Choose a structured and clear estimate receipt template to ensure accurate cost breakdowns and smooth client communication. A well-designed template includes essential details such as service descriptions, pricing, applicable taxes, and payment terms. Providing transparency in your estimates builds trust and minimizes potential misunderstandings.

Use a format that allows easy customization while maintaining a professional appearance. Key elements to include are your business name, client information, date of issuance, and a unique reference number for tracking purposes. Clearly specify the validity period of the estimate to avoid disputes and ensure timely decisions from clients.

Consider adding optional sections like discounts, additional notes, or terms and conditions to make your estimate more informative. A clean layout with readable fonts and logical organization enhances clarity. Whether you prefer a printable document or a digital format, ensuring consistency in your estimates reinforces professionalism and reliability.

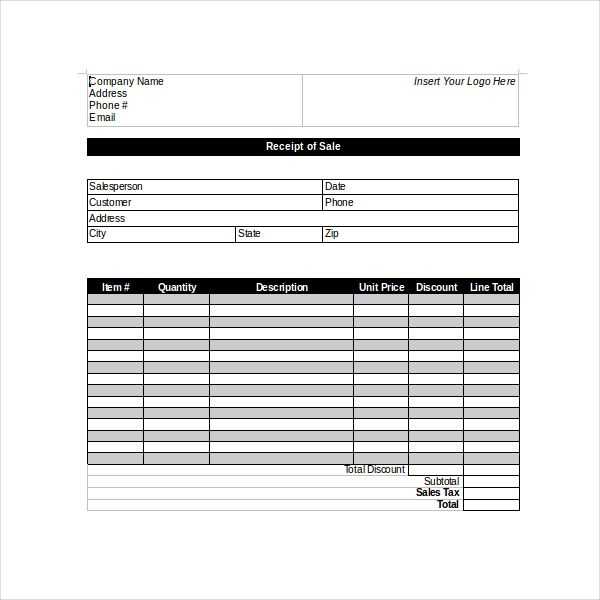

Template for Estimate Receipt

Use a well-structured estimate receipt template to ensure clarity and professionalism. A good format includes key details such as business information, client details, itemized costs, and terms. Keep it concise, easy to read, and legally compliant.

Key Elements to Include

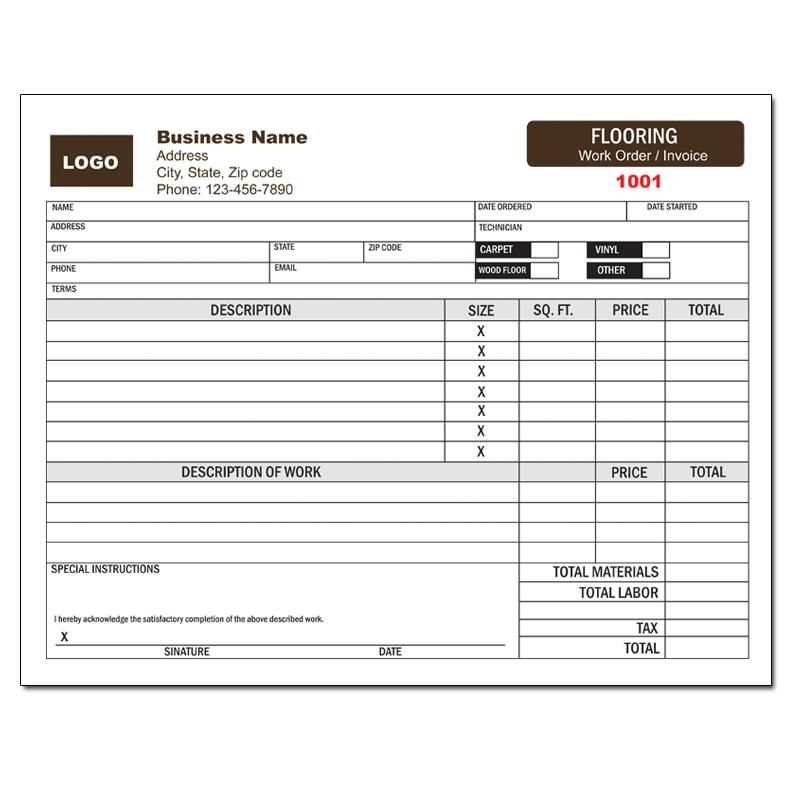

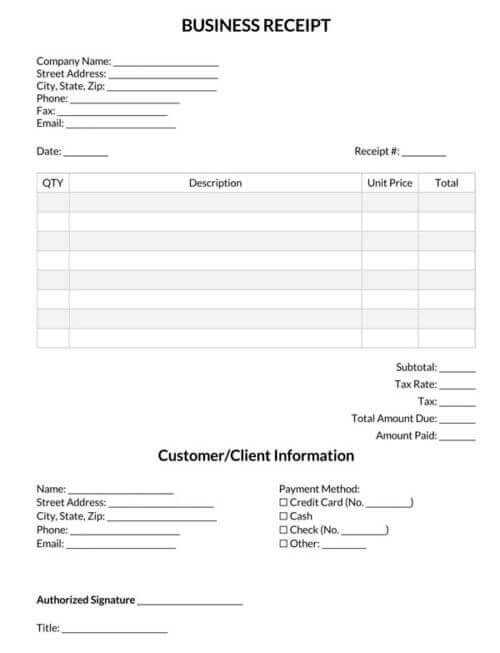

- Business Details: Company name, address, contact information, and logo.

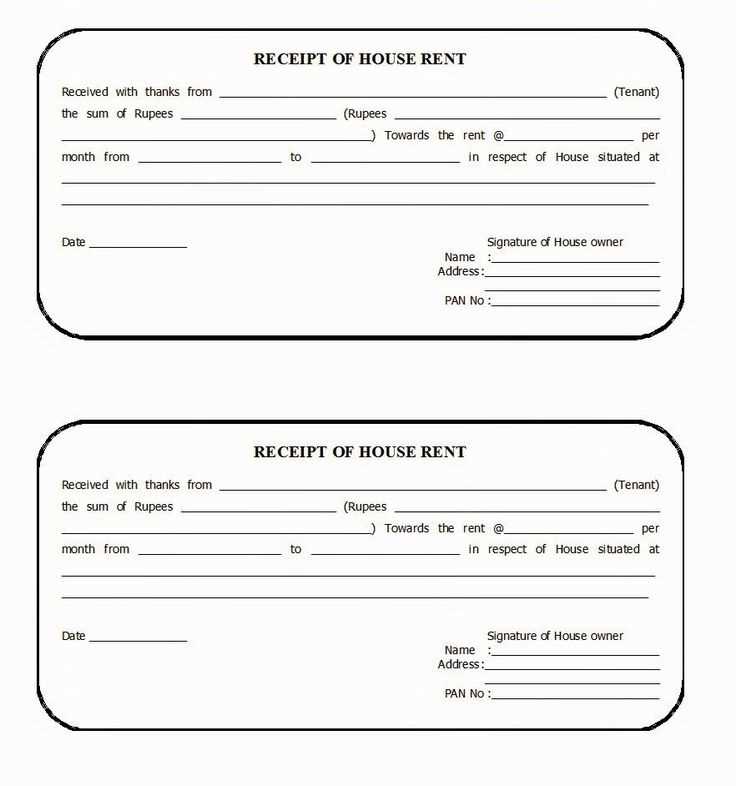

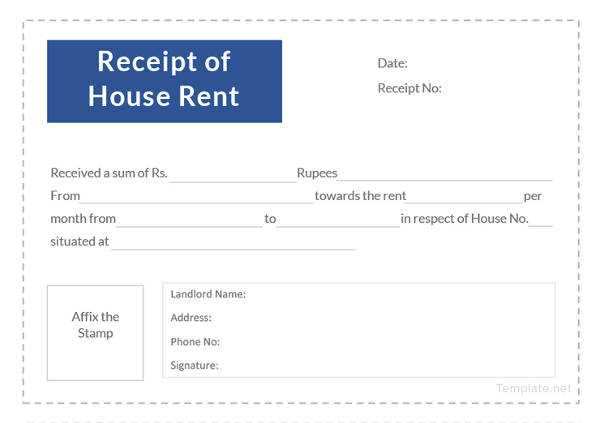

- Client Information: Name, address, and contact details of the recipient.

- Estimate Number: Unique reference for tracking and record-keeping.

- Itemized Breakdown: List of services or products with unit prices, quantities, and totals.

- Subtotal, Taxes, and Discounts: Clearly separate charges to avoid confusion.

- Payment Terms: Due date, accepted payment methods, and any conditions.

Best Practices for Formatting

- Use a clean, readable font with consistent spacing.

- Highlight key figures such as total amount due.

- Include a disclaimer if prices are subject to change.

- Save the template in PDF format for easy sharing and printing.

Keep the estimate receipt straightforward to avoid misunderstandings. A well-prepared document builds trust and ensures smooth transactions.

Key Components to Include in an Estimate Receipt

Business Information: Clearly display the company’s name, address, phone number, and email. This ensures the recipient can easily identify the source and reach out if needed.

Client Details: Include the customer’s name and contact information. Accuracy here helps avoid misunderstandings and keeps records organized.

Unique Estimate Number: Assign a distinct reference number to every estimate. This simplifies tracking and prevents confusion when discussing specific quotes.

Itemized Breakdown: List each service or product separately, specifying the quantity, unit price, and total cost. Transparency in pricing builds trust and minimizes disputes.

Subtotal, Taxes, and Discounts: Clearly separate the subtotal from applicable taxes and any discounts provided. This ensures the final amount is easy to verify.

Terms and Conditions: Outline payment terms, expiration date, and any relevant policies. Setting expectations upfront avoids potential disagreements.

Approval Section: Add a space for the client’s signature or confirmation. A signed estimate serves as proof of agreement before work begins.

How to Format an Estimate Receipt for Clarity

Use a structured layout with clear sections for each detail. List the company name and contact details at the top, followed by the client’s information. Ensure the document title, such as “Estimate Receipt,” is bold and prominently displayed.

Organize item descriptions in a table or aligned format. Each line should include a concise description, quantity, unit price, and total cost. Use consistent spacing and font size to enhance readability.

Break down additional charges separately, such as taxes and fees, to prevent confusion. Display the final amount in bold, making it easy to locate. If applicable, include payment terms and expiration dates.

Add a professional closing with your company’s contact information for any inquiries. A digital or handwritten signature reinforces authenticity. Save the document in a widely accessible format like PDF for easy sharing.

Best Practices for Presenting Costs and Terms

Use clear itemization. Break down costs into individual components to help recipients understand what they are paying for. List services or products separately with corresponding prices, avoiding bundled totals without explanations.

Highlight payment terms. Specify due dates, accepted payment methods, and any late fees in a dedicated section. Make these details easy to find to prevent misunderstandings.

Keep language simple. Avoid jargon or overly complex wording. Use straightforward terms so that customers can quickly grasp the details without needing clarification.

Include applicable taxes and discounts. Show tax amounts separately and apply discounts clearly to avoid confusion. A subtotal before taxes and a final total after adjustments improve transparency.

Provide a contact point. Offer a way for clients to ask questions or request adjustments. A clear point of contact builds trust and reduces the chance of disputes.