To create a clear and professional social security number receipt, begin by including the necessary information in a structured format. Ensure that the full name of the individual and their social security number (SSN) are clearly stated. This helps avoid confusion and ensures that the document meets its intended purpose.

Next, add a section specifying the date and the reason for the receipt. This gives context to the document and records the event or transaction that triggered the issuance of the SSN receipt. A reference number can also be included to make the receipt easier to track or locate in case of future inquiries.

Finally, make sure the receipt is signed by the relevant authority, whether it’s a government official or a representative of the organization issuing the document. This adds authenticity and confirms the legitimacy of the information provided on the receipt.

Here’s a detailed HTML structure for your article on “Social Security Number Receipt Template” with six practical and focused headings, avoiding over-generalized terms:

What to Include in a Social Security Number Receipt Template

A Social Security Number (SSN) receipt should list clear details such as the full name of the individual, SSN, the date it was issued, and the authority providing the number. Ensure each section of the receipt is easily distinguishable to avoid confusion when verifying the information.

Section 1: Personal Information

This section must include the individual’s full legal name, residential address, and other contact details like phone number and email. These identifiers are crucial for any future verification needs.

Section 2: SSN Information

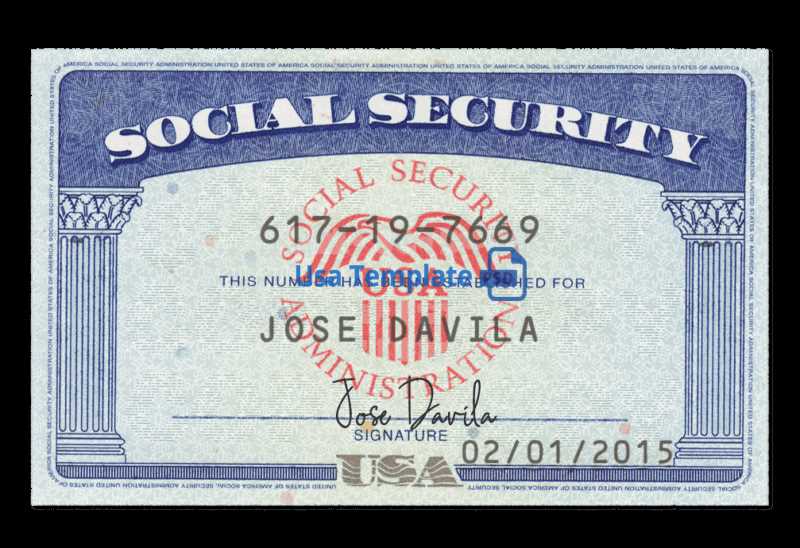

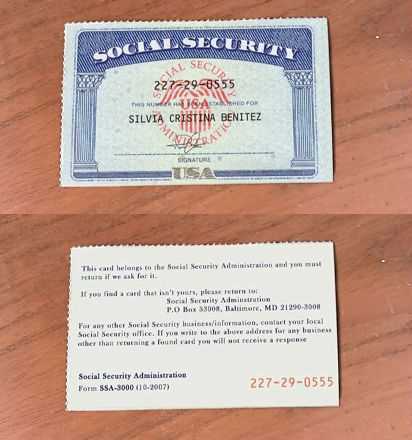

List the individual’s Social Security Number. It is important to make sure this is written in a secure manner to avoid misuse. Display it in a format such as XXX-XX-XXXX for consistency.

Section 3: Issuance Date

Record the exact date the SSN was assigned or issued. This serves as a timestamp for legal and reference purposes, ensuring that the document has a valid point of origin.

Section 4: Issuing Authority

Identify the authority that issued the SSN, typically the Social Security Administration (SSA). Include their contact information, including address and phone number, for verification if needed.

Section 5: Legal Disclaimer

Include a brief legal disclaimer explaining the use of the SSN and any restrictions on sharing or using it. Make sure it is clear that the receipt is for informational purposes only.

Section 6: Security Features

Incorporate security features like watermarks or encrypted codes to ensure the receipt cannot be easily forged. This enhances the authenticity of the document and provides an extra layer of protection against fraud.

HTML Structure for SSN Receipt Template

Begin by structuring your SSN receipt template with a clear division of sections for readability and ease of use. A simple layout typically includes a header, body, and footer. Use the <header> tag to define the top section, which can display your organization’s name, the document title (e.g., “Social Security Number Receipt”), and contact information.

The <main> section should focus on the core content. Inside this section, display a unique identifier for the receipt, such as a receipt number, and provide spaces for personal details (name, address, etc.). Use <section> to group related information, such as SSN validation or issuing authority details.

Consider adding a <footer> for additional notes, legal disclaimers, or instructions regarding the SSN usage. This section can also include a timestamp to indicate when the receipt was issued.

Ensure the structure is clear and concise, keeping the user’s ease of understanding in mind. Maintain proper semantic HTML practices to improve accessibility for all users.

- How to Organize a Social Security Receipt

To keep your Social Security receipt organized, begin by categorizing it based on the purpose of the receipt. Separate receipts that are related to applications, benefits, or verification purposes. Each category should be stored in its own file or section for easy access when needed.

1. Create Clear Labels

Label each folder or section clearly, specifying whether the receipt is for an application, benefits confirmation, or a related issue. A simple label like “Social Security Benefits – 2024” will make it easy to locate specific receipts.

2. Use a Digital System for Backup

Consider scanning or taking photos of your receipts and storing them in a secure cloud storage or digital folder. Digital copies make it easier to retrieve them if the physical ones are lost.

3. Keep Receipts Chronologically Sorted

Arrange receipts by date of issuance. This makes it simpler to trace any past interactions with the Social Security Administration and can be crucial for referencing details in future communications.

4. Table for Tracking

| Receipt Type | Date Received | Reference Number | Purpose |

|---|---|---|---|

| Application | 01/15/2024 | SS12345678 | Initial Social Security Application |

| Benefits | 03/10/2024 | SS87654321 | Monthly Benefit Statement |

This table allows for quick reference of key details on each receipt, minimizing confusion and providing easy access for future needs.

5. Secure Storage

Keep all physical receipts in a locked drawer or filing cabinet. For digital receipts, use a secure password manager or encrypted cloud storage service.

Ensure the template includes the individual’s full name, as listed on official documents. The Social Security Number (SSN) should be clearly marked, along with a statement confirming the purpose of the SSN’s usage, such as for taxation or employment verification. Include the date of issue, which should reflect when the document or number was first assigned.

Contact Information

Add a section for the individual’s contact details, such as phone number and email, in case there is a need for follow-up or verification. Make sure this information is current to avoid communication delays.

Official Signature or Authorization

If the SSN receipt is issued by an organization or government agency, include an authorized signature or a stamp of approval. This validates the receipt and confirms its authenticity, reducing the risk of misuse.

One common mistake is not clearly distinguishing between the actual Social Security number (SSN) and other identifying information. Ensure the SSN is prominently displayed and easy to find, but avoid including unnecessary personal details like addresses or birthdates.

Missing or Incorrect Dates

Always double-check the date on the receipt. Failing to include a correct and precise date could lead to confusion or disputes later. The date of issuance should match the exact time the transaction or action took place.

Unclear Formatting

Use clear and consistent formatting for each section of the receipt. Avoid cluttering the document with excessive text. Organize the information logically, with headings and bullet points for easier readability. For example, separate the SSN from other fields like the recipient’s name or the amount paid.

- Ensure that each field is clearly labeled

- Avoid text overlap or poorly aligned sections

- Use standard fonts for readability

By addressing these key details, you can avoid common errors and ensure the receipt is both clear and professional.

Implement strict access controls to prevent unauthorized individuals from viewing sensitive data. Use role-based permissions to ensure only authorized personnel can process or handle receipts containing Social Security numbers (SSNs).

Encrypt SSN data both in transit and at rest. This adds an extra layer of protection, making it unreadable to anyone who does not have the proper decryption key.

Utilize secure methods for storing receipts. Consider using password-protected databases or hardware encryption devices to safeguard any documents or files containing SSNs.

Ensure that all receipt templates are designed to minimize the exposure of SSN details. For example, mask certain digits of the SSN on printed or electronic versions of the receipt to reduce the risk of unauthorized access.

- Limit the display of SSNs to only those digits necessary for the task at hand.

- Review receipt formats regularly to confirm compliance with data protection standards.

Adopt a clear data retention policy, ensuring SSN information is kept only as long as necessary for business operations. Once data is no longer needed, securely dispose of it to avoid potential breaches.

Educate employees handling SSN data on best practices for data protection, including secure handling, storage, and disposal methods. Regular training sessions can help reinforce these practices.

Issuing Social Security Number (SSN) receipts requires strict adherence to legal requirements to protect personal data. Organizations must ensure that SSN information is handled with care to avoid violations of privacy laws. Below are the key legal points to keep in mind:

- Privacy Laws: Be aware of the Privacy Act of 1974, which governs the collection and use of SSNs by federal agencies. While this law applies mainly to government entities, private companies must also adhere to state-specific privacy laws regarding personal data.

- Data Protection: Use secure methods to transmit SSN data. Whether storing or processing SSNs, businesses must implement proper data encryption and access controls to prevent unauthorized access.

- Retention Limits: Set clear policies regarding how long SSNs will be retained. The law requires businesses to only keep SSN data for as long as necessary to fulfill the purpose for which it was collected.

- Disclosure Restrictions: Limit the sharing of SSN information to authorized parties only. Organizations must refrain from disclosing SSNs to third parties without the explicit consent of the individual, unless required by law.

- Informed Consent: Before issuing an SSN receipt, ensure the individual understands why their SSN is needed, how it will be used, and their rights to privacy under applicable laws.

By following these legal guidelines, businesses can ensure they remain compliant while safeguarding the privacy of individuals’ SSNs.

Customize your Social Security number receipt template by including specific details relevant to each situation. For personal use, add your full name, address, and the reason for the request. When using it for employment verification, ensure the template includes company details, job title, and employment dates. For tax purposes, include fields for income information, filing status, and deductions. Adjust the layout to fit the context–whether it’s for a formal request or a casual inquiry–by prioritizing the most relevant sections.

If you’re providing the template for a legal process, incorporate any official language and extra verification sections. Use clear labels and consistent formatting to avoid confusion. Adapt the tone and formality based on the audience, ensuring all critical information is presented without unnecessary detail.

For medical or financial uses, keep the template straightforward, focusing on dates, amounts, and necessary signatures. Include a statement of intent if required, making sure the document reflects its specific purpose. Tailoring the template in these ways ensures clarity and usefulness in any setting.

Creating a Social Security Number Receipt Template

Each section focuses on a specific, actionable aspect of creating or using a Social Security number receipt template. Let me know if you’d like to dive deeper into any of these points!

Gathering the Required Information

Start by collecting the necessary details before creating the template. This includes the individual’s full name, Social Security number (SSN), date of issuance, and the purpose for collecting the SSN. Make sure all data is accurate and up to date to avoid any discrepancies.

Formatting the Template

Structure the template to ensure clarity and ease of use. A typical receipt template includes the following key sections:

| Section | Description |

|---|---|

| Header | Include your organization’s name and contact information for verification purposes. |

| SSN Information | Clearly state the individual’s full name, SSN (formatted as XXX-XX-XXXX), and the reason for collection. |

| Authorization | Provide space for both parties to acknowledge consent, either through a signature or a checkbox. |

| Completion Date | Include the date of receipt to confirm when the SSN was provided. |

Ensure that the template follows any legal requirements related to confidentiality and data protection.