When selling items as-is, clarity in your transaction is key. A sold as is receipt ensures that both buyer and seller have a clear understanding of the terms of the sale. This type of receipt protects both parties from future disputes, as it indicates that the item is being sold with no warranties or guarantees.

Make sure your receipt includes the item description, the sale amount, and a statement like “Sold as is, no returns or warranties.” This sets the expectation upfront that the buyer is accepting the item in its current condition. Specify any defects or issues with the item if necessary, to avoid any confusion later.

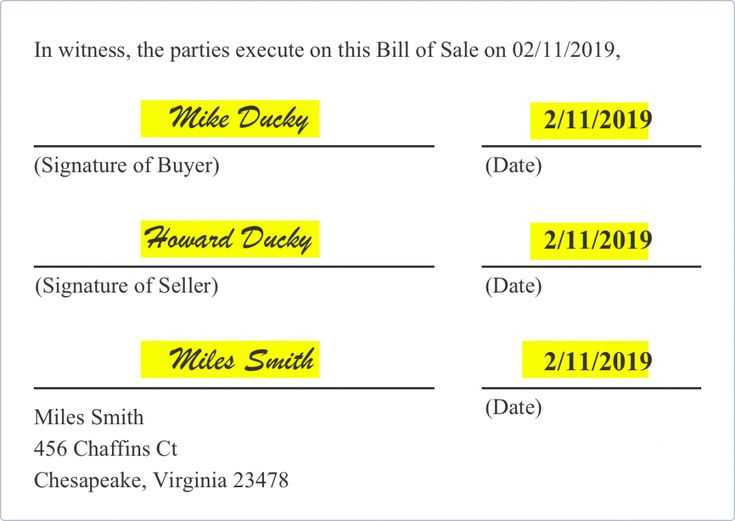

A well-structured receipt can also include the buyer’s and seller’s contact information, the date of the transaction, and payment method details. Keeping a copy of this receipt for your records is always a good practice, as it serves as documentation of the sale.

Understanding the Legal Implications of “Sold as Is”

When a product is sold “as is,” it means the seller makes no guarantees about its condition or functionality. This clause limits the seller’s liability, indicating that the buyer accepts the item with any flaws or defects that may not be immediately apparent. If you’re selling or purchasing an item under these terms, it’s essential to understand what this really means legally.

Seller’s Responsibility

Sellers using the “as is” clause typically waive any responsibility for repairs or returns, even if the item breaks shortly after purchase. However, they cannot misrepresent the condition of the product. For example, if the seller knowingly hides defects or provides false information about the product’s state, they could still be held accountable under consumer protection laws.

Buyer’s Risks

Buyers take on the risk when purchasing an item “as is.” Without any warranties, they cannot expect the seller to fix issues or accept returns. It’s crucial for buyers to inspect the product thoroughly before committing. If you’re uncertain about an item’s condition, consider seeking expert advice or avoiding the purchase altogether.

Remember, the “as is” clause doesn’t protect the seller from all legal claims. Fraudulent representations or violations of local laws can still result in legal action, even if the item is sold with an “as is” disclaimer. Buyers should also keep in mind that if the product doesn’t work as expected, they may have limited recourse for resolution.

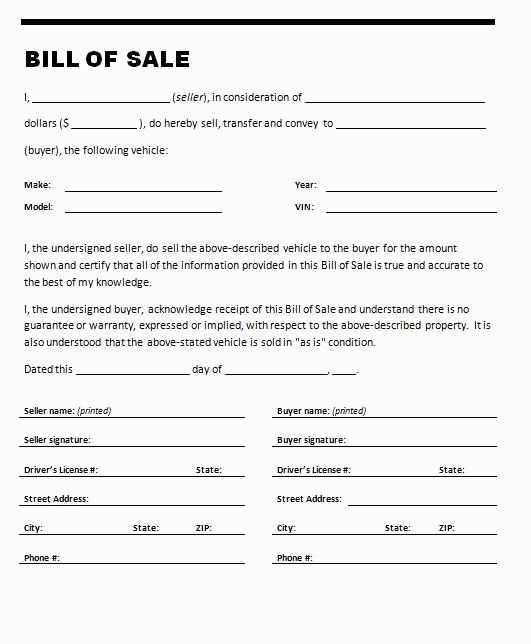

Key Elements to Include in Your Receipt Template

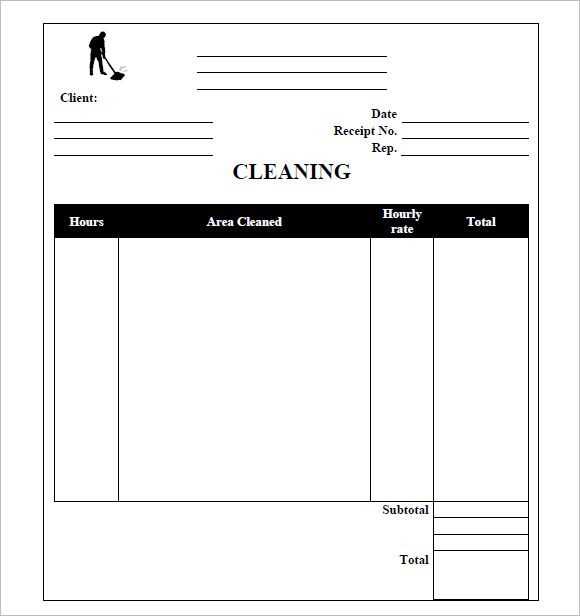

Clearly display the business name and contact information. This should be placed at the top for easy reference, including the address, phone number, and email. Providing this upfront makes it easier for customers to reach out if needed.

Include a unique receipt number. This helps both you and your customers track transactions efficiently. Make sure the number is distinct and sequential to avoid confusion with other records.

Provide the date of the transaction along with the payment method. Whether paid by cash, credit card, or other methods, clearly state this information for accurate records.

List the items or services sold along with their quantity and price. This ensures transparency and helps customers see exactly what they are paying for. Don’t forget to include any applicable taxes or discounts.

If applicable, include the return policy or any warranty information related to the products or services. This provides clarity and sets expectations about post-purchase support.

Finish with a thank you note or a brief message of appreciation. It leaves a positive impression and encourages future business.

How to Properly Word “Sold as Is” on Receipts

Clearly state “Sold as Is” on your receipt to ensure the buyer understands that the item is being purchased without any warranties or guarantees. Use precise language that leaves no room for confusion.

Place the phrase at the bottom of the receipt, near the total amount. Consider adding a short explanation that outlines the lack of liability for defects or returns, if applicable. Here is an example:

| Item | Price |

|---|---|

| Used Laptop | $200.00 |

| Sold as is. No returns or exchanges. | |

If the item is sold “as is” because it’s pre-owned, include a note such as “This is a pre-owned item with no warranty.” This provides clarity and avoids future disputes.

Also, ensure the buyer has had the opportunity to inspect the item before purchase. Add a line like, “Buyer acknowledges condition of item upon purchase.” This reinforces transparency and fairness.

Customizing Your Receipt Template for Specific Transactions

Adjust the layout to reflect the unique details of each transaction. If you’re selling a product with a warranty, include a section to specify the warranty period and conditions. For services, offer space to describe the service provided, its duration, and any special terms. This ensures clarity for both you and the customer.

Adding Transaction-Specific Information

For custom transactions, like deposits or partial payments, include a line item for the amount paid and the balance due. If the transaction involves a discount, make sure the original price, discount applied, and final price are clearly stated. This helps the customer understand the breakdown of the charges.

Incorporating Custom Fields

Incorporate fields that align with your business model. If your business is based on location or special offers, adding fields like location, offer code, or promotion terms can help contextualize the receipt. Custom fields allow for adaptability without overcrowding the template.

Examples of Common Mistakes to Avoid in Receipt Templates

One of the most common mistakes is leaving out key details that make a receipt legally valid. Always include the date of the transaction, the amount paid, and a description of the goods or services. Without this information, the receipt may not hold up in case of disputes.

Another mistake is using unclear or vague descriptions. Avoid generic terms like “item” or “service” without any specifics. Instead, provide detailed information about each item purchased to make it easier for both the buyer and seller to reference in the future.

Failing to include the business name and contact information can lead to confusion, especially if the receipt needs to be used for warranty claims or returns. Always make sure your business name, address, and phone number are visible on the template.

- Incorrect tax calculations can lead to disputes and dissatisfaction. Double-check the tax rate and ensure it matches the local requirements.

- Not accounting for payment methods is another mistake. Specify whether the payment was made in cash, via card, or by another method to avoid confusion later on.

Lastly, don’t forget about formatting. Cluttered or hard-to-read templates can create frustration. Use clear fonts, proper spacing, and logical organization to ensure the receipt is easy to read and understand.

How to Use the Template for Future Sales and Record-Keeping

Begin by customizing the template to reflect your business’s specific needs. Include fields such as the buyer’s details, item description, price, and any applicable terms of sale. This ensures that each transaction is clearly documented and easy to track.

Keep the template accessible, whether digitally or printed. For digital records, store completed templates in a dedicated folder with a clear naming system, such as “Sold as is – [Item Name] – [Date].” This allows for quick retrieval and simplifies organization over time.

Use the template consistently across all transactions. Having a uniform record for every sale, regardless of the item or customer, makes it easier to compare sales data and spot any discrepancies. This also streamlines the process for returning or exchanging items, should that be necessary.

Regularly update your template to reflect any changes in your sales process or business policies. If you introduce new payment methods or change return terms, adjust the template to include those details. Doing so ensures that your records are always up to date.

At the end of each month or quarter, review your sales records. This will help you identify trends, track revenue, and prepare for tax filing. The consistency of using the template ensures that this task is less time-consuming and more accurate.