To keep your finances organized, a tax receipt log template is a practical tool that helps track every receipt related to your taxes. Use this template to systematically record your transactions and ensure all expenses are documented for future reference. The template will save time during tax season by providing a clear and concise overview of your financial activities.

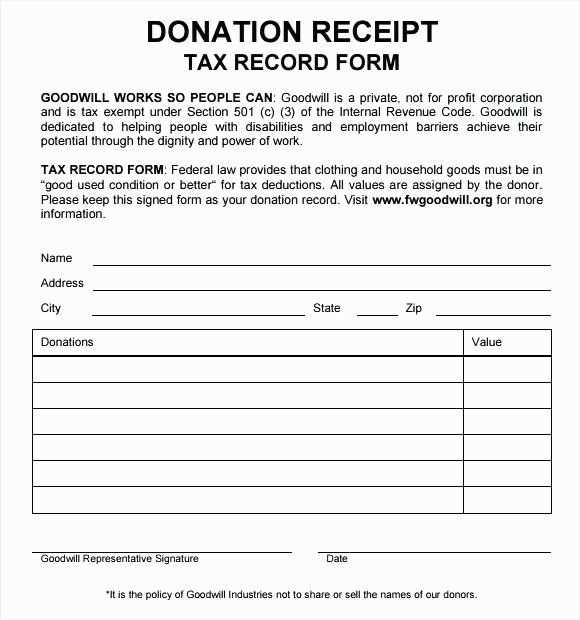

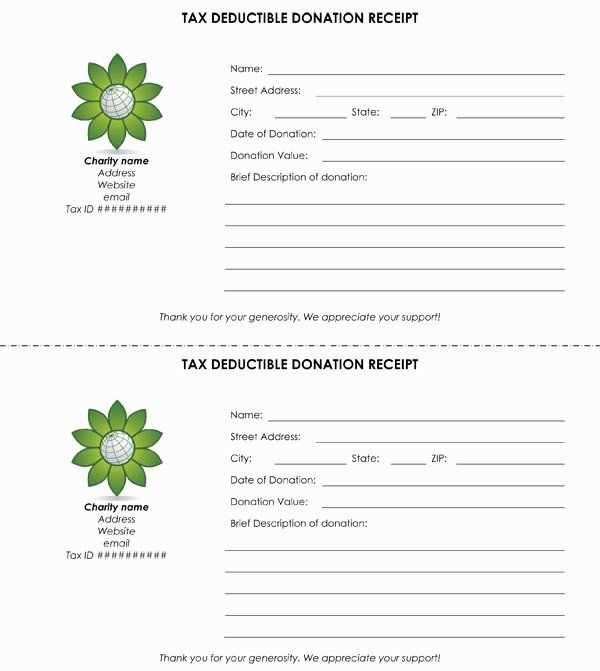

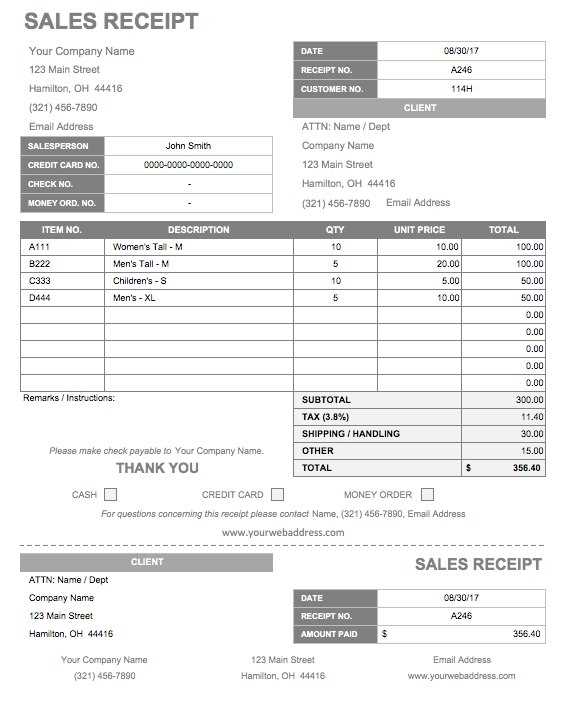

Start by categorizing each receipt, noting the date of purchase, the total amount, and the purpose of the expense. Always make sure to include details such as the vendor’s name and contact information, along with any relevant tax numbers that may apply. This will make your records more reliable and easier to reference if needed.

Keeping a log like this can help you avoid scrambling for receipts when it’s time to file taxes. You can also easily spot any deductions or credits you might qualify for by reviewing the categories you’ve set up in your log. As you continue using the log, it will evolve into a comprehensive financial document that tracks your spending in real-time.

Here’s the corrected version:

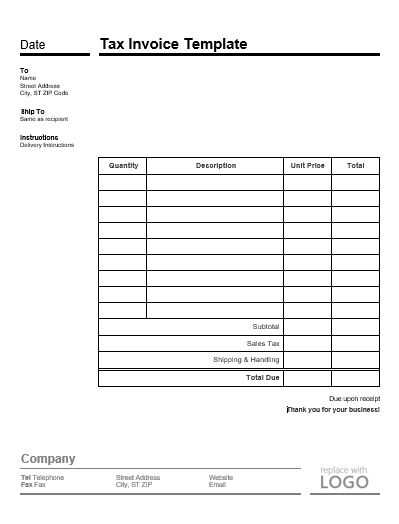

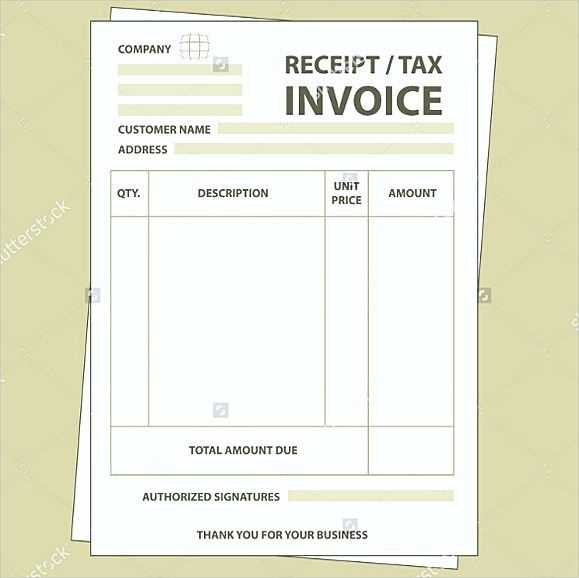

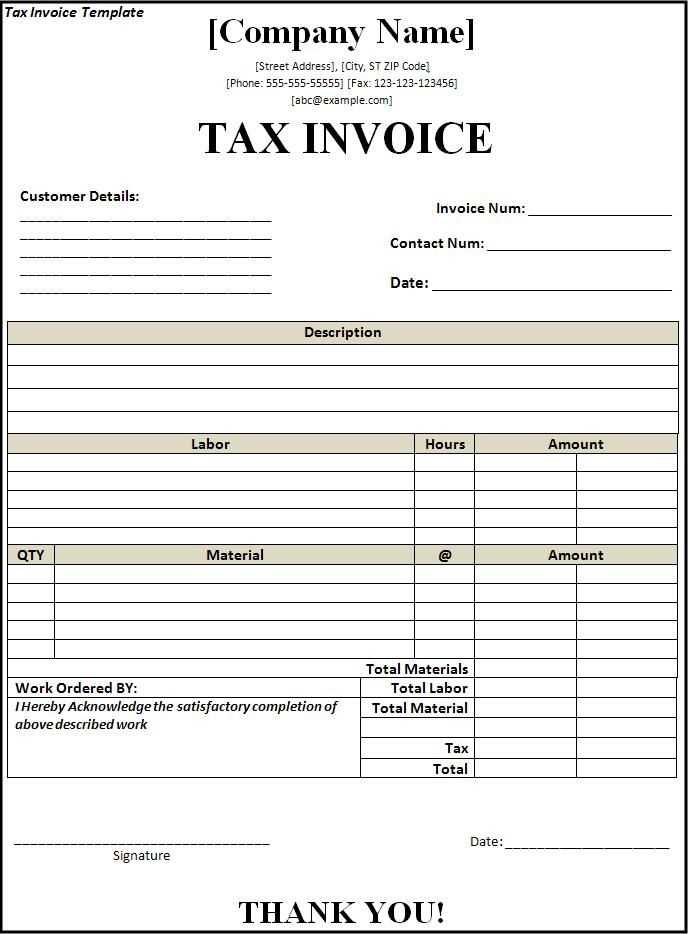

To create an efficient tax receipt log, structure it with essential fields. Start with a column for the date of the transaction. This helps track when each receipt was issued. Next, include a description field for the service or product provided. Keep this simple but clear. A total amount column ensures all expenses are recorded accurately, and a payment method section helps differentiate between cash, card, or other methods. Lastly, include a receipt number or identifier to easily reference each log entry. By keeping it organized, you ensure quick access to all necessary data during tax preparation.

Tax Receipt Log Template: A Practical Guide

Design your tax receipt log template to track every relevant transaction and keep all receipts organized. Start with columns that include the date, vendor, amount, payment method, and category. This will give you clarity and prevent missing crucial information for tax filing.

Creating a Log Template for Tax Receipts in Your Business

To create a practical log template, consider using spreadsheet software for easy customization. Include fields for the receipt number, tax rate, and expense type. Group receipts by category, such as office supplies, travel expenses, and equipment purchases, making it easier to categorize during tax filing. Be specific about the expense types to avoid confusion when preparing your taxes.

How to Organize and Categorize Receipts for Tax Filing

Group receipts by month and year, and ensure each receipt is recorded immediately after the purchase. If you use multiple payment methods, such as credit cards or checks, make sure you note which method was used for each transaction. Creating a separate section for sales tax amounts can also help you identify tax-deductible expenses at a glance.

Once organized, assign each receipt a unique number for easier reference. This can be done by simply assigning a sequential number, or by creating a custom system that works for your business. Always check for duplicates and ensure all receipts are documented accurately.

Tips for Ensuring Accuracy in Your Receipt Log

Double-check entries for any missing or incorrect information, especially if a receipt contains multiple line items. It’s helpful to attach scanned copies or photos of receipts to your log, so you have a digital backup. Periodically review the log for consistency, and reconcile it with bank statements to ensure no entries are overlooked.