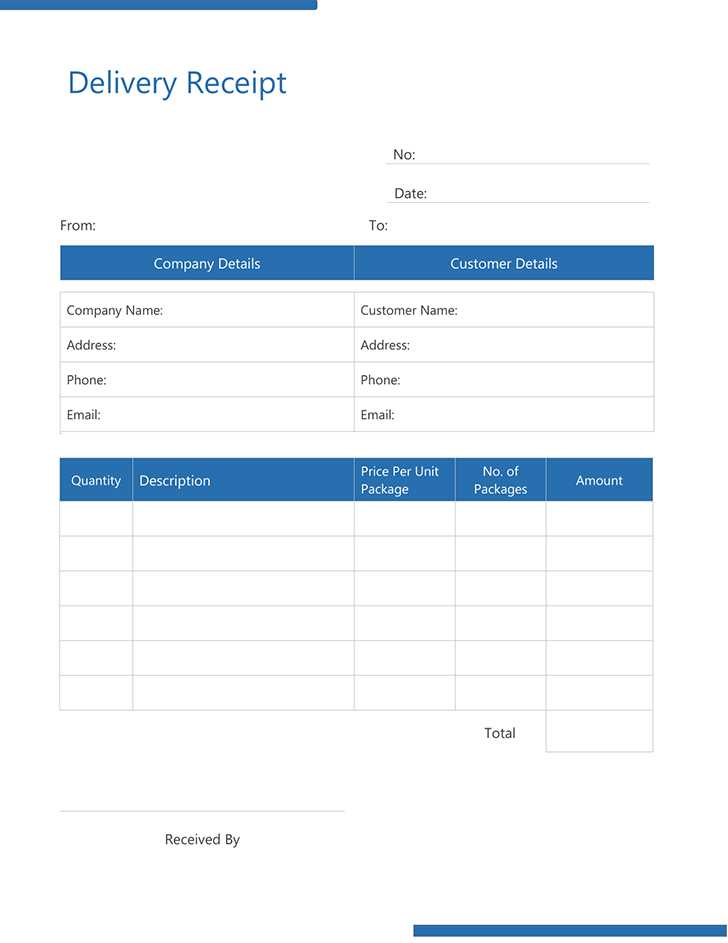

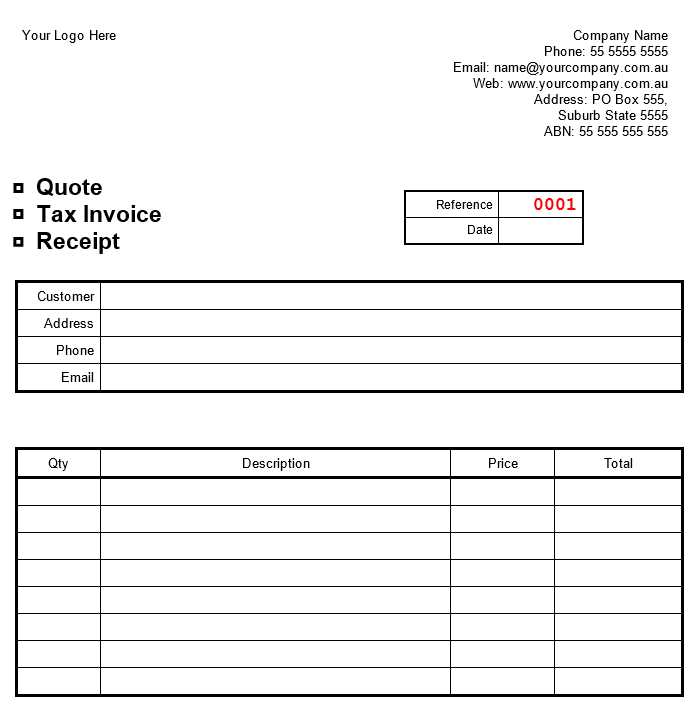

If you’re looking to create a standard receipt for transactions in the UK, it’s important to make sure your template includes all the required details for legal and record-keeping purposes. A well-structured receipt helps both you and your customers maintain transparency and clarity. Start with a clear header stating “Receipt” or “Invoice” and ensure it includes the business name, address, and contact details.

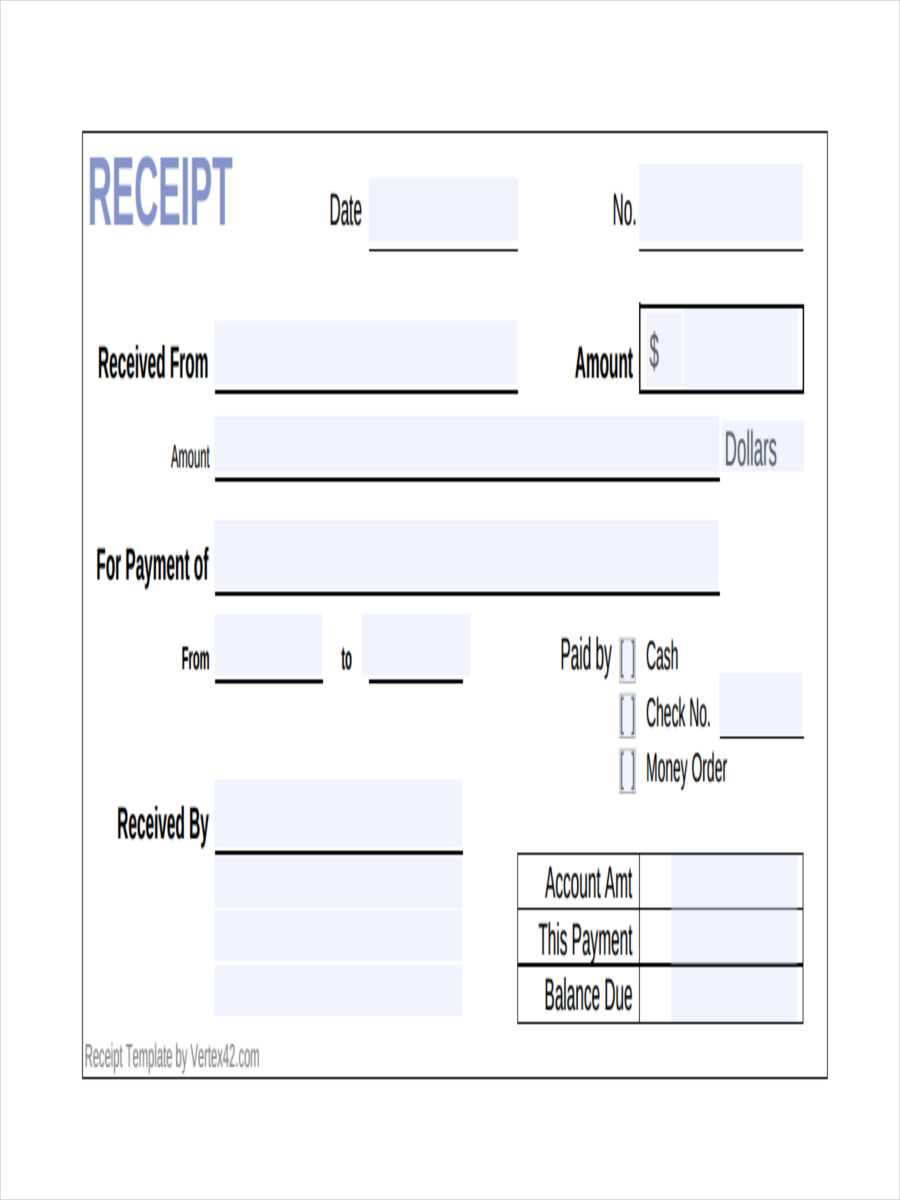

Next, include a unique receipt number for each transaction. This number helps with tracking sales and financial reporting. The date of the transaction should also be clearly displayed. For convenience, you may choose to include the payment method, such as cash, credit card, or bank transfer, as this helps provide a clear record of how the transaction was settled.

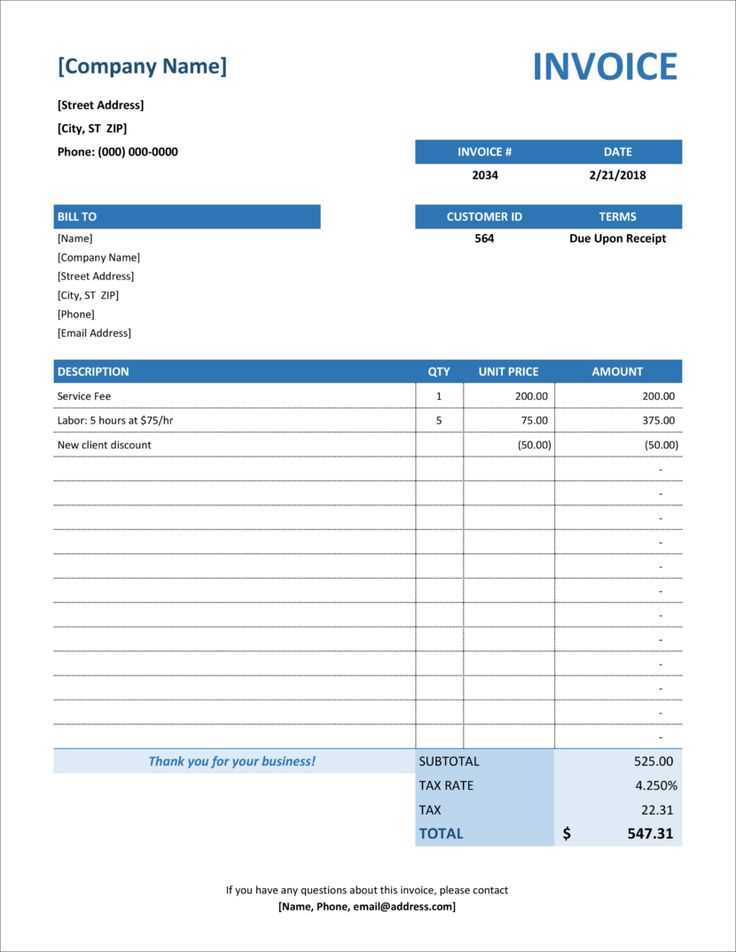

The receipt should also list the items purchased or services rendered, along with their respective prices. For products, include the quantity and unit price, while for services, specify the nature of the service and the agreed-upon fee. Adding VAT details, where applicable, is a must, as it ensures compliance with UK tax laws.

Lastly, make sure the receipt includes the total amount paid, including VAT if applicable, and any outstanding balances or deposits. This helps provide a clear and professional overview of the transaction, ensuring both parties are on the same page.

Standard Receipt Template UK

A standard receipt template in the UK should include specific details to ensure it meets legal and business requirements. Start by including the business name and contact information. This gives clarity and provides the recipient with easy access to the business’s details if needed for future reference.

Key Information to Include

Each receipt should contain the following elements:

- Receipt Number: A unique reference number helps track transactions.

- Business Information: Name, address, phone number, and email.

- Date of Transaction: The exact date the transaction took place.

- Description of Goods/Services: Clear details of what was purchased.

- Amount Paid: Total amount paid, including taxes.

- Payment Method: Specify if the payment was made via cash, card, or other methods.

- VAT Number: If applicable, the VAT registration number should be listed.

Formatting Tips

Ensure the receipt is easy to read by using clear fonts and consistent layout. Use a simple table structure to separate different sections such as item details and payment summary. If possible, incorporate your logo or business branding for a professional appearance. Keep the font size large enough to ensure clarity, especially for the payment and date sections.

How to Create a Legally Compliant Receipt in the UK

To create a legally compliant receipt in the UK, include the following key details:

- Seller’s Information: The name and address of the business or seller must be clearly stated. This includes a contact number or email address.

- Buyer’s Details (if applicable): For higher-value transactions or on request, include the buyer’s name and address.

- Date of Transaction: Specify the exact date the transaction took place.

- List of Items or Services: Provide a description of each item or service sold. This should include quantity, unit price, and the total price for each item.

- VAT Information (if applicable): If VAT is charged, show the VAT rate and the total VAT amount on the receipt. Businesses must also include their VAT registration number.

- Total Amount Paid: Clearly state the total amount the buyer has paid, including any VAT and additional charges.

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, bank transfer).

- Receipt Number: Assign a unique reference number for record-keeping purposes.

Ensure the receipt is legible and contains all necessary information, especially when providing goods or services that are subject to taxes. Keep copies for your records to meet financial and tax obligations.

Customizing Your Receipt Template for Different Business Types

Tailor your receipt template based on the specific needs of your business type. The template should reflect both the nature of the transaction and the type of product or service offered. For instance, a restaurant receipt may include itemized food and drink details, tips, and service charges, while a retail store receipt will typically list product names, quantities, and prices.

For Retail Businesses

Retail receipts should focus on clear product descriptions, quantities, and prices. Include details like SKU numbers for easy inventory management, taxes, and a total amount. Offering customers the option to view or request a digital receipt may also align with modern business practices. Ensure your receipt shows a return policy and customer service contact information to build trust and transparency.

For Service-Based Businesses

Service-based businesses, such as salons or consultants, should emphasize the services provided, the duration, and the cost per session. It’s useful to include appointment dates, employee names, and any special promotions or discounts. For businesses where customers are billed by the hour, a breakdown of the time spent can help clarify the total charge. Consider offering additional space for any notes or follow-up information.

Digital vs. Paper Receipts: Key Differences and Considerations

Digital receipts are more convenient for tracking and storing transactions. They’re easily accessible through emails or apps and can be stored without physical clutter. Paper receipts, while traditional, can be kept for proof of purchase but often deteriorate over time due to wear or exposure to light. A digital receipt doesn’t face these issues and can be retrieved anytime from your device.

Environmental impact is another major difference. Digital receipts don’t use paper, reducing waste, while paper receipts contribute to unnecessary consumption of resources. However, not everyone is comfortable with digital receipts. Some prefer paper due to its tangibility or simply because they find it easier to file and organize physically.

For businesses, digital receipts offer a streamlined approach to record-keeping, minimizing the cost of paper, ink, and storage space. On the other hand, businesses offering paper receipts may appeal more to customers who prefer the traditional format. The cost of printing paper receipts can add up for businesses, especially for those with high transaction volumes.

Security is also a factor. Paper receipts can be lost, stolen, or damaged. Digital receipts, while easily backed up and encrypted, are still subject to digital security risks like hacking or unauthorized access. Consumers should ensure that their email or app accounts are secure to prevent data breaches.

Choosing between digital and paper receipts depends on personal preference and business needs. Both options have their advantages, but the growing trend of digital solutions makes them an increasingly popular choice for modern transactions. Businesses may want to consider offering both options to cater to a wider range of customers.