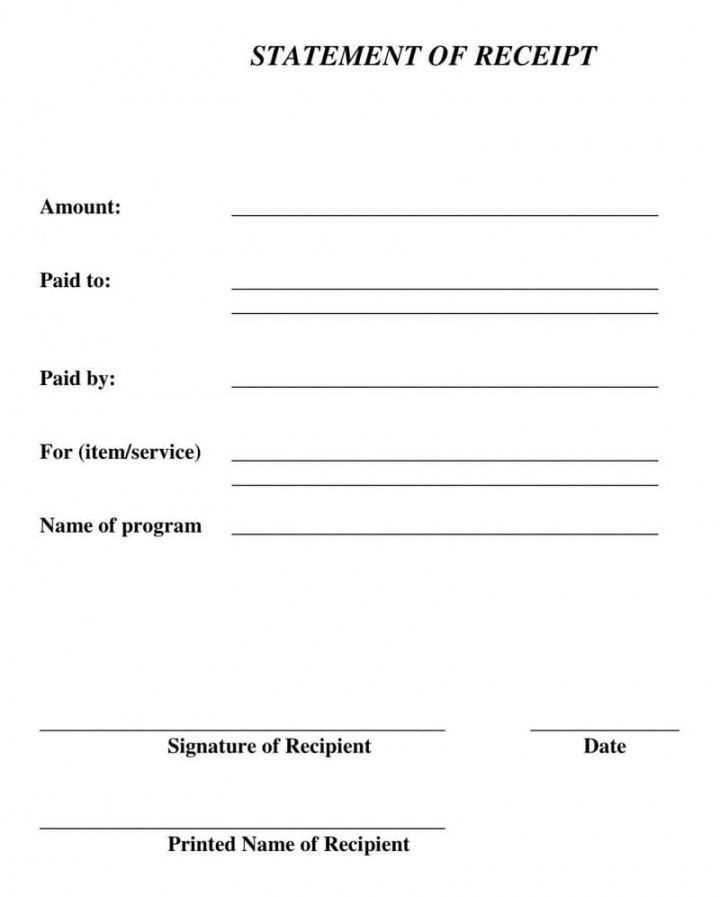

To create a clear and accurate statement receipt, start by including the full name and contact details of both the sender and the recipient. This information ensures that both parties are easily identifiable. Add the date of the transaction or agreement, followed by a detailed description of the items or services provided. Be specific about quantities, prices, and any applicable taxes or discounts.

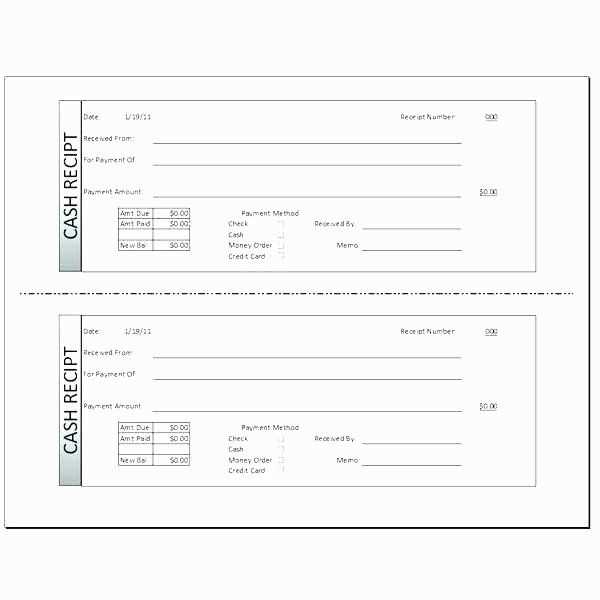

Include the total amount due or paid, along with the payment method. If the payment was made in installments, indicate the amount paid to date and the balance remaining. Ensure that all relevant transaction details are clearly outlined to avoid confusion. It’s also helpful to include a reference number for future inquiries or audits.

For clarity, use a clean and organized layout with ample space between sections. This helps ensure that all information is easily digestible. A well-organized receipt template helps streamline the process and offers both parties a reliable record of the transaction.

Here are the corrected lines with minimal repetition of words:

First, ensure each statement is clear and concise. Avoid using the same terms repeatedly in close proximity, as this may confuse the reader or make the document feel redundant.

Next, vary sentence structure. Alternate between simple and complex sentence forms to maintain interest and flow. Using different connectors will help avoid overuse of similar phrases or expressions.

Additionally, when repeating terms is necessary, use synonyms to create a more diverse vocabulary. This helps to keep the reader engaged without sacrificing clarity.

Lastly, consider rephrasing sections to break up repetitive language. This not only enhances readability but also makes the overall document feel more professional.

- Statement Receipt Template

A well-structured statement receipt should be clear and concise. Follow this format to ensure every necessary detail is included:

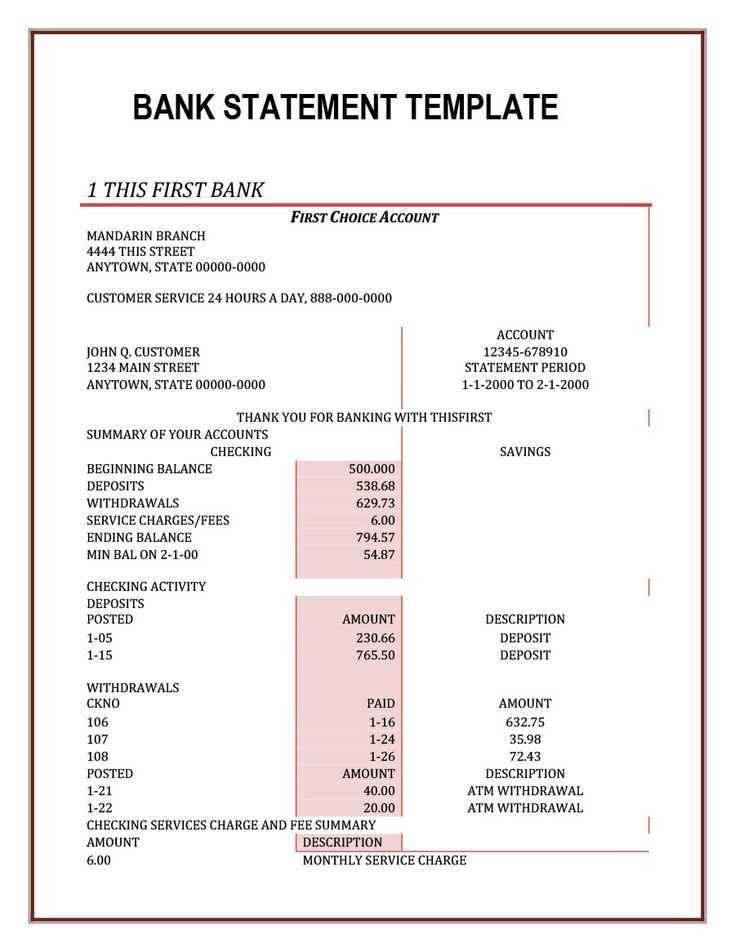

- Business Information: Include the business name, address, and contact details like phone number and email.

- Receipt Number: Assign a unique receipt number to track the transaction easily.

- Date and Time: Mention the exact date and time of the transaction for reference.

- Customer Details: Provide customer information such as name and contact (if applicable).

- Itemized List: List purchased items with their quantities and prices. Clearly show any discounts or adjustments.

- Payment Summary: Indicate the payment method used (e.g., credit card, cash) and the total amount paid, including tax.

- Tax Information: Show the tax rate applied and the total tax amount.

- Thank You Note: Add a polite closing message to reinforce customer satisfaction.

Ensure the layout is neat, with distinct sections for each part. Keep the design simple for easy reading, and highlight the most important details such as the total amount and receipt number.

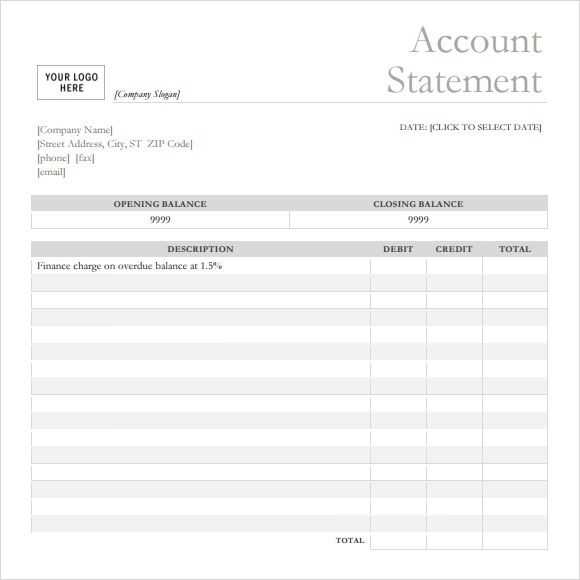

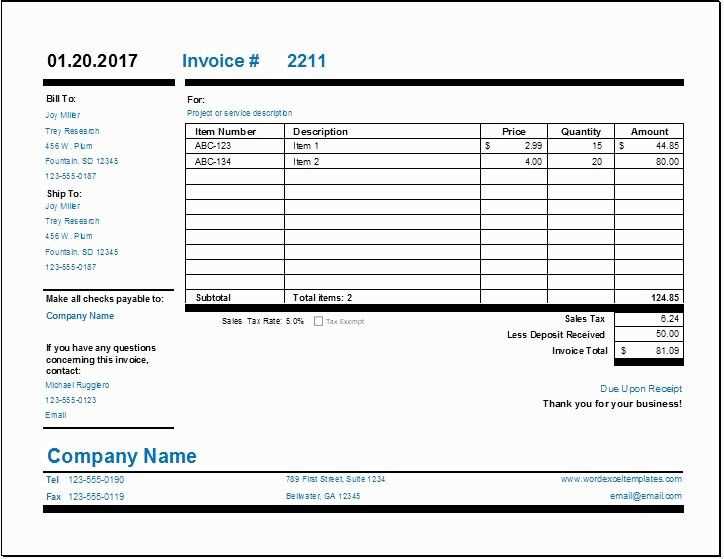

To tailor a statement template to fit your business requirements, begin by identifying the core information your customers need. This usually includes business details like name, address, and contact information, as well as specific transaction data. Use placeholders for dynamic fields such as invoice number, date, and item descriptions. This allows for easy updates without altering the core template.

Adjust the Design for Branding

Customize the design of the template to match your brand’s style. Incorporate your logo, brand colors, and preferred fonts. Keep the layout clean and organized, highlighting the most important details–such as totals and payment instructions–at the top for visibility.

Include Customizable Sections

Many businesses require additional sections for specific needs. For example, you might need to add a “Discount” or “Tax” field, depending on your pricing model. Ensure there’s space for optional notes or terms and conditions, which can vary with each transaction.

Once the core elements are adjusted, save the template as a reusable document or create a system where these fields can automatically populate. Test your customized template to ensure it’s flexible and functional for various transaction types.

Each statement must contain specific fields to ensure clarity and prevent errors. These fields help users understand the document and verify its details easily.

Start with the account holder’s full name and address to identify who the statement is for. Include an account number to differentiate between multiple users. A statement date, such as the issue or transaction date, ensures timely reference.

Include a breakdown of all transactions, with dates, descriptions, and amounts listed clearly. This section allows verification and correction of discrepancies. If applicable, highlight the balance before and after each transaction to give context to the changes.

For accurate reporting, list any fees or charges incurred during the period. This should be followed by any payments or credits made, detailing the amounts and dates to avoid confusion. A running balance is also crucial, offering insight into the financial movement throughout the statement.

If there are any interest rates or changes to terms, include those in a dedicated section. This ensures users can track fluctuations and understand their impact on the balance. Finally, provide contact details for customer support in case of discrepancies or questions.

Send receipts in PDF format for clear readability and easy accessibility. Include all transaction details such as date, amount, and payment method. Ensure the file is optimized for mobile devices since many users check receipts on their phones.

Sending Receipts Securely

Use encrypted email services to protect sensitive information. If sending receipts through SMS or messaging apps, always ensure that the platform you’re using supports end-to-end encryption. This keeps personal and financial data safe from unauthorized access.

Storing Receipts Safely

Store receipts in cloud storage with strong password protection. Choose services that offer two-factor authentication (2FA) for added security. For physical receipts, use fireproof and waterproof storage options to avoid damage. Ensure digital copies are easily searchable by labeling them with clear and descriptive filenames.

To enhance the clarity of statement receipts, use an organized unordered list format. This method helps in presenting key information succinctly while maintaining structure. Below is a template that captures all critical data in a clean, readable way:

- Date: Specify the exact date of the transaction or receipt issuance.

- Transaction ID: A unique identifier that ensures accurate tracking.

- Amount: Clearly list the amount of money involved in the transaction.

- Receiver’s Name: Include the full name of the person or entity receiving the payment.

- Purpose: Provide a brief description of the transaction’s purpose.

- Payment Method: Indicate the mode of payment used (credit card, bank transfer, etc.).

- Signature: Include a space for any necessary signatures to confirm receipt.

This structured approach will help you create a statement receipt that is both efficient and easy to understand. The use of bullet points keeps the information concise and visually accessible.

Sample Statement Receipt Format

- Transaction Date: 12/02/2025

- Transaction ID: TXN123456

- Amount Paid: $500.00

- Receiver’s Name: John Doe

- Payment Method: Credit Card

- Purpose of Payment: Service Fee

- Signature: _____________________

By adhering to this layout, you ensure all relevant details are included in an easily accessible format for both parties involved.