Creating a clear and accurate receipt for landscaping services helps maintain professionalism and transparency with clients. A well-structured receipt includes important details such as service description, cost breakdown, and payment terms. Start by listing the client’s name and contact information at the top of the document.

Include a thorough itemization of services rendered, such as lawn care, trimming, or installation of features. Break down each task with associated costs, including labor and material fees. Be sure to list the payment method used and any tax included in the final price. This helps clients understand what they are paying for and assures them that the charges are fair.

Make the receipt easy to read and organized. Use bold headers for sections like “Service Details,” “Payment Information,” and “Total Amount.” A concise and straightforward layout will help clients quickly find relevant information. Don’t forget to include your business name and logo for branding consistency.

Finally, keeping a copy of each receipt for your records ensures you can track payments and services over time. This can be helpful for tax purposes and to resolve any potential disputes with clients. Keep your receipts professional, clear, and consistent for a trustworthy image in the industry.

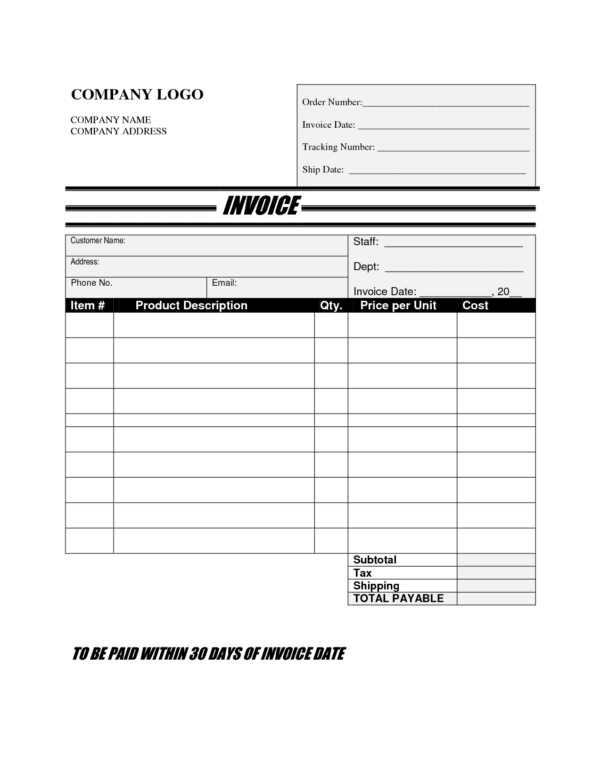

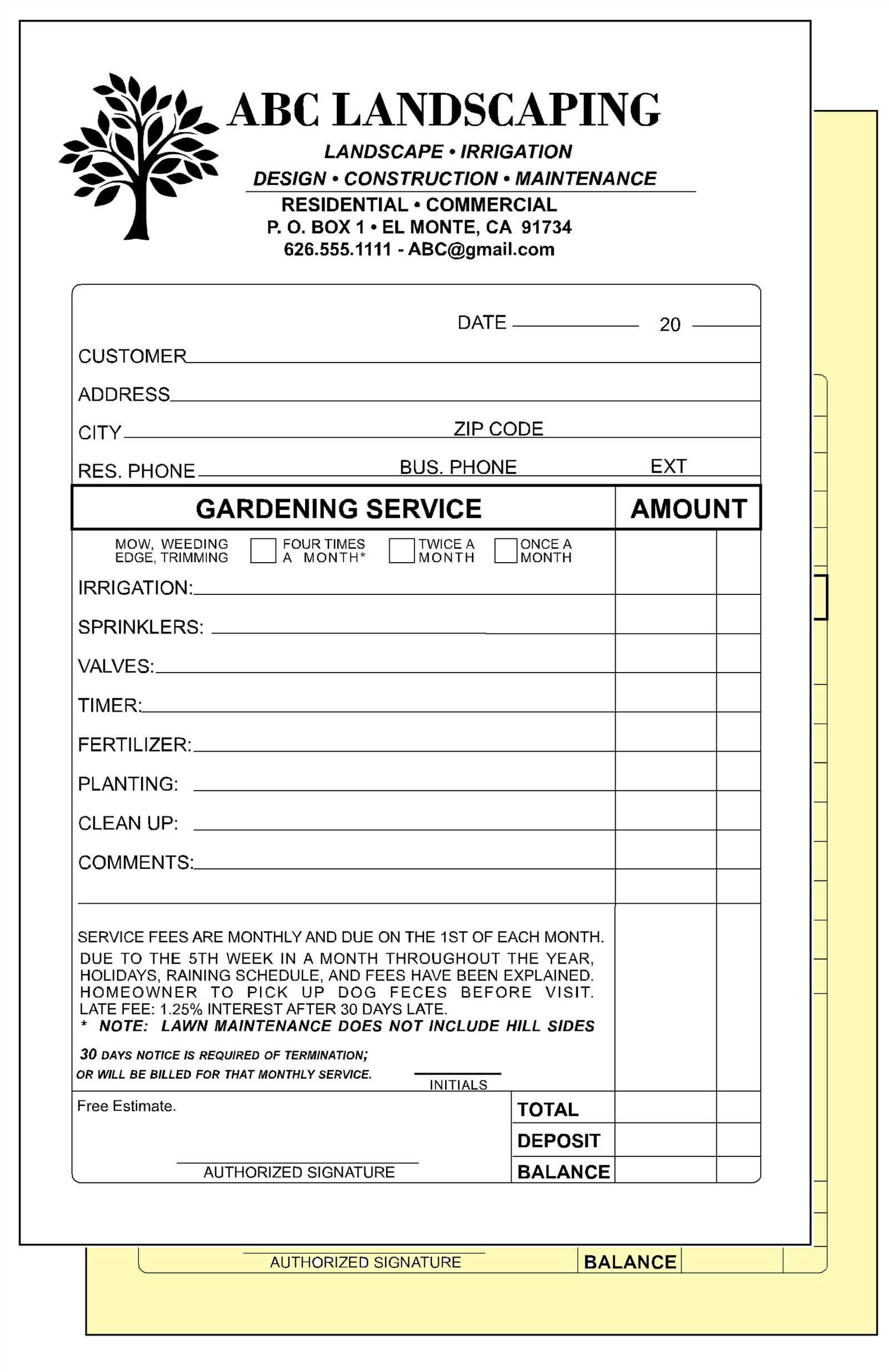

Template for Landscaper Receipt

A clear and professional receipt helps maintain transparency and track financial transactions. Use the following format to create a simple, yet effective receipt for landscaping services.

- Business Information: Include the full name of your landscaping business, address, phone number, and email. If applicable, add your business license number.

- Customer Details: Include the customer’s name, address, and contact information.

- Receipt Number: Assign a unique number to each receipt for easy reference and organization.

- Service Date: Mention the date when the landscaping services were completed.

- Services Provided: List all the tasks completed, such as lawn mowing, hedge trimming, or garden design. Be specific about each service.

- Itemized Charges: Break down the costs for each service provided, including labor, materials, and any additional charges.

- Subtotal: Add the total cost of all services before tax.

- Tax: Apply the appropriate sales tax based on your local tax rates.

- Total Amount Due: Display the final amount the customer owes, including tax.

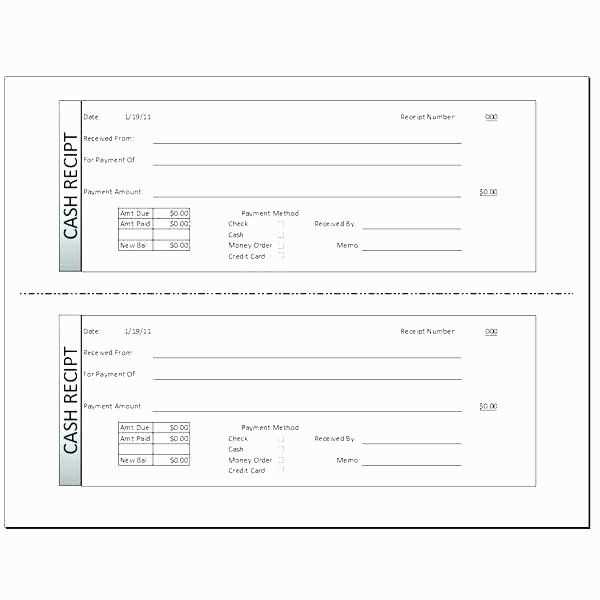

- Payment Method: Specify the payment method (cash, check, credit card, etc.) and note if the payment has been received.

- Thank You Message: A short message to thank the customer for their business.

This template ensures clarity and helps keep records in order. Make adjustments as necessary based on the specific needs of each transaction.

How to Include Service Details in Your Receipt

Clearly outline the services provided with specific descriptions. Include the type of service, such as “mowing,” “fertilization,” or “tree trimming,” and any additional tasks performed during the session. For each service, mention the duration and location, if relevant.

Break down the charges for each service, including any additional fees like equipment rental or disposal charges. This transparency ensures that the client understands exactly what they are being billed for.

If applicable, list any special products or materials used during the job, such as fertilizers, mulch, or plants, with corresponding costs. Provide a brief description of these products to clarify their purpose and value.

Include any discounts or promotions applied to the total amount. Be clear about how these reductions are calculated, whether it’s a percentage off or a flat rate. This helps the client see the value they received.

Finally, ensure that the service date, your business details (name, address, and contact information), and payment terms are clearly presented. This makes it easy for your client to contact you if needed and confirms the professionalism of your business.

Formatting Payment Information for Clarity

Clearly formatted payment details help clients understand their charges and avoid confusion. Start by listing each service or product with its corresponding cost. Break down complex charges into simple line items with a brief description next to each amount.

Itemizing Costs

When listing services, include specific details like labor hours, materials, and any additional fees. For example, instead of a general “yard work,” itemize the specific tasks: “tree trimming: $50,” “mowing: $30,” “mulching: $40.” This method helps clients track what they are paying for.

Including Payment Terms

Make sure to clearly state payment terms, including due dates, late fees, and accepted payment methods. For instance, “Payment due within 30 days” or “Late fee of 10% applies after 30 days.” This ensures transparency and sets expectations for both parties.

Double-check that all amounts are correct and consistent with the agreed-upon pricing. Presenting information clearly can help build trust and prevent misunderstandings.

Providing clear payment information reduces follow-up inquiries and makes the transaction process smoother for both you and your clients.

Legal Considerations When Issuing Receipts

Always include accurate details such as the date of the transaction, the amount paid, the description of services, and any applicable taxes. Providing this information helps avoid future disputes and ensures transparency for both parties involved.

Check local laws to ensure compliance with the specific requirements for receipts in your jurisdiction. Some areas may require receipts for certain types of transactions, while others may have particular formatting rules. Knowing these requirements prevents legal issues down the road.

Offer both physical and digital copies of receipts to customers. Many people prefer a physical receipt, but offering an electronic version can be a more sustainable and convenient option. Always ask customers for their preference to ensure satisfaction.

Store records properly for tax purposes and potential audits. Receipts act as a record of income, so maintain them for the legally required duration. This will help you avoid penalties and provide documentation if needed.

Ensure accuracy in tax information. If you’re collecting sales tax, the amount should be clearly listed on the receipt, and the tax rate should be correctly applied to the total cost of services. Failing to include tax details can lead to legal and financial complications.