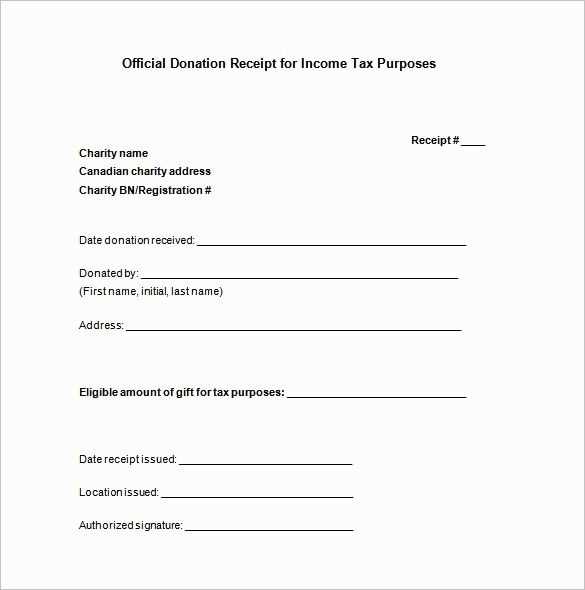

Creating a tax receipt for auction items is straightforward when you have a proper template. This document ensures both the buyer and seller have the necessary information for tax purposes. The key is to include accurate details about the transaction, item description, and the amount paid. This will make it easier for your buyer to claim any potential deductions on their taxes, and for you to stay compliant with regulations.

Start by listing the auction house or seller’s name, the date of the transaction, and the unique item number or description. Include a brief but precise description of the item sold, its condition, and the final bid or purchase price. For non-profit auctions, it’s crucial to specify if any portion of the amount paid is a donation.

Make sure to also indicate whether the transaction was paid via cash, credit card, or check. Finally, include any other relevant details, such as the buyer’s name and address, especially for large transactions. This will help ensure that all parties have the right paperwork when it’s time to file taxes.

Tax Receipt for Auction Items Template: Practical Guide

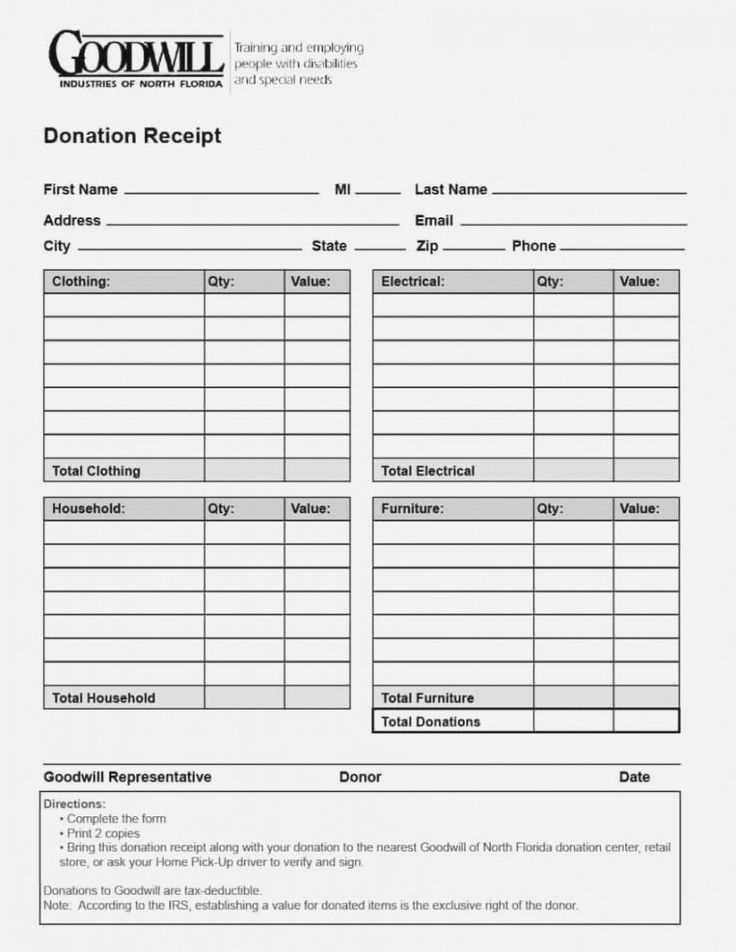

Include clear details in your tax receipt template, such as the full name and contact information of both the donor and the recipient. Specify the date of the auction and the description of each item, including its fair market value. Make sure to state that the donor received no goods or services in exchange for their contribution, as this is a key requirement for tax deductions.

Next, add a unique identification number for the auction event. This helps with record-keeping and provides a reference for both parties. If you’re using an online platform for auction management, ensure the receipt includes any reference codes or transaction numbers that can be linked back to the auction system. This will make it easier to trace the donation.

Clearly indicate whether the item was sold or donated and list the final auction price for each item. For donations, mark the item’s fair market value as determined by the appraiser or the seller’s valuation. For sold items, the final price can be listed along with any buyer’s premium or associated fees that apply to the sale.

If applicable, include tax-exempt status information for the organization hosting the auction, especially if the event is run by a nonprofit entity. Ensure your receipt complies with IRS guidelines for charitable contributions. Lastly, don’t forget to include a thank-you message to the donor for their generosity.

Creating a Simple Template for Auction Sales

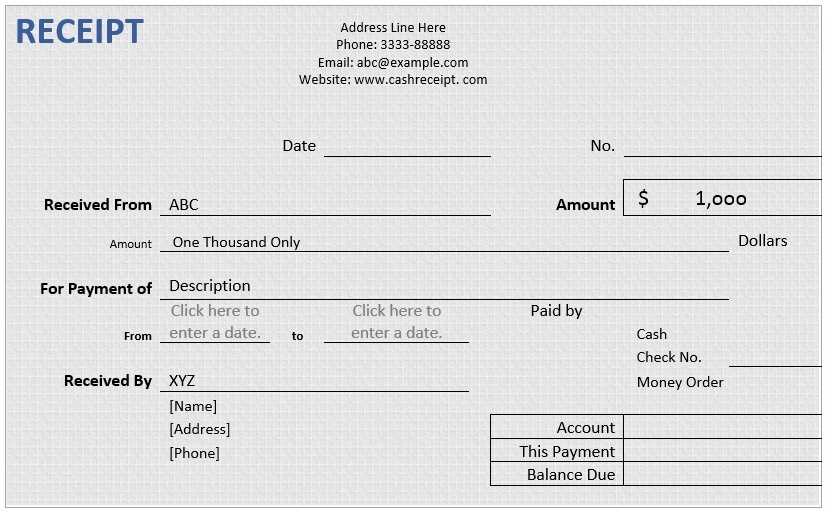

Begin by creating a clear and concise header with the auction’s name and the date of sale. This allows the buyer to quickly identify the transaction.

Example: Auction Sale Receipt – October 15, 2025

Next, include the seller’s details: name, business name (if applicable), and contact information. This establishes accountability and ensures buyers know how to reach out for any issues.

Example: Seller: John Doe | Contact: [email protected] | Phone: (123) 456-7890

List the item sold, including a brief description, item number (if applicable), and the final bid price. This serves as proof of purchase for the buyer.

Example: Item: Vintage Clock | Item Number: 5678 | Winning Bid: $150

Include the buyer’s information–name, contact, and address. This makes it easy to confirm who made the purchase and where the item should be shipped.

Example: Buyer: Jane Smith | Address: 123 Maple Street, City, State

Indicate the payment method and amount received. If applicable, mention taxes or shipping charges separately. This keeps everything transparent and organized.

Example: Payment Method: Credit Card | Amount Received: $150 | Shipping: $15

Finish the receipt by thanking the buyer and offering a contact point for any future questions or concerns.

Example: Thank you for your purchase! For inquiries, please contact us at [email protected].

Including Necessary Information for Tax Reporting

For accurate tax reporting, ensure your tax receipt includes the auction item’s final sale price, the auction date, and the buyer’s details. Clearly indicate the item’s description, including any serial numbers or unique identifiers, if applicable. If the item was sold with a reserve price, state whether it was met and the price achieved. For donations, include the fair market value of the item at the time of the auction.

Provide the seller’s contact information, including their name and address. If the auction is conducted by a third party, include the auction house’s details as well. In cases where the item is sold under a consignment agreement, specify the seller’s agreement terms to avoid confusion.

Make sure the receipt shows the total amount paid, including any applicable taxes or fees. If the auction involved any special conditions or exemptions, note these on the receipt. These details will help ensure both parties meet their reporting obligations accurately.

Handling Multiple Auction Transactions in One Template

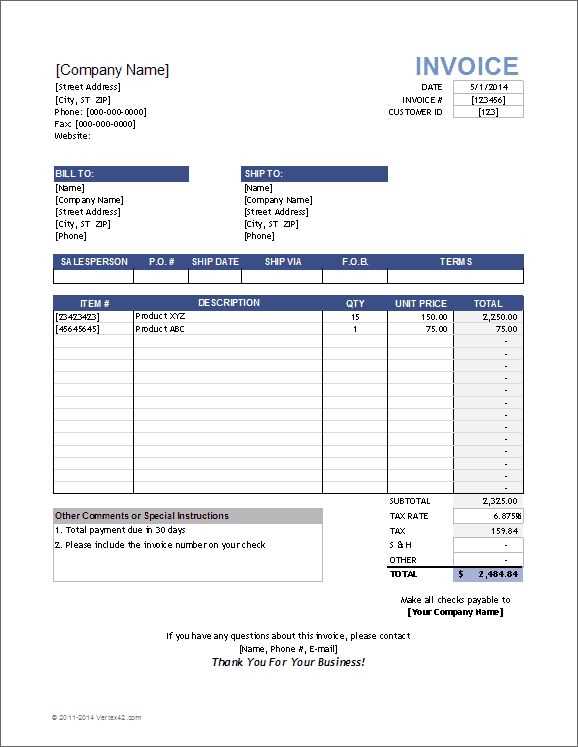

To handle multiple auction transactions efficiently in a single template, structure your document to clearly separate each transaction. This allows both buyers and sellers to easily track the details of each auction lot within one receipt.

- Use separate sections for each transaction: Create distinct areas for each auction item, listing the item description, final bid amount, and any additional fees. Label each section clearly with the auction lot number.

- Itemized breakdown: List the auction item, bid price, and associated taxes or service charges in a table format. This helps in keeping the information organized and accessible at a glance.

- Summarize totals at the bottom: After listing all individual transactions, include a total section where you can calculate the overall amount due, including taxes and shipping if applicable.

- Transaction identification: Include a unique identifier for each auction transaction, such as a reference number or a specific code for each buyer. This helps in tracking the details back to individual bidders.

- Ensure clarity in payment instructions: Provide concise instructions for payment, specifying the methods accepted, deadlines, and any payment references that may be required.

By organizing each transaction clearly within the template, you maintain clarity and ensure that all necessary information is presented for multiple auction lots, keeping the process smooth for both participants and organizers.