If you’re running a business in Australia, providing tax receipts is a requirement for your clients. A tax receipt must include specific details to comply with Australian tax laws, ensuring clarity and accuracy for both you and your customer.

Start by ensuring your receipt includes the Australian Business Number (ABN) for your business, which identifies your tax registration. The date of the transaction is also a key element, marking when the service or product was purchased. Don’t forget to list the total amount paid, along with a breakdown of any applicable taxes like GST, if relevant.

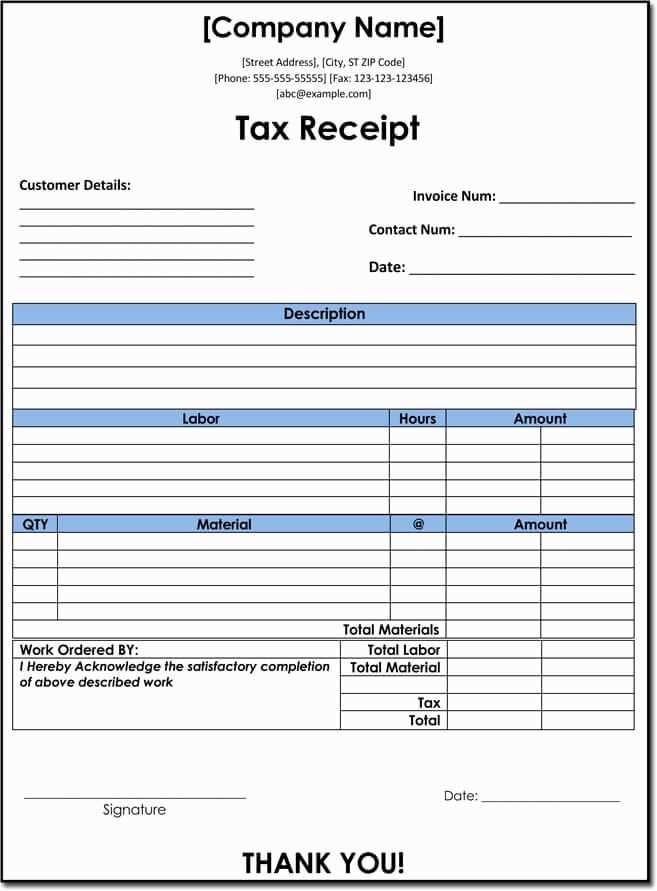

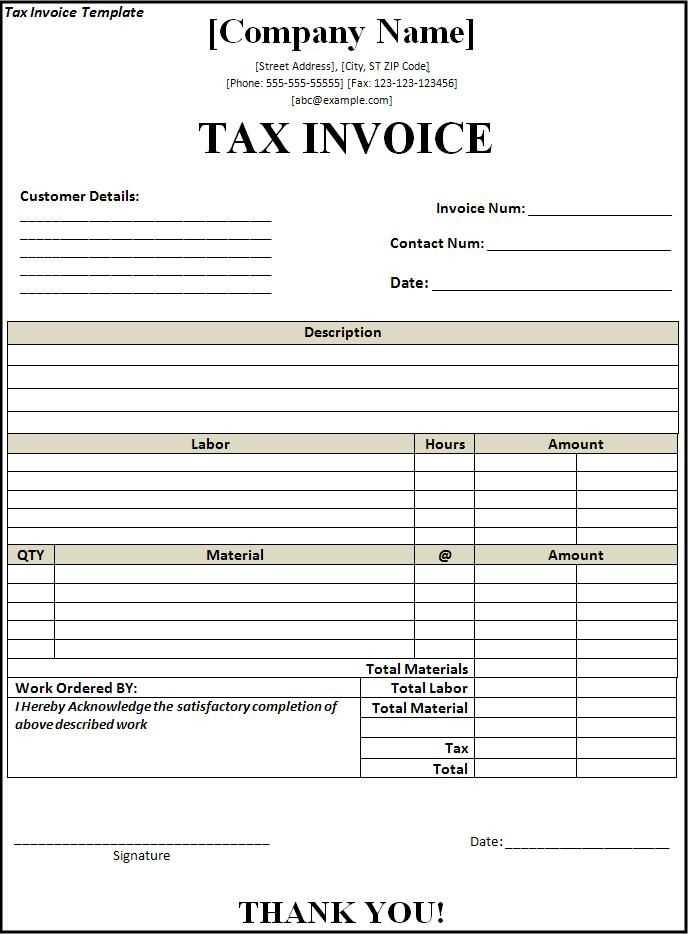

To maintain professionalism, consider using a tax receipt template that clearly organizes these details. Customizing templates helps you avoid missing any important information. Add your business details at the top, followed by a line-item list of products or services sold, including their respective costs. This will ensure your receipts are consistent and meet legal standards, making record-keeping straightforward for your customers.

Here are the corrected lines:

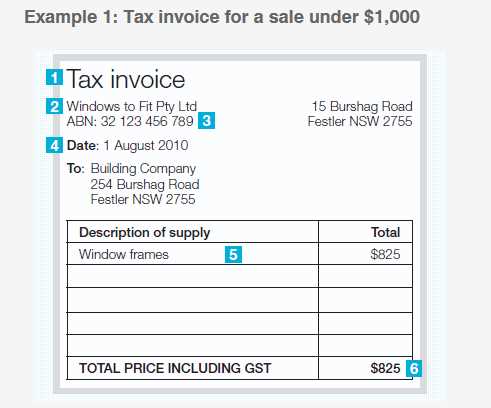

Ensure that the company name and ABN (Australian Business Number) are clearly stated at the top of the receipt. This helps identify the issuer of the receipt and ensures compliance with Australian tax laws.

Include the recipient’s name and address, if applicable, to provide a clear record of the transaction. This can be especially important for businesses that deal with high-value items or services.

State the date of the transaction and a unique receipt number for easy reference. This is necessary for tracking purposes and makes it easier to manage records in case of audits or disputes.

Itemize the goods or services sold, including a description, quantity, and unit price. This level of detail is required for tax purposes and gives the recipient a clear breakdown of their purchase.

Clearly display the total amount paid and any applicable GST (Goods and Services Tax). This ensures transparency in pricing and compliance with Australian tax regulations.

If the receipt includes any discounts, specify the amount or percentage of the discount to avoid confusion and to reflect the correct final price.

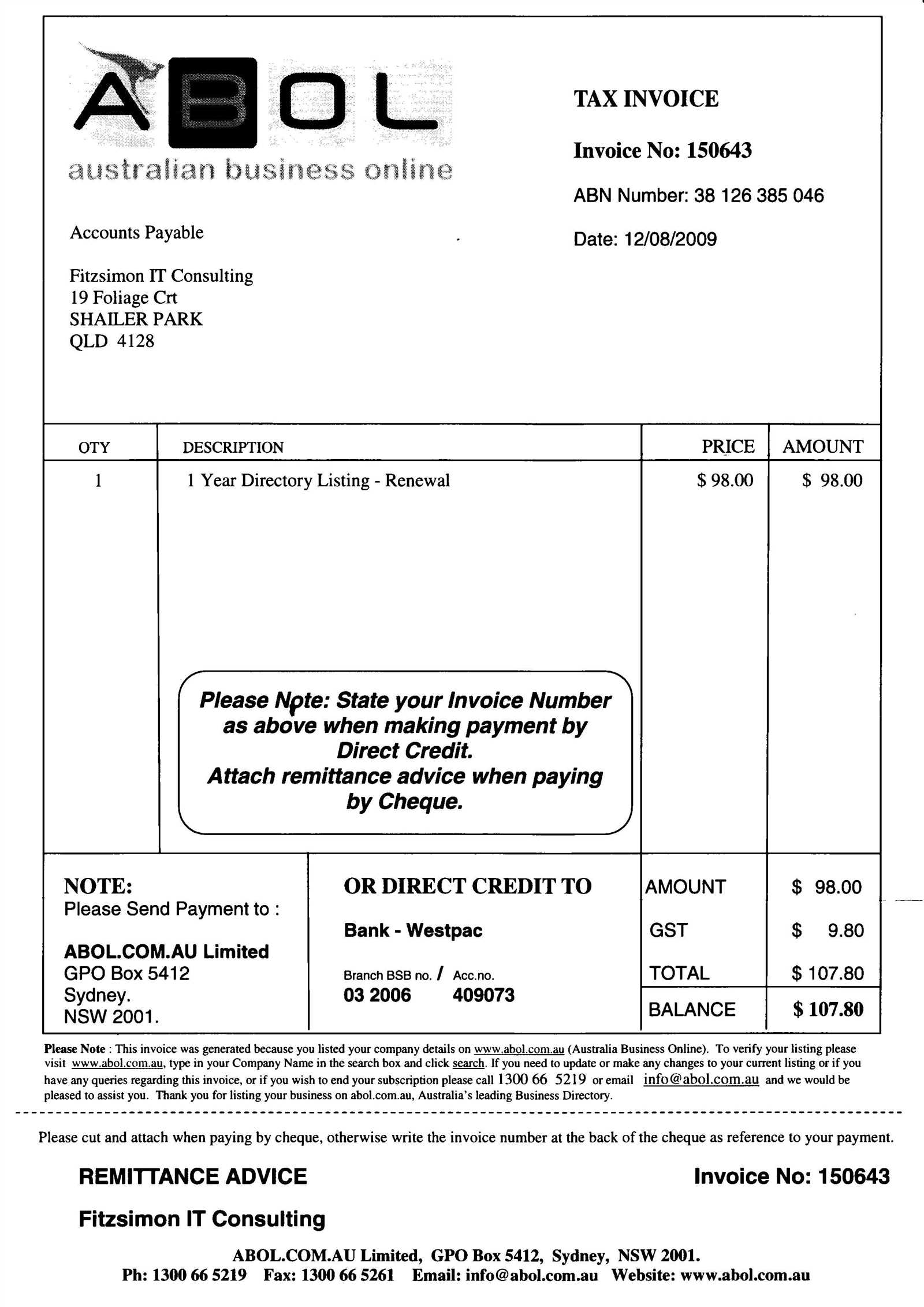

Ensure the payment method is indicated, whether it was made via cash, credit card, or bank transfer. This helps in verifying the transaction and matching it to financial records.

Tax Receipt Template Australia

When creating a tax receipt template for Australia, ensure it includes specific details that meet Australian Taxation Office (ATO) requirements. The template must clearly identify the transaction, including both the business’s and the customer’s information, along with the relevant tax details. Below is a guide to the required components and their formatting for a tax receipt template.

Required Fields

Each tax receipt template should include the following details:

| Field | Description |

|---|---|

| Business Details | Name of the business, Australian Business Number (ABN), and contact information. |

| Receipt Number | A unique identification number for each transaction for record-keeping and reference. |

| Issue Date | The date when the receipt is issued. |

| Customer’s Name | The name of the person or entity receiving the product or service. |

| Details of the Goods or Services | A clear description of the product or service provided, including quantity and unit price. |

| Total Amount | The total amount paid, including applicable taxes. |

| GST Amount | Breakdown of Goods and Services Tax (GST), if applicable. The rate should be clearly stated (usually 10%). |

Formatting Tips

Ensure the following formatting for clarity and ease of use:

- Use a clean, easy-to-read font.

- Keep the receipt layout simple, with each section clearly labelled.

- Ensure the font size is large enough for clear visibility, especially for key details like the receipt number and business contact information.

- If using software to generate the receipt, double-check the template for accuracy before sending it out.

For small businesses in Australia, customizing a tax receipt is a straightforward process that can be tailored to meet both legal requirements and your business needs. Make sure to include all the mandatory information, and feel free to adjust the format for clarity and professionalism.

Include Required Details

First, ensure the tax receipt includes the essential elements as per Australian law. These must feature:

- Business name and ABN (Australian Business Number)

- Customer’s details (name and address, if necessary)

- Date of the transaction

- Itemized list of goods or services sold, including quantity and price

- Total amount paid (including GST if applicable)

- GST amount, if applicable

Design and Format Adjustments

While keeping the required details intact, consider formatting the receipt for a better customer experience. For instance, group similar items together or use clear section breaks for readability. If you’re using software to generate receipts, explore the options for customizing the layout, such as adding a company logo or using distinct fonts for headings.

For businesses that frequently deal with multiple transactions, ensure your template includes space for adjustments or discounts. This allows you to maintain a clean, consistent look while providing all the necessary information for tax purposes.

Lastly, always store a copy of the receipt for your records, either digitally or in print, to comply with Australian taxation laws and make future audits simpler. Customizing your tax receipts helps maintain professionalism and ensure compliance at the same time.

Include the following key details to make sure your receipt is clear, accurate, and legally compliant:

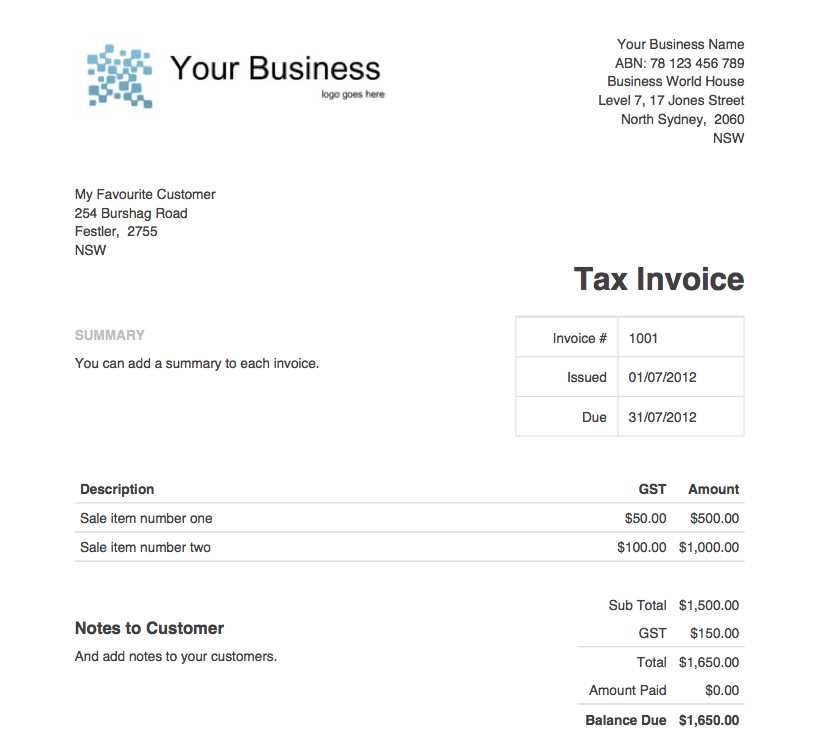

1. Business Name and Contact Information

Provide the full name of the business issuing the receipt. Include a physical address, phone number, and email address. This allows customers to easily reach out if they have questions or require further assistance.

2. ABN (Australian Business Number)

The ABN must appear on the receipt to confirm the legitimacy of the business. This is important for both tax purposes and for customers who may need it for their own reporting.

3. Date of the Transaction

The date is crucial for record-keeping. It ensures that both the business and the customer can trace when the transaction occurred for returns, warranties, or tax reasons.

4. Description of Goods or Services

Clearly list the items or services purchased, along with their quantities and individual prices. This helps avoid confusion and provides a detailed reference for future inquiries or claims.

5. Total Amount Paid

Show the total amount due, including taxes. If applicable, break down the price of individual items, any discounts, and the final amount paid. This should align with what the customer has been charged.

6. GST (Goods and Services Tax)

Indicate if GST was included in the total price. If your business is registered for GST, it must be shown separately on the receipt. Mention the GST-inclusive or exclusive price to make the transaction clear for tax reporting.

7. Payment Method

Detail the method of payment used–whether it was cash, credit card, debit card, or other methods. This helps both parties track payments and may be required for refunds or returns.

8. Receipt Number

Assign a unique receipt number to each transaction. This number is essential for internal accounting, auditing purposes, and for easy reference if the customer contacts you about the purchase.

9. Customer Information (Optional)

If needed, include the customer’s name or contact details. This can help identify them in case of a return or warranty claim.

In Australia, businesses must provide receipts for all transactions where goods or services are sold. This is especially important for businesses that are registered for Goods and Services Tax (GST). The receipt must include specific information for it to be legally valid, such as the date of the transaction, the amount paid, the name of the business, and a description of the goods or services provided.

If your business is GST registered, receipts must also show the amount of GST charged. The GST component must be separately itemized for transparency. For electronic payments, receipts can be issued digitally, but they still need to include the same required details.

While there is no explicit law requiring receipts for transactions under a certain amount, issuing them for every sale helps avoid disputes and ensures compliance with tax regulations. If requested, a receipt must be provided, regardless of the transaction size.

For businesses with a turnover of over $75,000, registration for GST is mandatory, and receipts must reflect this on the documentation provided to customers. Failure to issue receipts or provide incomplete information can result in penalties from the Australian Taxation Office (ATO).

Make sure your tax receipt template includes the following key elements:

- Business details: Add the business name, address, ABN (Australian Business Number), and contact information.

- Receipt number: Include a unique receipt number for tracking and referencing purposes.

- Date of transaction: Clearly state the date of purchase or payment.

- Buyer’s details: Include the buyer’s name or company name, address, and contact details (optional depending on the transaction).

- Itemized list: Provide a breakdown of the items or services purchased, including quantity and price for each.

- Total amount: Indicate the total amount paid, including any taxes or additional fees.

- GST (if applicable): Show the GST amount charged on the goods or services, or mention that the transaction is GST-free.

Ensure clarity and simplicity to avoid confusion for both parties involved.