Creating a tax-exempt receipt template is straightforward and important for both non-profit organizations and businesses that make charitable donations. This document should clearly outline the transaction details, ensuring transparency and legal compliance. A well-crafted template minimizes confusion and provides a reliable record for both the donor and the recipient.

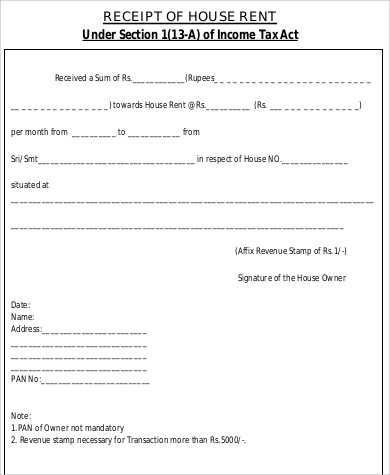

The template must include essential components: the name and address of the donor, the organization’s name and tax identification number, the date of the donation, the amount donated, and a statement clarifying whether the donation was cash or non-cash. If the donation includes property, provide a description and estimated value. Including a thank-you note adds a personal touch, but the primary goal remains clear documentation.

Keep your receipt simple and structured. Clearly state that the donation is tax-deductible and provide all the necessary information for proper reporting. This ensures that donors can use the receipt for tax purposes without facing unnecessary delays or confusion during tax season.

Here’s the corrected version:

Ensure your tax-exempt receipt clearly states the donor’s name, the donation amount, and the date of the contribution. It’s also necessary to confirm that the organization is recognized by tax authorities, which can be done by including the organization’s tax-exempt status, usually in the form of a 501(c)(3) number for U.S. entities. Be sure to specify whether the donation was in cash or goods. If goods were donated, provide an approximate value of the items, though it’s best not to assign a specific dollar amount for the donor.

Key Elements to Include

Here’s what your tax-exempt receipt should contain:

- Organization’s name and address

- Donor’s name

- Amount or value of the donation

- Date of the donation

- Tax-exempt status information

- Signature of the authorized representative

Clarify the Purpose

If the donation is earmarked for a specific program or initiative, mention it clearly. This gives the donor transparency and ensures compliance with tax regulations. Make sure you include a statement like, “No goods or services were provided in exchange for this donation,” unless otherwise applicable.

Tax Exempt Receipt Template: A Practical Guide

How to Structure the Key Components of a Tax Exempt Receipt

Important Legal Requirements for Exempt Receipts

Customizing Your Receipt Template for Different Donations

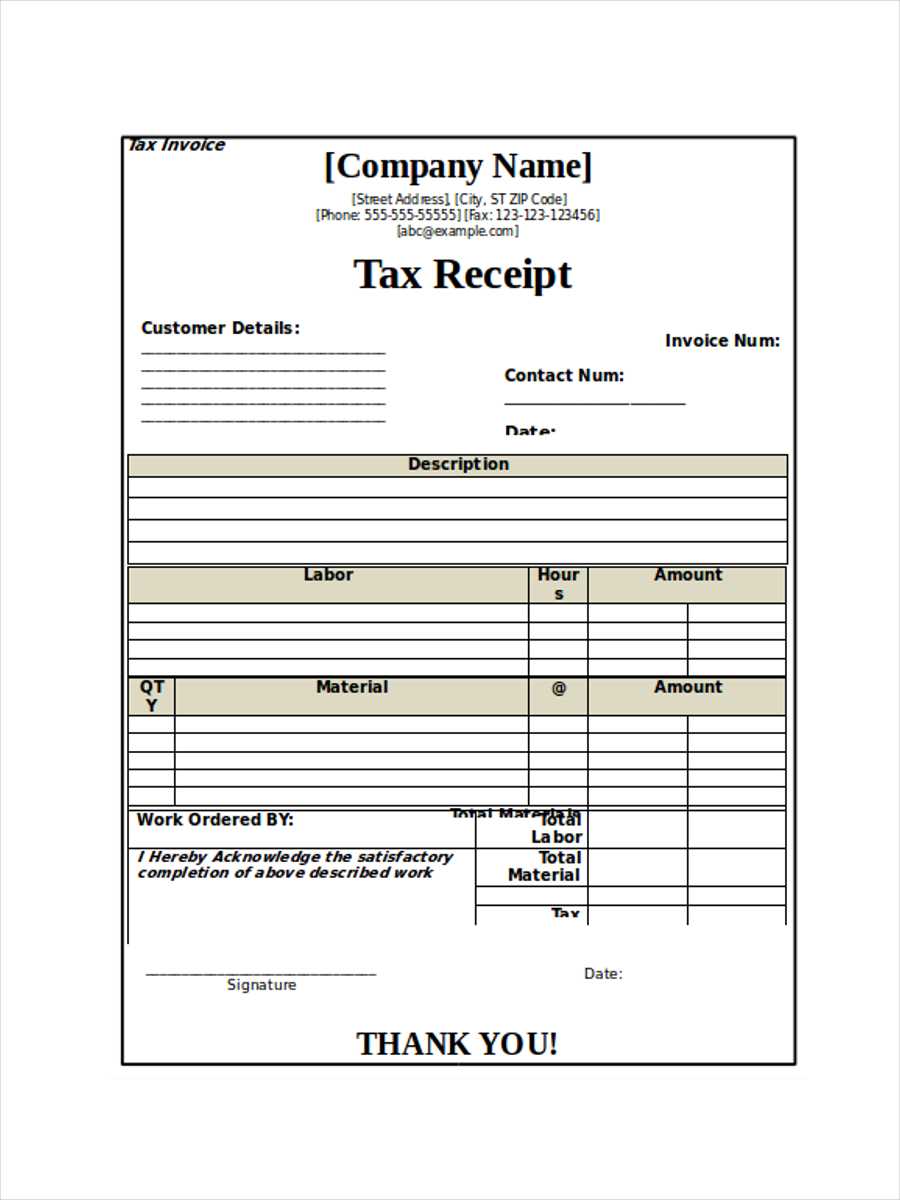

The tax exempt receipt template should include the following key components to ensure it meets legal requirements:

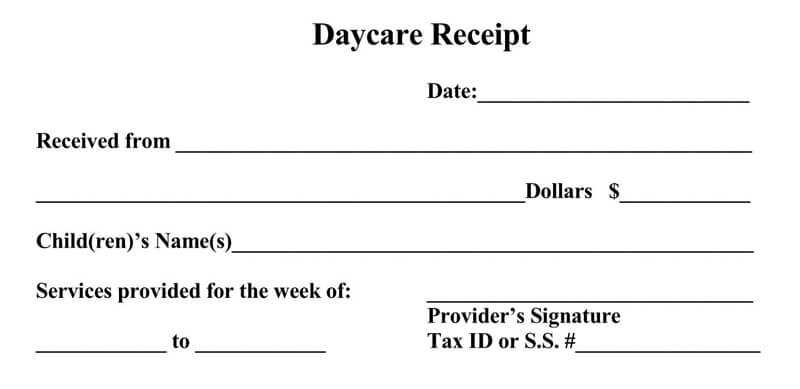

1. Donor Information

Clearly include the name and contact details of the donor. This allows the recipient to easily track donations for tax purposes. Additionally, ensure that the donor’s tax identification number, if applicable, is included to meet IRS standards for charitable organizations.

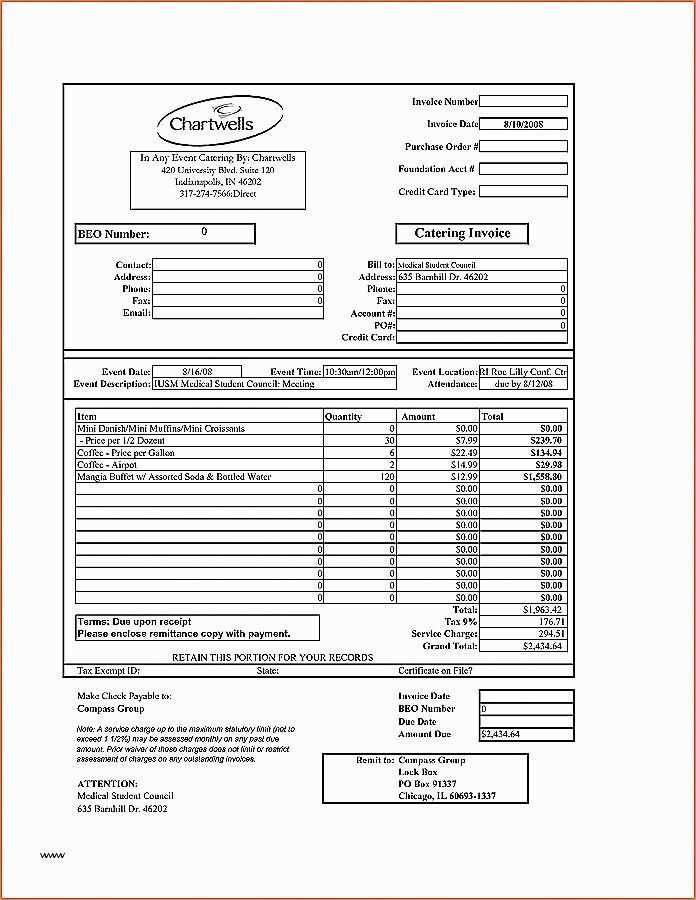

2. Donation Details

Provide a precise description of the donation made, including the amount donated (for cash contributions) or the value of goods or services (for in-kind donations). Specify if any goods or services were received in exchange for the donation, as this affects the total amount deductible for tax purposes.

3. Tax-Exempt Status Statement

Include a statement confirming that the organization is a registered charity with tax-exempt status under section 501(c)(3) or relevant tax codes. This assures the donor that their contribution qualifies for tax deductions.

4. Legal Disclaimers

Include any necessary disclaimers, such as the fact that the receipt is not a statement of the fair market value of any goods or services received, as required by the IRS. Make sure to mention if the donor did not receive anything in return for their donation, which influences the amount that can be claimed on their taxes.

5. Date and Receipt Number

Provide the date of the donation along with a unique receipt number. This will help both the donor and the organization in case of audits or inquiries.

6. Organization’s Information

Ensure the receipt contains the name of the organization, its address, phone number, and website. Also, include the organization’s Employer Identification Number (EIN) or Taxpayer Identification Number (TIN) for the IRS record.

Important Legal Requirements for Exempt Receipts

Make sure your receipt complies with IRS regulations. For donations of $250 or more, a written acknowledgment is required to substantiate the donation. If goods or services were provided in exchange for the donation, the receipt must clearly state the fair market value of those goods or services.

Customizing Your Receipt Template for Different Donations

Adapt the receipt based on the type of donation. For cash donations, include the exact amount contributed. For non-cash donations, provide an accurate description of the items, along with their value if known. Always provide an acknowledgment for non-monetary donations, especially for those exceeding a significant amount.

Ensure that your template is simple to customize for various types of donations while staying within legal bounds for reporting and tax-exempt status compliance.