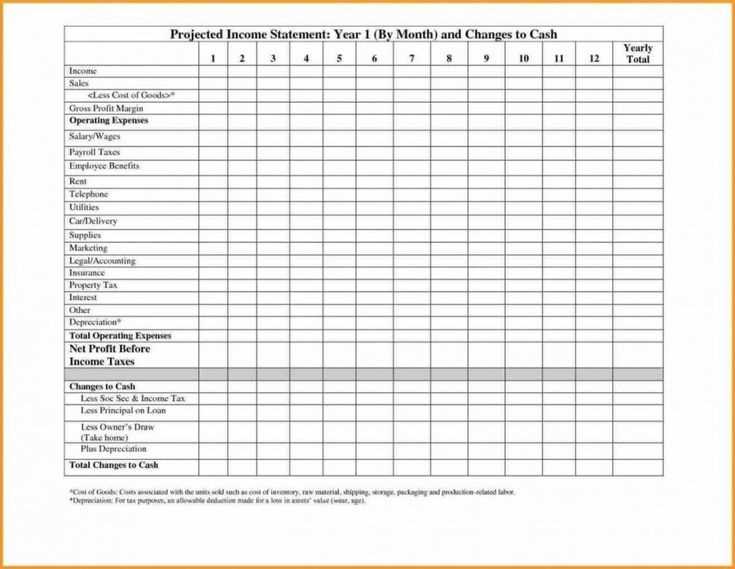

Save time on organizing tax receipts with a structured spreadsheet template. A well-designed template helps track expenses, categorize deductions, and prepare accurate reports for tax filings. Instead of sorting through piles of paperwork, use a digital format that ensures quick access and reduces errors.

Key features of a useful template include: predefined categories for expenses, automatic calculations for totals, and clear sections for important details like date, amount, and vendor. A well-structured layout minimizes mistakes and keeps all records in one place.

Customization is essential. Every taxpayer has unique needs, so modify the template to include specific expense categories or integrate formulas that simplify data entry. Consider adding dropdown lists for common vendors or expense types to speed up input and maintain consistency.

Using a spreadsheet template streamlines tax preparation and ensures compliance with record-keeping requirements. Set up a system that works for your needs, and stay ahead of deadlines without the last-minute stress.

Spreadsheet Template for Tax Receipts

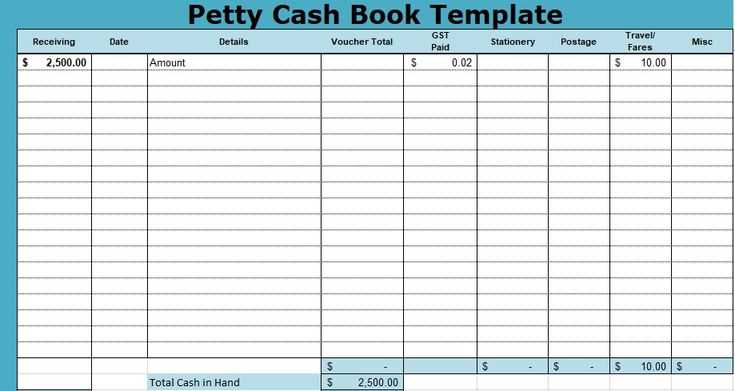

Use a structured spreadsheet to track tax receipts efficiently. Organize data into columns for date, amount, category, payer, and receipt reference. This ensures quick access and simplifies reporting.

- Standardize categories: Define expense types such as donations, medical costs, business expenses, and education fees. This helps with tax deductions.

- Use formulas: Apply SUM functions to calculate totals for each category. Implement conditional formatting to highlight missing or duplicate entries.

- Attach digital copies: Link scanned receipts or PDFs using hyperlinks. This provides instant verification during audits.

- Automate calculations: Set up percentage-based tax deduction formulas. Ensure accurate reporting by linking figures to yearly tax thresholds.

- Maintain consistency: Enter receipts in real-time to avoid missing transactions. Use drop-down lists for predefined expense types.

Export data in CSV or PDF format for seamless tax filing. Keep backup copies on cloud storage to prevent data loss.

How to Structure a Tax Receipt Spreadsheet

Use clear column headers to keep data organized and easy to reference. Include essential fields such as “Date,” “Donor Name,” “Amount,” “Receipt Number,” and “Purpose” to ensure every entry is properly recorded.

Format the “Amount” column for currency to prevent errors and inconsistencies. Set the “Date” column to a standard format (e.g., YYYY-MM-DD) to maintain uniformity. Use drop-down lists for recurring categories to speed up data entry and reduce mistakes.

Apply conditional formatting to highlight missing or duplicate entries. Use a formula to calculate total donations within a specified period. Protect formula cells to prevent accidental changes while allowing data input in designated fields.

Maintain a separate sheet for summary reports, linking data dynamically to provide real-time insights. Regularly back up the spreadsheet to avoid data loss. Use password protection if handling sensitive donor information.

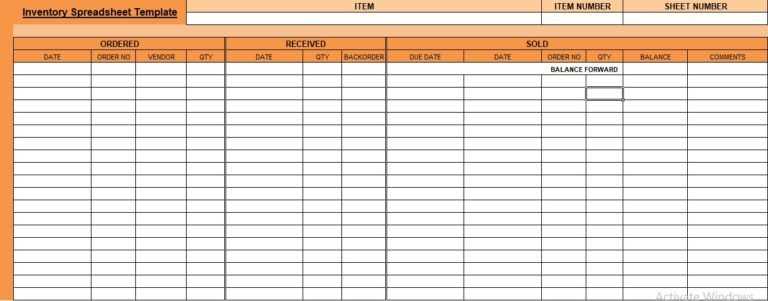

Key Columns and Data Fields to Include

Organizing tax receipts in a spreadsheet requires well-defined columns to track key details accurately. Each entry should contain essential information to ensure compliance and simplify record-keeping.

Primary Data Fields

Use the following columns to capture critical details for each receipt:

| Column Name | Description |

|---|---|

| Date | The transaction date in YYYY-MM-DD format for consistency. |

| Receipt Number | A unique identifier for tracking and referencing receipts. |

| Vendor Name | The name of the business or individual issuing the receipt. |

| Expense Category | A predefined category such as “Office Supplies,” “Travel,” or “Utilities.” |

| Amount | The total paid, recorded as a numeric value without symbols. |

| Tax Amount | The portion of the total representing taxes (if applicable). |

| Payment Method | Indicates whether the payment was made via credit card, cash, or bank transfer. |

| Notes | Optional field for additional details, such as purchase purpose or reimbursement status. |

Additional Fields for Better Organization

Consider adding columns for scanned receipt links, project associations, or client names if receipts relate to specific business expenses. Structuring data properly enhances searchability and simplifies audits.

Automating Calculations for Deductions

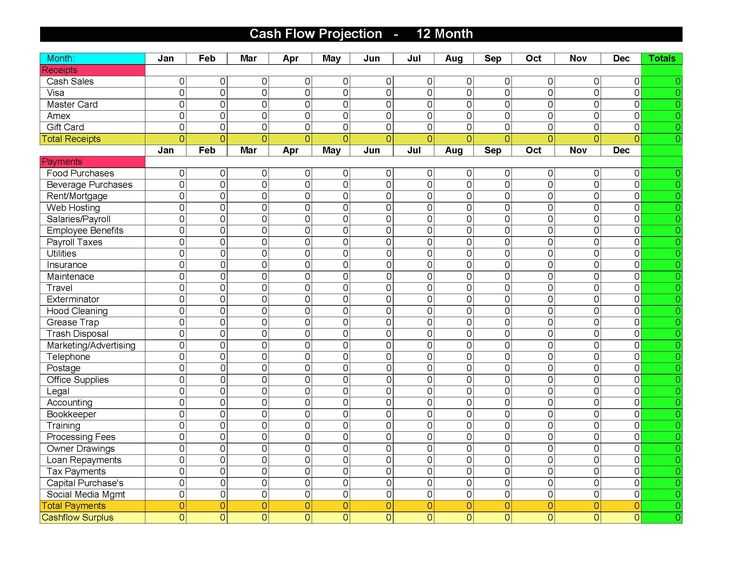

Utilize built-in functions like SUM and SUMIF in your spreadsheet to automate deduction calculations. These functions allow you to quickly aggregate expenses by category, ensuring accurate totals without manual input. For instance, use SUMIF to sum expenses that meet specific criteria, such as all travel-related costs.

Setting Up Your Spreadsheet

Organize your spreadsheet into clear categories for each deduction type. Create columns for the date, description, amount, and category. This structure makes it easy to apply formulas effectively. For example, in the total deduction cell, enter a formula like =SUMIF(D:D, “Travel”, C:C) to sum all travel expenses listed in column C.

Implementing Dynamic Ranges

To enhance your spreadsheet’s functionality, consider using dynamic ranges with the OFFSET function. This approach allows your formulas to adjust automatically as you add or remove entries. For example, a formula like =SUM(OFFSET(C1, 0, 0, COUNTA(C:C), 1)) can adapt to changes in the data range without needing manual updates.

Organizing Receipts by Category and Date

Group your receipts into clear categories to simplify tracking and retrieval. Consider the following categories:

- Business Expenses

- Medical Costs

- Travel Expenses

- Charitable Contributions

- Utilities

Label each receipt according to its category before entering it into your spreadsheet. This helps maintain clarity and ensures easy access during tax preparation.

Sorting by Date

Sort receipts chronologically within each category. Use the following approach:

- Enter the date of each receipt into your spreadsheet.

- Apply date sorting features in your spreadsheet software to organize them from the earliest to the latest.

This chronological organization provides a clear financial timeline, which is beneficial for understanding spending habits and preparing for tax filings.

Creating a Template

Design your spreadsheet template with columns for:

- Date

- Category

- Description

- Amount

- Payment Method

This structure enables efficient data entry and retrieval. Regularly update the template as new receipts are collected to maintain an organized record throughout the year.

Using Conditional Formatting for Compliance

Implement conditional formatting to highlight receipts that meet specific criteria. For example, set rules to flag receipts over a certain amount or those dated within a specific tax year. This immediate visual cue ensures you quickly identify relevant documents.

Utilize color scales to categorize receipt amounts. Apply a gradient that transitions from red for lower amounts to green for higher amounts, making it easy to spot high-value transactions that may require closer scrutiny. This visual hierarchy aids in prioritizing your review process.

Create custom rules to flag missing information, such as vendor names or dates. By applying formatting that changes the cell color to yellow for incomplete entries, you streamline your data validation. Regularly updating these rules keeps your spreadsheet aligned with compliance requirements.

Use icons alongside conditional formatting for quick recognition. For instance, display a green checkmark for compliant entries and a red cross for those needing attention. This combination of colors and symbols enhances clarity, reducing the time spent reviewing each receipt.

Ensure that your conditional formatting rules are documented. Maintain a separate tab in your spreadsheet outlining each rule’s purpose and criteria. This practice not only aids your understanding but also helps in training others who may use the template.

Regularly review and adjust your formatting rules to accommodate any changes in tax regulations or your organization’s requirements. Staying proactive in your approach prevents any last-minute scrambles during tax season.

Exporting and Sharing Tax Data Securely

Use password protection on spreadsheets before sharing them. This simple step ensures that only authorized users can access sensitive tax information. Choose a strong password that combines letters, numbers, and symbols to enhance security.

Utilize Encrypted File Formats

Export tax data in encrypted formats such as PDF or XLSX with encryption. These formats help safeguard your data from unauthorized access. Most spreadsheet software offers encryption options during the export process, making it easy to implement.

Limit Access and Use Secure Channels

Share tax data through secure channels like encrypted email or secure cloud storage. Avoid public file-sharing services that may compromise your data. Grant access only to individuals who need it and regularly review permissions to maintain control over your sensitive information.