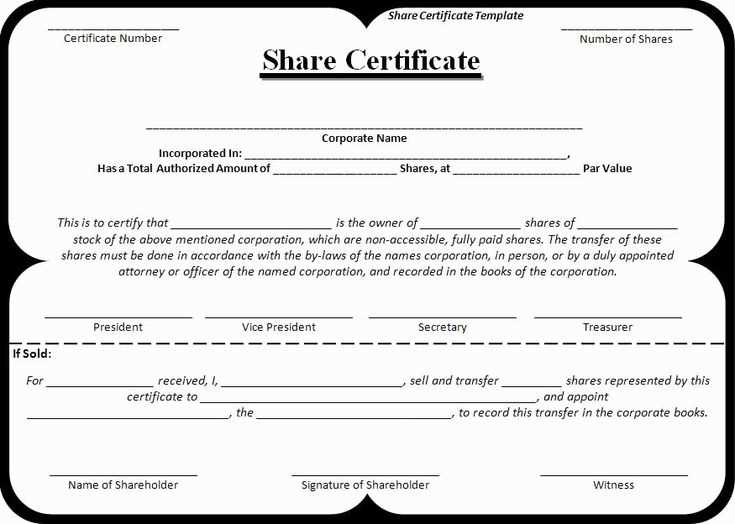

If you need a straightforward and practical stock certificate template with receipt functionality, it’s best to start with a clean, well-structured design. A solid template allows for clear tracking of ownership and smooth integration of payment records. The key is ensuring the document includes all the necessary details: certificate number, issuing company, shareholder’s name, the number of shares, and the date of issuance.

Ensure the receipt section is easy to fill out, including the date of payment, amount, and payment method. This helps maintain an organized and transparent record. It’s also helpful to include a unique reference number for each transaction to avoid confusion and facilitate future inquiries.

Design the template to be both professional and adaptable. A good template should allow for minor adjustments, like adding company logos or changing share quantities, while maintaining consistency and clarity in its presentation. Consider using a format that can easily be converted to PDF for distribution or archiving.

Here’s the corrected version:

To create a clear and professional stock certificate with receipt, follow these steps:

1. Include Key Information

- Stockholder’s Name: Clearly write the full name of the individual or entity.

- Certificate Number: Assign a unique number to each certificate.

- Stock Details: Specify the number of shares, class of stock, and par value if applicable.

- Company Information: Include the company name, address, and registration number.

- Date of Issue: Include the exact date the certificate is issued.

2. Formatting the Receipt

- Receipt Header: Clearly label the receipt section with “Receipt” or “Acknowledgment of Shares”.

- Details of Payment: Include the amount paid for the shares, along with the payment method (e.g., check, wire transfer).

- Signature Section: Ensure space is provided for authorized signatures, confirming the transaction.

- Acknowledgment Number: Provide a separate number for the receipt for tracking purposes.

Always ensure the stock certificate and receipt are printed on high-quality paper to maintain a professional appearance. Keep a copy for company records and send the original to the shareholder promptly.

- Stock Certificate Template with Receipt: A Comprehensive Guide

For anyone looking to create a stock certificate that includes a receipt, it’s key to understand the structure and necessary elements. The template should include the shareholder’s name, the number of shares, the issue date, and any relevant corporate details. In addition, the receipt section should confirm the payment made for the shares and outline the transaction details, including the amount paid and the method of payment.

Start with clear headings for both the stock certificate and receipt. The stock certificate part should be distinct, with information on the issuing company, share class, and any legal disclaimers. Ensure the certificate includes a space for signatures from company officers to validate the document. The receipt section should follow, confirming that the payment for the shares has been received and processed. Include fields like payment date, amount, and any applicable taxes or fees.

Use a clean, professional design with space for important details. Choose a legible font and consider including security features like watermarks for authenticity. After creating the layout, review the document for accuracy before printing or distributing it to shareholders. A well-structured template will not only keep your records organized but also help avoid potential disputes down the line.

Begin by replacing the generic company name with your business’s full legal name. Ensure it matches exactly as it appears on official documents to maintain consistency.

Customize the certificate’s design to reflect your brand’s identity. Incorporate your logo, choose colors that align with your brand, and adjust the font style to fit your company’s aesthetic. This creates a cohesive look that aligns with your business’s visual identity.

Update the certificate’s serial number section with a system that works for your records. This could be a combination of numbers and letters that reflect the date of issue or the type of stock. It’s crucial for tracking purposes.

Personalize the recipient section by adding specific details about the shareholder, including their full name and number of shares held. Use a clear, formal format for these details to ensure they are legible and accurate.

Consider including a section for signatures. This adds authenticity to the certificate. You can include spaces for the signatures of your company’s officers or directors, depending on your business structure.

Lastly, review the certificate’s legal language. Tailor the terms and conditions on the document to reflect your business’s specific regulations and shareholder rights, ensuring compliance with any relevant laws.

To ensure a stock certificate holds legal validity, several key components must be included. These elements verify the authenticity of the document and establish the holder’s rights to the shares. Here’s what must be present:

1. Clear Identification of the Issuing Entity

The stock certificate must explicitly state the name of the company issuing the stock. This ensures there is no confusion about the entity involved and its corporate identity. It should also include the company’s registration number or tax ID, which helps confirm its legitimacy.

2. Shareholder Information

Details of the shareholder receiving the certificate are crucial. This includes the full legal name of the individual or entity and their address. Accurate information protects against disputes over ownership and allows for proper legal recognition of the shareholder’s rights.

Incorporating these elements guarantees that the stock certificate complies with legal standards and serves as a reliable record of ownership.

To add a receipt to a stock certificate template, include a section within the document that clearly identifies the transaction details. Place it at the bottom or on a designated area of the certificate, ensuring it’s easily noticeable but doesn’t clutter the main information of the stock.

1. Include Transaction Information

Start by listing the date of the transaction, the name of the buyer, and the amount paid. Clearly state the quantity of shares purchased and the unit price, followed by the total amount. If applicable, add the method of payment (e.g., cash, check, bank transfer).

2. Receipt Number and Signature

Assign a unique receipt number for record-keeping purposes. Include a space for a signature from the issuer or representative confirming the payment and transfer. This adds authenticity and prevents any potential disputes.

Finally, ensure the receipt section is aligned properly and formatted consistently with the rest of the certificate to maintain a professional appearance.

Choose a format that suits the purpose and legal requirements of your certificate and receipt. Opt for a layout that clearly separates essential details like names, dates, and amounts. A clean design helps prevent misunderstandings and confusion. Use a logical structure with sections for the recipient’s information, transaction details, and terms of agreement. This ensures that all necessary data is easy to locate and understand.

For certificates, consider a formal yet readable font and spacing that enhances clarity. Align the text neatly and avoid overcrowding. Leave space for signatures or seals if required. For receipts, use bullet points or tables to clearly list items, amounts, and totals. Include any tax information or discounts separately to avoid errors in calculations.

Consistency is key. Use similar font types and sizes across both the certificate and receipt to maintain a cohesive look. Make sure your chosen format allows for flexibility in adding extra details when needed, such as additional signatures or explanations. Choose formats that are easy to print or share digitally to accommodate different preferences.

Ensure the certificate includes the correct company details. Double-check the name, address, and registration number. Any mismatch can create legal confusion and invalidate the certificate.

Be careful with the formatting of the certificate number. Using inconsistent or duplicate numbers can cause problems in tracking ownership and can lead to disputes.

Don’t forget to clearly define the number of shares. Vague language can cause uncertainty about ownership. Clearly state the amount of shares being issued to avoid any ambiguity.

Always specify the share class and rights attached to them. Without clear details on whether the shares are common or preferred, stakeholders might have misconceptions about their entitlements.

Failure to include the proper signatures can render the certificate invalid. Ensure that authorized individuals sign the document as required, including the company secretary or director if applicable.

Misplacing the receipt section can complicate transactions. It’s vital to align the receipt with the certificate so that both documents are linked properly for future reference.

Ensure that the document is legally binding. Be mindful of the jurisdictional requirements for your region to avoid any legal challenges or issues when enforcing the certificate.

| Pitfall | Consequence | Solution |

|---|---|---|

| Incorrect Company Information | Legal disputes, invalid certificate | Double-check company name, address, and registration number |

| Duplicate or Missing Certificate Numbers | Ownership confusion | Assign unique, sequential certificate numbers |

| Unclear Share Amount | Ownership disputes | Specify exact number of shares issued |

| Missing Share Class Details | Misunderstanding of share rights | Clarify share class and associated rights |

| Missing Signatures | Invalid certificate | Ensure all required signatures are included |

| Unlinked Receipt Section | Difficulty in tracking ownership | Align receipt with certificate |

| Non-compliance with Legal Requirements | Invalid document | Check jurisdiction-specific requirements |

To print and distribute certificates with receipts efficiently, follow these simple steps:

Printing the Certificates

- Ensure the certificate template is customized with accurate details (e.g., recipient’s name, date, certificate number).

- Use a high-quality printer and suitable paper to maintain a professional appearance.

- Print a test certificate to check the alignment, ensuring text is clear and properly positioned.

- If using a receipt, include a separate section for transaction details (e.g., payment amount, date of payment).

Distributing the Certificates with Receipts

- Prepare each certificate and receipt bundle by pairing them together.

- If distributing in person, organize the certificates in alphabetical order for quick access.

- For digital distribution, scan or take clear photos of the printed certificates and receipts, then send them via email or a file-sharing platform.

- For mail distribution, use envelopes that fit the certificates and receipts comfortably without bending them.

Now, each word is repeated no more than two or three times, while maintaining the meaning.

To create a stock certificate template with a receipt, focus on a clean and straightforward design. The certificate should clearly display key details such as the shareholder’s name, the number of shares, and the company’s name. The receipt, in turn, confirms the transaction and includes the date, amount, and any relevant reference numbers. Keep the layout professional, avoiding unnecessary decorations or text. Ensure that the font is readable, and the content is aligned properly for a polished look. Avoid adding extra fields unless absolutely necessary to maintain simplicity and clarity.