Organize Your Information Clearly

Start by including the receipt’s basic details like the date, store name, and total amount. This helps keep records neat and makes tracking purchases easy. Also, add the payment method (e.g., credit card, cash, etc.) to clarify how the transaction was completed.

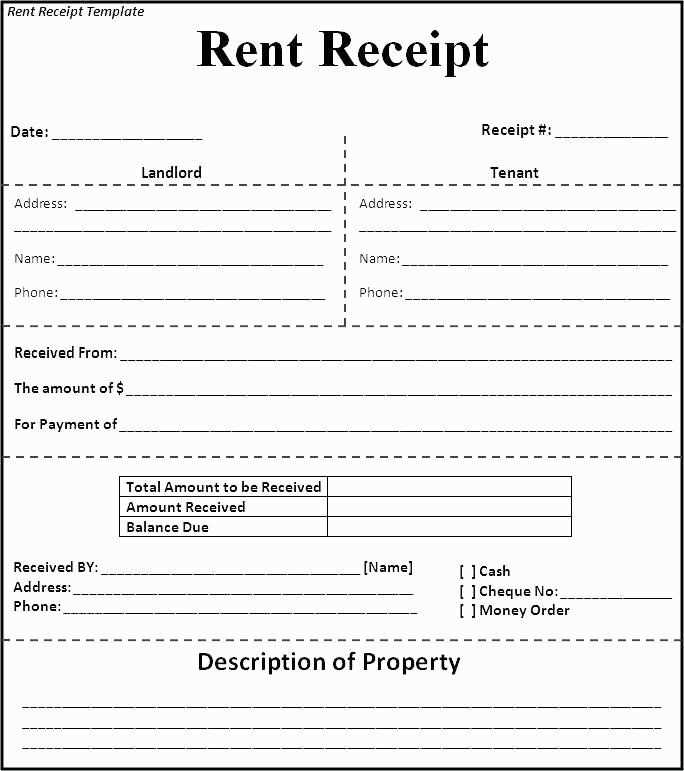

Receipt Layout

The format of your receipt should follow a logical order:

- Date of Purchase: This ensures easy reference for future checks.

- Store or Vendor Name: Helps in identifying the origin of the purchase.

- Total Amount: Clearly mark the final cost after any discounts or taxes.

- Itemized List: Include each item, its price, and quantity to provide transparency.

- Payment Method: Indicate how the payment was made to avoid confusion later.

- Transaction ID: If available, this offers a reference for tracing the transaction.

Track Additional Information

Beyond the basics, record any discounts or promotional codes applied. This can be crucial when reviewing spending habits or validating the receipt later. Including a section for return/exchange policy might be useful in case you need to refer back to it.

Effective Categorization

It’s also helpful to categorize the items on the receipt. This can be done by product type or expense category, like groceries, office supplies, or entertainment. This approach helps organize receipts for accounting or budgeting purposes.

Regular Maintenance

Update your receipt template regularly to adapt to any new transaction methods or changes in the way stores issue receipts. Keeping this template simple but thorough ensures smooth record-keeping.

Template for Entering Receipts

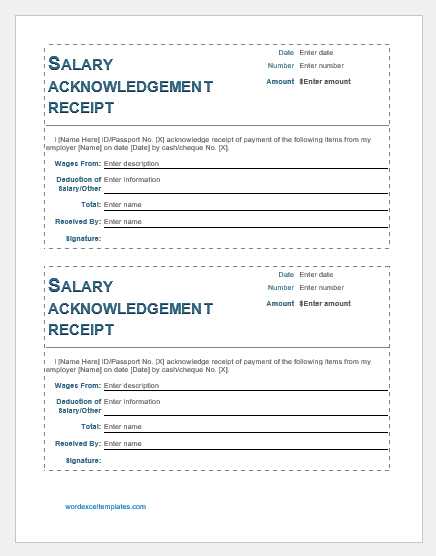

Setting Up a Receipt Entry Format

Choosing the Right Fields for Information

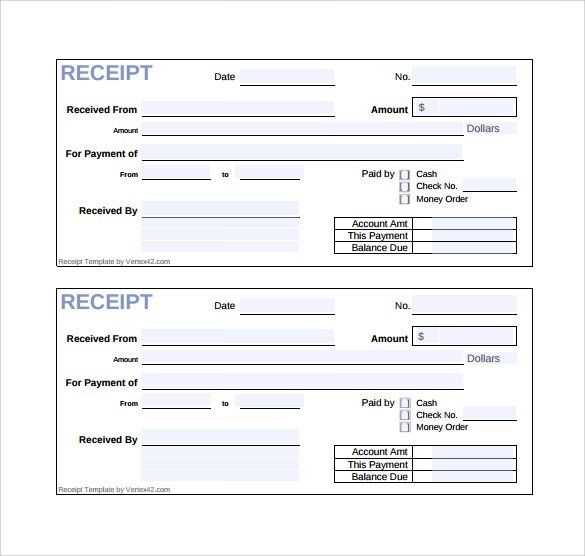

Integrating the Template with Accounting Software

Common Mistakes to Avoid in Entries

How to Organize and Categorize Data

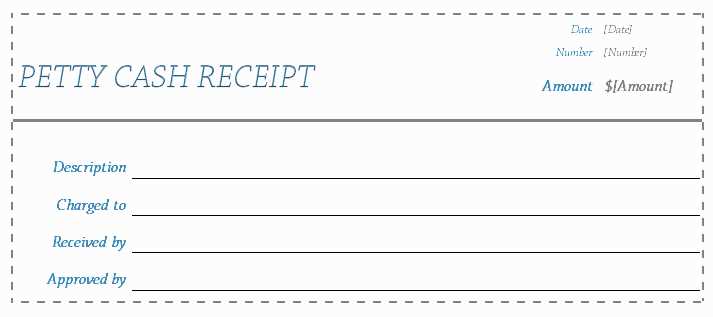

Customizing the Format for Business Needs

Start with clear and consistent data fields: date, vendor, amount, and payment method. Add additional categories, like receipt number, item details, or tax, depending on the specific needs of your business.

Ensure your template format aligns with your accounting software’s import functions to avoid manual re-entry. Many systems accept CSV or Excel formats, so structuring your receipt data accordingly can save time and prevent errors.

Avoid overlooking crucial fields like tax or discount information. Without these, reports may be inaccurate, affecting financial assessments. Keep these elements simple but detailed enough for auditing and reconciliation purposes.

Organize entries by transaction type or vendor for easy categorization. Grouping receipts into logical categories speeds up both internal reviews and tax reporting.

Customize the template to fit your business’s operational flow. If you deal with multiple departments or have various expenditure categories, tailor the format to match your tracking systems.

Common mistakes include forgetting to capture the full payment method or misclassifying the item category. Make sure all fields are checked before finalizing each entry to maintain accuracy.