Providing accurate tax receipts for daycare services is a key responsibility for caregivers and childcare providers. Parents rely on these documents to claim childcare expenses on their tax returns, and any mistakes can lead to delays or compliance issues. A well-structured receipt ensures clarity for both parties and helps maintain accurate financial records.

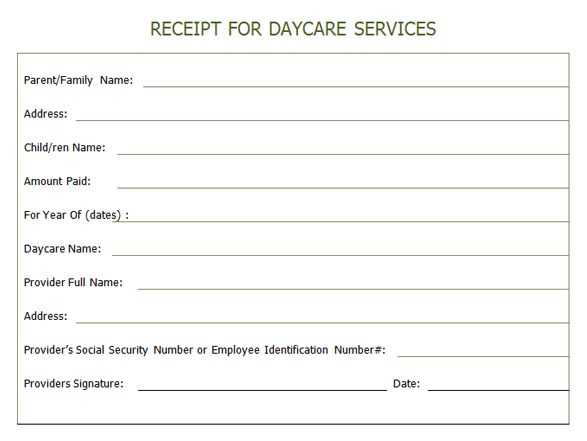

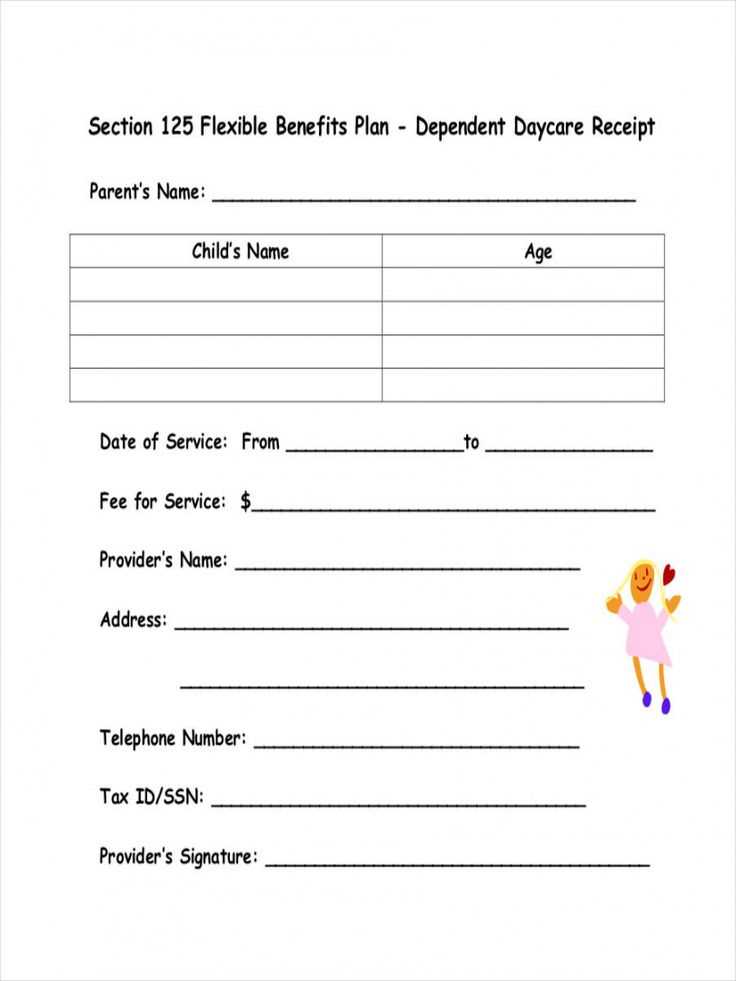

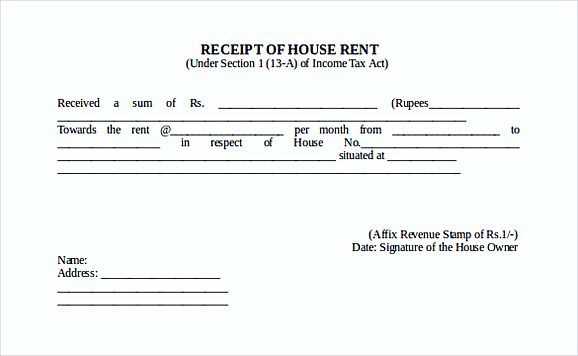

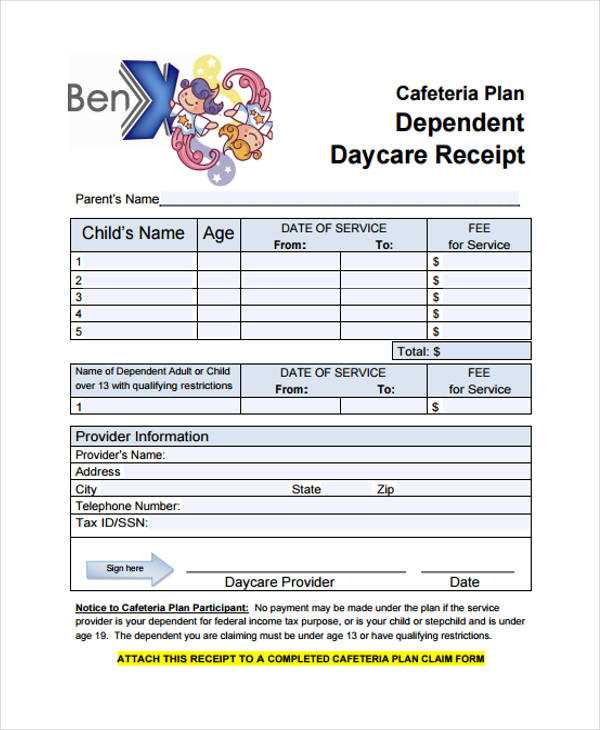

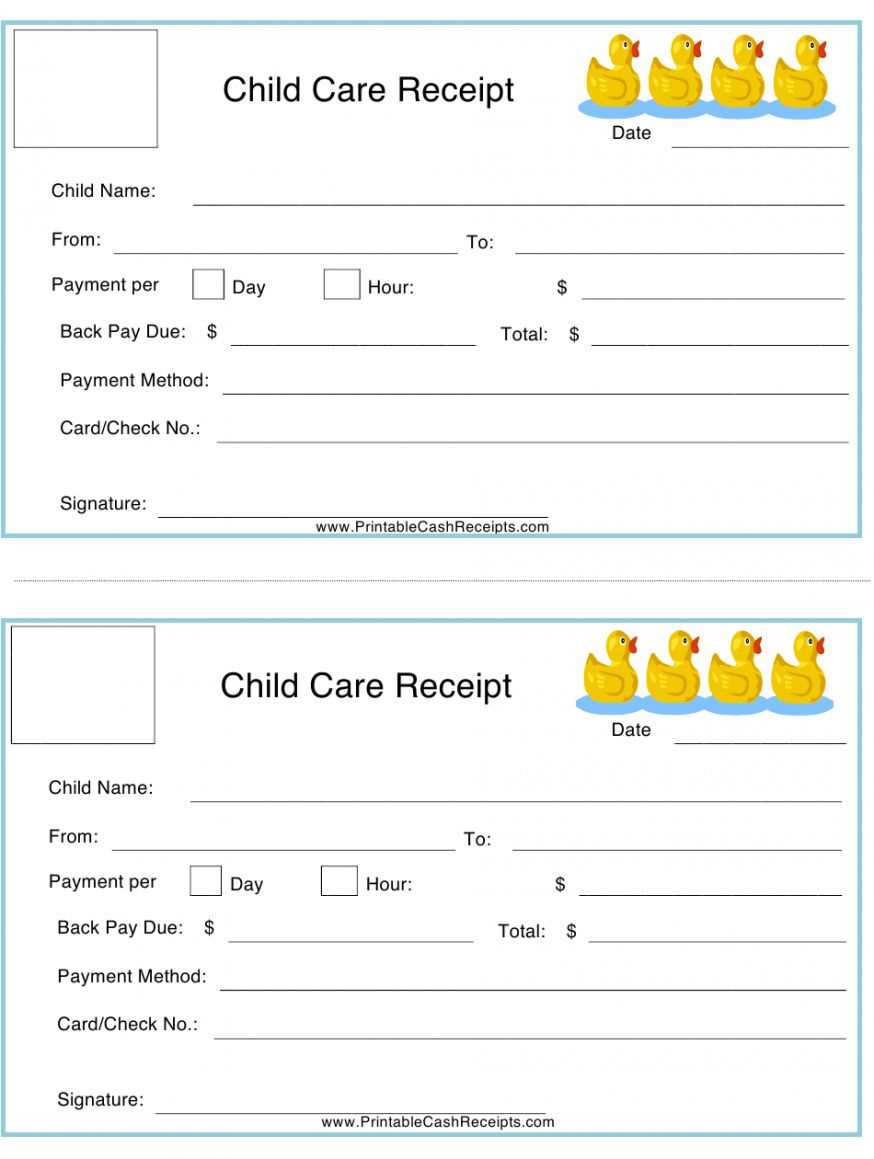

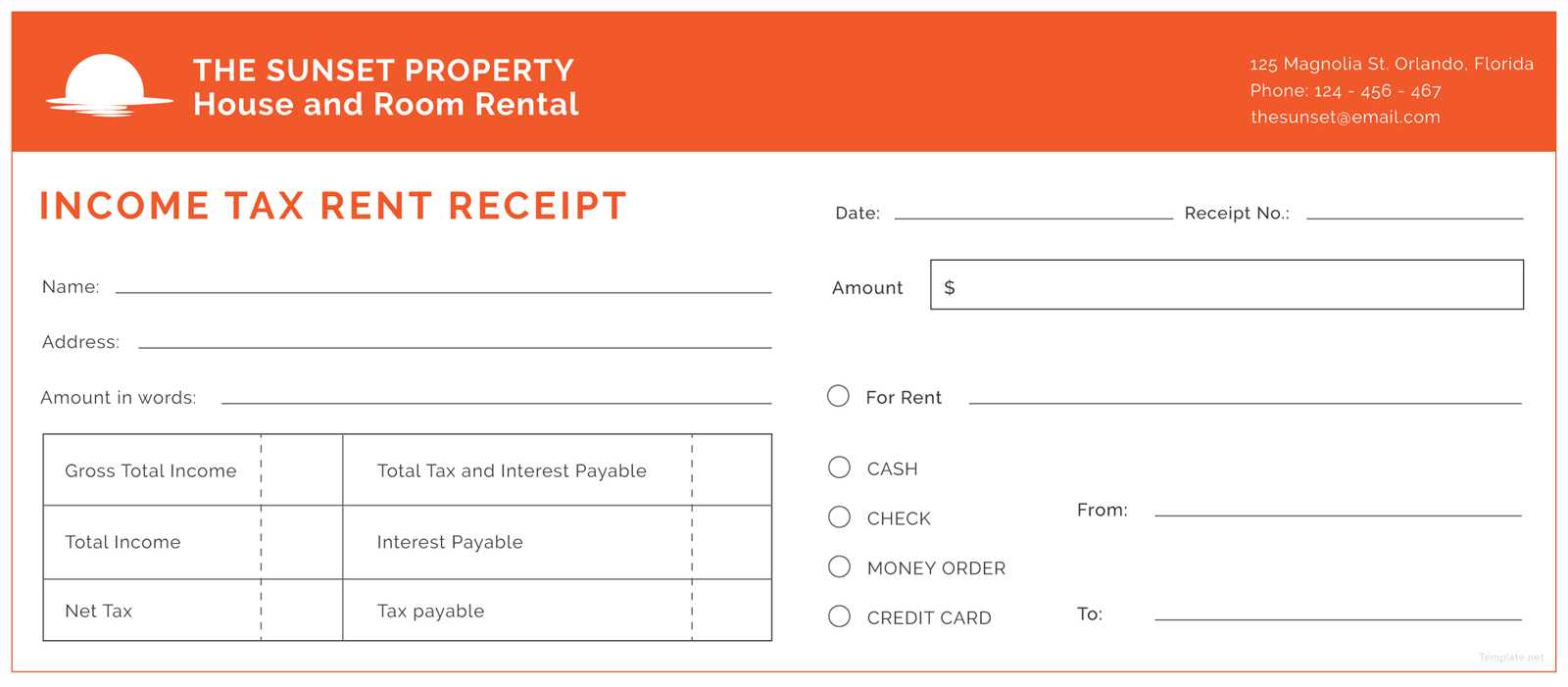

Each receipt should include the provider’s name and contact details, the parent’s name, the child’s name, and the total amount paid. Additionally, include the payment date, service period, and a brief description of the services provided. A unique receipt number adds an extra layer of organization, making it easier to track payments over time.

For added credibility, consider including the provider’s tax identification number (if applicable) and a signature. If the receipt is digital, ensure it is in PDF format to prevent modifications. Parents may need multiple copies, so keeping records organized benefits both the daycare and the families it serves.

By using a structured template, daycare providers can streamline the process, reduce errors, and offer parents a hassle-free way to document childcare expenses. A clear, professional receipt not only meets tax requirements but also reinforces trust and transparency in childcare services.

Here’s the refined list with reduced word repetition while maintaining clarity and correctness:

Ensure the tax receipt includes all necessary details to meet regulatory standards. Use the following structured format:

| Field | Details |

|---|---|

| Provider’s Name | Full legal name of the daycare provider |

| Business Address | Registered address where services are provided |

| Contact Information | Phone number and email for verification |

| Parent’s Name | Full name of the person making payments |

| Child’s Name | Full name of the child receiving care |

| Date Range | Start and end dates of services covered |

| Amount Paid | Total payment received for the specified period |

| Payment Method | Cash, check, bank transfer, or other |

| Tax ID | Provider’s tax identification number (if applicable) |

| Signature | Daycare provider’s signature for authenticity |

Keep copies of receipts for at least three years to comply with potential audits. Verify all entries before issuing to prevent discrepancies.

- Tax Receipt Template for Childcare

Provide a structured tax receipt to ensure parents can claim childcare expenses accurately. Include key details such as provider and recipient information, payment breakdown, and an authorized signature.

Essential Information

Ensure the receipt includes the following:

- Childcare provider’s full name and contact details

- Parent or guardian’s name

- Child’s name

- Total amount paid and payment period

- Date of issue

- Provider’s tax identification number

- Authorized signature

Example Template

| Childcare Provider | [Business Name or Individual Name] |

|---|---|

| Provider Address | [Street Address, City, State, ZIP] |

| Phone | [Provider’s Contact Number] |

| Tax ID | [Tax Identification Number] |

| Parent/Guardian | [Full Name] |

| Child’s Name | [Full Name] |

| Payment Period | [Start Date] – [End Date] |

| Total Amount Paid | [$ Amount] |

| Date Issued | [MM/DD/YYYY] |

| Authorized Signature | _________________________ |

Maintain copies of all receipts for record-keeping. Ensure the information is clear and legible to avoid any tax filing issues.

Include the full name and contact details of both the daycare provider and the parent or guardian. This ensures clarity in case of any discrepancies or tax-related inquiries.

- Receipt Number: Assign a unique number to each receipt for easy tracking and organization.

- Date of Service: Specify the period covered by the payment to avoid confusion.

- Child’s Name: List the full name of the child receiving daycare services to link the payment to the correct account.

- Payment Details: Clearly state the total amount paid, payment method, and date of payment.

- Service Description: Outline the type of care provided (e.g., full-day, half-day, after-school) to justify the charges.

- Provider’s Tax Identification: Include the daycare’s tax ID or social security number if required for tax deductions.

- Signature: If issuing a paper receipt, provide a space for the provider’s signature to validate the document.

Keep copies of all receipts for record-keeping and tax filing purposes. Digital and printed versions should be stored securely for future reference.

Include the provider’s full legal name, business name (if applicable), and Tax Identification Number (TIN) or Social Security Number (SSN) on all receipts. Without this information, parents may not be able to claim tax deductions or credits.

Required Details on Tax Receipts

Ensure receipts specify the total amount paid, payment dates, and the child’s name. The IRS may request proof of payment, so maintaining accurate records is essential. If payments are made in cash, provide signed receipts to avoid disputes.

Compliance with Local Regulations

Check state-specific requirements, as some jurisdictions mandate additional disclosures, such as license numbers or operational status. If operating as a registered business, keep financial records for at least three years in case of audits.

Use a clear, organized layout to ensure easy readability. Position the daycare’s name, address, and contact details at the top. Below, include the receipt number and date of issue for tracking purposes.

Key Details to Include

List the parent’s name, child’s name, and the service period covered. Specify the payment method and amount paid. If applicable, break down charges such as tuition, meals, or additional fees.

Clear Payment Breakdown

Format the total amount with a labeled section for clarity. If taxes apply, show a separate line for tax calculations. Conclude with a signature or official stamp to validate authenticity.

Issue tax receipts by using reliable software or templates that include all necessary details like the date, daycare services provided, total payment, and the parent’s name. Ensure the document is clear and easy to understand to avoid any confusion. It’s helpful to provide receipts in both printed and digital formats to accommodate different preferences.

Secure Storage of Tax Receipts

Store both digital and physical tax receipts in secure locations. For digital receipts, use cloud-based services with encryption or password-protected folders. Ensure that only authorized individuals have access to these files. For physical receipts, maintain a dedicated filing system in a locked cabinet to prevent unauthorized access.

Backup and Accessibility

Regularly back up digital receipts to avoid losing important records. Store backups in multiple locations, such as an external hard drive or another cloud service. Make sure all receipts are easy to retrieve when needed, especially during tax season or for audits.

Double-check income details. Ensure all sources of income, including part-time or freelance work, are accurately reported. Missing income can lead to penalties or delays in processing your tax return.

Verify deductions. Many parents forget to claim deductions for daycare expenses. Keep accurate records of payments and make sure to include receipts for tax purposes. Tax credits related to childcare can help reduce your tax burden.

Use the correct tax form. Tax forms vary depending on your situation. Make sure to use the appropriate form for your tax filing, whether it’s for individual taxes or business-related deductions. Filing with the wrong form can cause errors and delays.

Check personal information. Small mistakes like incorrect Social Security numbers, names, or addresses can delay processing. Always verify that your personal details are correctly listed.

Don’t overlook deadlines. Missing deadlines can result in fines or missed opportunities for tax deductions. Set reminders to ensure that all documents are filed on time.

Keep records organized. Disorganized documentation can lead to missing deductions or tax credits. Use a system to keep track of all receipts, invoices, and financial statements in one place.

Consult a professional if unsure. If you’re uncertain about the tax process, it’s worth consulting a tax professional to avoid costly mistakes that could arise from incorrect filings.

Both printable and digital formats offer convenience for parents and daycare providers alike. Choose a method that best suits your needs and preferences.

- Printable Receipts: Many daycare centers provide receipts in a paper format, allowing parents to have a physical record for tax filing or reimbursement purposes. These receipts can be printed at the time of payment or provided at the end of the month. Ensure that the receipt includes important details such as dates, services rendered, and the total amount paid.

- Digital Receipts: A growing number of daycare providers offer digital receipts. These receipts are often emailed directly to parents or made available through an online portal. They provide the same level of detail as printed versions but allow for easy storage and access on smartphones, tablets, or computers.

- Hybrid Option: Some daycare centers offer both printed and digital receipts, giving parents flexibility. This option caters to those who prefer physical copies for their records and those who need digital receipts for quicker access and organization.

- Customizable Templates: If your daycare provider allows, you may opt for a customizable receipt template. This can be adjusted for frequency of payments or include specific breakdowns of charges, such as additional services or discounts. Providers can choose templates that suit their business operations, offering greater clarity and transparency for parents.

Use clear and consistent formatting when designing a tax receipt template for daycare services. Start with the daycare provider’s name, address, and contact information at the top, followed by a section for the parent’s details, including the child’s name, care dates, and the total amount paid. This ensures all necessary data is easily accessible for tax purposes.

Breakdown of Service Charges

List each service provided and the corresponding cost, whether it’s for daily care, after-hours, or special activities. This breakdown will help parents understand the charges, making it easier for them to report the expenses correctly on their taxes.

Payment Details

Clearly note the payment method, whether it was made by check, credit card, or another form. Including the date of payment and any relevant transaction or reference numbers will make the receipt more accurate and verifiable if needed for tax purposes.