Every chiropractic clinic needs a well-structured receipt template to ensure transparency in billing and compliance with financial records. A properly formatted receipt provides patients with clear details of services rendered, payment confirmation, and essential clinic information. Below, you’ll find key elements to include in your chiropractic receipt template and tips to make it both professional and user-friendly.

Key Elements of a Chiropractic Receipt:

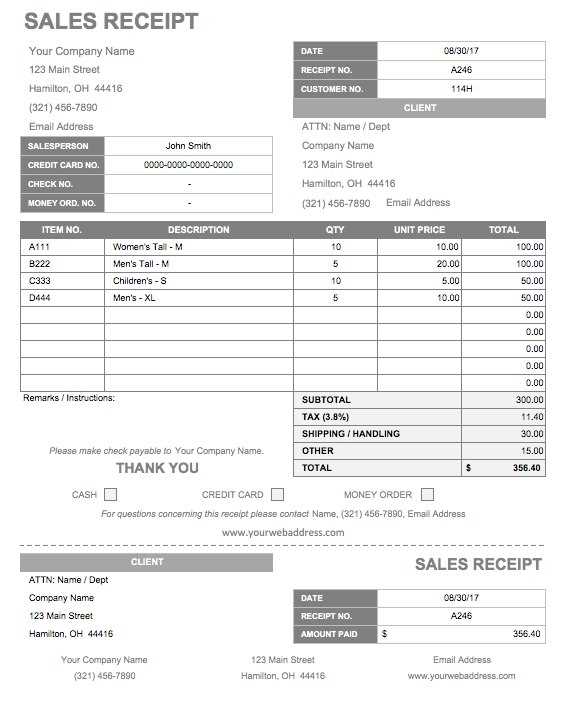

- Clinic Details: Include the name, address, phone number, and email of your chiropractic office. This ensures patients can easily contact you if needed.

- Patient Information: Add fields for the patient’s full name and contact details to personalize the receipt.

- Receipt Number: Use a unique identifier for each transaction to maintain accurate financial records.

- Date of Service: Clearly specify the date the chiropractic service was provided.

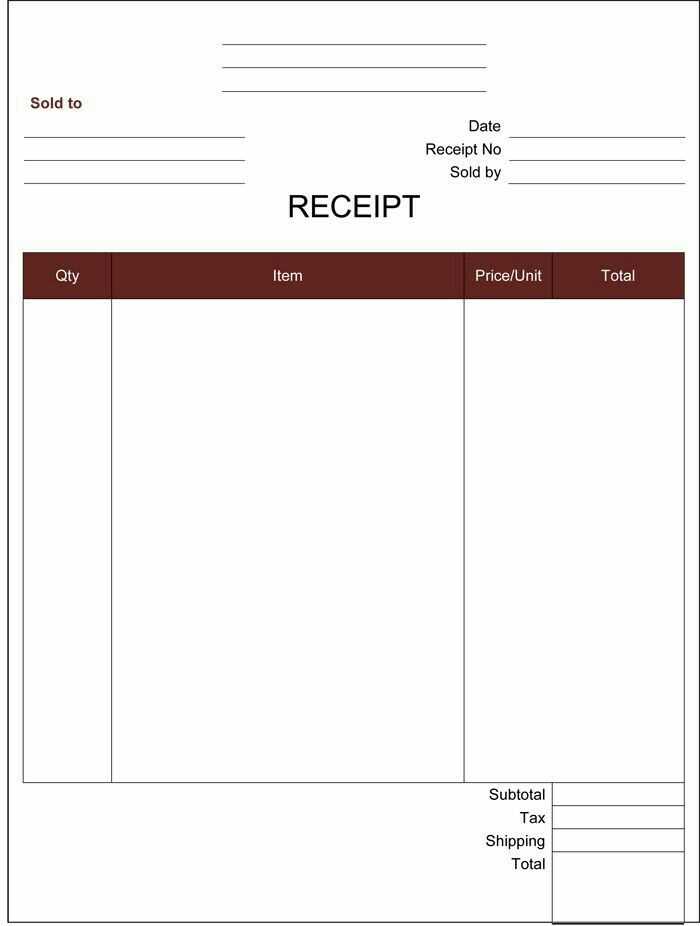

- Services and Fees: List each service separately with a brief description and corresponding fee to provide clarity on charges.

- Payment Details: Indicate the payment method (cash, credit card, insurance) and include a breakdown of any discounts or adjustments.

- Tax and Total Amount: If applicable, show tax calculations and the final total for easy reference.

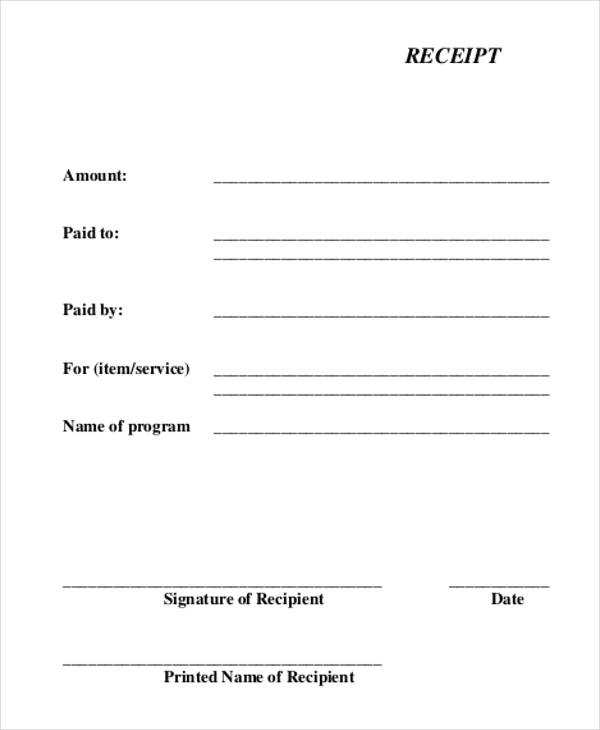

- Signature or Approval: Consider adding a space for the chiropractor’s or patient’s signature to confirm the transaction.

To make your chiropractic receipt easy to use, design it in a way that allows quick entry of details. A structured layout with clearly labeled sections improves readability. Additionally, using digital templates in formats such as PDF or Excel ensures consistency and saves time when generating receipts for multiple patients.

By incorporating these elements, your chiropractic receipt template will help maintain accurate records, enhance patient trust, and streamline your billing process.

Here’s the corrected version without unnecessary repetitions:

Ensure all details on the chiropractic receipt are clear and concise. Include the patient’s name, treatment date, chiropractor’s name, address, and contact information. List each service with corresponding charges and specify any insurance details, if applicable. Make the receipt easy to read by avoiding redundant wording and excessive details. A clean, straightforward format reduces confusion and ensures the patient understands what they’re being billed for.

- Template Chiropractic Receipt

A chiropractic receipt should clearly outline services rendered, providing patients with the necessary documentation for insurance or personal record-keeping. The following elements are key to an organized, professional receipt:

- Practice Information: Include the name, address, phone number, and website of the chiropractic office.

- Patient Information: The full name, contact details, and date of service should be displayed.

- Service Description: List each chiropractic service provided, such as adjustments, therapy, or consultation, along with the corresponding charges.

- Date of Service: Clearly indicate the date each service was provided to the patient.

- Total Charges: The total amount for all services should be shown at the bottom of the receipt.

- Payment Information: Document the method of payment, whether cash, credit, or insurance coverage.

- Insurance Details: If applicable, include the insurance provider and claim number to support reimbursement processes.

- Chiropractor’s License Number: This assures patients that the practitioner is licensed and authorized to perform chiropractic services.

A well-structured receipt not only meets patient needs but also provides clarity for any insurance-related issues. Make sure your receipt template is easy to read and includes all relevant details to avoid confusion.

Each chiropractic receipt must include specific details for it to be valid and clear. This ensures transparency and helps both the practitioner and the patient. Here’s what to include:

- Patient’s Full Name: Clearly state the patient’s full name to ensure the receipt corresponds to the right individual.

- Date of Service: Include the exact date when the chiropractic service was provided.

- Service Description: List the specific chiropractic treatments or services rendered. Be concise yet descriptive to avoid confusion.

- Total Amount Charged: Provide a breakdown of the total cost, including any adjustments or discounts applied.

- Payment Method: Specify how the payment was made, whether by cash, credit card, or insurance. This adds clarity in case of disputes.

- Provider’s Details: The name and license number of the chiropractor should be visible to confirm the legitimacy of the service.

- Practice Information: Include the address, phone number, and email of the chiropractic office for easy contact.

Make sure the receipt is clear and free from errors. This reduces the chances of misunderstandings and helps with insurance claims if needed.

Keep your receipt layout simple, with well-defined sections. Use clear headings for each part: chiropractor’s details, patient information, services, and payment summary. This structure makes it easy for clients to find important details quickly.

Use Clear and Legible Fonts

Choose a professional, readable font like Arial or Times New Roman. Set the font size for the main text to 10–12pt for easy reading, and slightly larger for headings (14–16pt). This ensures the text is legible, even for older patients.

Maintain Consistent Spacing

Proper spacing between sections improves readability. Ensure there’s enough space between headings, details, and line items. Use 1.15–1.5 line spacing for text and add a line break between different sections to prevent the document from feeling cluttered.

Align the text to the left to avoid awkward gaps. This is especially important for itemized lists, where proper alignment of descriptions and prices enhances clarity. Ensure that margins are set correctly (1 inch on all sides), so the layout looks balanced.

Include the patient’s full name, address, and contact information on the receipt. Clearly list the date of service and provide an itemized breakdown of each chiropractic treatment or service rendered, including the cost for each. Also, make sure to note any discounts or special billing arrangements.

Payment Details

Indicate the total amount charged, specifying any applicable taxes or fees. Include the payment method, whether by cash, check, credit card, or insurance coverage. If insurance is involved, include the details of the insurance claim and any patient responsibility amount (co-pays or deductibles).

Legal Compliance Information

Ensure the receipt complies with local and federal laws. Include disclaimers regarding the nature of the services provided, and any applicable legal terms, such as patient consent. Mention the chiropractor’s business name, license number, and contact information, to fulfill regulatory requirements and transparency.

For chiropractic practices, tailoring receipts to reflect different services ensures transparency and enhances client trust. Consider customizing the receipt layout to highlight the specific treatments provided during a visit. For example, include separate lines for spinal adjustments, massage therapy, or other specialized treatments, each with its price. This clear breakdown allows patients to easily understand their charges.

Personalized Service Descriptions

Use brief but descriptive terms for services rendered. For example, instead of generic terms like “therapy session,” specify “cervical spine adjustment” or “muscle relaxation therapy.” Customization options allow you to display more relevant details and help clients understand exactly what they are paying for, enhancing their satisfaction with your service.

Additional Customizable Details

Adding fields for specific notes on each visit, such as “prepaid balance” or “insurance coverage applied,” offers clients greater insight into payment breakdowns. You could also include fields for patient referrals or wellness program memberships, which add value and personalize the receipt further. This attention to detail builds client loyalty and strengthens relationships.

Opt for digital receipts if you prefer easy storage and quick access. They can be saved on your phone or computer and easily organized by date, category, or type of service. Digital receipts are convenient for keeping track of expenses and can be easily shared via email or apps. The downside is that they rely on devices, and losing a phone or file without backup could result in losing important information.

Paper receipts, while more tangible, are easy to carry and don’t require any devices. They are useful when you need something physical to keep for warranty or insurance purposes. However, they are prone to fading, wear, and loss, making them harder to manage long-term. Additionally, they can pile up and take up space, requiring a filing system to stay organized.

Consider your storage preferences and how you access receipts regularly. Digital receipts offer more convenience and organization, while paper receipts may work better for those who need something physical for specific purposes.

Incorrectly listing the services provided is one of the most frequent errors. Always ensure that each service is clearly described and aligned with the corresponding price. Mislabeling or leaving out details can lead to confusion or disputes.

Another common mistake is failing to include the correct date. Receipts should always have the date of the transaction, as it provides an important record for both the customer and the business. Without it, the receipt loses its value for tracking purposes.

Incorrect tax calculations are a typical issue. Double-check tax rates and apply them accurately to avoid discrepancies. This is especially important for businesses operating in multiple regions with varying tax rates.

Avoid missing payment methods. Always specify whether the payment was made via cash, credit card, or another method. This provides clarity and makes it easier to reconcile transactions later.

Forgetting to add the business’s contact information is another mistake. Include the business name, address, and phone number on each receipt. This helps customers reach you in case of any issues or questions.

| Mistake | Impact | Solution |

|---|---|---|

| Incorrect service descriptions | Customer confusion, potential disputes | Ensure detailed and accurate descriptions |

| Missing date | Lack of record-keeping, confusion | Include the transaction date |

| Incorrect tax calculation | Tax issues, financial discrepancies | Verify tax rates before applying them |

| Missing payment method | Inaccurate financial tracking | List the payment method used |

| Lack of business contact details | Difficulty contacting the business | Add business name, address, and phone number |

Start by ensuring the chiropractic receipt template is clear and includes all necessary details. This will make it easier for both the provider and the patient to understand the information quickly.

- Include the chiropractor’s name, business name, address, and contact information at the top of the receipt.

- Clearly display the patient’s name and contact information beneath the clinic details.

- List the services provided, such as adjustments, consultations, and any additional treatments, with corresponding prices.

- State the date and time of the service rendered. Include the receipt number for easy reference.

- Specify the payment method used, whether by insurance, credit card, or cash.

- If applicable, include the insurance details, such as provider name and claim number.

Using a template will help maintain consistency across receipts and reduce errors. Ensure that all items are legible and that patients have enough information to submit to insurance or keep for their records.