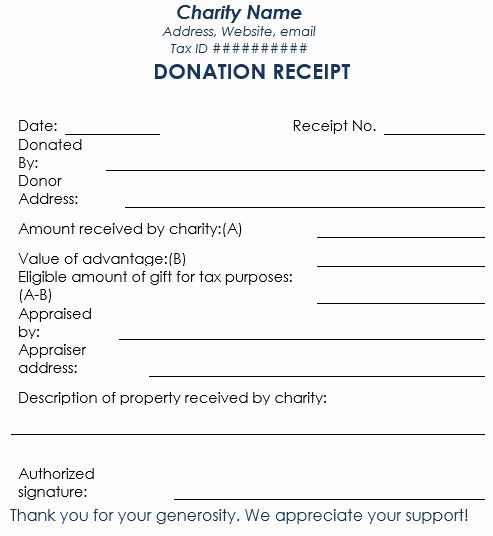

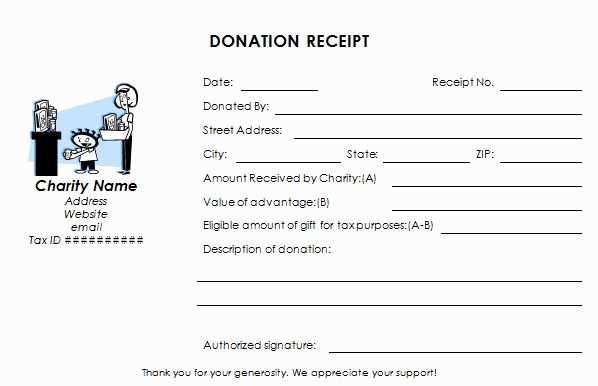

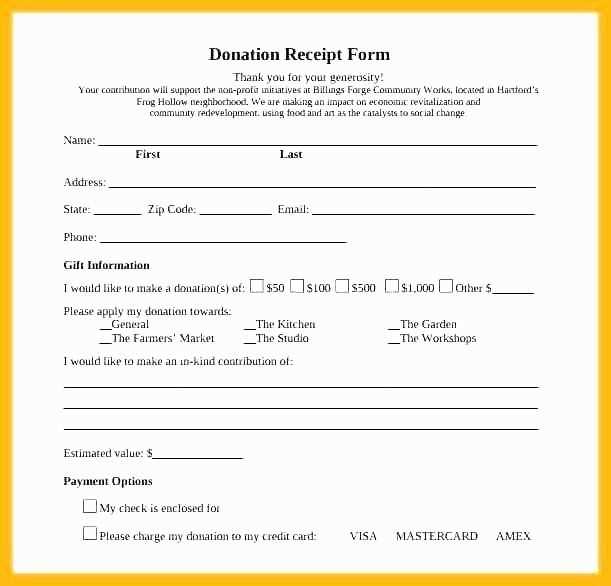

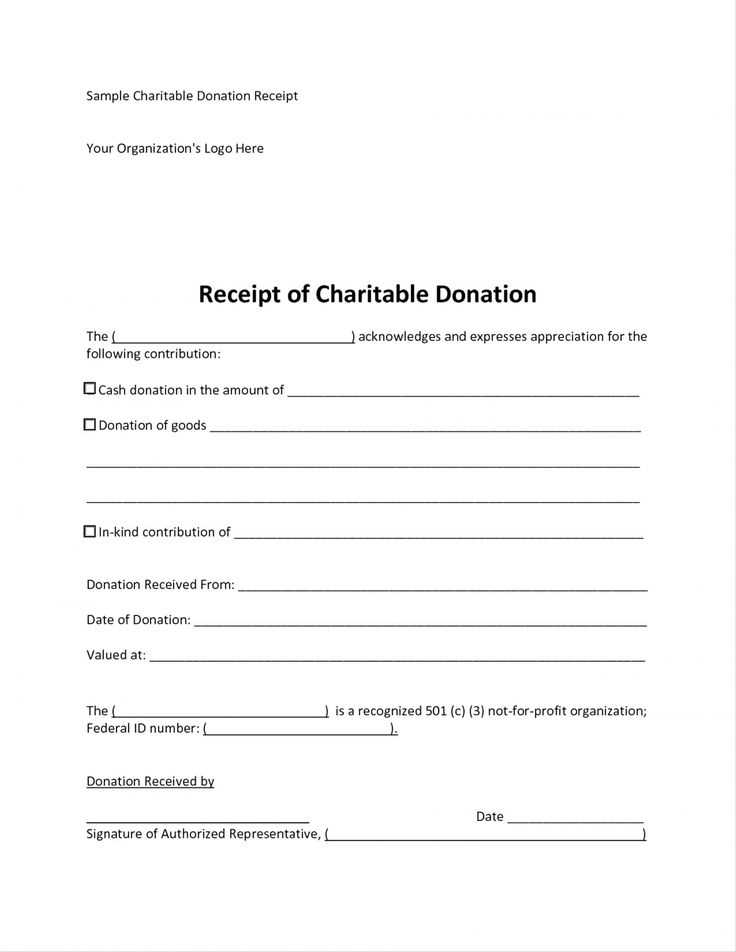

Creating a clear and accurate donor receipt template is a must for any organization that relies on donations. Start by including the donor’s full name, address, and the donation date. Ensure the amount donated, whether cash or in-kind, is clearly specified. For in-kind donations, describe the items donated, as well as their estimated value. This transparency helps maintain trust with your supporters and ensures compliance with tax regulations.

Details to include: Ensure the receipt contains the legal name of your organization, its address, and its tax-exempt status if applicable. Add a statement that the donation was received without any goods or services in return, which is a key requirement for tax-deductible donations. If any goods or services were exchanged, be clear about their value.

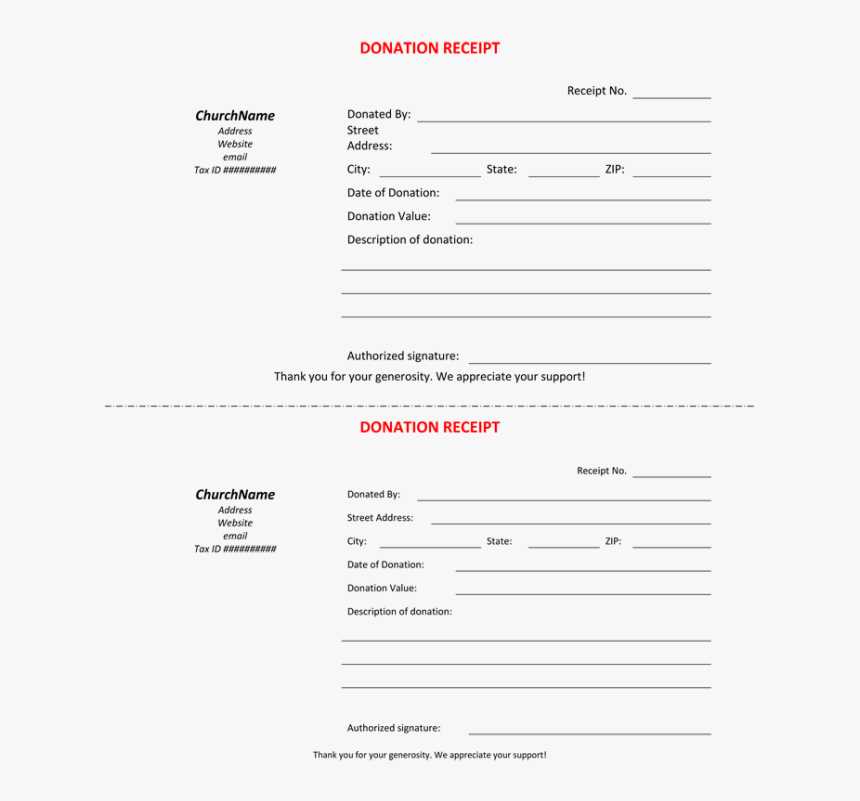

Formatting Tips: Keep the template simple and organized. Use a consistent format that includes the donor’s information at the top, followed by the donation details and the organization’s tax-exempt status statement. Always include a thank-you message to acknowledge the donor’s generosity and contribution to your cause.

When preparing your receipt, double-check all details for accuracy. A mistake in the donor’s name, donation amount, or date could complicate matters when they file taxes. Additionally, make sure to provide a receipt for every donation, regardless of size, to maintain proper records and compliance.

Template for Donor Receipts

Design your donor receipts with clarity and transparency. Include key information like the donor’s name, donation amount, date, and purpose of the contribution. Specify if the donation is tax-deductible and mention any goods or services provided in return, including their estimated value. Always provide a unique receipt number for tracking purposes. A clean layout, easy-to-read fonts, and logical organization will make the receipt user-friendly and professional.

Ensure your organization’s name, logo, and contact details are clearly visible. Mention the donation method (e.g., online, check, cash) and any reference number for verification. Don’t forget to include a thank-you message to acknowledge the donor’s contribution and reinforce goodwill.

Finally, provide a section for the donor’s signature (if required), and specify the organization’s EIN (Employer Identification Number) for tax reporting. Keep the receipt concise, free from unnecessary text, and focused on the essential details that support tax filing and acknowledgment.

Designing a Clear Structure for Donation Acknowledgement

Begin with a concise heading that identifies the receipt as a donation acknowledgment. This provides immediate clarity and helps avoid confusion. Include the donor’s name and donation date prominently, as this builds personal recognition.

Follow with a brief description of the donation, specifying the amount and any relevant project or fund it supports. This ensures the donor understands the impact of their contribution.

Offer a clear, easy-to-read breakdown of the receipt. Consider organizing information using bullet points or short paragraphs, highlighting key details: donation amount, purpose of funds, and any special instructions for tax purposes.

Conclude with a warm thank you message that acknowledges the donor’s generosity. This reinforces the personal connection and encourages future support.

Always include your nonprofit’s contact information, including an address or email for any inquiries. This fosters trust and transparency with your supporters.

Incorporating Legal and Tax Information in Donor Receipts

Ensure donor receipts include the organization’s legal name, address, and tax identification number (TIN). This data validates the organization’s non-profit status and provides donors with the necessary information for tax reporting. Include a clear statement confirming that no goods or services were exchanged for the donation or specify the value of any goods or services if applicable. This transparency helps donors accurately claim tax deductions.

Specify the date and amount of the donation to support proper tax documentation. If the contribution involves property, include a description of the items donated. Avoid placing estimated values on donated goods; the donor should determine the value for tax purposes. Make sure your receipts reflect the donation’s correct classification–whether cash, non-cash, or in-kind–and use precise wording to align with IRS requirements.

If applicable, include any other relevant legal disclaimers to ensure the receipt complies with both state and federal regulations. Regularly review the format and content of the receipts to guarantee adherence to evolving tax laws.

Customizing Templates for Different Donation Types and Amounts

Adjust your template design based on the donation type and amount for a personalized experience. Tailoring receipts ensures clarity and appreciation, fostering stronger donor relationships.

1. Donation Amount-Based Customization

- Small Donations: For smaller amounts, keep the format simple. Highlight the donor’s name, the donation amount, and the date. Avoid overloading the receipt with too much detail.

- Medium Donations: Include a brief message expressing gratitude, and specify the intended purpose of the funds, if applicable. Offer a personalized touch with specific thank-you notes.

- Large Donations: For larger donations, provide detailed breakdowns of how the funds will be used. This can include a list of funded programs or specific projects. A thank-you message from the organization’s leadership can also be included.

2. Donation Type-Based Customization

- Monetary Donations: For cash or credit donations, emphasize the amount, donor’s information, and donation date. Optionally, include a thank-you message along with tax information for year-end documentation.

- In-Kind Donations: Acknowledge the value of the goods donated and provide space for itemized listings. If the donor has donated items, be clear about their contribution with descriptions and estimated values.

- Recurring Donations: Customize the receipt to show frequency of donation, amount for each interval, and the total donation so far. Include a note of appreciation for continued support and commitment.