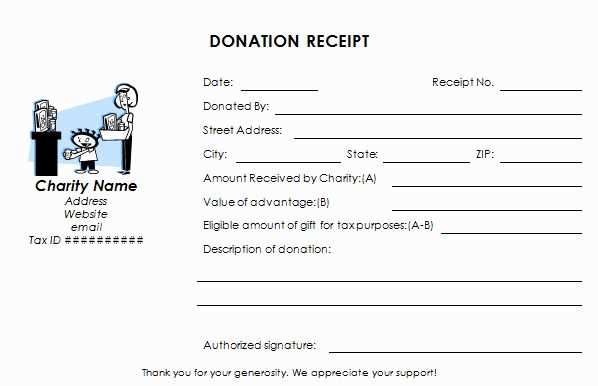

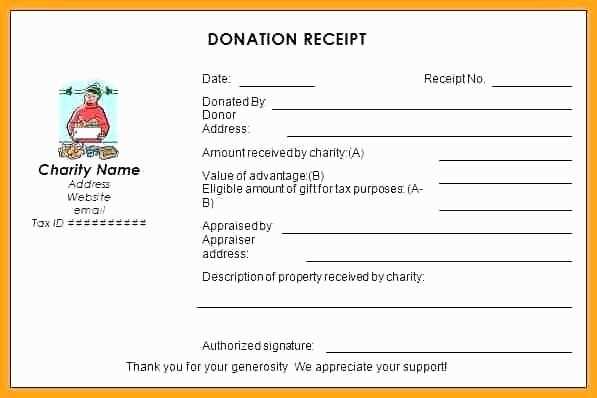

Provide your donors with a clear, concise receipt that acknowledges their contribution to your silent auction. A well-structured donor receipt serves as a legal record for tax purposes and reassures donors that their donation is appreciated. Use a template that includes all necessary information to ensure accuracy and transparency.

At a minimum, the receipt should include the donor’s name, the value of the donated item, the date of the donation, and a statement that no goods or services were provided in exchange for the donation. If goods or services were offered, be sure to include their value and how it affects the donation amount.

Don’t forget to personalize the receipt with your organization’s details–such as name, address, and tax-exempt status. This information helps donors during tax filing and ensures they have everything they need to claim their charitable deductions.

Ensure that your receipt template is simple, professional, and easy to understand. Make it available as soon as possible after the event to maintain donor trust and encourage future contributions.

Here’s the revised version with minimal repetition:

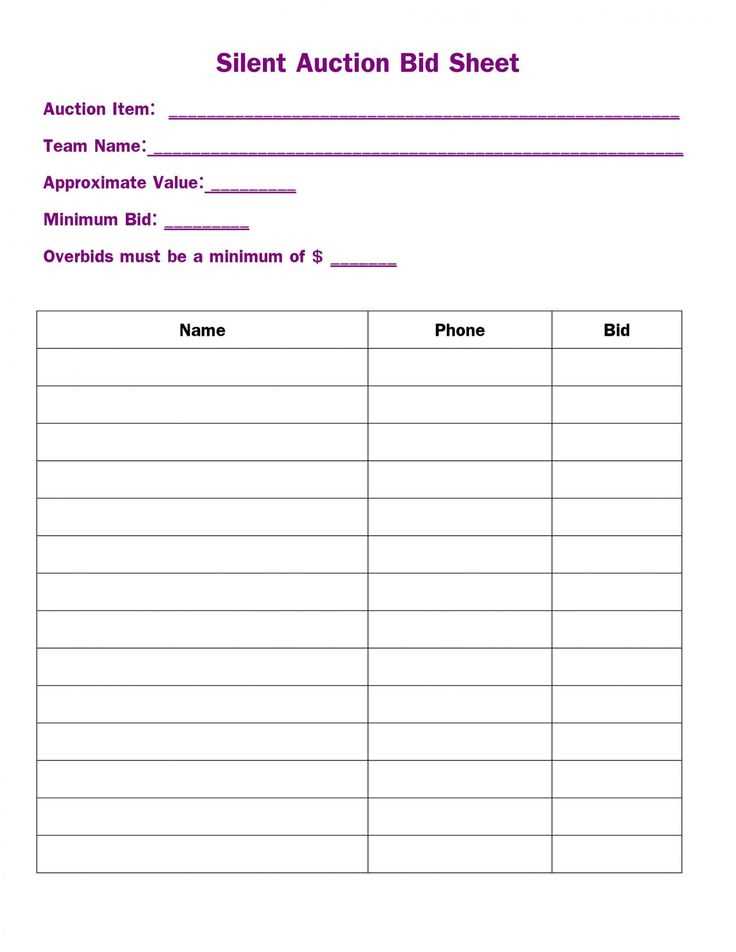

To streamline donor receipts for silent auctions, focus on clarity and key information. A clean layout ensures the donor understands their contribution and its value. Keep descriptions concise and avoid redundant phrases. Below is a suggested template with specific elements you should include:

| Information | Details |

|---|---|

| Donor Name | [Donor’s Full Name] |

| Donation Item | [Description of Item] |

| Item Value | [Estimated Value of the Item] |

| Auction Date | [Date of Auction] |

| Receipt Date | [Date of Receipt] |

| Non-Tax Deductible Amount | [Value of Auction Item minus Auction Winning Bid] |

Ensure the donor’s name, the auction date, and the value of the donation are accurate. Avoid overloading the receipt with excessive details, as simplicity aids readability and clarity. Keep the tone professional yet warm.

- Silent Auction Donor Receipt Template

Creating a clear and accurate donor receipt is key for any silent auction. It helps donors track their contributions and ensures compliance with tax regulations. Below is a structured template to help you capture all necessary details and ensure smooth transactions.

Key Information to Include

The donor receipt should contain several core elements:

- Donor’s Name: Include the full name or organization name of the donor.

- Item Description: Clearly describe the donated item or service. Mention any relevant details like the auction number or item code.

- Estimated Fair Market Value (FMV): Provide an accurate FMV, which reflects what the item could reasonably sell for in the marketplace. This value is crucial for tax purposes.

- Date of Donation: Record the exact date when the donation was made.

- Auction Date: Specify the date the auction will take place or when the donation was used, if different from the donation date.

- Receipt Number: Assign a unique receipt number for tracking and accounting purposes.

Additional Considerations

If the donor received any goods or services in exchange for their donation, you must indicate the value of these items. This will allow donors to distinguish the tax-deductible portion of their contribution. If the donor did not receive anything in return, this should be clearly stated as well.

For transparency, include a statement that the receipt is not an acknowledgment of tax-exempt status. Donors should consult with their tax advisors to confirm the deductibility of their contributions.

Ensure the receipt is signed by an authorized person from the organizing committee to further authenticate the document.

This template will make the process of acknowledging donations organized, streamlined, and compliant with regulations. Proper documentation can lead to a smoother tax filing process for your donors and increase their confidence in your event.

Make sure your donor receipt includes the following key details to maintain clarity and meet IRS requirements:

1. Donor Information: List the full name of the donor or their organization. If applicable, include the address and contact details for future correspondence.

2. Description of the Donated Item: Provide a clear description of the item or service donated. If it’s a tangible item, include details like brand, model, and condition. For services, describe the scope and value.

3. Date of Donation: Include the exact date the donation was made. This is important for tracking purposes and ensuring the proper tax year is recorded.

4. Fair Market Value (FMV): State the estimated fair market value of the donated item or service. Do not assign a dollar value to the tax-deductible portion of the donation; the IRS requires the donor to assess this themselves.

5. Acknowledgment of No Goods or Services Received: If the donor receives no goods or services in exchange for the donation, the receipt should state this clearly. This ensures the donor understands their tax-deductible contribution is the full value of the item or service.

6. Tax ID Number: Include your organization’s Tax Identification Number (TIN) or Employer Identification Number (EIN). This confirms your charity’s legal status and enables donors to claim their deductions.

7. Auction Information: If the donation was made specifically for an auction, mention the auction date and event name. This gives context to the donation and ties it to the event it supports.

8. Signature: Your organization’s representative should sign the receipt to verify the information is accurate. This adds legitimacy and helps avoid any confusion later.

9. Donor’s Responsibility: Include a brief note stating that the donor is responsible for determining the value of the donation for tax purposes. This clarifies that the receipt does not determine the tax-deductible amount.

By following these guidelines, you ensure your donor receipt is clear, concise, and meets both legal and tax requirements. A well-formatted receipt not only helps donors claim deductions but also builds trust with your supporters.

When creating a donor receipt for a silent auction, make sure to include these key details for transparency and to comply with tax regulations.

- Donor’s Name and Address: Include the full name and address of the donor for proper identification. This is essential for the donor’s tax deduction purposes.

- Date of the Donation: Clearly state the date when the donation was made. This helps both the donor and the organization keep track of transactions for reporting or tax purposes.

- Description of the Item Donated: Provide a brief but accurate description of the item donated. Avoid assigning a value to the item if the value is subjective or uncertain.

- Value of the Donation: If the item has a set fair market value, include this information. For donations without a fixed value, avoid estimating the worth unless a qualified appraiser has given an official valuation.

- Statement of Non-Exchange: Include a clear statement that the donation was made without the donor receiving anything in return (other than an acknowledgment of the donation). This ensures the donation is tax-deductible.

- Event Details: Specify the event for which the item was donated, including the name of the silent auction and its date, if applicable.

- Tax-Exempt Status: If the organization is tax-exempt, indicate this status and provide the tax-exempt number, as it is required for the donor’s records.

Double-check that all of the details are correct to prevent any issues with the donor’s tax deductions and to ensure that the receipt complies with IRS guidelines. Keeping the language clear and direct is key to making sure the donor can easily use the receipt for their own purposes.

One of the most common mistakes when issuing receipts is failing to include the correct donor information. Always ensure that the donor’s name, address, and contact details are accurately listed. This allows both the donor and the organization to maintain proper records for tax purposes and future communication.

Not Specifying the Value of Donations

Receipts must clearly state whether the donation is a monetary gift or an item and provide an estimated fair market value for goods or services. If you fail to specify this, donors may face difficulties when claiming tax deductions. If the donation is in-kind, include an estimated value that reflects current market conditions or comparable sales.

Incorrect Tax-Deductible Amounts

Always separate the fair market value from the amount that qualifies for tax deduction. For instance, if a donor paid more than the market value for an item, the receipt should only reflect the excess as a tax-deductible contribution. Misstating this figure can cause confusion and compliance issues.

Another mistake is failing to send receipts in a timely manner. Delays can lead to donors losing their documentation or forgetting important details. Ensure that receipts are issued shortly after the event and ideally no later than the end of the month in which the auction took place.

Lastly, don’t forget to include the organization’s tax ID number. Without it, the receipt won’t meet IRS requirements, and donors may not be able to use it for tax purposes. Always check that your receipts contain this crucial information before distribution.

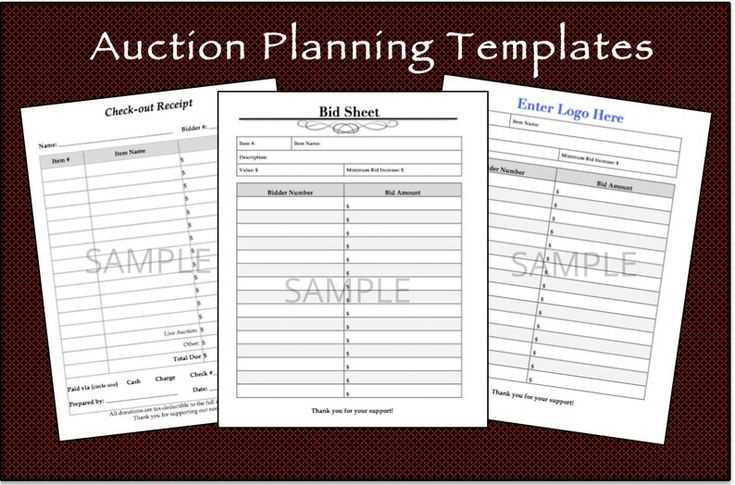

Silent Auction Donor Receipt: Template Guidelines

When creating a donor receipt for a silent auction, ensure it provides all necessary details for the donor’s records. A well-crafted receipt not only confirms their contribution but also serves as a tool for tax purposes. Here’s how to structure it effectively:

Key Information to Include

- Donor’s Name: Clearly state the donor’s full name or organization.

- Item Description: Provide a concise yet thorough description of the donated item or service.

- Fair Market Value: If known, include the fair market value of the item. This is crucial for tax deductions.

- Donation Date: Specify the date of the donation, as this is necessary for tax records.

- Tax-Exempt Status: If applicable, include a note that the organization is tax-exempt under section 501(c)(3) of the IRS code.

- Signature: The receipt should be signed by an authorized representative of the organization.

Format Suggestions

- Keep the receipt clear and professional, using a clean design.

- Include the organization’s logo and contact details for easy reference.

- Ensure the font is readable and the layout is easy to follow.

Providing donors with a detailed and accurate receipt strengthens trust and ensures compliance with tax laws. Make sure to keep records for future reference and audits.