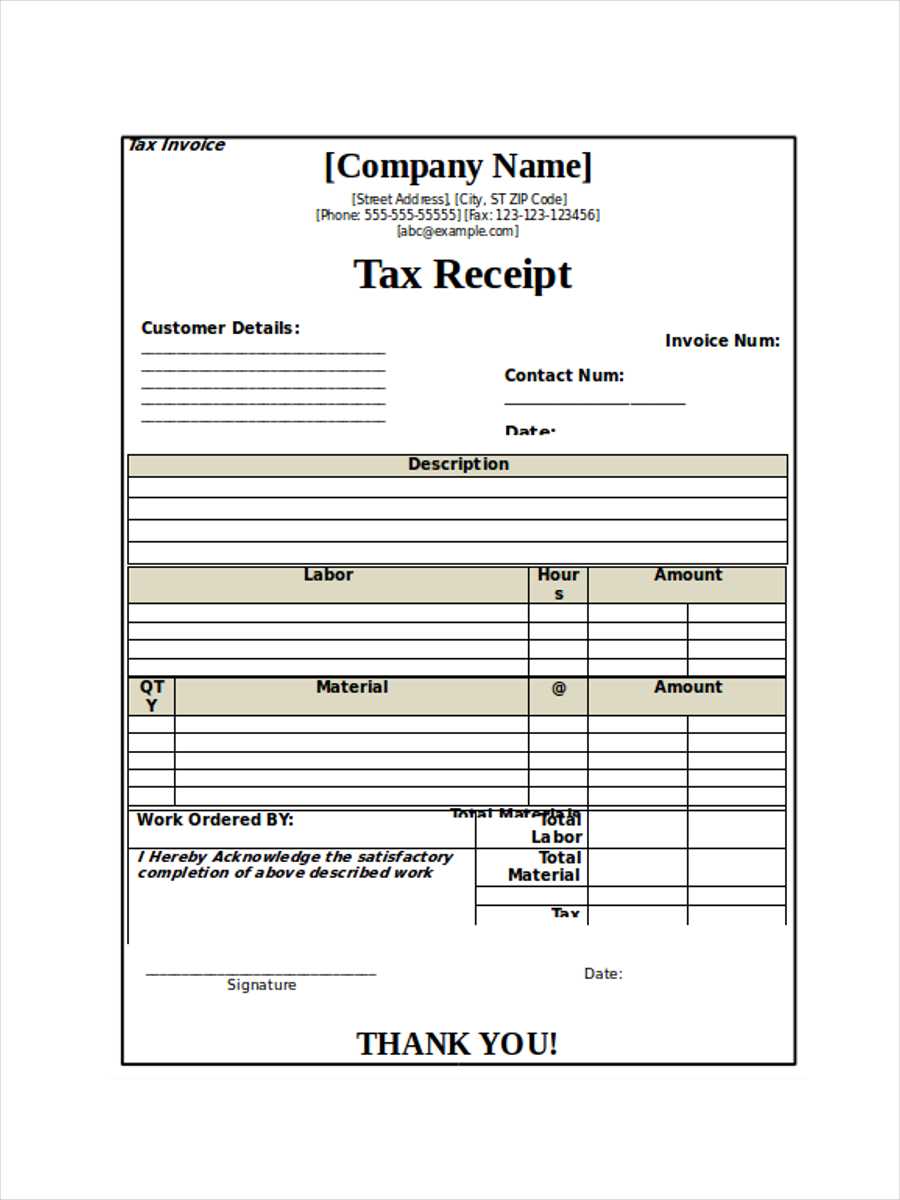

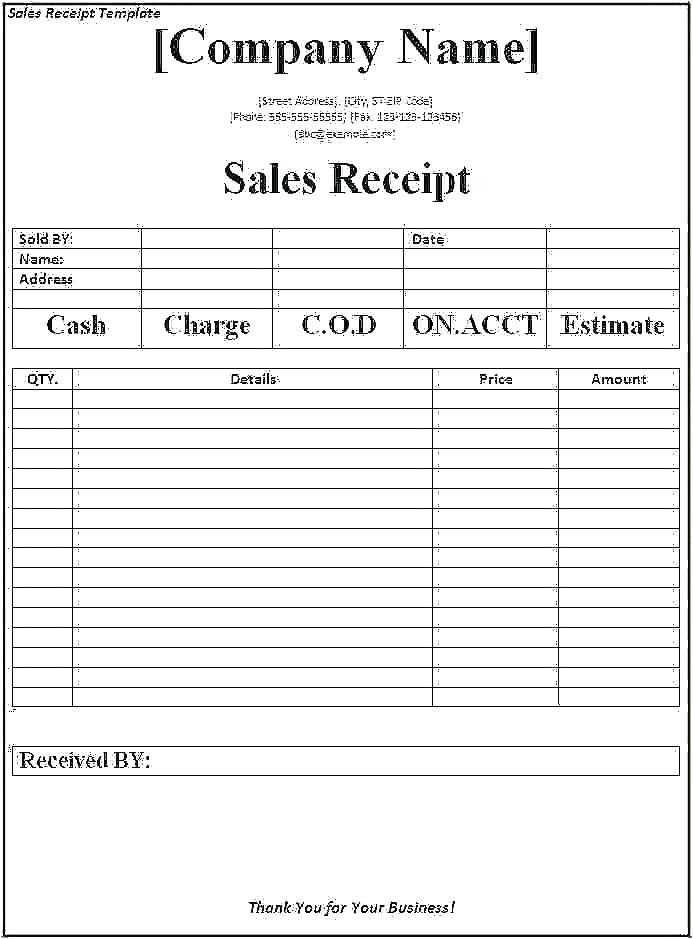

Creating a tax receipt in New Zealand is straightforward when you follow the right format. A well-structured tax receipt ensures clarity and helps avoid confusion for both the issuer and the recipient. Start by including basic details like the business name, address, and contact information.

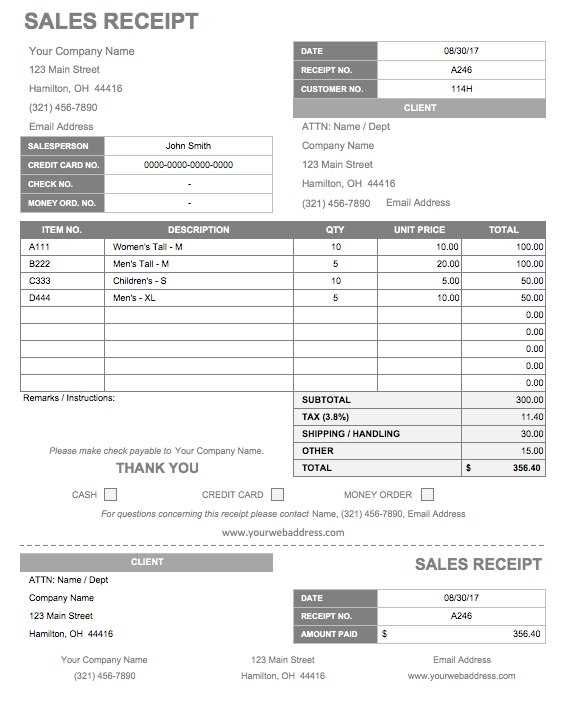

Ensure the receipt contains a unique receipt number for tracking purposes. This is particularly useful for record-keeping and tax audits. The date of the transaction, as well as a clear description of the goods or services provided, should also be specified.

Always include the amount paid and specify the GST (Goods and Services Tax) separately, if applicable. Make sure to include the recipient’s name or business name, along with their contact information, to meet the legal requirements of a tax receipt in New Zealand.

Lastly, clearly state the payment method, such as cash, credit card, or bank transfer. This adds another layer of transparency and aids in proper accounting. Using this template will make your tax receipts clear, professional, and compliant with local regulations.

Here’s the improved version, eliminating word repetition:

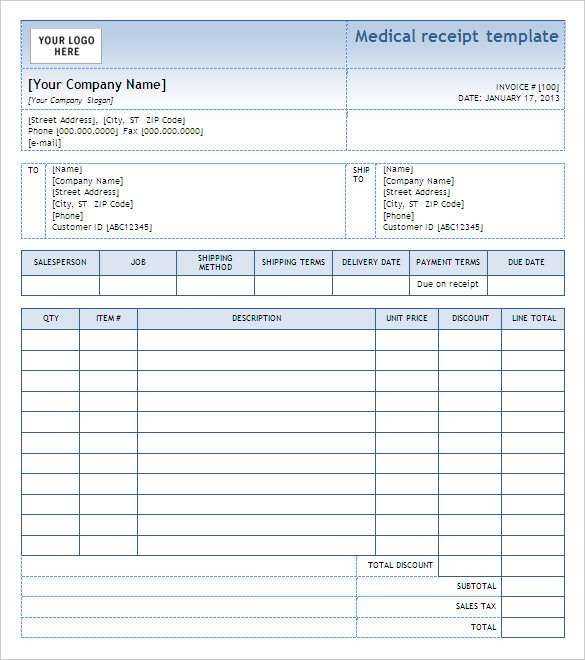

The tax receipt template should include clear sections for the business name, address, contact information, and tax registration number. Ensure the amount paid is listed with the applicable tax rate and total sum. Use a unique reference number for each transaction to make record-keeping easier. Provide details about the nature of the service or product, as well as the date of the transaction. The payment method should also be indicated. Be sure to include space for signatures if needed. Make the template easy to read with distinct sections and a clean layout to avoid confusion. Adjust the font size and style for legibility, and leave enough white space to ensure all details are clearly visible.

- Tax Receipt Template NZ: A Practical Guide

Use this tax receipt template for accurate and straightforward record-keeping. It ensures all required information is included for compliance with New Zealand’s tax system.

Required Information

| Field | Description |

|---|---|

| Business Name | Enter the full name of your business or trading entity. |

| Receipt Number | Each receipt should have a unique identification number for tracking purposes. |

| Date of Transaction | Include the exact date the transaction took place. |

| Amount Paid | Specify the total amount paid, including the GST if applicable. |

| GST | If GST is charged, list it separately from the total amount paid. |

| Item Description | Provide a brief description of the goods or services provided. |

| Payment Method | State how the payment was made (e.g., cash, credit card, bank transfer). |

Example Tax Receipt

| Field | Example |

|---|---|

| Business Name | ABC Services Ltd. |

| Receipt Number | REC-123456 |

| Date of Transaction | February 14, 2025 |

| Amount Paid | $500.00 |

| GST | $75.00 |

| Item Description | Consulting Services |

| Payment Method | Credit Card |

With these details, your tax receipt is compliant with New Zealand’s requirements and ensures clarity for both parties involved in the transaction.

Creating a tax receipt in New Zealand involves several key elements. Follow these steps to ensure your receipt meets the required standards:

- Include Your Business Details: Your receipt must display your business name, address, and GST (Goods and Services Tax) registration number, if applicable. This is essential for record-keeping and tax purposes.

- Issue a Unique Receipt Number: Each receipt should have a unique identifier. This helps in organizing your records and ensures that the receipt can be easily referenced in the future.

- Provide Date and Time of Transaction: Always include the date and time of the transaction. This helps both you and the customer keep track of purchases and payments for tax filing.

- List the Items or Services Sold: Clearly itemize the goods or services provided, including the quantity, unit price, and total cost. If applicable, include the GST amount separately.

- Include Total Payment Amount: The total sum paid by the customer should be clearly shown, including any applicable taxes. This ensures transparency and accurate reporting of sales.

- Provide Payment Method: Indicate how the customer paid, such as by cash, credit card, or bank transfer. This helps in reconciling payments with bank records.

- Offer a Statement of Purpose: If the receipt is for a donation or similar transaction, state the purpose clearly. This can be particularly important for charitable contributions, which may qualify for tax deductions.

By including these details, you’ll create a tax receipt that complies with New Zealand’s tax regulations and helps maintain clear and organized financial records.

For accurate and professional receipts, tailor the layout based on the transaction type. Adjust the details for cash payments, card payments, refunds, or exchanges to reflect the correct information. This ensures both transparency and compliance with tax laws.

Cash Transactions

In a cash transaction, include a clear breakdown of the items purchased, along with the total amount paid. Highlight the payment method–cash–at the bottom of the receipt. It’s also helpful to display the change given, if any.

Card Payments

For card payments, ensure the receipt includes the type of card used (credit or debit), the last four digits of the card number, and the transaction authorization code. This adds security and verifies the payment source without exposing full card details.

For refunds or exchanges, specify the original transaction and the reason for the adjustment. This provides a clear audit trail and prevents confusion for both the customer and the business.

In New Zealand, tax receipts must comply with specific requirements outlined by the Inland Revenue Department (IRD). These receipts serve as proof of transactions for tax purposes, and failing to meet the standards can lead to penalties or audits. Below are the key legal aspects businesses must follow when issuing tax receipts.

Key Information to Include

A tax receipt must display the following details clearly:

- The name of the business issuing the receipt.

- The date of the transaction.

- The amount paid, including a breakdown of the GST (Goods and Services Tax) if applicable.

- A description of the goods or services purchased.

- A unique receipt or invoice number.

GST Requirements

If your business is GST-registered, the receipt must also include a statement confirming that GST has been charged. Ensure the total GST amount is listed separately from the overall price. This allows customers to claim GST credits on their purchases if eligible.

Failure to follow these rules can result in issues during tax filing and potential audits, so it’s critical for businesses to issue receipts that meet these requirements consistently.

Tax Receipt Template Guidelines

For clarity, ensure that the tax receipt includes the necessary components: the business name, date of transaction, description of goods or services, and the total amount paid. Keep the format simple and precise. The document should clearly display the applicable GST, if relevant, along with the recipient’s details, such as their name or business name. Avoid unnecessary information that could complicate the receipt. Regularly update the template to meet any regulatory changes. Make sure to include your contact details and any reference numbers if applicable for easier tracking and verification.