To create a professional and clear Spanish receipt template, include key elements such as the business name, date of transaction, details of the purchased items, amounts, taxes, and payment methods. Ensure the text is easy to read, with well-defined sections. This will help avoid confusion and make it simpler for both you and the customer.

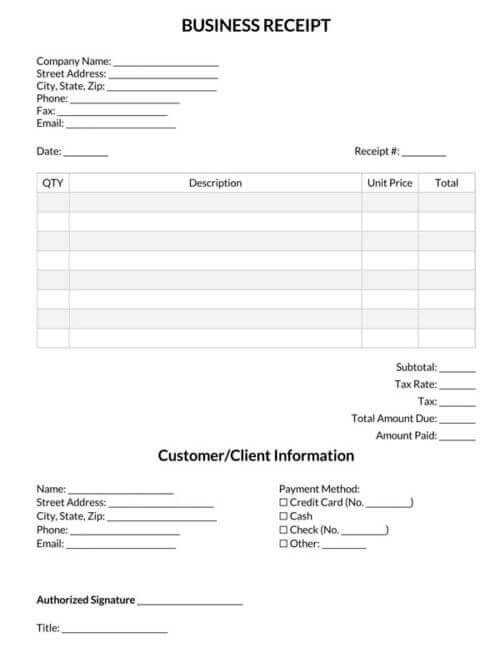

1. Business Information: Start by adding the name of your business or service provider at the top, along with the company address and contact details. Include a space for the company’s tax identification number (NIF). These details make your receipt more official and trustworthy.

2. Transaction Details: The date of the transaction should be clearly visible. Follow this with a list of the purchased items or services, along with the individual price and total for each item. You can break down complex products or services into separate line items to enhance clarity.

3. Total Amount and Tax: Clearly indicate the total amount, including taxes. In Spain, the VAT (IVA) should be listed as a separate line item, showing the percentage and amount applied. A clear breakdown of the final total prevents misunderstandings.

4. Payment Method: Mention the method of payment, whether it’s cash, card, or bank transfer. If possible, include the last four digits of the card number for verification purposes in case of refunds or disputes.

5. Terms and Conditions: If needed, provide additional terms such as return policies or warranty information. This should be brief but visible at the bottom of the receipt.

Creating a structured Spanish receipt template not only keeps your business organized but also ensures your customers have all the information they need for future reference or any follow-up inquiries.

Here is the revised version without repeats:

Ensure the header section of your receipt includes clear business details. Provide the name, address, phone number, and tax identification number. These should be easy to spot for the recipient.

Next, include a table or structured list showing the itemized details. This will help in tracking each product or service purchased. Be sure to include the quantity, unit price, and total price per item.

Afterward, highlight the overall total, including applicable taxes. This part should be in a larger or bold font to ensure clarity.

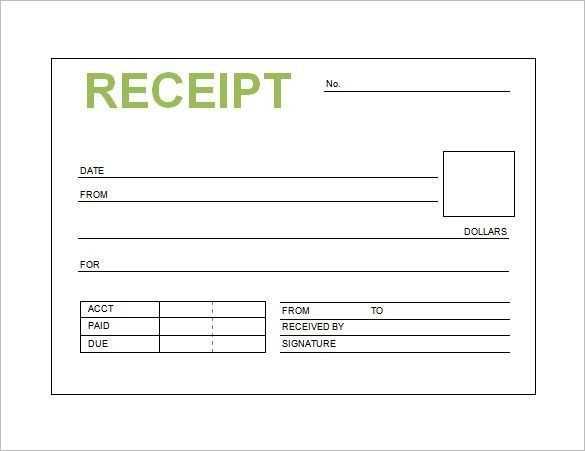

Lastly, add payment details, such as the method used and any transaction number or confirmation, so both parties have reference points for future inquiries.

For better legibility, avoid clutter. Keep the layout organized with sufficient spacing between sections.

- Spanish Receipt Template

A Spanish receipt should include key information for clarity and compliance. Start with the seller’s name and address at the top, followed by the buyer’s details. Clearly state the date of the transaction and assign a unique receipt number for tracking purposes.

Detail each purchased item or service, including its description, quantity, unit price, and total price. For services, ensure the scope of work is defined. Add the applicable tax rate, such as IVA (Value Added Tax), and the total amount including taxes. This section should also highlight any discounts applied.

At the bottom, provide payment information, including the method used (e.g., cash, credit card, bank transfer). Include a space for signatures if required. Finally, indicate any return or warranty policies that may apply.

Ensure the format is clear and legible, using bullet points or tables for easy reference. A structured, easy-to-read Spanish receipt promotes transparency in the transaction process.

Start by organizing the necessary details: the business name, address, and tax identification number (NIF). Make sure to include the date of the transaction, and the receipt number to keep track of it. This information is typically placed at the top of the receipt.

Itemize the Products or Services

Clearly list each product or service purchased, along with its price. Include the quantity and unit price for each item. If there are any discounts, tax rates, or special conditions (like free shipping), mention them below the respective item.

Show the Total Amount

After itemizing, calculate and display the subtotal, taxes, and the total amount due. The Spanish tax system requires VAT (IVA), so specify the rate and amount clearly. Add a “total” line at the end, including the final price to be paid.

Always make sure the receipt has the correct format, avoiding clutter, and leaving space for payment methods or customer notes if needed. This helps to keep everything professional and easy to understand.

Key Components of a Spanish Receipt: What to Include

Include the business name, address, and VAT number at the top. This makes the receipt recognizable as a formal document in Spain. Clearly state the date of the transaction, along with the time, to ensure accuracy and legal compliance.

The list of purchased items or services must be detailed. Provide the quantity, description, and price of each item, along with the applicable tax rate. This helps customers verify the products they received and the charges applied.

Incorporate the total amount due, including taxes. The receipt should show the final price the customer paid, including VAT and any discounts. Specify the payment method (cash, credit card, bank transfer) to maintain transparency.

Make sure to add a receipt or invoice number for tracking purposes. This makes it easier to reference the document later if needed. Finally, if applicable, include any return or exchange policies to ensure the customer is informed of their rights.

Spanish receipts typically include specific tax details that are important for both individuals and businesses. The tax information on a receipt indicates the VAT (Value Added Tax) included in the purchase price, which is governed by Spanish tax laws.

Key Tax Details on Spanish Receipts

- VAT Rate: The VAT rate will often appear next to the price of the product or service. Common rates are 21% for general goods and services, 10% for reduced rate items (such as transport), and 4% for essential goods (e.g., food, books, medicine).

- Tax Identification Number (NIF/CIF): The seller’s tax ID number should be listed on the receipt. This number is essential for verifying the seller’s registration with the Spanish tax authorities.

- VAT Breakdown: Receipts should clearly show how much of the total amount is attributable to VAT. This helps you understand how much tax you are paying for the item or service purchased.

- Exemptions: In some cases, products or services may be exempt from VAT. This should be stated explicitly on the receipt, such as when purchasing certain medical goods or services.

Why It Matters

- Business Tax Returns: If you’re a business, accurately tracking VAT is crucial for submitting tax returns. Receipts are proof of the VAT you’ve paid, which can be claimed back under certain circumstances.

- Reimbursement Claims: For travelers or foreign residents, keeping receipts with VAT breakdown can be helpful if you plan to claim a VAT refund or use them for other official purposes.

Adjust your receipt template to suit the specific needs of your business. Different industries have distinct requirements, so tailoring your receipt format will help maintain professionalism and ensure legal compliance.

- Retail Stores: Include detailed product descriptions, quantities, and prices. Incorporate a barcode or SKU for inventory tracking. Make sure to display sales tax clearly.

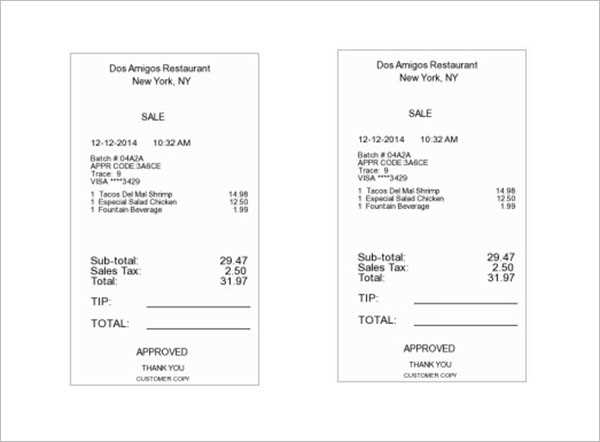

- Restaurants: Add sections for menu items, quantities, prices, and taxes. It may be helpful to include tips or service charges. A section for order number or table number enhances organization.

- Freelancers and Service Providers: List the services rendered, hourly rates, and total hours worked. Specify payment terms and include your business contact details. It’s a good idea to state payment methods clearly.

- Online Stores: Focus on clear breakdowns of the product price, shipping charges, and any discounts applied. Include order numbers and trackable shipping information. A refund policy can also be useful here.

- Subscription-based Businesses: Ensure the template reflects the recurring nature of payments. List subscription period, rates, and renewal dates. Provide clear information on cancellation policies or changes to the service.

Customize fonts and colors to align with your branding, but keep readability in mind. The goal is clarity and consistency across all receipts, regardless of the type of business.

In Spain, receipts must meet specific legal standards to be considered valid. Whether you’re a business owner or consumer, understanding these requirements ensures smooth transactions and compliance with tax regulations. Here are the key points to keep in mind:

1. Invoice Information

A Spanish receipt must include certain details to meet legal standards. These include:

- Seller’s and buyer’s full name or company name.

- Seller’s tax identification number (NIF or CIF).

- Detailed description of the products or services sold.

- Quantity and unit price of items.

- Total amount, including VAT (IVA in Spanish) with the applicable rate clearly stated.

- Date of the transaction.

- Unique invoice number, issued sequentially.

2. VAT (IVA) Requirements

Spanish receipts must specify the VAT amount. Businesses must issue receipts with VAT, reflecting the tax rate that applies to the goods or services. In most cases, the VAT rate is 21%, but reduced rates of 10% and 4% apply to specific goods and services.

| Tax Rate | Applicable Items |

|---|---|

| 21% | General products and services |

| 10% | Hotel accommodations, restaurant services |

| 4% | Basic foodstuffs, medical products |

Each rate must be clearly mentioned on the receipt, showing both the net amount and the tax value.

3. Electronic Invoicing

If your business operates electronically, you must ensure receipts comply with the same rules as paper invoices. Digital receipts are legally valid if they meet the same criteria and are signed electronically. Businesses must use authorized software to ensure accuracy and tax compliance.

By following these guidelines, you can ensure your receipts comply with Spanish legal standards and avoid any potential issues with tax authorities.

To add payment methods to your receipt template, include a section that clearly lists all available options. Begin with a simple label like “Payment Method” and leave space for specific details such as credit card, PayPal, cash, or bank transfer. If the transaction is made via credit card, include the last four digits for security and clarity. For digital payments, provide a reference number or transaction ID. If using multiple methods, format them in a list or table for easy readability. Make sure to specify the amount paid by each method if split payments are involved. Keep the information concise but complete to ensure your receipt remains clear and accurate for both parties.

To properly structure your receipt template in Spanish, ensure it starts with a clear header displaying the business name and tax identification number. Include a section for the receipt date, followed by a detailed list of products or services rendered. Each item should have its own line with a description, quantity, price per unit, and total cost. Make sure to calculate the subtotal, applicable taxes (IVA), and the final total. Don’t forget to indicate the payment method used, whether it’s by card, cash, or other means.

Incorporate a footer that provides contact information and any additional terms or conditions related to the sale. Ensure all details are legible and formatted in a way that aligns with local regulations. Keep it simple, and focus on clarity and accuracy throughout the document.