If you’ve won an item in a silent auction, you may be eligible for a tax deduction. The IRS allows you to claim deductions for certain donations made through these events, but you’ll need a proper receipt to substantiate the claim. This template can help ensure your donation is documented correctly and meets all requirements for tax purposes.

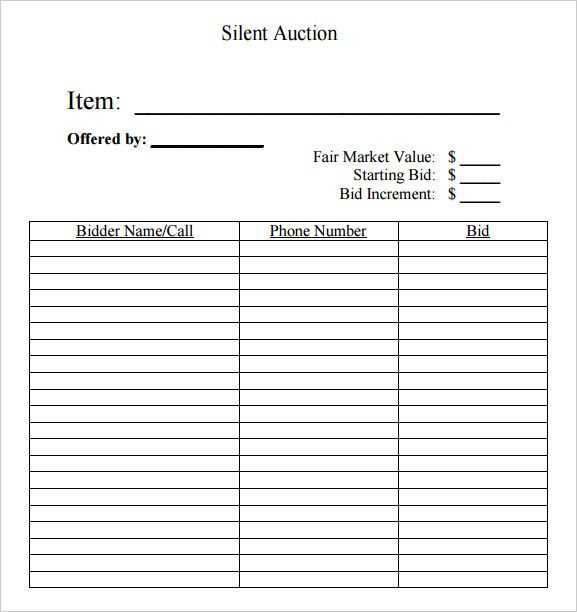

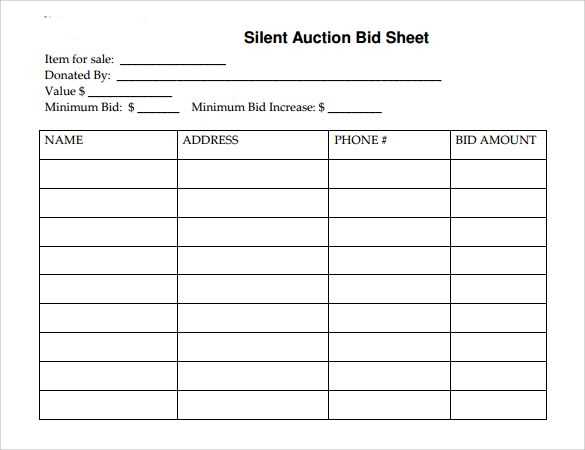

First, your receipt should clearly state the auction item’s fair market value (FMV), which is the price it would likely sell for on the open market. This value is crucial, as it determines the amount you can deduct. Be sure to note whether the donation is partially or fully tax-deductible. For example, if you paid more than the FMV for the item, you may only be able to deduct the difference.

Next, include the name of the event, the date it took place, and the name of the organization that hosted it. Your receipt should also mention that you received no goods or services in exchange for your contribution, especially if you paid more than the FMV of the item. This statement is key for ensuring your donation qualifies for a deduction.

Finally, make sure the organization’s tax-exempt status is clearly stated. This can usually be verified by including their IRS 501(c)(3) status or other relevant tax-exempt documentation. Providing all of these details ensures your receipt is IRS-compliant and that you can confidently claim your deduction on your taxes.

Here’s the corrected version:

For your silent auction winner tax-deduction receipt, ensure it includes the following key details:

Recipient and Donor Information

Clearly list the name of the organization receiving the donation and the donor’s name. Include the donor’s address, if possible, for further verification and tax purposes.

Item Description and Value

Describe the item donated, including its condition and purpose. If the auction item was valued by an appraiser or the organization, provide the appraised value for tax deduction purposes. If there is no appraised value, state that the value was not determined by the charity.

Make sure to specify that the donor did not receive any goods or services in exchange for the donation, as this allows them to claim a tax deduction. This is a crucial detail for accurate reporting and claiming.

Official Language and Disclaimers

Include a statement that the receipt is for tax-deductible purposes and explain the donor’s responsibility for ensuring compliance with tax laws. Avoid using ambiguous terms, and stay concise and clear.

Provide the date of the donation and make sure the receipt is signed by an authorized representative of the organization.

- Silent Auction Winner Tax-Deduction Receipt Template

For tax purposes, provide a receipt to the silent auction winner that outlines the amount eligible for tax deduction. Include the following details:

Key Elements of the Receipt

- Organization Information: The name, address, and tax identification number (TIN) of the organization hosting the auction.

- Event Date: The specific date of the silent auction.

- Item Description: A clear description of the auction item the winner purchased.

- Fair Market Value (FMV): The estimated value of the item, as determined by the organization at the time of the auction.

- Amount Paid: The total amount the winner paid for the item.

- Tax-Deductible Portion: If the amount paid is higher than the FMV, the difference may be considered a tax-deductible donation.

Receipt Template

Use this simple template to generate the receipt:

[Organization Name] [Organization Address] [Organization TIN] Date: [Auction Date] Recipient: [Winner's Name] Address: [Winner's Address] Item Description: [Item Name] Fair Market Value: $[FMV] Amount Paid: $[Amount Paid] Tax-Deductible Portion: $[FMV - Amount Paid] (if applicable) Thank you for your support. This document confirms the amount paid and potential tax-deductible donation. Authorized Signature: [Signature]

Be sure to provide the winner with this receipt after the auction. The tax-deductible amount is calculated by subtracting the fair market value from the total amount paid. This portion can be used by the winner as a charitable donation on their tax return.

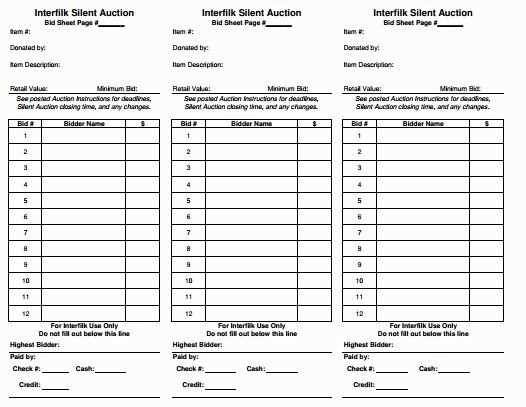

Begin by including your organization’s name, address, and contact information at the top of the form. Clearly state that the form is a receipt for tax-deduction purposes. Mention the date of the auction and specify the item or service the winner has won, including a brief description and the fair market value of the item. The fair market value is crucial for the donor’s tax records. If the item is a donation, indicate whether the entire amount paid by the winner is tax-deductible or if part of it represents the fair market value.

Next, outline the total amount paid for the item, and explicitly state the portion that is tax-deductible. This should reflect the amount paid above the fair market value of the item. Provide a statement that no goods or services were exchanged for the donation exceeding this amount. Make sure to include a note that your organization is a qualified 501(c)(3) nonprofit to reassure the winner that the donation qualifies for tax benefits.

End the form with a signature from a representative of your organization and the date. Ensure the winner knows to keep the form for their tax records. This process ensures compliance with IRS guidelines and provides clarity for both the donor and your organization.

Ensure the receipt contains specific details to make the deduction valid for tax purposes. These include:

- Donor’s Name: Clearly list the name of the donor who contributed the item or funds. This ensures the IRS can match the receipt with their records.

- Date of the Donation: The date the donation was made is necessary for tax filing. Make sure it’s accurate and easy to identify.

- Charity Name and Address: Include the full name and address of the charity receiving the donation to confirm its status and eligibility for tax deductions.

- Description of the Donated Item: Provide a brief but clear description of the item or service, including any relevant details like condition or specific features.

- Value of the Donation: If the donation is monetary, state the exact amount. If it’s an item, note its fair market value as determined by the donor or appraiser.

- Statement of No Goods or Services Provided: If the donor did not receive anything in exchange for the donation, include a statement confirming this fact. If goods or services were given, their fair market value should be mentioned.

- Organization’s Tax-Exempt Status: Include a statement confirming the organization’s tax-exempt status (e.g., 501(c)(3)) to assure the donor of their eligibility for deductions.

The fair market value (FMV) of an item directly impacts the amount you can deduct from your taxes after winning a silent auction. It’s the price a willing buyer would pay to a willing seller in an open market, with neither party under any compulsion to buy or sell.

When you claim a tax deduction for a donation made through a silent auction, you can only deduct the portion of the payment that exceeds the FMV of the item. For example, if you bid $500 for an item with an FMV of $300, your deductible contribution would be $200 ($500 – $300).

- Determine FMV by comparing the auction item to similar items in the market.

- If the auction house provides an estimated value, this often serves as a starting point, but it’s your responsibility to verify it.

- For donated goods, research or appraisals may be needed to establish the FMV, especially for high-value items like artwork or antiques.

Remember that if the amount you paid does not exceed the FMV, you cannot claim a tax deduction for the auction item. Make sure your deduction is based on the actual contribution, not the total amount paid.

Begin by gathering a complete description of the donated item, including its condition and any relevant details such as brand, model, or unique features. This helps verify the item’s value for tax deduction purposes.

Next, determine the fair market value (FMV) of the item. Research comparable items or seek professional appraisal if needed. Ensure that the valuation is reasonable and substantiated by relevant data, such as auction prices or retail listings.

Prepare a donation receipt that includes the donor’s name, date of the donation, description of the item, and its FMV. Be clear that no goods or services were exchanged for the donation, as this is key to securing the deduction.

If the item’s FMV exceeds $500, complete IRS Form 8283, which must be submitted with your tax return. For donations valued over $5,000, a qualified appraisal is required to substantiate the deduction.

Finally, maintain thorough records. This includes photographs of the item, correspondence with the donor, and any receipts or appraisal reports. These documents will support your claims if questioned by tax authorities.

To ensure that donors can claim a tax deduction, provide them with a detailed receipt that complies with IRS guidelines. Include all necessary information to help the donor claim their deduction and make the process smooth for both parties.

1. Key Information to Include

Each receipt should contain the following elements:

- Organization Name: Clearly state the name of your nonprofit organization.

- Date of Donation: Specify the exact date the donation was made.

- Donor Information: Include the name and contact details of the donor.

- Description of Donated Items: Include a brief description of what was donated (if applicable).

- Fair Market Value (FMV): If the donation is property, list its FMV. This is essential for non-cash donations.

- Statement of No Goods or Services Provided: If no goods or services were provided in exchange for the donation, include a statement to this effect.

- Signature: Some organizations may also include an authorized signature or an official seal.

2. Create a Template for Easy Access

To streamline the process, create a receipt template that includes the above details, leaving space to fill in the donor’s information and donation specifics. Make sure the template is easy to use and can be modified quickly for each donation.

| Information | Example |

|---|---|

| Organization Name | Charity Foundation |

| Date of Donation | February 5, 2025 |

| Donor’s Name | John Doe |

| Donation Description | Cash Donation |

| Fair Market Value | N/A (Cash Donation) |

| Statement | No goods or services were provided in exchange for this donation. |

Ensure the donor receives the receipt promptly, preferably within a reasonable time frame after the donation. This helps them take advantage of their tax-deduction opportunities and makes the process easier for your organization.

Make sure the receipt includes all required information. Missing details such as the donor’s name, donation amount, or the date of the gift can lead to confusion and potential issues with tax deductions. Double-check that each receipt is accurate and complete before it is issued.

Don’t confuse donations with purchases. If someone has bought an item at a silent auction, the receipt must clearly distinguish the donation amount from the purchase price. The receipt should state the fair market value of the item, as this affects the donor’s ability to claim a tax deduction.

Always include a statement about no goods or services being exchanged for donations. If no goods or services were provided in return for the gift, make sure the receipt explicitly states this, as it influences the donor’s eligibility for tax deductions.

Avoid vague descriptions of the donated items. Instead of listing an item as “miscellaneous,” clearly describe it with enough detail to show its value. This helps prevent disputes or confusion regarding the deduction amount.

Do not forget to issue the receipt in a timely manner. Issuing receipts months after the donation is made can complicate the donor’s tax filings. Stick to a regular schedule to send out receipts shortly after the donation has been processed.

| Error | Impact | Solution |

|---|---|---|

| Missing details (name, date, amount) | Can lead to confusion during tax filing | Double-check all information for accuracy |

| Confusing purchases with donations | Donor may lose eligibility for tax deductions | Separate donation amount from auction purchases |

| Lack of goods/services statement | May cause the donor to incorrectly claim deductions | State explicitly if no goods or services were provided |

| Vague item descriptions | Can lead to disputes over item value | Provide clear and specific descriptions of donations |

| Delayed receipt issuance | Donor may have issues with timely tax filing | Issue receipts as soon as possible after donation |

Silent Auction Winner Tax-Deduction Receipt Template

Make sure to include the following details in your silent auction winner tax-deduction receipt:

- Donor Information: Clearly state the name, address, and contact details of the donor. This establishes the legitimacy of the contribution.

- Nonprofit Organization Details: Include the full name, address, and EIN (Employer Identification Number) of the nonprofit organization, verifying its tax-exempt status.

- Item Description: List the item(s) or services won at the auction. Provide a detailed description, including quantity, condition, and any unique features.

- Fair Market Value (FMV): Clearly indicate the fair market value of the item or service as determined by the nonprofit. This is essential for the donor’s tax deduction.

- Auction Winning Amount: State the total amount paid for the item or service. If the winning bid exceeds the fair market value, specify the difference for the donor’s tax purposes.

- Statement of No Goods or Services Received: If the donor received nothing in return for the contribution, explicitly state this, as this impacts the tax-deductible amount.

- Date of Auction: Include the date of the auction to clarify when the transaction occurred.

- Tax-Deductible Amount: Clearly state the portion of the winning bid that is tax-deductible. This is the difference between the auction winning amount and the fair market value.

- Signature: Have an authorized person from the nonprofit organization sign the receipt. This confirms its authenticity.

Always issue this receipt to the winner promptly after the auction to ensure they can claim the appropriate tax deductions. Keep a copy for your records as well.