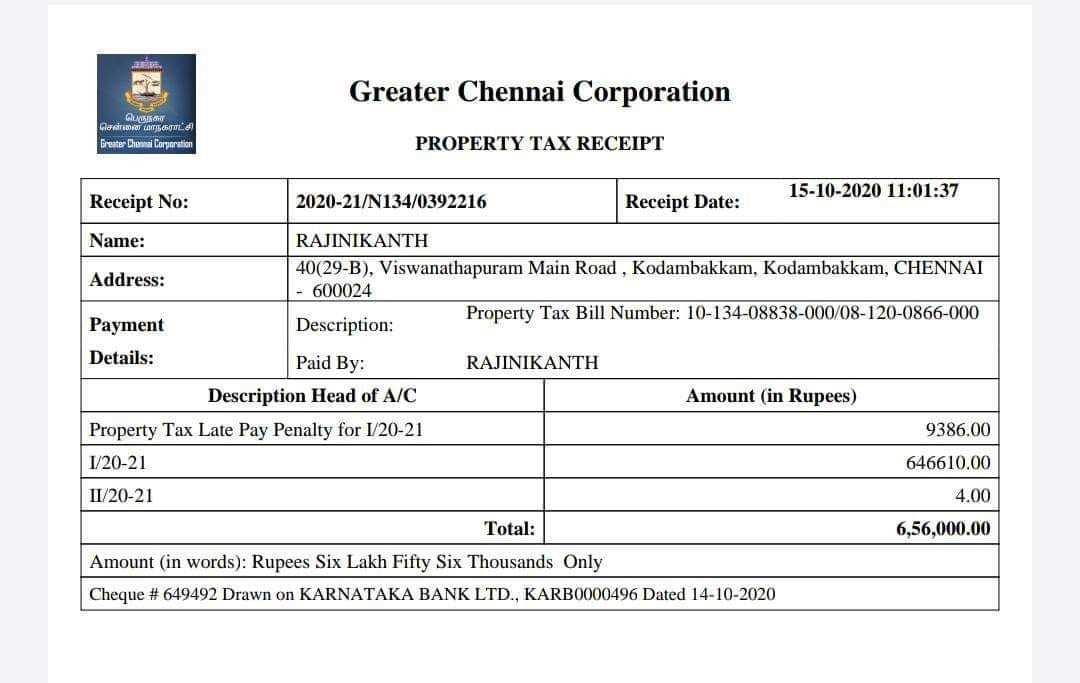

A tax receipt for auction sales is a key document that ensures both buyers and sellers comply with tax regulations. This template serves as a formal acknowledgment of the transaction, providing all necessary details for tax reporting. When creating or using a template, accuracy is paramount to avoid confusion or potential issues with tax authorities.

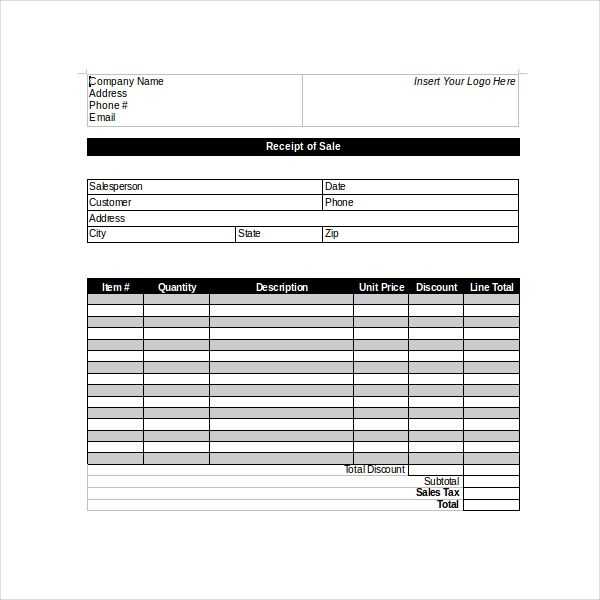

Start with clear headings for the auction’s date, item description, and final bid amount. Specify the seller’s name, address, and tax identification number. These details are necessary for proper identification in case of future inquiries. Include a section outlining whether any tax was collected, as this will help both parties accurately report income or expenses on their tax returns.

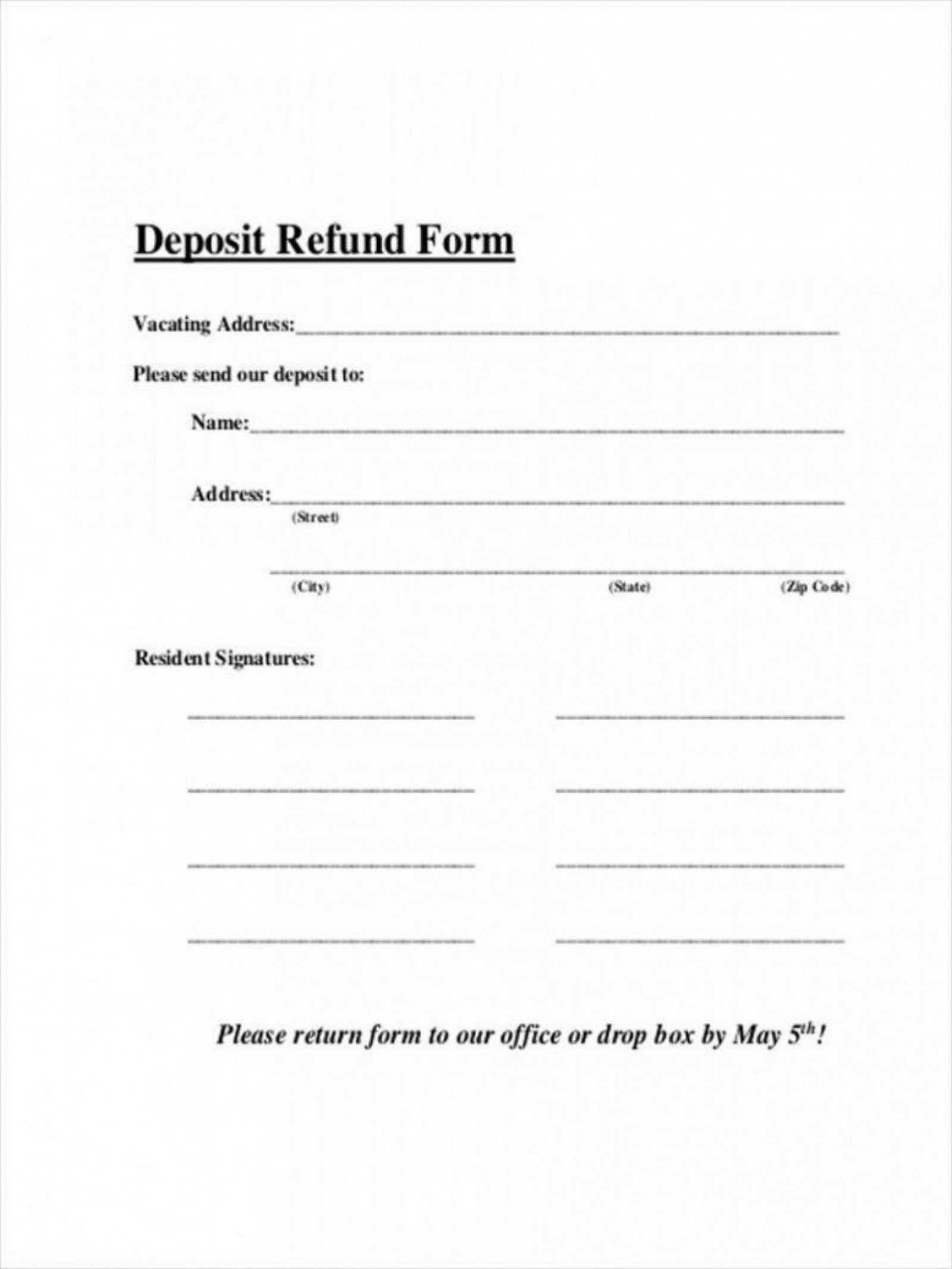

It is also important to provide space for both the buyer and seller to sign, indicating they agree to the transaction’s terms. Ensure the template is adaptable for different auction formats, whether for charity, estate sales, or art auctions. Always double-check the template to ensure it complies with local tax laws and regulations specific to your area.

Here’s the revised version without unnecessary repetitions:

To create a tax receipt for an auction, include the following details clearly and concisely:

Key Information to Include

Start with the buyer’s name, address, and contact information. Add the auction’s name, date, and location. Clearly state the item purchased, along with its description and sale price. Include any applicable taxes and fees, and calculate the total amount paid.

Legal and Compliance Notes

Ensure that the receipt includes the auction house’s legal business name, tax identification number, and contact details. If applicable, add a disclaimer about the sale’s terms and any applicable refund or return policies. Keep the language straightforward and avoid ambiguity.

Ensure all information is accurate and formatted clearly for easy reference by both the buyer and the auction house.

- Tax Receipt for Auction Template

Ensure your tax receipt includes the following key details: the donor’s name, address, and the auction item description. Clearly indicate the fair market value of the item at the time of the auction. It’s important to specify that the auction item was sold as a donation to receive a tax deduction. Include the name and address of the charity or organization that benefited from the auction proceeds. You should also note the auction date and the amount paid for the item.

For transparency, be sure to state that no goods or services were provided in exchange for the donation if applicable. The template should also contain a statement on whether the auction price was less than, equal to, or greater than the fair market value, as this can affect the donor’s tax benefits.

Additionally, the receipt should include the signature of an authorized representative from the charity or organization. A clear and concise statement about the donor’s tax obligations and benefits is helpful. Lastly, keep the receipt format simple, easy to read, and free of unnecessary information.

A tax receipt in auctions serves a clear role: it documents the transaction and supports tax reporting for both buyers and sellers. This is crucial for tax deductions, especially for charitable auctions, where buyers may claim deductions for contributions made to nonprofit organizations.

Buyers need tax receipts to verify the amount spent during an auction. These receipts can include details like the total purchase price, any applicable taxes, and the description of the auctioned item. For charitable organizations, a tax receipt provides proof of a donation, supporting their tax-exempt status.

Tax Benefits for Buyers

- If the auction is a charity event, buyers can use the tax receipt to claim deductions on their income taxes. The receipt confirms the donation made to the organization.

- Receipts help buyers track their spending on auction items, ensuring accuracy when filing taxes, especially if the items purchased have tax implications.

Tax Reporting for Sellers

- Sellers, especially charitable organizations, use tax receipts to confirm that the proceeds from an auction are being reported correctly to tax authorities.

- For sellers operating as nonprofits, these receipts allow them to maintain transparency and show compliance with tax regulations.

Begin with the donor’s full name and address. This identifies the individual or entity contributing to the auction. Specify the date of the donation, as it’s needed for tax purposes. Include a description of the item donated, whether it’s goods or services, and note any restrictions or conditions tied to the donation, if applicable.

List the fair market value of the item. If the item is a non-cash donation, include an estimated value based on the current market rate. If services are donated, indicate the fair value of the time provided, which is typically based on the donor’s usual rate. If the item is sold at auction, document the sale price to avoid any discrepancies.

Next, include the auction event details such as the name, date, and location. It adds transparency and ensures the tax receipt aligns with the correct event. For non-monetary donations, state whether any goods or services were received in exchange. If none were given, specify that it was a “pure donation.” This will clarify the donor’s tax benefit eligibility.

End with a statement confirming that no goods or services were exchanged, if that’s the case. This helps solidify the receipt’s status as a legitimate tax-deductible contribution. Be sure to sign the receipt with the appropriate authority, typically an auction organizer or representative, to authenticate the document.

A tax receipt for auction sales must include specific information to ensure compliance with tax regulations and provide proper documentation to buyers. Here’s how to structure it correctly:

1. Seller Information

Include the name, address, and contact details of the auction house or seller. This is critical for identifying the source of the transaction.

2. Buyer Information

Record the buyer’s full name, address, and contact details. This ensures they can be properly identified for tax purposes.

3. Transaction Details

Provide a clear breakdown of the sale. Include the item description, auction lot number, sale price, and any taxes applied. If applicable, list any discounts or fees.

| Item Description | Lot Number | Sale Price | Tax Applied |

|---|---|---|---|

| Antique Vase | 1234 | $500 | $50 |

4. Payment Details

Record the payment method used for the purchase, such as cash, credit card, or check. This helps track the flow of funds for tax purposes.

5. Date and Time

Always include the date and time of the transaction. This is useful for tracking the timeline of the sale.

6. Tax Identification Numbers

Include any relevant tax identification numbers for both the seller and buyer, if applicable. This is often required for tax reporting.

Be sure to keep a copy of the tax receipt for your own records and provide a copy to the buyer immediately after the sale.

Make sure the receipt clearly identifies the buyer, the auction house, and the item sold. Include the auction date and a description of the item, such as its condition, provenance, and any warranties offered. This can protect both parties in case of disputes or tax audits.

Ensure the receipt complies with local tax laws. In many jurisdictions, auction houses must provide detailed receipts that outline sales tax collected, as well as any applicable fees. The buyer should also receive information on how tax payments were calculated. This ensures transparency and avoids complications during tax reporting.

Be clear about refund or return policies. A well-structured receipt should include statements regarding any returns or exchanges and outline conditions under which refunds may be granted. This reduces the potential for misunderstandings or legal issues after the sale.

Remember to keep records of all auction transactions. Both the seller and buyer may need documentation for tax filings or legal purposes. Consider implementing a system for storing these receipts securely for future reference.

Lastly, make sure to respect privacy laws. Receipts should not include sensitive personal information beyond what’s necessary for the transaction, ensuring that data privacy regulations are followed.

Clearly state the auction date and time on the receipt. This ensures both parties know when the transaction took place. Include the auction item number or description to avoid any confusion, making it easy to reference the exact lot. If multiple items were auctioned, list them with corresponding lot numbers for clarity.

Include the buyer’s details, such as their name, address, and contact information, if applicable. This helps confirm the transaction and ensures accountability. The auctioneer’s name or the organization handling the auction should also be noted.

Specify the winning bid amount, including any buyer’s premiums, taxes, or other fees that apply. Break these down to give a clear picture of the total cost. If payment terms are applicable, note the payment method and any due dates.

If shipping or delivery is part of the transaction, include the relevant shipping details, such as the address, shipping method, and estimated delivery time. Make sure all fees related to shipping are clearly outlined.

Lastly, for legal clarity, include a brief statement confirming that the buyer acknowledges the auction terms and conditions. This ensures both parties are aligned on the agreement made during the auction process.

Make sure your receipts include all required tax information specific to your location. Include tax registration numbers, the applicable tax rate, and the amount of tax charged. Local regulations might mandate the inclusion of certain legal language on receipts, so check with your local tax authority to ensure compliance.

List both the pre-tax and post-tax amounts clearly on the receipt. This helps avoid confusion and ensures clarity for both buyers and auditors. Make sure to accurately categorize each item if different tax rates apply to different products or services. Some regions may require specific fields like “VAT number” or “tax-inclusive price,” so verify any additional fields that might be mandatory in your area.

Regularly review and update your templates to reflect any tax rate changes. Staying up to date with local legislation ensures you avoid errors and potential fines for incorrect documentation.

For an auction tax receipt template, include clear details of the transaction. Start with the full name of the auction house or seller and their contact information. Specify the auction date and the item description, including a brief summary of its condition and any identifying characteristics, like serial numbers or model names.

Basic Information

- Buyer’s name and contact details

- Item sold, including description and condition

- Auction house name, address, and contact details

Financial Details

- Total purchase amount, including any fees or additional charges

- Tax rate applied to the sale, if applicable

- Amount of tax collected, clearly separated from the total sale price

Ensure the receipt clearly states whether the auction house or seller is required to collect tax and provide all supporting details for proper record-keeping. You may also want to include the payment method (cash, credit card, etc.) and any reference or transaction number for easier tracking.