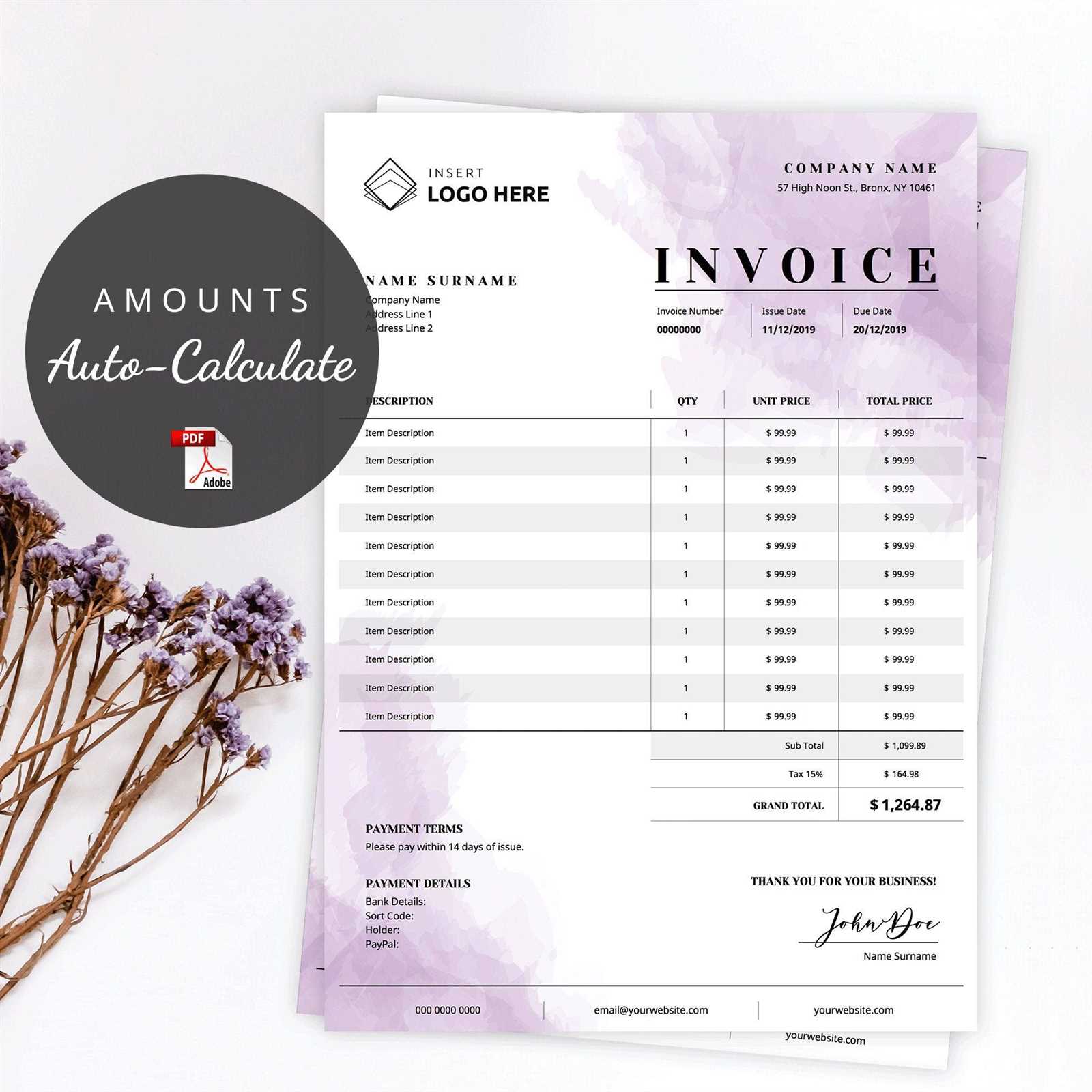

Key Considerations When Customizing Your Receipt Template

Design your receipt template to reflect your business’s professionalism and provide clarity for your customers. Start by ensuring that all necessary information is included. This includes your business name, address, contact information, and tax identification number. The date and a unique transaction ID should also be part of every receipt.

Consider the layout and structure. A clean, simple design is easier for customers to read and use. Avoid clutter, and prioritize key elements like item descriptions, quantities, prices, and total amounts. Organize this information logically so the receipt is easy to follow.

Use appropriate fonts and sizes. Choose readable fonts that align with your brand’s style. Ensure that text size is large enough for legibility, especially for important details like totals and payment methods.

If your business requires taxes to be shown, clearly break down the tax rate and amount. Transparency in taxes fosters trust and helps customers understand the charges they are paying.

Don’t forget payment details. Indicate whether the transaction was paid via cash, card, or another method. If applicable, include the last four digits of the credit card or other transaction IDs for clarity and record-keeping purposes.

Consider including additional business-specific details such as return policies, loyalty program information, or promotional offers, but avoid overcrowding the receipt with unnecessary text.

- Make sure your template is customizable for different payment methods and transaction types.

- Test your template with real transactions to ensure everything aligns correctly and is easy to read.

- Consider the format–PDFs, emails, or printed receipts should all have consistent formatting and easy-to-read fonts.

- Check your template for compliance with local tax regulations and business requirements.

Remember, a well-designed receipt not only serves as proof of purchase but also reinforces your business image and enhances customer satisfaction.

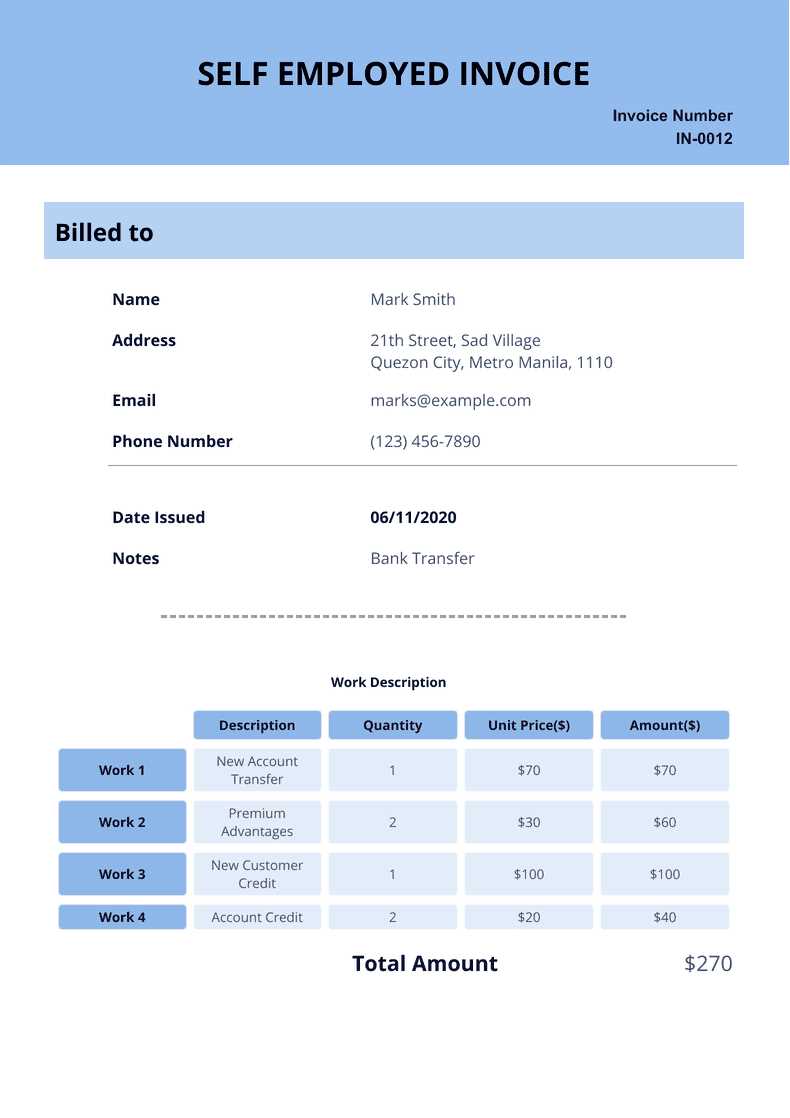

Legal and Tax Implications of Self Employment Receipts

Self-employment receipts play a key role in keeping your business compliant with legal and tax requirements. Ensure each receipt you issue includes accurate details about the services rendered, payment amount, and date to avoid legal issues with clients or tax authorities.

Tax Reporting

Self-employed individuals must report their income, including payments received from clients. Receipts serve as proof of earnings and can be used to accurately complete tax returns. For tax purposes, receipts should include a clear breakdown of the amount paid, the services provided, and the date of the transaction. This detail is crucial when calculating taxable income.

Record-Keeping Requirements

Tax authorities expect self-employed individuals to maintain records of their income and expenses. Receipts should be kept for a minimum period of time, usually between 3 to 7 years, depending on local regulations. Failure to keep proper records may result in fines or penalties if audited.

Be sure to store both physical and digital receipts in an organized manner, ensuring they are easy to retrieve if needed for tax filings or legal purposes. A thorough and accurate record-keeping system can prevent discrepancies or issues when filing your taxes.

Self-employed workers may also be entitled to claim deductions for business-related expenses. Proper receipts and documentation are necessary to substantiate these claims, helping to reduce taxable income.