To simplify the process of managing your finances, downloading a tax receipt template is an excellent first step. A well-designed template allows you to create clear, professional receipts quickly, saving you time and effort. With a ready-made format, you ensure that all required information is included, avoiding any errors or omissions that might cause delays or complications when filing taxes.

Many templates are customizable, allowing you to adjust details like your company logo, contact information, and specific tax rates. Look for templates that offer easy editing features, so you can personalize them as needed without hassle. Once you’ve downloaded the template, all you have to do is input the necessary details for each transaction.

Having a standard format helps you stay organized, especially during tax season. Instead of scrambling to find receipts or reconstruct information, you’ll have everything neatly organized in one place. Whether you’re managing a small business or personal finances, a downloadable tax receipt template will save you time and keep your records in order for any future tax filings.

Here’s the corrected version with minimized repetition:

To ensure clarity and reduce redundancy, use these practical tips when creating a tax receipt template:

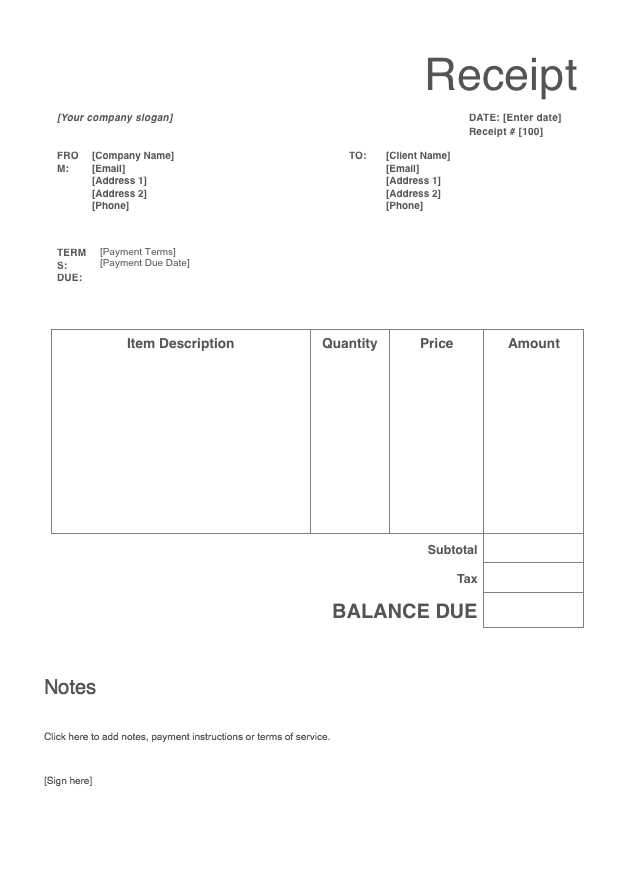

- Include only the necessary details, such as the name of the service provider, the date of transaction, the amount, and a brief description of the service.

- Avoid repeating the same information in different sections. For example, don’t mention the payment method multiple times.

- Organize the receipt clearly with separate sections for items like the total amount, taxes, and any discounts, if applicable.

- Incorporate a unique reference or transaction number that links back to your records, but avoid over-explaining this on the receipt.

Keeping the structure simple ensures the receipt remains readable and efficient, without unnecessary details. If you’re using a template, make sure it is adaptable to your business needs and doesn’t overcrowd the document.

- Tax Receipt Template Download Guide

To download a tax receipt template, follow these simple steps:

1. Choose a Reliable Source

First, ensure that the platform you’re downloading from is trustworthy. Many websites offer free or paid templates, but make sure to check reviews or recommendations before proceeding. Sites like Microsoft Office templates or Google Docs offer a wide range of professional options that are easily customizable.

2. Verify the Template Format

Choose a template format compatible with your software. Common options include .docx, .pdf, or .xlsx files. If you’re using Google Docs or Sheets, make sure the template is compatible for easy editing and downloading.

Once you’ve selected the right template, click the download link and save it to your device. Customize it with your specific tax details, including donation amounts, payer’s information, and relevant dates.

Begin by visiting trusted websites like official business software platforms or reputable online marketplaces. Look for sites that offer customer reviews and ratings. These feedbacks will help you gauge the quality of the templates available. Be sure to check if the template is customizable and compatible with your accounting or tax system.

Another effective method is searching on trusted forums or communities related to tax preparation. Experienced users often share their template recommendations based on real-world use, which can be more reliable than marketing material.

Lastly, pay attention to the date of the template’s last update. A template that hasn’t been updated in a while may not comply with the latest tax regulations, making it less reliable for current use. Stay away from templates that seem outdated or too generic.

To get started, follow these steps to download a receipt template easily:

1. Find a Reliable Source

Search for trusted websites that offer free or paid receipt templates. Look for platforms that specialize in business documents or templates, ensuring they provide customizable formats for different types of receipts.

2. Select Your Preferred Template

Browse through the available templates and pick one that suits your needs. Choose the format that fits your business or personal requirements, such as PDF, Word, or Excel.

3. Download the Template

Click on the download button next to the template. The template file will be saved to your computer or device. Make sure to check the file format and ensure it is compatible with your software.

4. Open and Customize

Open the downloaded file using the appropriate software (e.g., Adobe Acrobat for PDF, Microsoft Word, or Excel). Customize the template by filling in your business details, transaction information, and any other specifics relevant to the receipt.

5. Save or Print

Once you’ve filled out the template, save the file on your device for future use. You can also print the receipt if needed for your records or to give to a client.

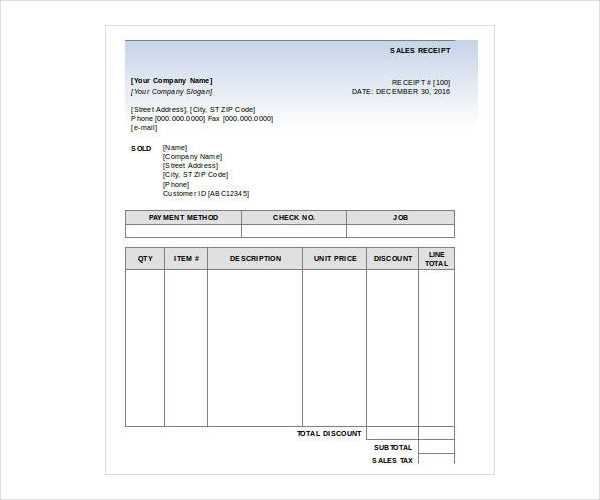

Adjust your tax receipt template to reflect specific details based on the payment method used by the customer. This ensures accuracy and transparency in your records, whether the payment was made via credit card, bank transfer, or another method.

Credit Card Payments

For credit card payments, include the payment processor’s name and transaction ID. You may also want to note any applicable service fees. These details help both parties track the payment, especially if disputes arise.

Bank Transfers

For payments made through bank transfer, ensure that you provide the transaction reference number and the payment date. If possible, include the bank’s name and the amount transferred to verify the source.

| Payment Method | Key Information to Include |

|---|---|

| Credit Card | Payment processor name, transaction ID, service fees (if applicable) |

| Bank Transfer | Transaction reference number, bank name, transfer date, amount |

| Cash | Amount paid, date of payment |

By customizing these fields for each payment method, you’ll provide clear, comprehensive documentation for both you and your customers.

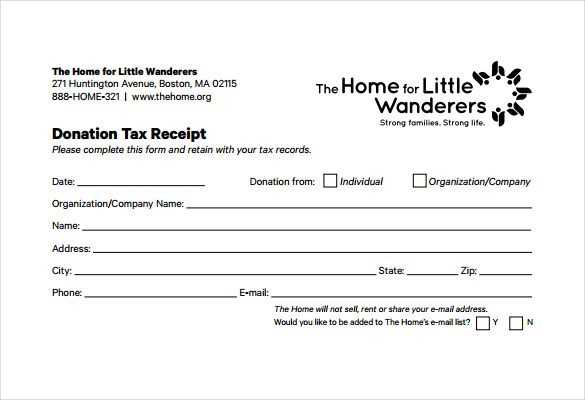

Incorrectly filling out a tax receipt can lead to significant issues during tax filing. Always double-check the accuracy of all information on the receipt, especially the donor’s name and address. These must match the official records to avoid any confusion during tax submissions.

1. Missing Necessary Details

Make sure every required field is filled in, including the date of the donation, amount, and purpose of the gift. If a receipt lacks these details, it may not be accepted during tax filing or could trigger an audit.

2. Inaccurate Valuation of Non-Cash Donations

When donating goods instead of money, an accurate valuation is crucial. Failing to provide a proper estimate can lead to deductions being disallowed. Always use reliable methods to determine the fair market value of non-cash donations.

Lastly, avoid using old or outdated templates. Using a tax receipt template that hasn’t been updated to reflect the latest tax laws can lead to non-compliance, so always ensure you’re using the current version of your chosen template.

Ensure your receipt includes all necessary details, such as the seller’s name, business address, and tax identification number. It must also clearly show the date of the transaction and the list of items purchased, along with the price of each. The total amount paid, including taxes, should be clearly indicated.

Include Tax Information

Make sure the receipt states the tax rate applied to the purchase. The breakdown of the tax amount and total should be visible to comply with local tax laws. This helps both you and the buyer track the appropriate taxes for future reference or audits.

Comply with Local Regulations

Check your local regulations for specific receipt requirements. Some jurisdictions might require additional details like the method of payment or even specific wording. Being familiar with these regulations ensures your receipts are legally sound and can prevent future disputes or penalties.

Use a well-organized folder structure to store your receipts. Create specific folders for each year or category (e.g., “2025 Receipts” or “Business Expenses”). This makes it easier to find receipts when needed and helps with tax filing or expense reporting.

Ensure you name each file descriptively. Include the vendor’s name, date, and the transaction amount. For example, “Amazon_01-25-2025_50USD.” This approach speeds up retrieval and avoids confusion.

Consider cloud storage services like Google Drive or Dropbox for easy access and backup. Cloud storage keeps your files safe from computer malfunctions and offers convenient access from any device, even while traveling.

Make use of receipt scanning apps that convert paper receipts into digital files. Many apps also allow you to categorize receipts for faster searching and tagging for tax purposes.

Always back up your receipt files in multiple locations. An external hard drive or a second cloud service can act as a backup, reducing the risk of losing important records.

Regularly review and delete outdated receipts that you no longer need. Keeping only necessary files reduces clutter and ensures your records are always relevant and up-to-date.

For receipts related to warranties or tax purposes, label and mark them as “important.” Store them in a separate folder or create a system to prioritize them for quick access when required.

The meaning and structure are preserved, and repetitions are minimized.

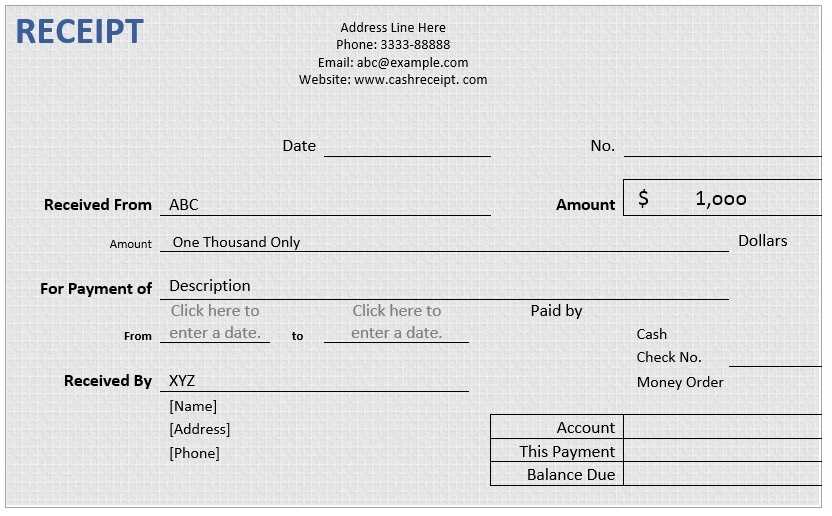

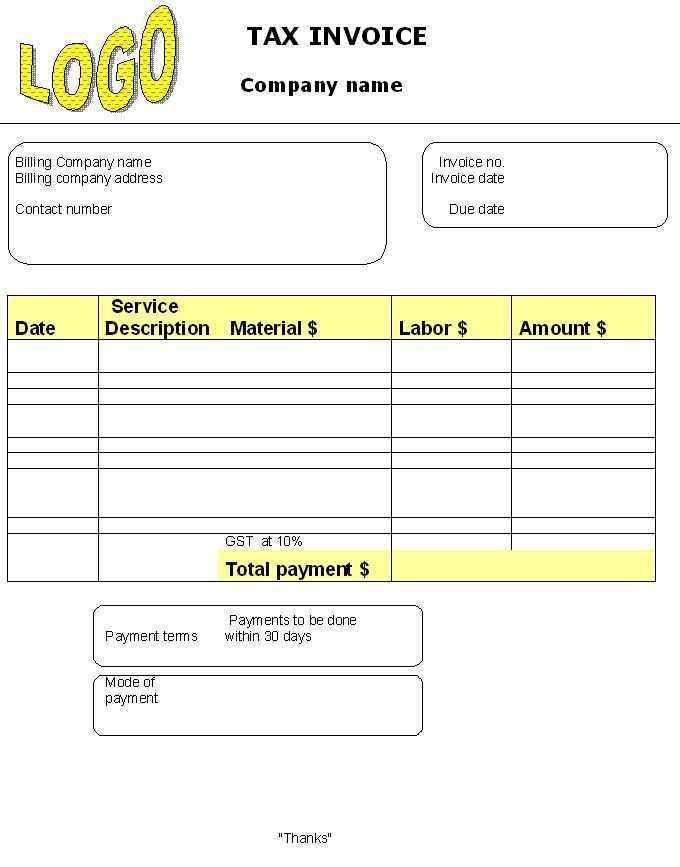

To create a functional and clear tax receipt template, include the following key elements:

- Receipt Title – Start with a clear header like “Tax Receipt” or “Receipt for Tax Purposes” at the top of the document.

- Business Information – List the business name, address, phone number, and email to help identify the issuer of the receipt.

- Receipt Number – Include a unique number for tracking purposes. This ensures that each receipt is distinguishable.

- Transaction Date – Clearly state the date the transaction took place, which is crucial for tax purposes.

- Payment Details – Mention the amount paid, the form of payment (credit card, cash, etc.), and any relevant taxes applied.

- Item Description – If applicable, describe the goods or services that were paid for, including quantities and prices.

- Signature/Authorization – Some receipts may need a signature or other form of authentication to confirm the transaction.

- Terms and Conditions – Include a section detailing any refund or return policies, especially if they impact tax deductions.

When designing the template, prioritize clarity and conciseness. Avoid excessive information that may overwhelm the user but ensure all necessary details are included. Keep the layout simple and structured to make it easy for both parties to review the receipt quickly.

Minimize the repetition of information to avoid confusion. Instead, use placeholders and categories to keep the content organized and straightforward, ensuring every detail serves a clear purpose.