Creating a standard receipt template is a practical solution for businesses looking to streamline their transaction processes. It ensures that all necessary details are clearly presented, making it easy for both the seller and the customer to understand the specifics of each transaction.

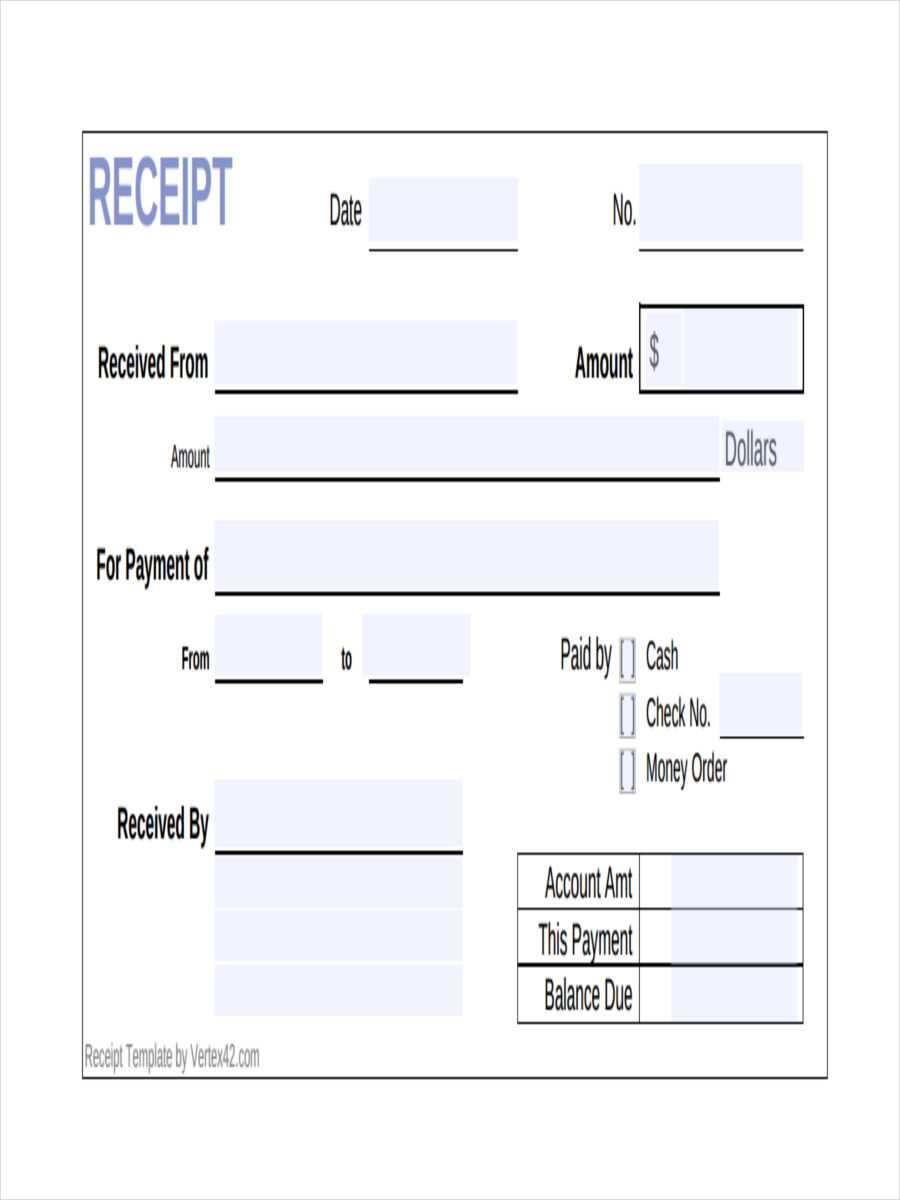

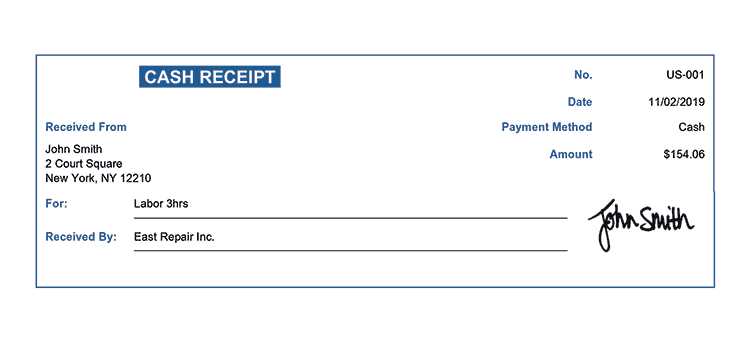

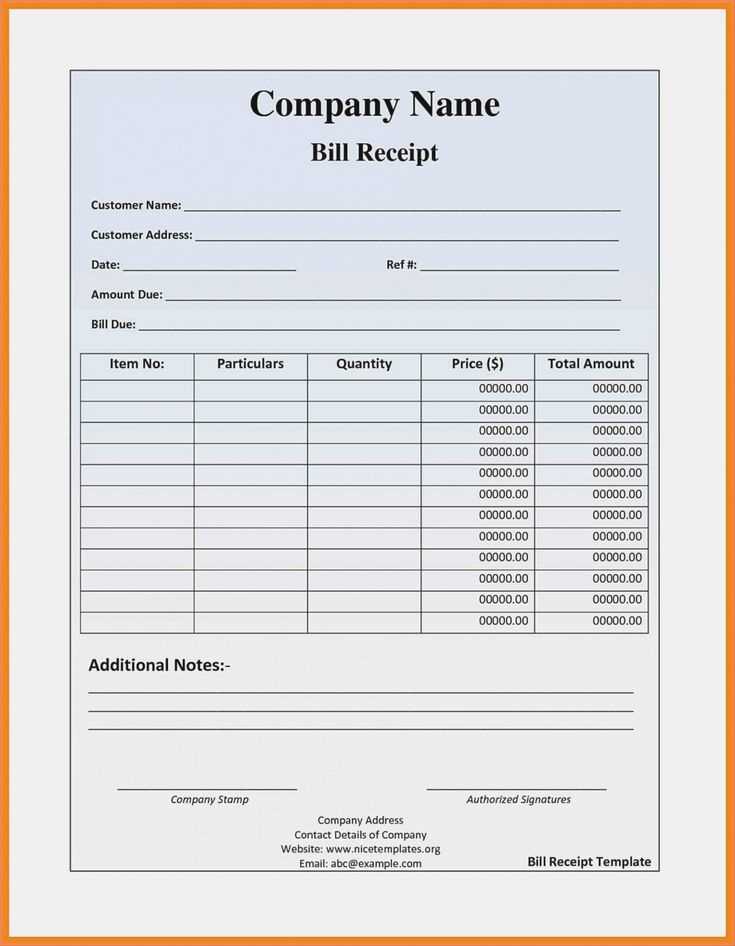

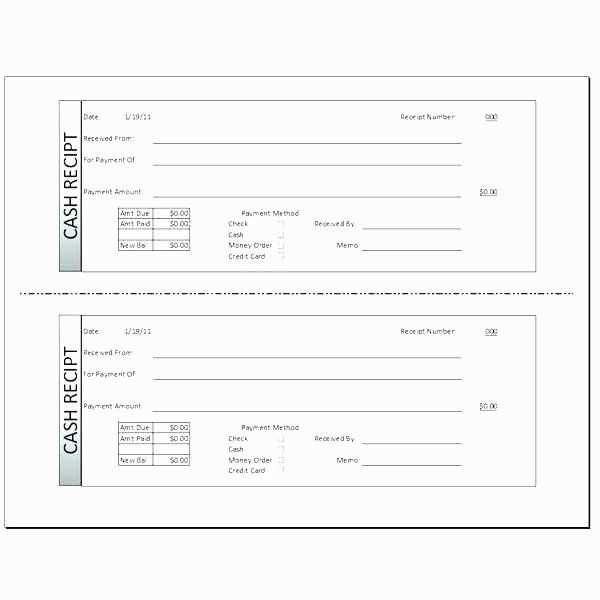

The template should include basic transaction information, such as the date, receipt number, seller details, and itemized list of purchased goods or services. Each line should clearly show the description, quantity, price, and total for easy reference.

Including a section for payment method is helpful for record-keeping and accountability. Whether the transaction is cash, credit, or online payment, this section offers transparency. A thank you note or a simple message expressing appreciation for the business adds a personal touch to the receipt.

Don’t forget to leave space for taxes and any applicable discounts, as they can significantly affect the final amount. Ensure the layout is organized to avoid confusion, with totals standing out for quick access.

Here’s the revised version with duplicates removed:

Focus on consistency in your receipt format. Ensure that key information, such as product name, price, and total amount, is clear and not repeated unnecessarily. Consolidate line items that have similar information to avoid redundancy.

Organize Information Logically

Group similar details together, such as customer information, payment method, and transaction summary. This reduces the chance of repeating data and enhances the readability of the receipt.

Use Short and Clear Descriptions

Avoid using long phrases or jargon. Keep the language concise and to the point, allowing the receipt to convey all relevant information without repetition.

- Standard Receipt Template: Comprehensive Guide

For creating a straightforward and functional receipt template, focus on the following key elements: clear identification of the transaction, itemized list of products or services, and total amount due. A well-structured receipt enhances transparency and fosters trust between the business and customer.

Layout and Structure

Begin with the business’s name, logo, and contact details placed at the top. This ensures customers can easily identify the source of the receipt. Follow with the date and unique receipt number for reference. A clearly visible subtotal, taxes, and any discounts applied should be listed to avoid confusion.

Itemized Breakdown

Ensure each product or service is listed with a brief description, quantity, unit price, and total. If there are multiple items, grouping similar ones together will help the customer quickly understand the breakdown. This not only adds clarity but also prevents disputes over the charges.

Finally, include a section for the total amount due, including any applicable taxes, along with payment method details. If the transaction involved a tip or additional fees, those should be listed separately. Include space for any further notes or terms, such as return policies or warranties, if applicable.

By keeping these elements consistent, a standard receipt template will effectively communicate all necessary transaction details while maintaining professionalism and clarity.

Receipts must contain specific elements to ensure clarity and provide all necessary information. The primary components of any receipt include the business name, date, items purchased, and total amount. This provides transparency for both the buyer and seller. Make sure these details are clear and easily readable to avoid confusion or disputes.

Business Details and Transaction Date

The business name, address, and contact details are typically placed at the top of the receipt. Including the date and time of the transaction helps both parties track their purchases accurately, particularly for returns or exchanges. Always verify these details are correct before issuing the receipt.

Itemized List and Pricing

An itemized list breaks down the products or services purchased. Each item should be clearly labeled with its name, price, and quantity. If applicable, taxes and discounts should also be shown to reflect the final price accurately. Avoid using overly complicated formats to maintain readability.

Choose a layout based on the specific goals of your business. If you prioritize simplicity and speed, a minimal design with clear sections can keep everything organized and easy for customers to navigate. This is ideal for businesses like cafes or retail stores where quick transactions are key.

For Service-Oriented Businesses

If your business offers services rather than physical products, consider layouts that highlight service categories. Use clear headings, icons, and space for descriptions to help clients understand what you offer at a glance. This approach works well for salons, consultancy services, and repair shops.

For High-Volume Transactions

For businesses with high transaction volumes, such as grocery stores or e-commerce platforms, focus on layouts that prioritize speed and clarity. Sections like total cost, payment methods, and purchase details should be easily visible and separated. This reduces errors and speeds up the process for both staff and customers.

Tailor the layout to your specific audience’s needs and the nature of your business. A layout that suits your goals will create a smoother, more efficient experience for everyone involved.

Choose a color scheme that aligns with your brand’s identity. Select colors that reflect the personality and values of your business. This consistency across your receipts helps reinforce your branding every time a customer engages with your business.

Incorporate Your Logo

Adding your logo to receipts strengthens brand recognition. Place it in a spot where it’s visible but not overwhelming. The top or bottom corners work well, ensuring it doesn’t distract from the receipt details while still being prominent.

Customize Fonts and Typography

Choose fonts that match your branding style. Opt for clear, legible fonts for key information, but feel free to use decorative fonts for headings or accents. Keep consistency with your website or marketing materials for a cohesive look.

Make sure the layout reflects your brand’s image–clean, modern, or classic–depending on the feel you want to communicate. This attention to detail gives a polished, professional touch to your receipts.

Consider adding a tagline or message that reinforces your brand’s mission. Whether it’s a thank you note, a promotional message, or a unique customer offering, this small addition helps create a lasting impression.

Review your template regularly to ensure it remains aligned with any updates to your branding strategy, keeping it fresh and relevant to your audience.

Choose legible fonts. Small or overly decorative fonts can make the receipt difficult to read, especially under low lighting. Stick to simple, clean fonts like Arial or Helvetica for clarity.

Cluttered Layout

A cluttered design overwhelms the user. Keep spacing consistent, align elements properly, and avoid overcrowding. Organize sections logically: business name, itemized list, total, and payment details.

Missing Important Details

Omitting necessary information, like the business address or contact number, can create confusion. Ensure all required elements are included and clearly visible. Double-check for accuracy in details such as tax amounts and payment methods.

- Include transaction date and time

- Provide clear descriptions of purchased items

- Ensure accurate pricing and taxes

Don’t ignore paper size and format. Receipts that don’t fit into wallets or are too long can become inconvenient. Select a size that is both practical and easy to store.

Poor Color Choices

Excessive use of bright or contrasting colors can distract from important information. Stick to a neutral palette with a few highlights to maintain readability and professionalism.

Minimize excessive branding. While it’s essential to showcase your logo, overbranding can make the receipt look too busy. Keep it subtle and focused on functionality.

Choose printable receipts when you need a physical copy for quick reference or proof of purchase. They are reliable for situations where digital access might be unavailable. However, they can take up physical space and contribute to paper waste.

On the other hand, digital receipts offer convenience by allowing easy storage and access on your device. They are eco-friendly and reduce paper clutter. But they can be lost if you lose access to your device or if the email containing the receipt gets buried in your inbox.

- Printable Receipts

- Guaranteed physical backup

- No device required for access

- Can be used for in-person returns

- Contributes to paper waste

- Takes up storage space

- Digital Receipts

- Eco-friendly and space-saving

- Easy to organize and search

- Can be accessed from multiple devices

- Requires a digital device to view

- At risk of being lost if not backed up

Receipt templates must comply with local legal and tax requirements. Make sure your template includes the necessary details for both legal documentation and tax reporting.

For businesses, it’s important to clearly state the transaction type, including whether it’s a sale, return, or refund. Tax regulations in many regions mandate that the tax amount is separately listed to maintain transparency for both businesses and customers.

| Required Fields | Purpose |

|---|---|

| Date of transaction | To confirm when the sale occurred for tax purposes. |

| Seller and buyer details | To ensure proper identification of both parties involved. |

| Tax amount | For tax reporting compliance. |

| Itemized list of products/services | To track and justify the value of each product/service sold for taxation. |

| Receipt number | For record-keeping and verification purposes. |

Different regions have specific requirements, so it’s vital to check local regulations. For example, in some countries, businesses must provide VAT (Value Added Tax) numbers on receipts, while others may require the inclusion of a specific tax rate. Failing to meet these requirements may result in fines or complications with tax filings.

To avoid issues with the authorities, businesses should ensure their receipt template is aligned with these regulations, regularly updating it to reflect any changes in tax laws. Consider consulting a tax professional if you’re uncertain about local requirements.

If you need even more variety or adjustments, let me know!

If you’re looking to customize a standard receipt template further, consider adjusting the layout or adding specific fields that match your business needs. Tailor the information to make sure it’s clear and concise for your customers.

For example, if you’re adding discounts or special offers, ensure that the discount amount is clearly displayed and distinguished from the regular price. This helps customers easily identify the savings they received.

Another tip is to integrate an itemized list that includes product descriptions, quantities, and prices. This can be done through a table format that’s both organized and easy to read. Below is an example of how to structure this section:

| Item | Quantity | Price |

|---|---|---|

| Item 1 | 2 | $10.00 |

| Item 2 | 1 | $20.00 |

| Total | $40.00 |

Including clear headings, such as “Total” and “Tax”, helps ensure that key figures are easily spotted. If you’re offering tax-free options, indicate that prominently in a separate line item.

Should you want to experiment with more dynamic elements or design changes, don’t hesitate to reach out for further suggestions.