A well-structured CVS receipt template simplifies transaction record-keeping and ensures consistency in documentation. Whether you need a digital or printed format, a properly formatted template includes key details such as store information, itemized purchases, taxes, and payment method.

To create an accurate template, include date and time of purchase, unique transaction ID, and a barcode for returns or verification. Standard fonts like Arial or Courier ensure readability, while clear sectioning improves usability.

For businesses, adding a custom footer with return policies, loyalty program details, or customer service contacts enhances user experience. Digital receipts should support email delivery and PDF export for easy access and record-keeping.

Using a template eliminates formatting errors and saves time on receipt generation. Whether designing from scratch or modifying an existing format, ensure compliance with tax regulations and business requirements to maintain accuracy and transparency.

Here’s the Revised Version Without Redundant Words, While Retaining the Meaning:

For a cleaner and more readable format, use the following version of the template, which removes unnecessary word repetitions and maintains clarity:

Revised Template:

| Item | Price | Quantity | Total |

|---|---|---|---|

| Product 1 | $10.00 | 2 | $20.00 |

| Product 2 | $5.50 | 1 | $5.50 |

| Total | $25.50 | ||

Ensure the template is formatted consistently to make it easy to read and process. Avoid repetitive phrases like “total price” and “final sum.” Instead, use clear labels such as “Total” and “Price.”

Tips for Clarity:

1. Use simple, direct language to describe quantities and prices.

2. Align the columns properly to enhance the table’s legibility.

3. Keep descriptions minimal but informative, avoiding redundancy.

Template CVS Receipt: Structure, Customization, and Uses

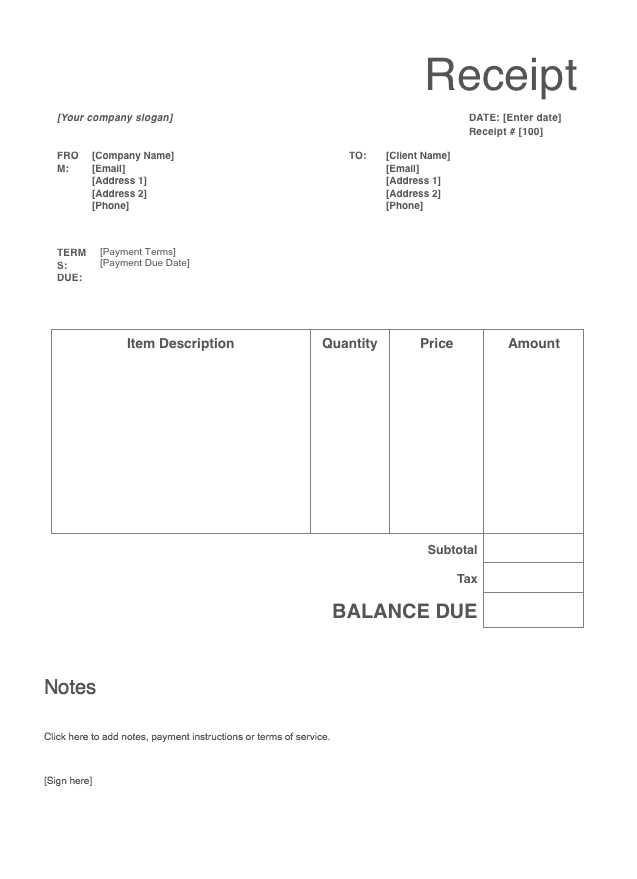

To create a functional and adaptable CVS receipt template, focus on structuring key elements in a clear and concise manner. The primary sections should include the store information, transaction details, and a breakdown of purchased items. Each part should be logically ordered to ensure readability and easy customization.

Structure of a CVS Receipt

A standard CVS receipt typically includes the following components:

- Store Details: Name, address, and contact information.

- Transaction Information: Date, time, and register number.

- Itemized List: Each product purchased, with price, quantity, and subtotal.

- Payment Summary: Total amount, taxes, discounts, and payment method.

- Loyalty Program Details: If applicable, points earned or available for future use.

- Return Policy and Legal Notices: Any disclaimers or instructions on returning items.

Customization of the Template

Customize a CVS receipt template to suit your business or personal needs by adjusting the layout, adding branding elements, and including any specific information relevant to your customers. You can easily modify fonts, colors, and sections like the loyalty program or discounts. For businesses, it’s important to ensure that all required legal information is present and clear.

Including a clean, professional design with clearly distinguishable sections makes the receipt easy to understand. This improves the customer experience and streamlines the transaction process. Use a clear hierarchy of information to guide the reader from top to bottom in a logical flow.

Uses of CVS Receipt Templates

CVS receipt templates can be utilized for various purposes beyond just providing proof of purchase. For instance, businesses can use them to track customer spending, manage returns, and maintain records of inventory. Additionally, CVS receipts can serve as a useful tool for customer loyalty programs, offering discounts or rewards to repeat customers. Templates can also be adapted for digital receipts, making them more environmentally friendly and accessible through email or mobile apps.

When analyzing a CVS receipt, break it down into its key sections for clarity. Here’s what to look for:

Header Information

- Store Details: Includes the CVS location, address, and contact number.

- Transaction Date and Time: Provides the timestamp of your purchase.

- Receipt Number: A unique identifier for the receipt, useful for tracking or returns.

Itemized List

- Product Name: Each item purchased is listed with its name.

- Quantity: Displays how many units of each product were bought.

- Price per Item: The cost for each individual product.

- Subtotal for Each Item: Calculated by multiplying the unit price by the quantity.

Discounts and Offers

- Coupon Codes: Discounts applied from physical or digital coupons are clearly indicated.

- CVS ExtraBucks: Rewards or points, including any discounts used during the purchase.

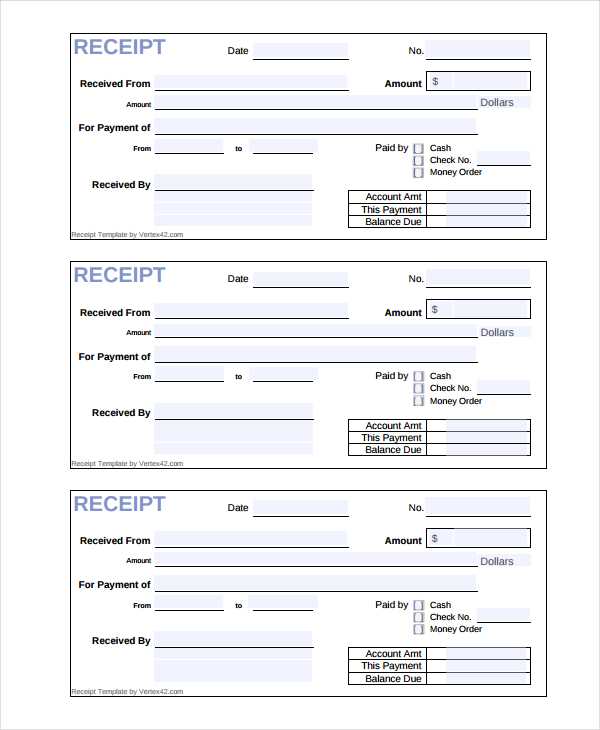

Total and Payment Details

- Subtotal: The total cost of the items before tax and any discounts.

- Sales Tax: Displays the applicable sales tax on the subtotal.

- Total Amount: The final amount, which includes tax and any discounts applied.

- Payment Method: Indicates whether payment was made via cash, card, or other methods.

- Amount Paid: Shows the exact amount paid for the purchase.

By breaking the receipt down into these sections, you can quickly verify the accuracy of each transaction detail.

Adjust the template for each type of transaction to ensure the necessary details are included. Here are practical steps to follow:

- For sales receipts: Include itemized lists of products or services, quantity, unit price, and total. Make sure to include the tax rate applied and any discounts.

- For returns or exchanges: Add fields for the original purchase date, reason for return, and restocking fees if applicable. Specify the items returned and the refund method (store credit, cash, etc.).

- For services rendered: Customize the template to display hours worked, service rates, and any additional charges like materials or travel fees. Clearly show the breakdown of the total cost.

- For donations or charity receipts: Include the donor’s name, the donation amount, and the date. You may also need a disclaimer for tax-exempt status if applicable.

- For gift receipts: If you offer gift receipts, adjust the template to exclude prices but include all other transaction details, such as product description and transaction date.

Consider adding customizable sections to your template for any special conditions that apply to different transactions, such as loyalty points, coupon use, or shipping details. This allows flexibility while keeping the format clean and readable.

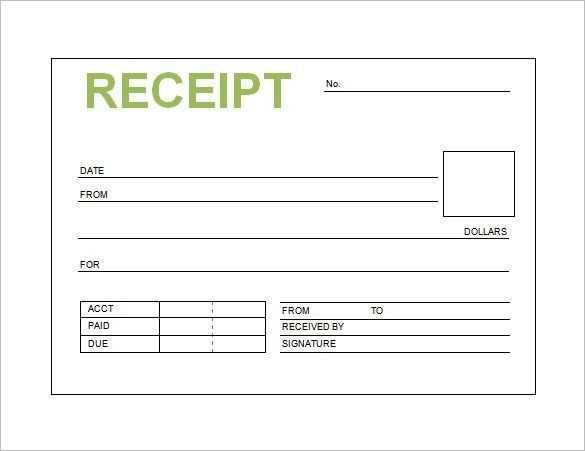

Choose an appropriate paper size to ensure your receipt fits well within standard printing parameters. A common choice is 80mm x 80mm for thermal printers, but confirm the specifications of your printing equipment.

Margins should be set with enough space to prevent important text from being cut off during printing. A standard margin of 0.2 inches around the edges typically works well. Adjust based on your printer’s specific capabilities.

Ensure the font size is readable. A size of 8-10 pt is ideal for receipt printing, ensuring legibility without wasting paper. Test different font families to find one that prints clearly and is compact enough to fit the required data.

For multi-line information, use line spacing of around 1.2 to 1.5, ensuring the text does not crowd together. Space is valuable, but readability is the priority.

When including logos or images, consider the image resolution. Use a resolution of at least 200dpi to ensure the print quality remains sharp without increasing the file size unnecessarily.

Don’t forget to configure the printer’s settings for optimal paper handling. Calibrate your printer for consistent results to avoid cut-off text or misaligned printing.

Lastly, always run test prints to check that formatting, margins, and text align properly. Minor tweaks can make a significant difference in print quality.

To properly close an unordered list in HTML, ensure that you use the closing tag for the list: . It’s crucial to place this tag after you’ve listed all your list items within

- tags. Without this closing tag, the structure of your HTML will break, potentially affecting the rendering of the page and leading to errors in how your content is displayed.

- tags are properly nested inside

- as well.

Best Practices

Always validate your HTML to catch these small but impactful errors. Using an HTML validator tool can help ensure your structure is correct and prevent unwanted display issues.

Common Mistakes

A frequent issue is forgetting to close the

- element, which results in misaligned content. Always check the balance between opening

- and closing

tags before finalizing your code. Ensure all