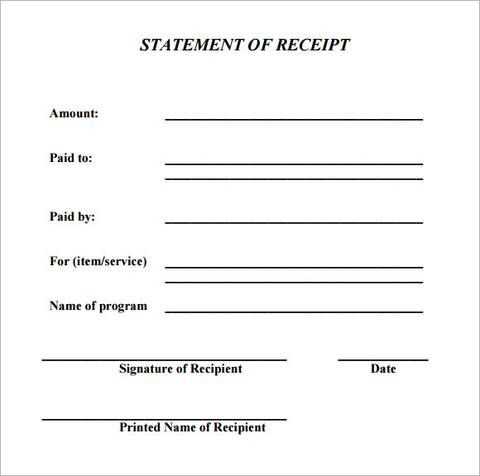

A properly drafted receipt for damages paid in full serves as legal proof that a payment obligation has been met. It should clearly state the amount paid, the reason for the payment, and the parties involved. Providing a detailed and structured document protects both the payer and the recipient from future disputes.

Include the full names and contact details of both parties. Specify the date of payment and a breakdown of the damages covered. If applicable, mention any previous partial payments and confirm that no further amounts are due.

To reinforce the validity of the receipt, include a statement acknowledging that the debt is settled and that neither party has outstanding claims related to the damages. The recipient should sign the document, and if possible, have a witness or notary certify it.

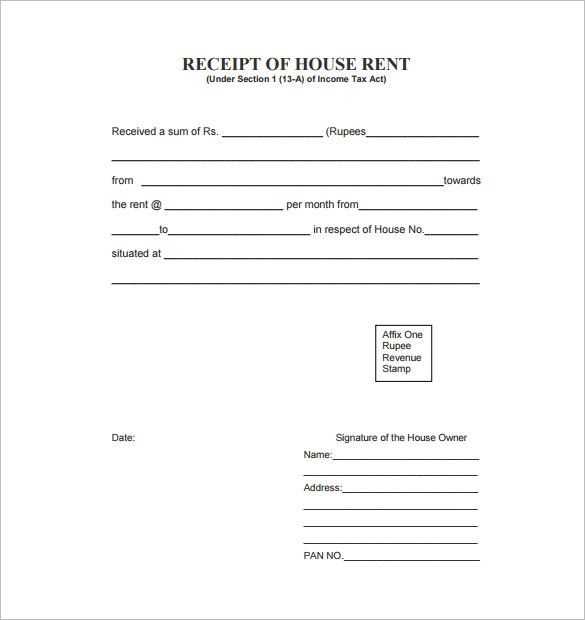

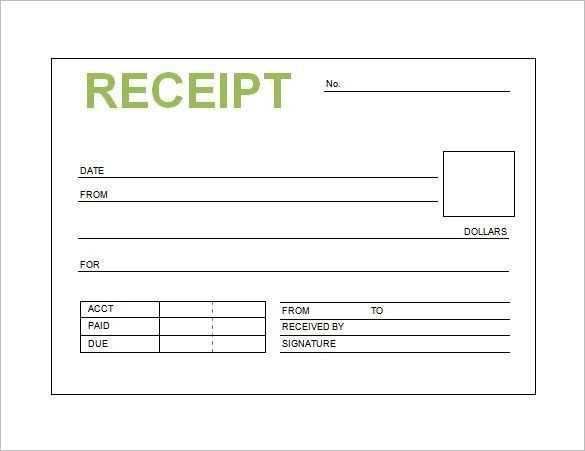

Below is a structured template that ensures all critical details are covered, providing clarity and legal security.

Here is the revised version without unnecessary repetitions:

Use a clear statement confirming that the payment has been made in full. Specify the amount paid, the date of payment, and the purpose of the payment. Ensure the document includes the payer’s name, the recipient’s name, and the signature of both parties. Make the terms straightforward, with no ambiguous language. If there is any remaining balance or unresolved issue, clarify it explicitly. Mention any relevant reference numbers or documents tied to the payment. Ensure both parties acknowledge and accept the settlement with their signatures.

For a legally binding receipt, ensure that the payment terms are outlined with complete accuracy. Double-check for any omitted details to avoid confusion. This simple format helps avoid misunderstandings and ensures a smooth transaction process.

- Template for a Receipt Confirming Full Damage Payment

Provide a clear and straightforward receipt when confirming full payment for damages. The receipt should include specific details to avoid confusion and ensure both parties are aligned. Here is a practical template to follow:

- Receipt Number: Assign a unique receipt number to track the transaction.

- Date of Payment: Mention the exact date when the full payment was made.

- Payer Information: Include the full name and contact details of the person or entity making the payment.

- Payee Information: Include your name or the name of the receiving party.

- Damage Description: Briefly describe the damage that was repaired or compensated for.

- Amount Paid: Clearly state the total amount paid for the damages.

- Payment Method: Specify the method used for payment (cash, bank transfer, check, etc.).

- Confirmation of Full Payment: State that the payment covers the full amount due for the damages.

- Signature: Include space for both parties to sign, confirming the receipt of full payment.

- Additional Notes: Any further information or terms related to the payment or damages can be included here.

This template helps ensure all necessary details are captured, providing both parties with clear documentation. Adjust the layout as needed to suit the specific circumstances.

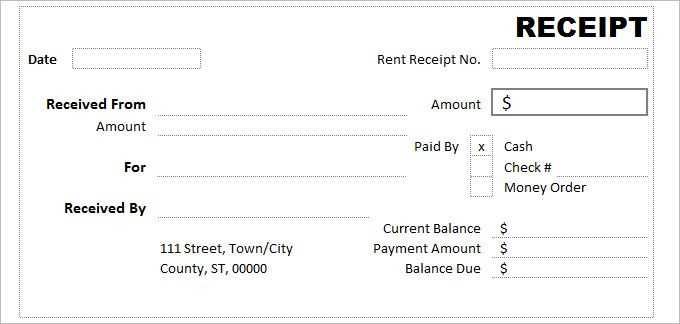

Each damage payment receipt must have specific details to ensure clarity and proper documentation. Include the following elements:

1. Payment Information

Clearly state the total amount paid for damages. This should be the full amount received and should match the agreed-upon amount. Include the currency used to avoid any confusion.

2. Date of Payment

Provide the exact date the payment was made. This helps establish a clear timeline and serves as a reference for both parties if any follow-up is needed.

3. Parties Involved

List both the payer and the recipient’s full legal names and contact information. This ensures that there is no ambiguity regarding who made the payment and who received it.

4. Description of Damages

Provide a detailed description of the damages for which payment was made. Include any relevant information, such as the item or property affected and the nature of the damage.

5. Acknowledgment of Full Payment

State clearly that the payment represents the full settlement for the damages. This confirms that no further amounts are owed for the incident in question.

6. Signature of Both Parties

Have both the payer and the recipient sign the receipt. This confirms that both parties agree on the payment and terms of the settlement.

Begin with clear identification of the parties involved: the recipient and the payer. Include the full legal names and contact information (addresses, phone numbers, and email addresses). Specify the date the receipt is issued and the date of the payment transaction.

List the specific damages being paid for, along with an accurate description of the property or item, including its condition before the damage occurred. The amount of damages should be clearly stated in both numerical and written forms. For instance, “$1,000 (One thousand dollars)”.

Include the exact amount paid and confirm the payment method (e.g., cash, check, bank transfer) to avoid any ambiguity. If a check or bank transfer was used, include the check number or transaction ID for traceability.

Clearly note that the payment covers the full amount due for the specified damages, leaving no outstanding balance. Use phrases like “full payment” or “paid in full” to eliminate confusion.

The receipt should be signed by both parties. The payer’s signature confirms that they’ve made the payment, while the recipient’s signature verifies receipt of the payment. Include a line for the date of signing to finalize the document.

End with a statement of acknowledgment, such as “This receipt confirms that all agreed-upon damages have been fully compensated, and no further claims are pending.”

Common Mistakes to Avoid When Drafting a Damage Receipt

Omitting key details is one of the most frequent mistakes. Always include the specific damage description, the total amount paid, and the date of payment. Missing this information can lead to confusion or disputes down the line.

Another mistake is failing to clearly state that the payment is made in full. Clearly note that the damage payment satisfies all obligations, ensuring both parties understand that no further amounts are due.

Ambiguity in Terms

Ambiguous language can create problems. Avoid vague statements like “a reasonable amount” or “partial satisfaction” in the receipt. Be specific about the nature of the damages and the exact payment made.

Inaccurate Dates

Ensure that the payment date is correctly recorded. Errors in dates can raise doubts regarding the payment timeline and may lead to misunderstandings or complications in future dealings.

Failure to Include Payment Method

Always specify how the payment was made. Whether by cash, check, credit card, or another method, this detail should be documented to prevent questions about the payment’s authenticity.

| Common Mistake | Recommended Practice |

|---|---|

| Omitting key details | Include specific damage description, total amount, and payment date. |

| Ambiguous language | Be specific about damages and payment terms. |

| Inaccurate dates | Verify that the payment date is correct. |

| Missing payment method | Document the method of payment used. |

Avoiding these errors ensures your damage receipt serves its purpose clearly and effectively. Proper documentation prevents potential conflicts and ensures both parties have a mutual understanding of the agreement.

A standard receipt confirms the payment for goods or services, whereas a damage payment receipt specifically acknowledges the compensation for damages. The purpose and details included in each document vary significantly. Here’s what sets them apart:

- Purpose: A standard receipt verifies the completion of a transaction for products or services. A damage payment receipt, however, confirms the payment made for the repair or replacement of damaged property.

- Details Included: A standard receipt will list the items purchased or services rendered. In contrast, a damage payment receipt typically includes a description of the damages, the extent of repairs or replacements needed, and the cost of these services.

- Nature of Transaction: Standard receipts are usually for routine purchases. Damage payment receipts often result from accidents, legal disputes, or insurance claims.

- Additional Information: Damage payment receipts may include information on liability or a statement of full payment settlement, confirming that no further compensation is due. Standard receipts don’t generally contain this type of information.

By understanding these differences, you can ensure the right type of receipt is used for your transactions, protecting both parties involved.

For clarity and to ensure that both parties are on the same page, it’s best to keep the acknowledgment of full payment straightforward. Use precise language to confirm the payment has been received and the outstanding balance has been settled. Here’s an example of clear wording for this purpose:

Sample Acknowledgment Text

“We hereby acknowledge receipt of the full payment of $[amount] for the damages as outlined in the agreement dated [date]. This payment fully satisfies all obligations under the terms of the agreement. No further amounts are due.”

Points to Include in Your Acknowledgment

Make sure the following elements are covered in your wording:

| Element | Description |

|---|---|

| Amount | State the exact amount paid to avoid any ambiguity. |

| Date of Payment | Include the date the payment was received. |

| Agreement Reference | Identify the relevant agreement or contract to which the payment relates. |

| Confirmation of Full Payment | Explicitly mention that the payment fully settles the debt or obligation. |

Using this structure helps keep the receipt clear, reducing the risk of confusion in future transactions. Avoid overly complex language to ensure that the statement remains accessible to both parties involved.

Provide copies of the receipt to all parties involved immediately after payment has been made in full. This ensures clarity and transparency for everyone. Below are key steps for efficient distribution:

- Timing: Hand over copies within 24 to 48 hours after the payment is confirmed. This avoids unnecessary delays and ensures all parties are aligned promptly.

- Methods of Distribution: You can provide copies in person, via email, or through certified mail. Choose the method that is most convenient for the parties involved, ensuring it’s documented properly.

- Recipient Confirmation: Ask each party to acknowledge receipt by signing or confirming via email. This keeps records clear and prevents any future disputes about whether copies were received.

- Record Keeping: Retain a copy of the receipt and all correspondence for your records. Consider using cloud storage for easy access and organization.

By following these steps, all parties will have the necessary documentation in a timely manner, reducing any risk of confusion or miscommunication later on.

Meaning is preserved, repetitions are minimized.

Focus on clarity by keeping the text simple and straightforward. Remove any redundant phrases that don’t add value. The goal is to communicate the necessary information without excess detail. Use clear, direct language that gets straight to the point, ensuring readers grasp the message quickly.

Structure your document effectively

Start with the most important details. Provide a concise overview of the damages, payment, and confirmation of full settlement. Avoid rephrasing the same information in multiple ways. For example, instead of repeating payment details, highlight the amount, date, and method once, then move on to the next step in the process.

Confirm payment and closure

Clearly state that payment has been received in full, and include the reference number or other identifying information if necessary. This serves as confirmation for both parties. Keep this section factual and avoid redundant language. The goal is to leave no room for confusion while keeping the message concise.