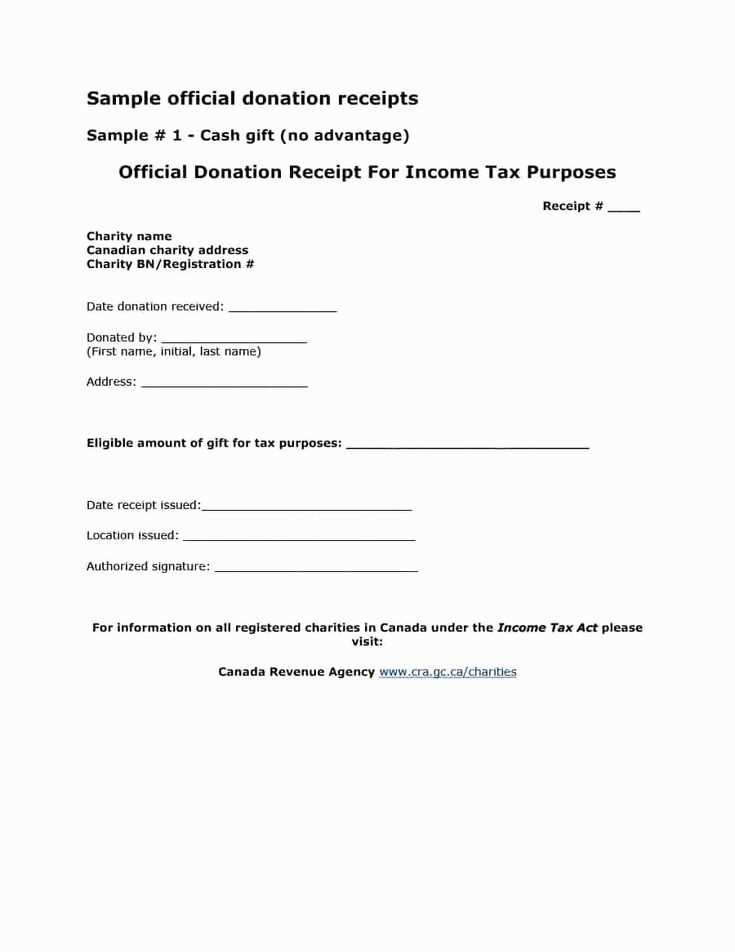

Non-profit organizations must issue tax receipts to donors for their contributions. These receipts are necessary for donors to claim tax deductions and demonstrate the charitable nature of their gift. The tax receipt template should include all required information to ensure compliance with local regulations. A well-structured template not only ensures proper documentation but also builds trust with donors by clearly outlining their contribution details.

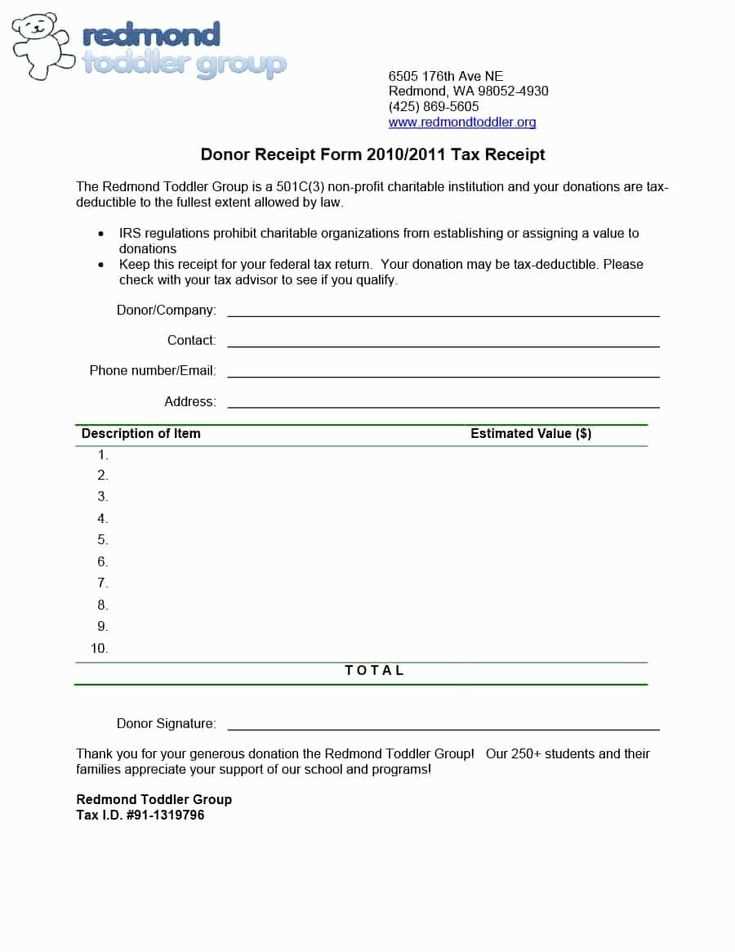

Start with the donor’s full name, address, and the donation date. This basic information should appear at the top of the receipt. Below, include a description of the donation, specifying whether it’s in the form of cash, property, or services. For cash donations, always include the exact amount. For property donations, a brief description of the items donated and their fair market value should be stated. Make sure to include a statement acknowledging that the organization did not provide any goods or services in exchange for the donation, unless applicable.

Ensure your template also contains the official name and address of the non-profit organization, the registration number (if applicable), and the signature of a responsible person, typically the organization’s executive director or treasurer. The format should be clear and easy to understand, with no room for confusion. This makes the receipt not only valid but also user-friendly for donors seeking tax relief.

Here are the corrected lines with repetitions removed:

The tax receipt template for a nonprofit must provide clear and concise information. Repetitive content can confuse both donors and tax authorities. Focus on key details, ensuring they are not repeated unnecessarily. Below are examples of how to streamline your receipt for clarity and accuracy.

Corrected Template Example

- Donation Date: Include the exact date the donation was made.

- Donor’s Information: Name, address, and contact details should be listed only once.

- Donation Amount: Specify the amount in words and figures to avoid confusion.

- Nonprofit’s Details: Include the organization’s name, address, and tax-exempt status number.

- Purpose of Donation: Clearly describe the purpose if designated, otherwise state “general support.”

By avoiding redundant phrasing and keeping the receipt clear, you ensure that both your nonprofit’s documentation and the donor’s tax filing process remain efficient and error-free.

Additional Tips

- Limit the use of generic terms that repeat across the template.

- Ensure that all sections are concise, with no overlap in the information provided.

- Double-check that donation amounts match the figures provided by the donor.

- Tax Receipt Template for Non-Profits: Practical Guidelines

Ensure your tax receipt includes the following key elements to comply with IRS requirements and provide your donors with clear, accurate documentation:

1. Donor Information

Include the donor’s full name and address. This helps verify the donor and makes it easier for both the non-profit and the IRS to track charitable contributions.

2. Contribution Details

Clearly state the amount or description of the donation. For cash donations, provide the specific dollar amount. For non-cash donations (like goods), include a detailed description, but not the value, as it’s the donor’s responsibility to assess the value of the gift.

3. Organization Information

Provide the non-profit’s legal name, address, and EIN (Employer Identification Number). This confirms that the donation is going to a legitimate 501(c)(3) organization. You can typically find the EIN on your organization’s IRS Form 990 or tax filings.

4. Acknowledgement of No Goods or Services Received

If the donation is a pure gift with no goods or services provided in exchange, include a statement like: “No goods or services were provided in exchange for this donation.” If something was received (e.g., event tickets, merchandise), specify the fair market value of the goods or services.

5. Date of Donation

The date of the donation is necessary for both the donor’s tax records and your organization’s financial statements. Be sure to accurately note the date the donation was made or the goods were received.

6. Organization’s Tax Status

Include a statement confirming that the organization is a tax-exempt entity under IRS 501(c)(3). This reassures donors that their contributions are tax-deductible.

7. Donor’s Signature (Optional)

While not always required, some organizations choose to include a space for the donor’s signature for additional verification. It can be useful for record-keeping purposes.

8. Sample Tax Receipt Template

| Element | Example |

|---|---|

| Donor’s Name | Jane Doe |

| Donor’s Address | 123 Main St, City, State, ZIP |

| Donation Amount | $100 |

| Organization’s Name | Helping Hands Nonprofit |

| Organization’s EIN | 12-3456789 |

| Date of Donation | January 15, 2025 |

| Acknowledgement Statement | No goods or services were provided in exchange for this donation. |

By following these guidelines, your tax receipts will be accurate and compliant with IRS regulations, ensuring a smooth process for both you and your donors.

Organization Details: Include the nonprofit’s full name, address, and tax-exempt status number. This confirms the legitimacy of the organization and helps donors verify their donation is tax-deductible.

Donation Information: State the donation amount or describe the goods donated. For in-kind donations, give a detailed description of the items and their estimated value. This is critical for the donor’s tax records.

Date of Donation: Clearly mark the date the donation was made. This helps donors track the tax year in which the contribution was made, ensuring proper filing.

Statement of No Goods or Services: If no goods or services were exchanged for the donation, include a simple statement like, “No goods or services were provided in exchange for this donation.” If any were, list their value so the donor knows what part of the donation is tax-deductible.

Signature: Have an authorized representative from the nonprofit sign the receipt. This adds validity to the document and confirms it was officially issued.

Donor Information: List the donor’s full name or the organization’s name. It’s crucial that the donation is properly attributed for tax purposes.

Tax Year: Indicate the specific year for which the receipt applies. This helps donors align their donations with their tax filings.

Modify your tax receipt template to suit different donor types by ensuring that all required details are clearly presented for each donor’s unique contribution. This simplifies tax filing and promotes transparency.

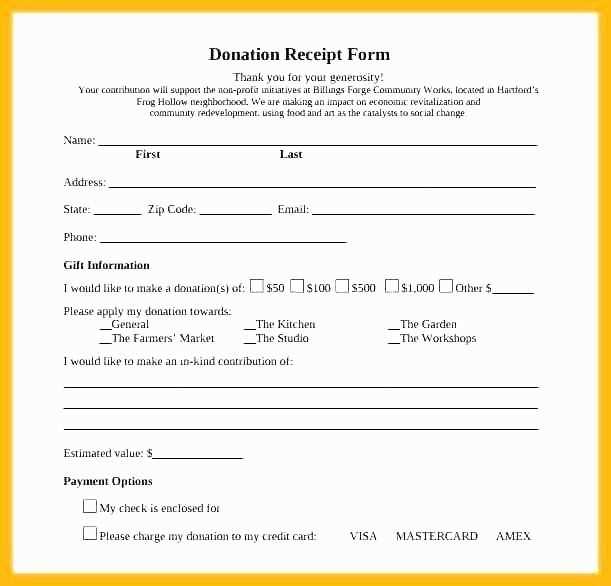

Individual Donors

For individual donors, list their full name, mailing address, and donation amount. If the donation is non-cash (such as clothing or property), provide a brief description and an estimated value. Additionally, if the donor receives something in return (e.g., tickets or gifts), itemize the value of these benefits to determine the amount of the donation eligible for a tax deduction.

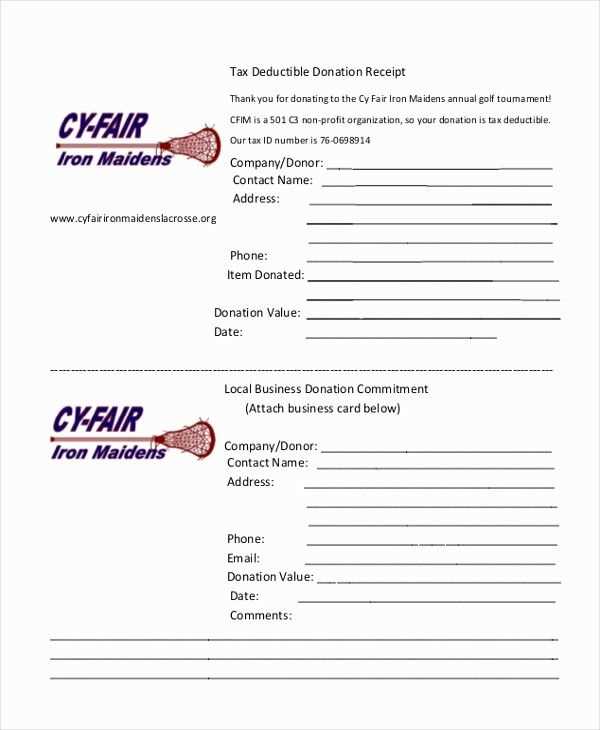

Corporate Donors

Corporate donations require the inclusion of the company’s legal name, tax identification number, and contact details. If a company makes an in-kind contribution, be specific about the nature of the goods or services provided, along with their fair market value. Additionally, if the company receives any promotional benefits (e.g., advertising), clarify the value of these in your receipt, which helps the donor with their tax deductions.

Tailoring your receipts in this way ensures that both individual and corporate donors have the necessary information to claim tax deductions accurately, while also keeping your organization compliant with relevant tax laws.

Ensure you accurately reflect the donation date on the receipt. Incorrect or missing dates can cause issues for both the donor and the nonprofit, especially when tax time arrives. Always match the receipt date with the actual donation date to avoid confusion.

Double-check the donor’s name and address for correctness. A small error in spelling or missing information can complicate tax filings for your donors. Make sure the donor’s full legal name is clearly printed, and verify the address if necessary.

Do not overlook the donation amount. Whether the donation is in cash, check, or goods, the exact value must be listed. For in-kind donations, clearly specify the item(s) donated and the fair market value. Failing to do so might lead to difficulties in tax deductions for the donor.

Include your nonprofit’s tax identification number (TIN) on the receipt. This is a critical detail that ensures the donation is eligible for tax deduction. Without it, the donor may face challenges proving their charitable contribution during tax filing.

Be mindful of providing receipts for donations that do not qualify for tax deductions. For example, if a donor receives something of value in return for their donation (e.g., tickets, gifts), the receipt should reflect the value of the donation minus the goods or services provided. Failing to do this may lead to inaccurate claims on tax returns.

Clearly state that no goods or services were provided in exchange for the donation if that is the case. Donors rely on this statement to support their deduction claims. If you forget this important detail, the donor might struggle with tax compliance.

Tax Receipt Template for Non-Profit Organizations

To create a tax receipt for your non-profit organization, make sure the document includes specific information for the donor’s tax purposes. Include the non-profit’s legal name, tax identification number (TIN), and a statement confirming that no goods or services were provided in exchange for the donation, unless applicable. This confirms the receipt is purely for charitable contributions.

Key Elements of a Tax Receipt

The receipt should clearly state the donation amount, date, and the donor’s information. Be sure to indicate whether the donation was monetary or in-kind. For in-kind donations, provide a brief description of the donated items without assigning a monetary value.

Clear, Concise Language

Avoid unnecessary language and focus on the facts. Tax receipts should be simple and direct to ensure donors can easily file their taxes. Make sure to specify whether the donation was a one-time or recurring gift.

Including these elements on your tax receipt helps ensure that donors can easily claim their deductions and reduces the chance of confusion or errors. Keep your templates updated with any tax law changes to stay compliant and continue offering clear documentation for your supporters.