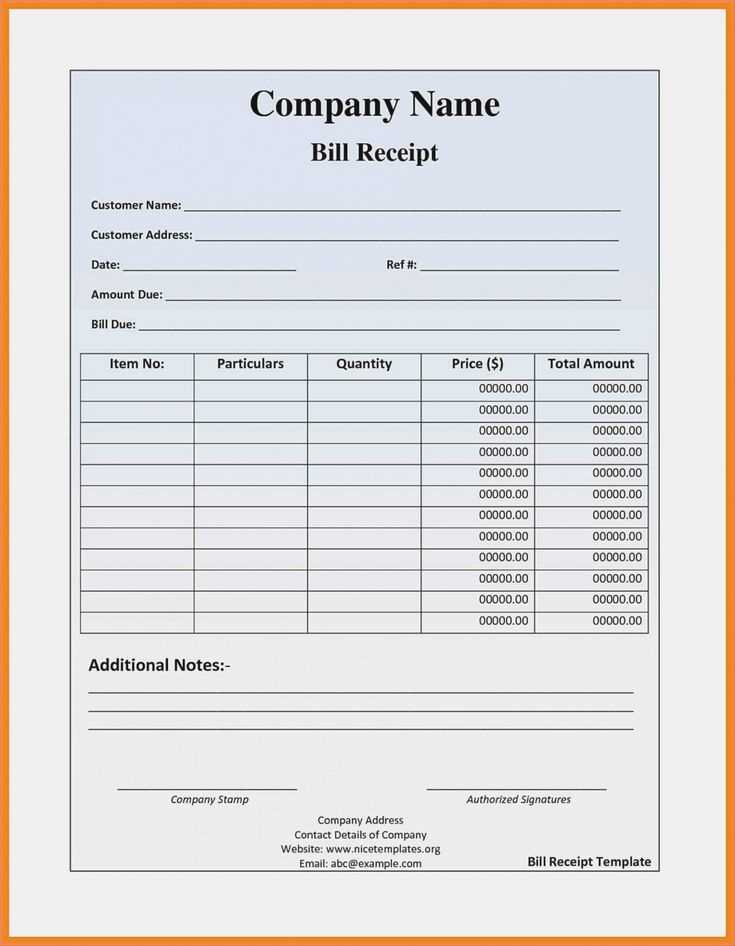

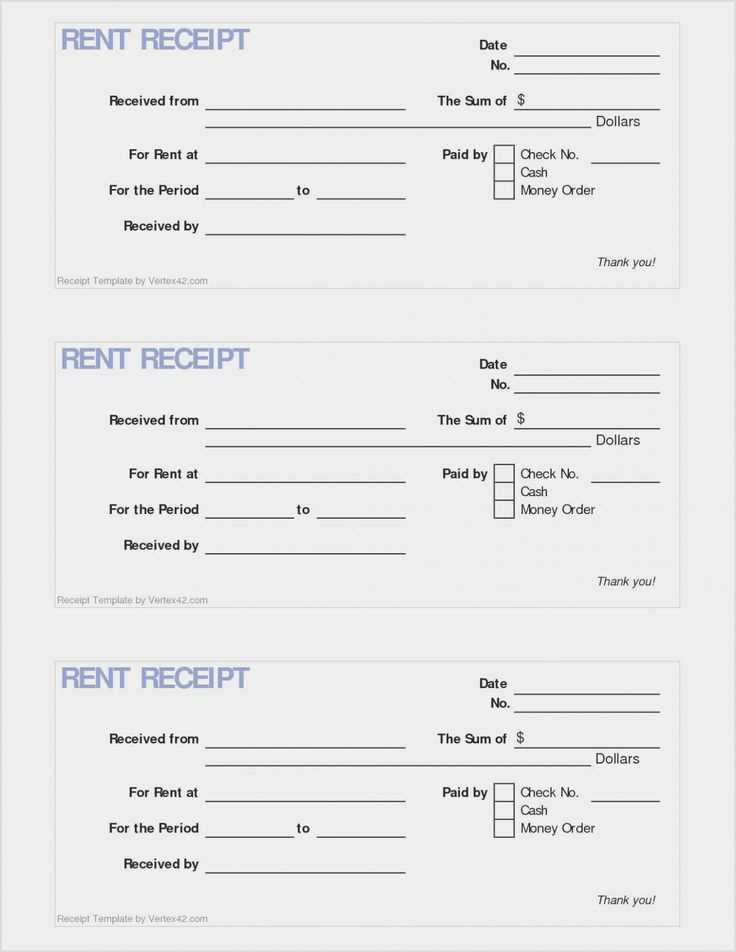

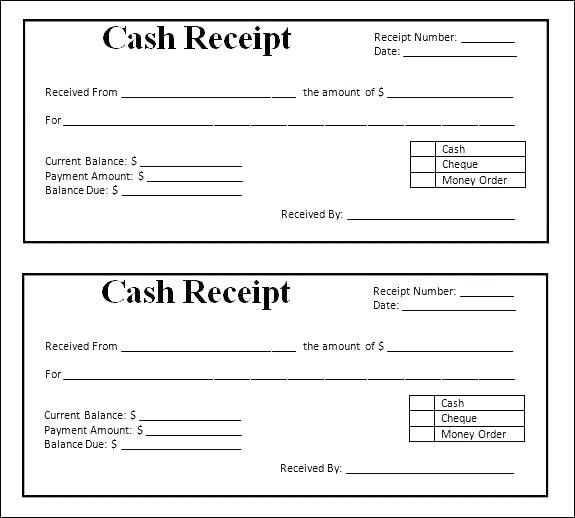

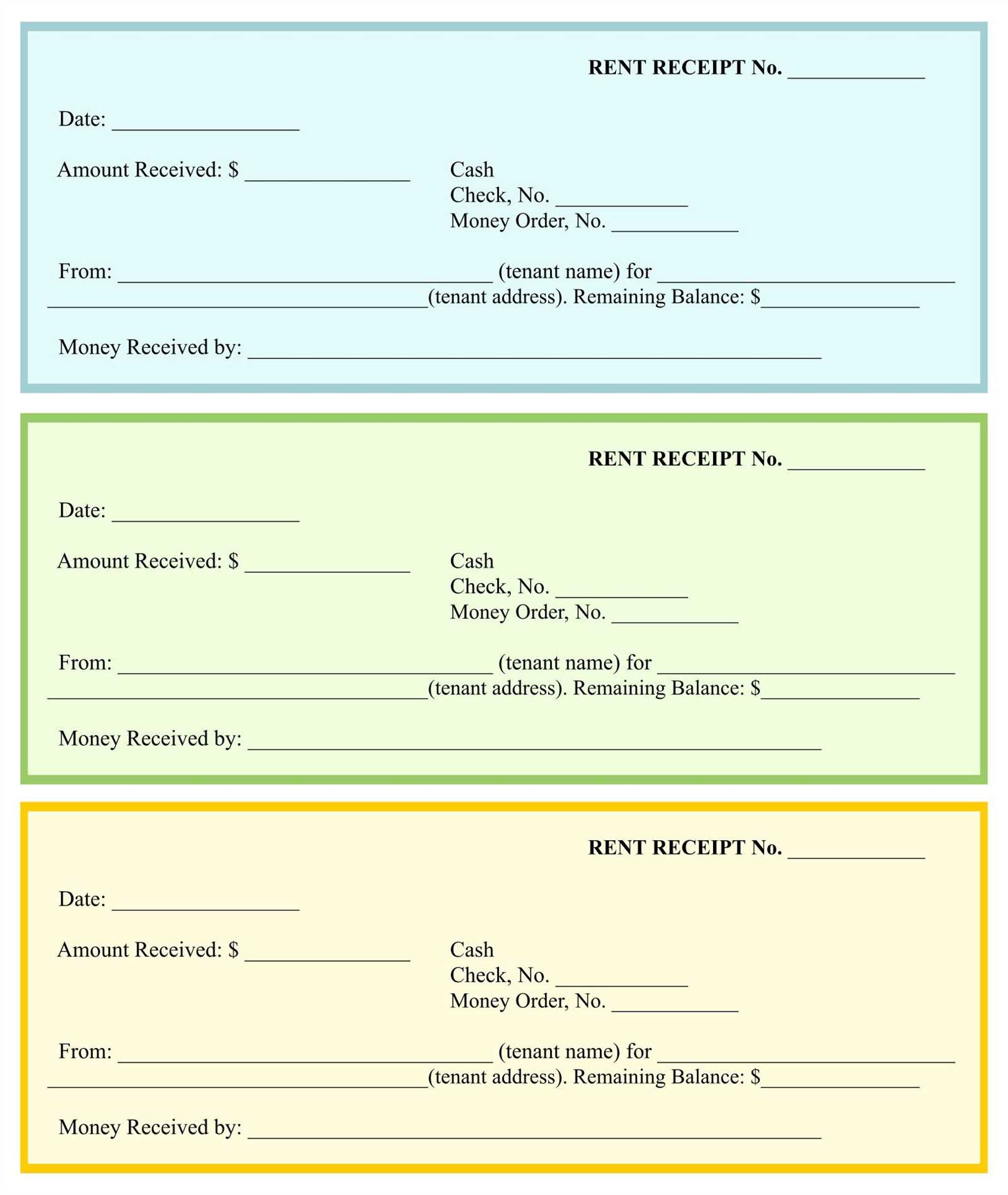

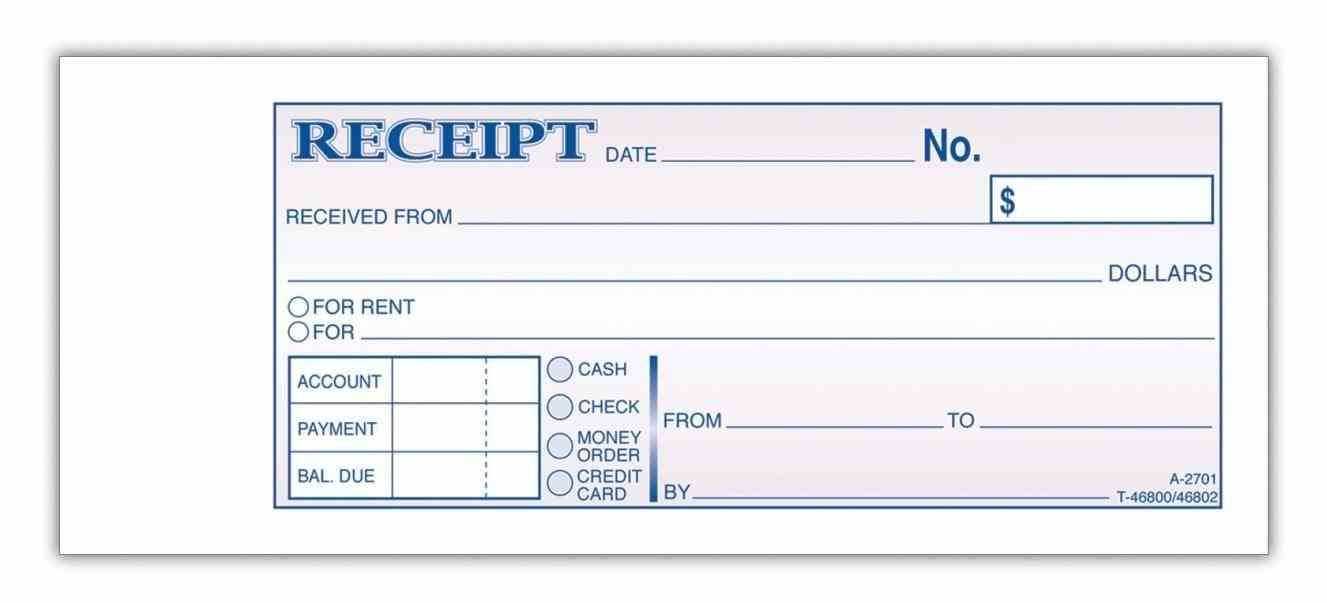

Choose a structured format that includes the date, payer’s name, amount received, and purpose of payment. A well-designed receipt ensures both parties have a clear record of the transaction, preventing future disputes.

Include a section for payment method. Whether it’s cash, check, or electronic transfer, specifying how the payment was made adds transparency. If applicable, note any remaining balance.

Always reserve space for a signature. This confirms acknowledgment from both parties, making the receipt a legally reliable document. A simple line for the payer and recipient signatures, along with printed names, is sufficient.

For business use, adding a company logo and contact details enhances credibility. If issuing receipts frequently, consider using a digital template with automated date and numbering for consistency.

Avoid clutter. Stick to a clean layout with aligned text and readable fonts. A straightforward receipt reduces confusion and ensures quick verification when needed.

Sign Receipt Template

Design a clear and concise sign receipt template to enhance the signing process. Include sections for the date, the name of the signer, and a description of the transaction. This ensures all relevant details are documented effectively.

Use a simple layout with designated areas for signatures. A line for the printed name beneath the signature adds clarity and accountability. Incorporate a section for notes, allowing the signer to include additional information if necessary.

Ensure your template is easily accessible. Consider using a digital format for quick distribution and storage. A PDF format can maintain the integrity of the design while being easy to share.

Regularly review and update your template to reflect any changes in your business practices or legal requirements. This keeps your documentation relevant and compliant.

Encourage feedback from users of the template. Insights from clients or team members can lead to improvements that enhance usability and effectiveness.

Key Elements to Include in a Receipt for Signature

Include a clear header at the top, stating “Receipt” to indicate the document’s purpose. This helps in easy identification and organization.

Provide the business name, address, phone number, and email at the beginning. This information establishes the identity of the issuing party.

Add a unique receipt number. This number aids in tracking transactions and simplifies record-keeping.

Clearly state the date of the transaction. This serves as a reference point for both the customer and the business.

List the items or services purchased in detail. Include descriptions, quantities, and individual prices to ensure transparency.

Show the total amount paid prominently. This figure should include any taxes or fees to provide clarity on the overall cost.

Incorporate payment method details, such as credit card, cash, or check. This adds another layer of accountability to the transaction.

Reserve a space for the customer’s signature. This confirms their acceptance of the transaction and serves as a record of agreement.

Consider adding terms and conditions or return policies at the bottom of the receipt. This information protects both parties in case of disputes.

Ensure the format is clean and easy to read. Use legible fonts and sufficient spacing to enhance clarity.

Choosing the Right Format for Different Transactions

Select the format based on transaction type. For cash transactions, a simple, concise receipt suffices. Include transaction date, amount, and payment method for clarity.

For Invoices

When dealing with invoices, use a detailed format. Itemize products or services, including descriptions, quantities, and prices. Adding tax and total due amounts enhances transparency.

For Online Transactions

For online transactions, opt for digital receipts. Ensure they are accessible via email or app notifications. Include unique transaction IDs and links for easy reference. This format helps customers track their purchases efficiently.

Legal Considerations When Creating a Signed Receipt

Ensure that both parties clearly understand the terms of the transaction. Clearly outline the goods or services exchanged, including any relevant details such as quantities and prices. This clarity helps prevent disputes later.

Incorporate specific language that indicates acceptance by both parties. Phrases like “Received by” followed by the recipient’s name and signature solidify the agreement. A date should accompany the signature to confirm the transaction timeline.

Include a statement that acknowledges the receipt of payment. This statement can affirm that the funds have been received, which adds an extra layer of security for both parties.

Consider the jurisdiction where the transaction occurs. Different regions may have specific regulations regarding receipts and contracts. Familiarize yourself with local laws to ensure compliance and avoid potential legal issues.

Keep a copy of the signed receipt for your records. Both parties should retain their copies to facilitate reference in case of future disputes. Organizing these documents can streamline resolution processes if necessary.

| Key Elements | Description |

|---|---|

| Transaction Details | Clearly state what was exchanged, including specifics. |

| Acceptance Language | Use clear phrases to denote agreement and acceptance. |

| Payment Acknowledgment | Include a statement confirming payment has been received. |

| Legal Compliance | Research local regulations regarding signed receipts. |

| Record Keeping | Both parties should keep copies for future reference. |

Customization Options for Various Business Needs

Choose a template that aligns with your brand identity. Use colors, logos, and fonts that represent your business effectively. Tailor the layout to emphasize key information such as transaction details or customer messages. A clean and intuitive design enhances readability and reinforces professionalism.

Incorporate additional fields as necessary. Depending on your industry, you might need spaces for items like service descriptions, tax breakdowns, or payment methods. This flexibility allows for accurate documentation that meets specific business requirements.

Integrate digital features like QR codes or links to your website. These elements provide customers with easy access to additional resources or promotional offers. Ensure these features align with your marketing strategies to maximize their impact.

Consider offering bilingual options if you serve a diverse clientele. Providing receipts in multiple languages can improve customer satisfaction and inclusivity, fostering positive relationships.

Utilize software that enables easy customization. Look for platforms that offer drag-and-drop functionality, allowing you to modify templates effortlessly. This capability saves time and ensures your receipts can adapt to any business change swiftly.

Regularly update your templates based on customer feedback. Listen to your clients and adjust your designs and formats as needed. This responsiveness not only enhances user experience but also demonstrates your commitment to their needs.

Digital vs. Paper Receipts: Pros and Cons

Choose digital receipts for convenience and eco-friendliness. They reduce clutter, are easily searchable, and can be stored indefinitely without taking up physical space. Many apps and services allow for instant organization, making expense tracking straightforward.

However, paper receipts still hold significant value. They don’t rely on technology, making them accessible to everyone. For those without smartphones or consistent internet access, paper remains a reliable option. Additionally, some businesses or services may require physical proof of purchase, which a printed receipt provides.

Digital receipts offer the advantage of automated record-keeping. Businesses can send them via email or apps, streamlining processes for both customers and vendors. They can also be integrated into accounting software, saving time during tax season.

On the flip side, consider the potential for technology issues. If a customer loses access to their email or if the service provider has a system failure, retrieving a digital receipt could become challenging. Users must also be cautious about privacy, ensuring their information is secure when using online services.

For specific industries, one format may be favored over the other. Retailers often benefit from paper receipts as they can be printed instantly at the point of sale. In contrast, tech-savvy companies and eco-conscious businesses might prioritize digital solutions to minimize their carbon footprint.

Evaluate personal preferences and circumstances. Some individuals prefer the tactile feel of paper, while others appreciate the modern convenience of digital records. Balancing these preferences can guide decisions on which format best suits your needs.

Best Practices for Storing and Managing Signed Receipts

Utilize a secure cloud storage solution to keep signed receipts safe and accessible. This allows easy retrieval and reduces the risk of physical damage or loss.

Implement a systematic naming convention for receipts. Include the date, vendor, and amount in the file name for quick identification. For example, “2025-02-08_VendorName_Amount.pdf” simplifies searching.

Organize receipts into folders based on categories such as expenses, tax documents, or business purchases. This structure streamlines access during audits or financial reviews.

Regularly back up your receipt files. Schedule automatic backups to ensure no data is lost in case of a system failure or accidental deletion.

Maintain an index or spreadsheet of all stored receipts. This document should list the details of each receipt, including the date, amount, and category, facilitating quick tracking and reference.

Use digital scanning apps to convert paper receipts into digital formats. These apps often enhance readability and help in storing the documents electronically.

Review your storage system periodically. Remove outdated or unnecessary receipts while ensuring essential documents are preserved for future reference.

Consider using tags or labels within your storage solution for added organization. This method helps in filtering and finding specific receipts quickly.

Train your team on proper receipt management practices. Clear guidelines will enhance consistency and reduce the risk of losing important documents.

Finally, ensure compliance with relevant legal and tax regulations regarding the storage and management of financial documents. Stay informed about the requirements in your jurisdiction.