Need a quick and reliable way to document payments? A self-receipt template lets you create clear and structured payment records without hassle. Whether you’re a freelancer, small business owner, or handling personal transactions, a well-formatted receipt ensures transparency and keeps financial records organized.

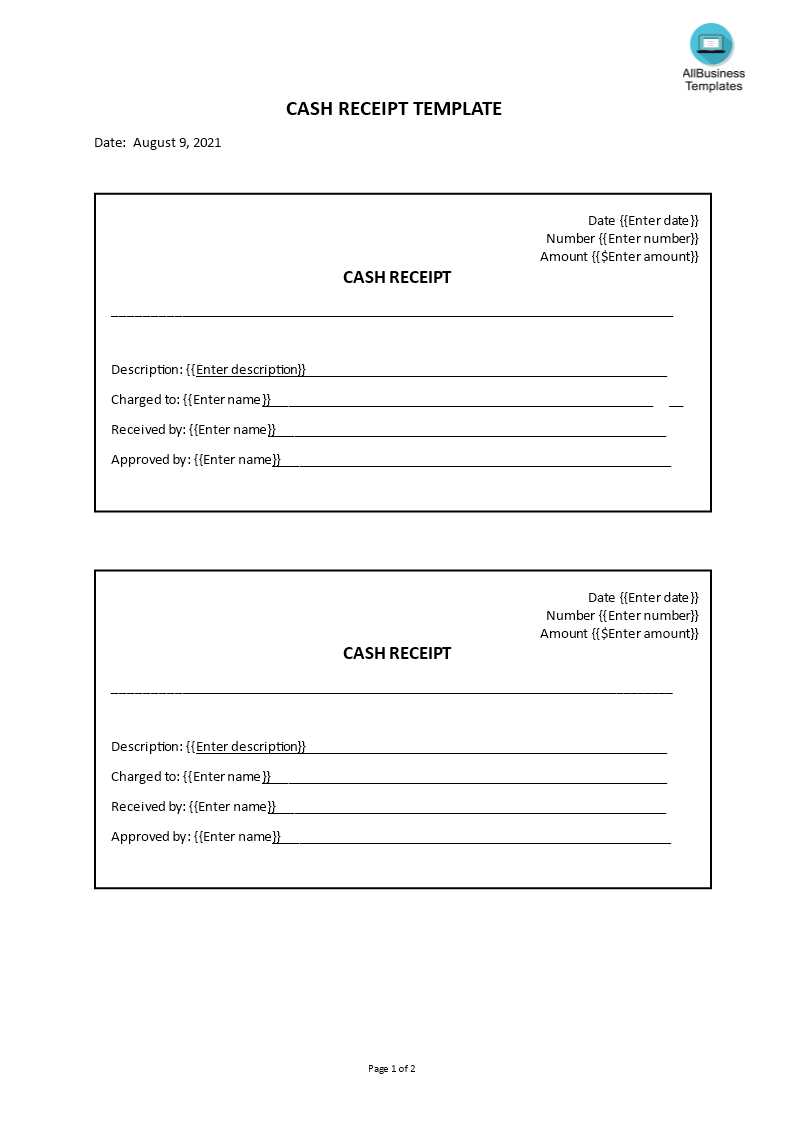

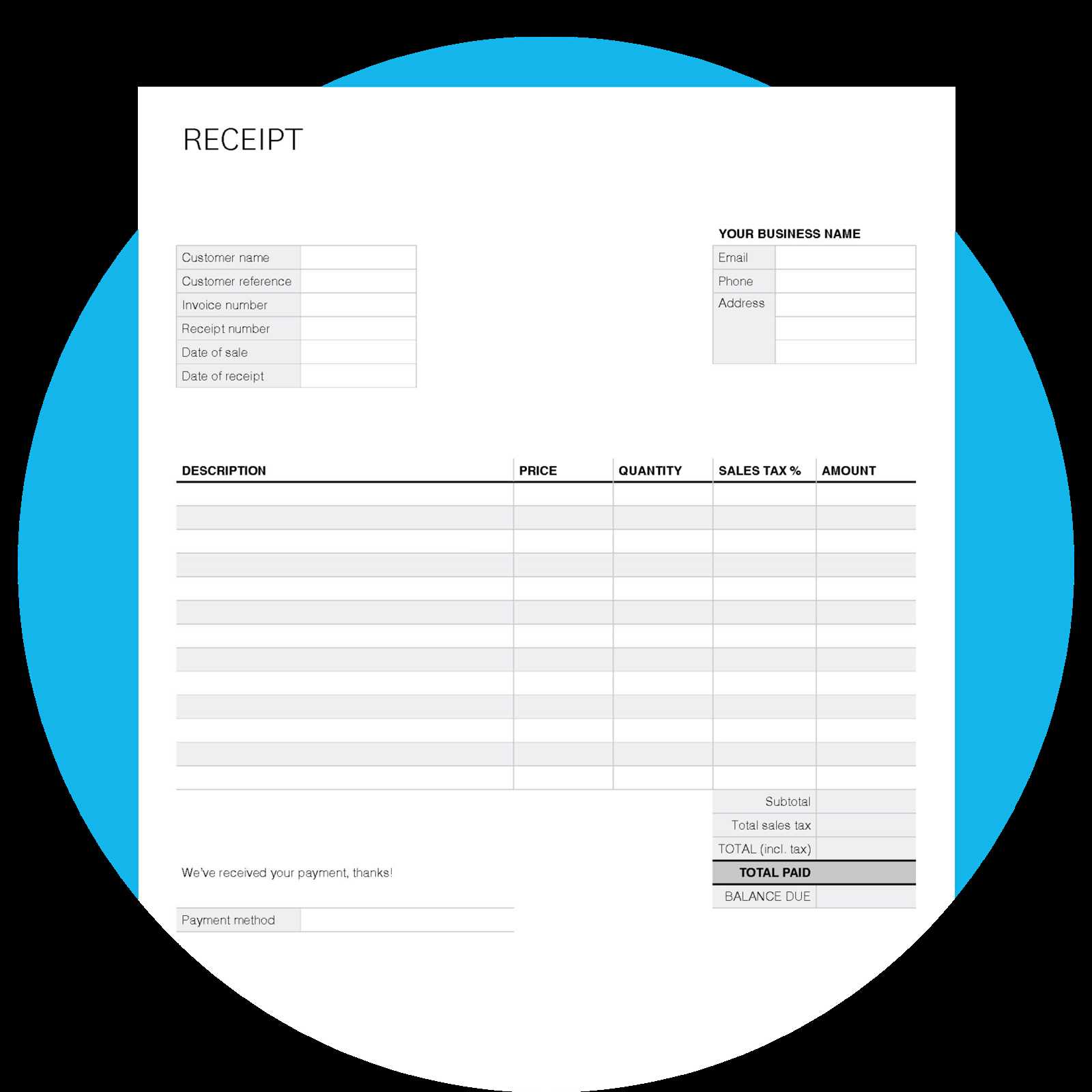

Include key details such as payer and payee names, date, amount, and payment method. A brief description of the transaction adds clarity. If applicable, mention tax details or reference numbers for easier tracking.

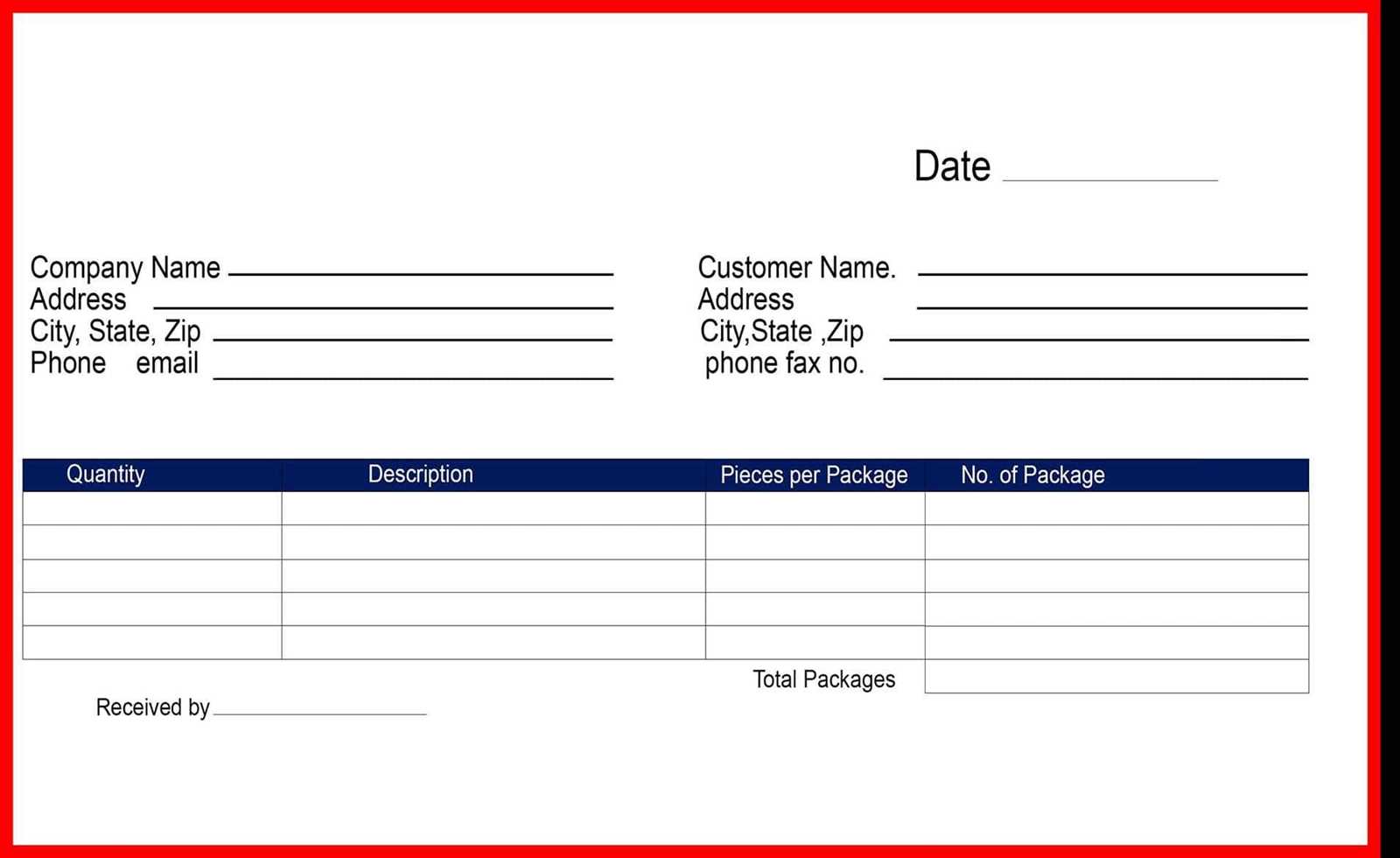

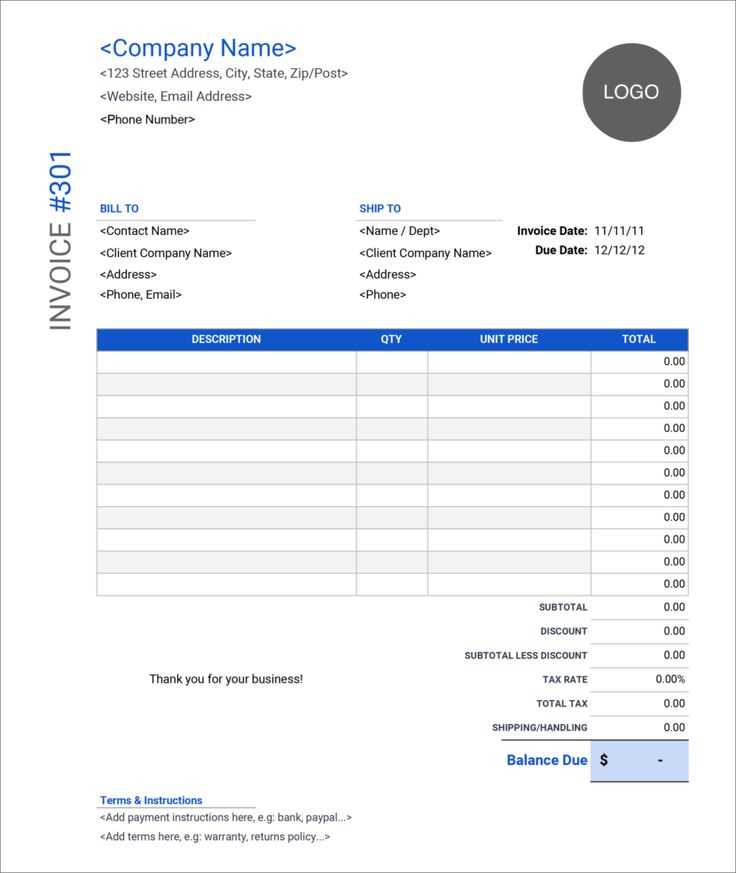

For convenience, choose a format that suits your needs. A simple table layout works well for digital use, while a printable version with a signature line adds authenticity. Many prefer editable templates in PDF, Word, or Excel for flexibility.

Accuracy is essential. Double-check all entries before finalizing the receipt. A clear and concise template saves time, minimizes errors, and ensures all necessary details are included.

Self Receipt Template: Practical Guide

Use a self-receipt template to document transactions where a formal invoice isn’t available. This helps maintain clear financial records and ensures compliance with tax regulations.

Key Elements to Include

- Date: Specify when the transaction took place.

- Amount: Clearly state the total sum paid.

- Purpose: Describe the reason for the payment.

- Recipient’s Name: Identify who received the payment.

- Payment Method: Mention whether it was cash, bank transfer, or another form.

- Signature: Add a signature for authenticity.

Step-by-Step Creation

- Use a standard document format like PDF or Word.

- Fill in all relevant details to ensure accuracy.

- Print or save a digital copy for future reference.

- If required, attach supporting documents such as bank statements.

Common Mistakes to Avoid

- Leaving out critical details like the date or amount.

- Using vague descriptions that don’t clarify the purpose.

- Failing to keep copies for record-keeping.

A well-prepared self-receipt ensures transparency and simplifies financial tracking.

Key Elements to Include in a Self Receipt

Ensure every self-receipt includes a clear and concise heading, such as “Payment Receipt” or “Sales Receipt,” positioned at the top for immediate recognition. Below, state the issue date to confirm when the transaction was recorded.

Transaction Details

Specify the amount paid in both numerical and written formats to avoid misinterpretation. List the payment method used, whether cash, credit card, or another form. If applicable, include the last four digits of a card number or a check reference.

Parties Involved

Include the full name and contact details of the payer and the recipient. If representing a business, add the company name and address. This information verifies the receipt’s authenticity and provides reference points for future inquiries.

End with a unique receipt number for easy tracking and an optional signature line for added credibility. Keeping the format structured ensures clarity and usability.

Legal Considerations and Compliance

Ensure that the self-receipt includes accurate transaction details, such as the date, amount, and description of goods or services. Missing or incorrect information may lead to disputes or tax issues.

Verify that the receipt format complies with local tax regulations. Some jurisdictions require specific wording, sequential numbering, or additional disclosures, such as tax identification numbers.

Include a statement clarifying that the receipt is for record-keeping purposes only and does not represent an invoice. This distinction is crucial for tax reporting and financial audits.

Secure digital copies of receipts for future reference. Many countries mandate businesses to retain financial records for a set number of years to comply with tax and audit requirements.

Consult a legal professional if the receipt is used for business transactions. Certain industries have additional compliance requirements, such as consumer protection laws or sector-specific financial regulations.

Step-by-Step Guide to Creating a Self Receipt

Write a receipt that includes key details: date, amount, payer, payee, and payment method. Keep it clear and structured to ensure easy reference.

1. Define the Transaction Details

Specify the date of the transaction and the amount paid. Use a standard format like MM/DD/YYYY to avoid confusion.

Identify the payer and payee. Include full names or business names for accuracy.

2. Describe the Payment

Mention the payment method–cash, bank transfer, or another form. If applicable, add a check number or transaction ID.

Briefly state the purpose of the payment, whether it’s for a service, rental, reimbursement, or other reason.

For clarity, format the receipt consistently. Use simple tables or bullet points if needed. Always review for accuracy before finalizing.

Best Formats and Tools for Generating Receipts

PDF and Excel are the most practical formats for receipts. PDFs ensure consistency and are easy to share, while Excel allows customization and calculations. Choosing the right tool depends on whether automation or flexibility is the priority.

| Tool | Format | Key Features |

|---|---|---|

| Microsoft Excel | XLSX | Custom templates, formulas, and data tracking |

| Adobe Acrobat | Secure, professional layouts, e-signature support | |

| Wave Receipts | Cloud storage, automatic calculations, mobile app | |

| Google Sheets | XLSX, PDF | Collaboration, cloud access, free templates |

| Zoho Invoice | Automated invoicing, branding options, email integration |

For quick, one-time receipts, online generators like Invoice Simple offer ready-made templates. Businesses needing automation should consider Zoho Invoice or Wave, while Excel remains a solid option for manual customization.

Common Mistakes and How to Avoid Them

Skipping essential details leads to misunderstandings and disputes. Always include the date, amount, payer, recipient, and purpose of payment.

- Missing Signatures: If the receipt requires validation, add a signature or digital confirmation.

- Ambiguous Descriptions: Avoid vague terms like “services rendered.” Specify what was provided.

- Incorrect Amounts: Double-check numbers to prevent discrepancies.

- Omitting Payment Method: Indicate cash, card, or bank transfer to clarify transaction records.

- Ignoring Taxes: If applicable, include tax details to maintain compliance.

Proofread before finalizing to eliminate errors. Consistency in format improves readability and ensures professionalism.

Use Cases and Industry-Specific Examples

Self-receipt templates find practical applications in a variety of industries, streamlining processes, improving customer experience, and reducing administrative burden. Retail, hospitality, and healthcare sectors leverage these templates to enhance transactions and service delivery.

Retail Industry

In retail, self-receipt templates enable customers to quickly access proof of purchase. By integrating with point-of-sale (POS) systems, these templates automate receipt generation, eliminating paper waste and improving the checkout experience. For example, stores like Walmart allow customers to opt for self-receipts sent directly to their email or mobile app, reducing in-store wait times and paper costs.

Hospitality and Food Services

In the hospitality sector, hotels and restaurants implement self-receipt templates to simplify billing. A customer checking out of a hotel can receive an instant electronic receipt with itemized charges, reducing the need for front desk interaction. Similarly, cafes and fast food chains use these templates to provide customers with digital receipts upon payment, enhancing efficiency and reducing printing costs.