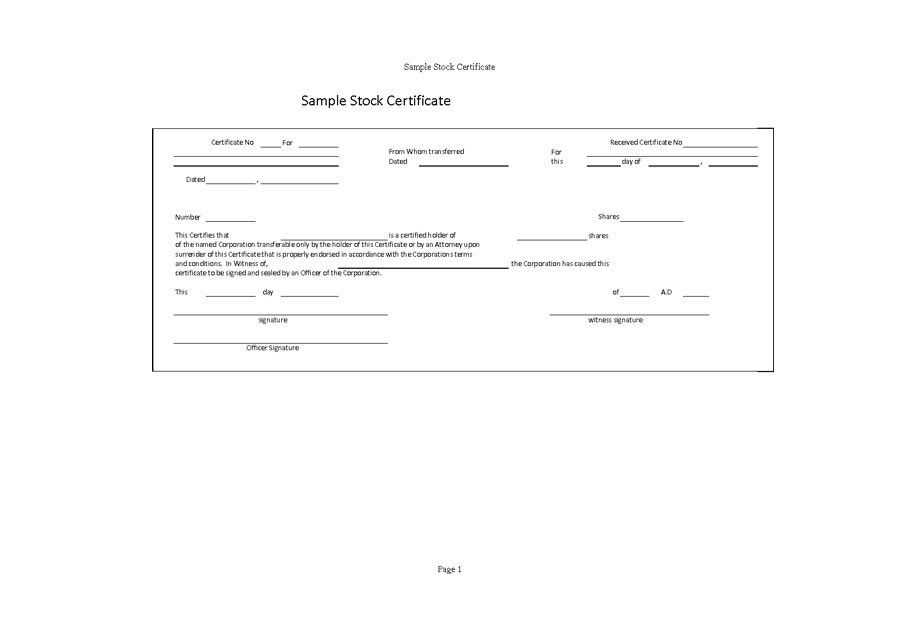

Creating a stock certificate receipt template involves focusing on key elements like company information, shareholder details, and the number of shares issued. A well-structured template helps ensure clarity and accuracy for both the issuing party and the recipient.

Start with clear identification: The template should begin with the company name, its legal status, and contact details. Include a unique serial number for each certificate issued to maintain organization. This makes the certificate easily traceable.

List shareholder information: Specify the shareholder’s name, address, and the type of shares issued. Include a space to note the exact number of shares the shareholder holds, along with any class of shares, if applicable. This avoids confusion in the future.

Include issuance details: State the date of issuance and the signatures of authorized personnel. It’s also helpful to include a section for any conditions tied to the stock or restrictions on its transferability, depending on your company’s policies.

This simple, straightforward approach helps avoid errors and ensures all required details are present, making the process smooth for both parties involved.

Here’s the revised version:

To create a stock certificate receipt, it’s vital to include specific information to ensure it serves its purpose. Begin with the company name and its legal address. Then, specify the number of shares issued and the class of stock (common or preferred). Clearly state the name of the shareholder and include a unique identification number for the certificate. The date of issuance should also be noted.

Key Components of a Stock Certificate Receipt

- Company Name and Address

- Shareholder Name

- Number of Shares

- Class of Stock

- Unique Certificate Number

- Date of Issuance

Additional Details

Including terms of transferability and any restrictions on the stock can provide further clarity. A section outlining the shareholder’s rights, such as voting rights or dividend eligibility, can also be beneficial. Ensure that the document includes the signature of an authorized person, such as a company officer, to validate the certificate.

- Stock Certificate Receipt Template Guide

Use a stock certificate receipt template to confirm ownership of stocks. It simplifies recordkeeping for shareholders and companies alike. Here’s what to include in a basic template:

- Title: Clearly label the document as a “Stock Certificate Receipt” or “Stock Transfer Receipt.”

- Stockholder Details: Include the shareholder’s name and address.

- Issuer Information: List the company’s name, registration number, and office address.

- Certificate Number: Each certificate should have a unique identifier for tracking and verification.

- Shares Information: Specify the number of shares, class of stock, and par value (if applicable).

- Transaction Details: Record the date of issuance and the transaction type (purchase, transfer, etc.).

- Signature: Ensure an authorized person from the company signs the receipt.

- Legal Disclaimer: Include a statement that the receipt doesn’t convey ownership without the company’s official acknowledgment or additional documentation.

Using a template reduces errors and ensures consistency across receipts. Customize it based on your company’s specific needs, and ensure that both parties involved in the transaction keep a copy for their records.

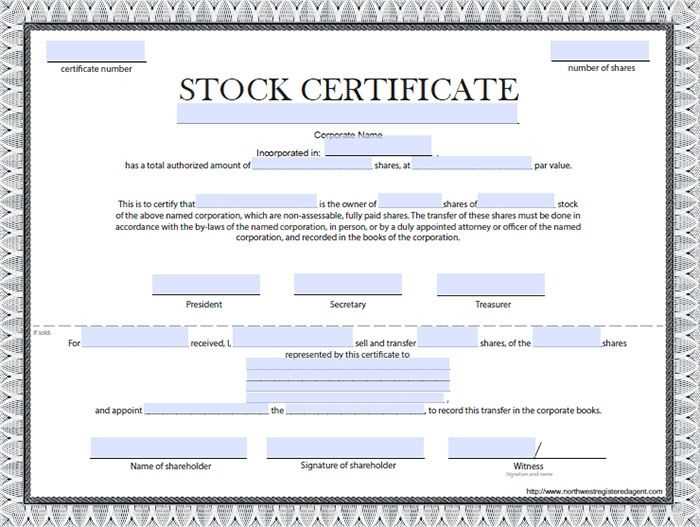

A stock certificate should clearly present key details about the ownership of shares in a company. Ensure it includes the following elements:

| Element | Description |

|---|---|

| Company Name | The full legal name of the company issuing the shares. |

| Shareholder’s Name | The individual or entity to whom the shares are issued. |

| Number of Shares | The specific number of shares the certificate represents. |

| Certificate Number | A unique identification number for the certificate. |

| Issuance Date | The date the shares were issued to the shareholder. |

| Par Value | The nominal value assigned to each share (if applicable). |

| Signatures | The signatures of authorized company representatives (usually the president and secretary). |

| Seal | The company’s official seal or emblem. |

Each of these elements contributes to the authenticity and legal recognition of the stock certificate. Make sure these details are accurate to avoid complications or disputes regarding share ownership.

Begin by gathering the necessary details for the certificate receipt. These typically include the certificate number, recipient’s name, issuing authority, date of issuance, and the amount or value of the certificate. If applicable, also note the certificate’s validity period and any terms related to its use.

Next, choose a layout for the certificate receipt. Keep the design clean and professional. Use clear, legible fonts and make sure there is adequate space between sections. Highlight key information, such as the certificate number and recipient’s name, to ensure visibility.

Create a header section where the title “Certificate Receipt” is prominently displayed. Below the title, include the certificate number, recipient’s name, and the date of issuance. This will be the main section of the document, so ensure the details are well-aligned and easy to read.

Below the main section, include a table for the terms and details of the certificate. The table should have columns for the description of the terms, the corresponding details, and any additional information or notes. Here’s an example of how the table structure could look:

| Term Description | Details |

|---|---|

| Certificate Number | 12345XYZ |

| Recipient Name | John Doe |

| Issuing Authority | XYZ Corporation |

| Issuance Date | February 6, 2025 |

| Validity | One Year |

| Value | $1,000 |

Finally, include a footer section with contact information for the issuing authority and any necessary legal disclaimers or instructions. Make sure this section is clear, concise, and unobtrusive to maintain a professional appearance.

Ensure Accuracy in Shareholder Information – Double-check the spelling of the shareholder’s name and address. Mistakes here can lead to confusion and delays in future transactions. Also, ensure the correct number of shares is listed to avoid disputes.

Don’t Skip the Certificate Number – Each certificate should have a unique identification number. This helps keep track of shares and is necessary for any future changes or transfers of ownership. Missing or duplicating numbers can cause administrative issues.

Verify the Company Details – Ensure that the company’s name, registration number, and address are correctly listed. Inaccurate or outdated information may invalidate the certificate and complicate legal or financial matters.

Clear and Concise Language – Avoid complex or unclear terms. The wording should be straightforward and easy to understand. Misleading or overly technical language can lead to confusion about the rights and responsibilities of shareholders.

Signature and Date – The certificate must be signed by authorized individuals and include the date of issuance. Missing signatures or undated certificates may be seen as incomplete or unenforceable.

Avoiding Overcomplicated Designs – While it’s tempting to make the certificate visually striking, keep the design clean and professional. Too much decoration can obscure important details and make the certificate harder to read.

Document Ownership Transfer Information – If the certificate involves a transfer of ownership, ensure all relevant information about the transaction is accurately recorded, including the transfer date and the parties involved.

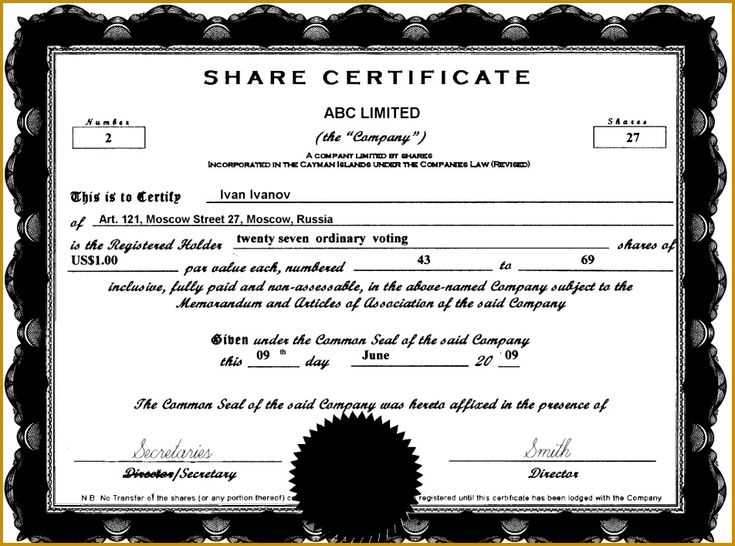

Begin by identifying the type of stock being issued. For common stocks, include shareholder details, the number of shares, and the stock’s market value. For preferred stocks, add information about the dividend rate and any special voting rights. If it’s a restricted stock, clearly state the restrictions and vesting schedule.

Include a section that outlines the issuing company’s name, the stock’s ticker symbol, and the date of issuance. This helps ensure clarity and accuracy for both the issuer and the shareholder.

Customize the certificate by incorporating any specific clauses that apply to the stock type, such as dividend payment dates for preferred stocks or any transfer limitations for restricted shares. Make sure the document specifies the ownership rights associated with each stock type, as this helps prevent confusion in the future.

For stock types that may involve additional legal considerations, such as warrants or convertible stocks, include terms for conversion rates or exercise options. Ensure this information is easily accessible and easy to interpret by the recipient.

Finally, make sure the certificate includes contact information for the issuer’s shareholder services, in case any questions arise after the receipt is issued.

Each jurisdiction has specific requirements for issuing stock receipts, which must be strictly followed to ensure validity. These regulations vary based on the legal framework, the type of company, and the method of issuance. Below are key considerations for stock receipts in several regions:

United States: In the U.S., stock receipts must include detailed information such as the shareholder’s name, the number of shares owned, the stock class, and the issuing corporation’s name. Receipts for publicly traded stocks must comply with the Securities Exchange Act of 1934, ensuring proper registration with the SEC. Additionally, states may have local regulations governing the content and format of stock certificates. Electronic receipts must follow the Digital Signature and Electronic Transactions Acts to ensure they are legally binding.

European Union: In the EU, stock receipts must adhere to the regulations set by the Markets in Financial Instruments Directive (MiFID II), which mandates transparency and fair disclosure. Jurisdictions like the UK and Germany also require that receipts include the shareholder’s identity and the relevant corporate details. The use of electronic stock receipts is permitted, but these must comply with the EU’s Electronic Identification and Trust Services Regulation (eIDAS) for security and authenticity.

Canada: Canadian laws demand that stock receipts contain the corporation’s name, the shareholder’s name, the number of shares, and any rights attached to those shares. The Canada Business Corporations Act (CBCA) governs the issuance of stock certificates, including provisions on the electronic transfer of shares. Public companies must also ensure compliance with the regulations set by the Canadian Securities Administrators (CSA).

Australia: In Australia, stock receipts must comply with the Corporations Act 2001, which mandates that they include information such as shareholder details, share class, and the company’s ACN (Australian Company Number). Additionally, Australian regulations permit the issuance of electronic stock receipts, provided they meet the standards set by the Electronic Transactions Act 1999.

Asia (China, Japan, and India): In China, stock receipts must follow the rules established by the China Securities Regulatory Commission (CSRC), which ensures that the certificates meet transparency standards and protect investors’ rights. Japan’s Financial Instruments and Exchange Act requires that stock certificates include shareholder identification and the number of shares. In India, the Companies Act 2013 regulates the issuance of stock receipts, mandating that they be signed by directors and meet the disclosure requirements specified by the Securities and Exchange Board of India (SEBI).

Failure to adhere to jurisdictional requirements can result in legal complications, delays, or invalid transactions. Always ensure compliance with local laws to maintain the integrity and enforceability of stock receipts across borders.

Store receipts in a well-organized system to ensure easy retrieval and accurate record-keeping. Utilize a consistent naming convention for files to prevent confusion and streamline searching.

- Label digital files with clear, descriptive names that include key details like the stock certificate type and date of issuance.

- Ensure receipts are scanned or photographed in high resolution to retain legibility and prevent loss of information over time.

- Use cloud storage or secure external drives for backup, making sure to encrypt sensitive information to prevent unauthorized access.

- For physical receipts, use fireproof and waterproof storage options, such as filing cabinets or safes, to protect from damage.

Regularly review and update your storage practices. Archive older receipts that no longer require frequent access, while keeping active documents easily accessible for quick reference.

- Establish a routine for verifying and organizing receipts at least once a year to maintain order and avoid unnecessary clutter.

- Set up automated reminders for renewing or transferring stock certificates when applicable, ensuring important deadlines aren’t overlooked.

- Consider using a receipt management software that can track document expiration dates and notify you of necessary actions.

Maintain security by limiting access to stock receipts to authorized personnel only. Use access control systems for digital storage and locked filing cabinets for physical receipts to keep information confidential.

To create a professional and clear stock certificate receipt, make sure your template includes all necessary details. Start with the company name, stockholder’s name, and the number of shares received. Include the date of receipt and a unique receipt number for record-keeping. A signature section for the issuer adds authenticity and ensures legal validity.

Key Components

Each receipt should clearly display the stock certificate number, the type of stock issued (common or preferred), and the par value of each share. Provide space for any special instructions or terms, such as transfer restrictions or voting rights.

Tips for Customization

Adjust the layout to match the company’s branding, using logos and consistent fonts. Ensure the text is easy to read and the document can be printed clearly. Use secure paper if issuing physical receipts to prevent counterfeiting.