If you’re managing sports events or running a sports-related business, creating a clear and accurate tax receipt template is vital. A well-structured receipt helps you maintain transparency with your clients while ensuring compliance with tax regulations.

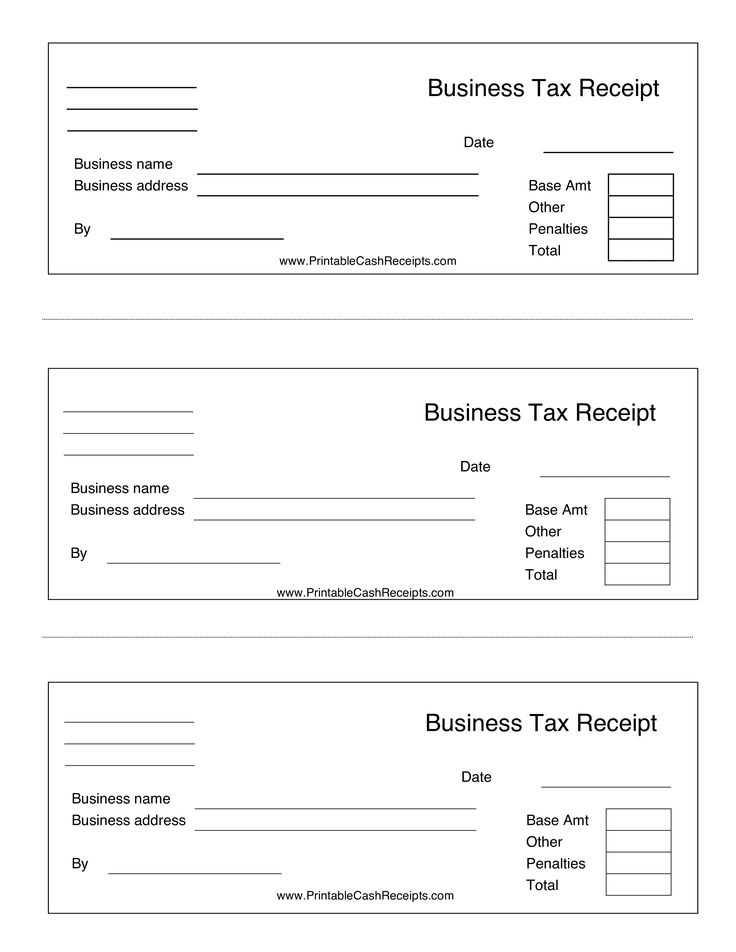

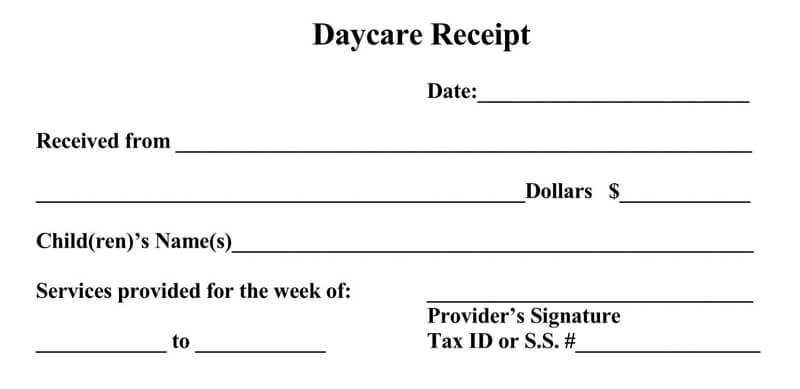

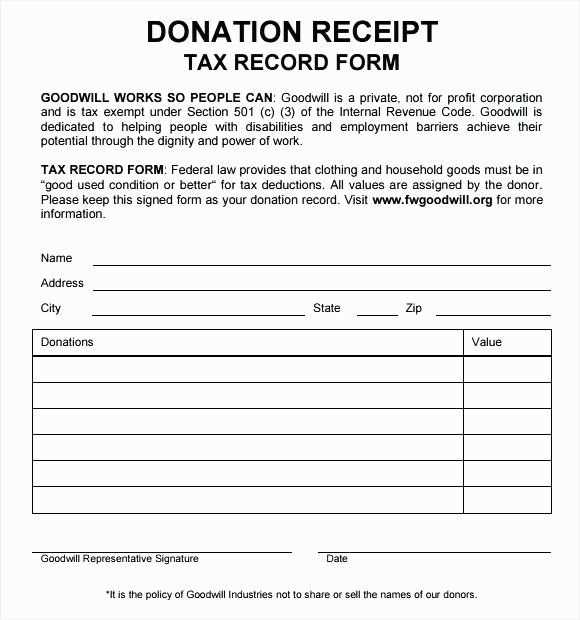

Start by including all necessary details on the receipt. This includes the payer’s name, the amount paid, the date of the transaction, and a description of the services rendered or goods sold. For sports-related services, such as training sessions, ticket sales, or equipment purchases, be specific about what was provided.

Include your business details, such as your business name, address, and contact information. This not only adds professionalism but also helps if any follow-up is needed. A clear breakdown of the payment method (cash, credit card, etc.) is also helpful for both you and the payer.

Lastly, ensure that your receipt complies with the tax laws in your region. Double-check any local requirements, such as including a tax identification number or adding the applicable tax rate. By using a tax receipt template tailored to the sports industry, you streamline your operations and avoid unnecessary complications during tax season.

How to Create a Sports Tax Receipt Template

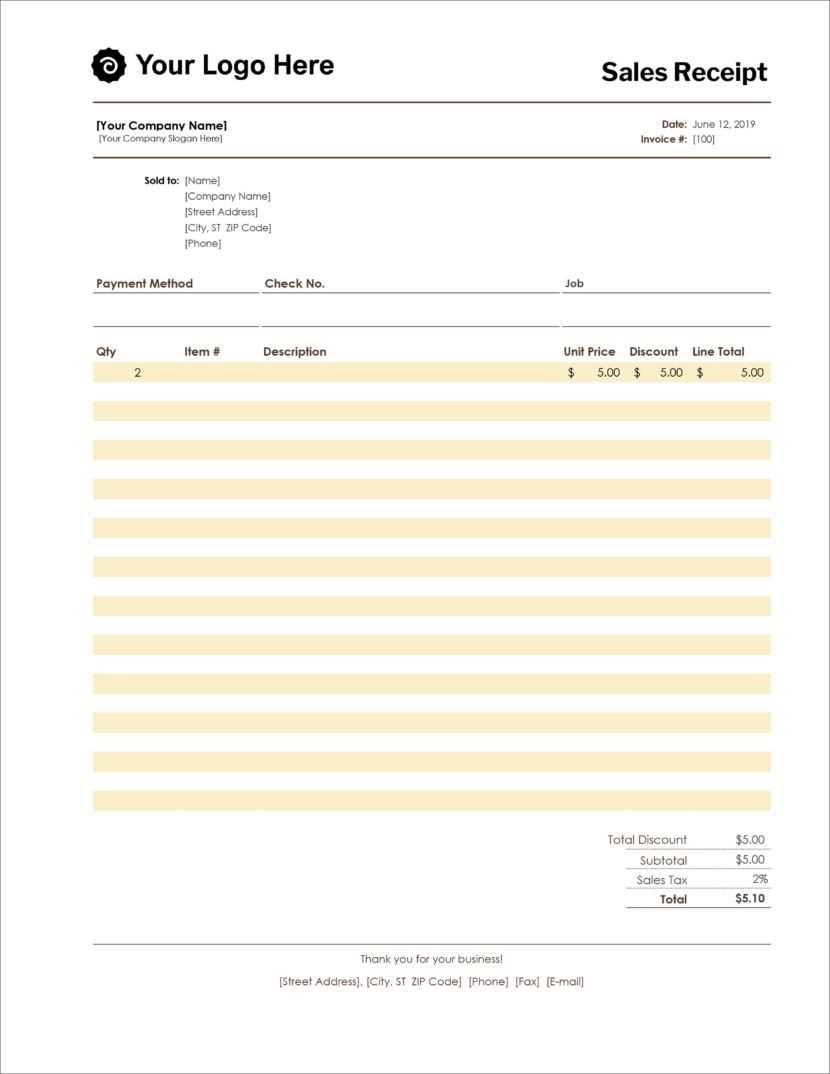

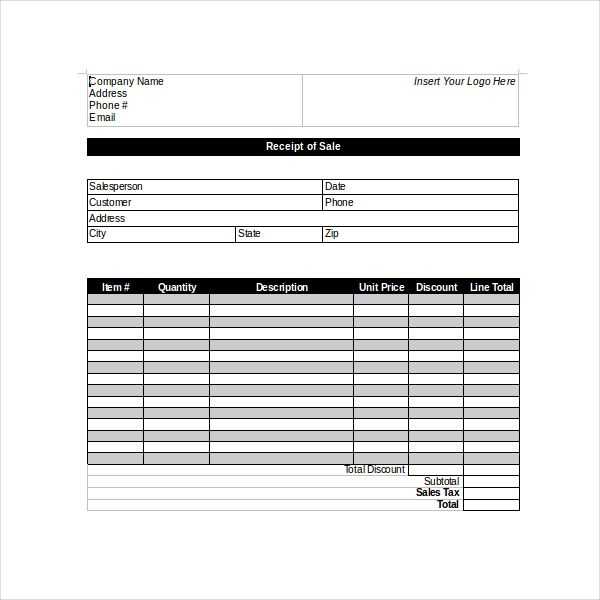

Begin with a clean layout that highlights key details. Include a title such as “Sports Tax Receipt” at the top. Ensure the document clearly identifies the recipient’s name, the amount paid, and the date of payment.

Include fields for the sport or activity type, such as “Registration Fee” or “Coaching Services.” Add a section for the organization’s name, address, and contact details, ensuring it is easy to locate for tax filing purposes.

The template should have space to record payment methods (cash, card, etc.) and a unique receipt number for tracking. For transparency, add a breakdown of costs if applicable, and ensure tax rates are included, along with the total amount paid.

Ensure there’s a section for both the payer’s signature and a representative of the organization for validation. This adds legitimacy and avoids any confusion during tax reporting.

Finally, incorporate a disclaimer or note that outlines the tax-exempt status of the payment (if applicable) or any specific tax information relevant to the payer’s jurisdiction.

Key Information to Include on Sports Tax Receipts

Ensure the receipt contains the date of payment and the amount paid. This helps both the payer and the tax authorities track transactions accurately.

List the name of the sports organization or entity receiving the payment. This provides clarity on the recipient and helps in verifying the transaction.

Include the type of service or goods provided, whether it’s for registration, equipment, or participation in a specific event. Clear itemization avoids confusion.

Provide the payer’s name and contact details, ensuring there is no ambiguity regarding who made the payment.

Make sure the receipt includes the tax identification number (TIN) of the sports entity. This facilitates tax tracking and verification by tax authorities.

If applicable, include the payment method (credit card, cash, check, etc.) to clarify how the transaction was completed.

Consider adding a unique reference number for the receipt. This number helps in quickly locating and verifying the transaction in case of future inquiries or audits.

Customizing a Tax Receipt Template for Different Sports Organizations

To tailor a tax receipt template for various sports organizations, begin by including the organization’s specific details, such as name, address, and tax ID number. Customize the header with the organization’s logo to maintain brand identity. If you’re working with a non-profit sports club, be sure to highlight their non-profit status clearly to comply with tax regulations.

Adjust the fields for donation amounts and membership fees to reflect the types of payments the organization typically receives. For example, a youth soccer league might require a separate section for registration fees, while a tennis club might need to list contributions for equipment or facility upkeep.

For organizations with multiple departments or sports teams, consider adding dropdown menus or checkboxes to specify the purpose of the donation or payment. This helps donors know exactly how their contributions are being used, whether it’s for team travel, scholarships, or equipment purchases.

Incorporate a space for a personalized thank-you message to enhance donor relations. This small touch can improve engagement and encourage further contributions. The receipt should also mention any applicable tax deductions related to the donation, providing donors with clarity on how their gift impacts their tax filings.

Finally, ensure that the template complies with local and national tax laws. Sports organizations might need to include specific wording or disclaimers to meet legal requirements, especially if they are registered as charitable entities. Consult a tax expert to confirm the template’s accuracy.