Setting Up a Clear Structure

Begin by organizing all necessary fields in a simple, easy-to-follow structure. Include the transaction date, vendor name, total amount, and payment method. Make sure to add any additional fees, taxes, and a breakdown of items or services purchased.

Key Fields

- Date: Always record the exact date of the transaction.

- Vendor Name: Include the name of the business or individual receiving the payment.

- Total Amount: Clearly display the total cost of the transaction, including taxes.

- Payment Method: Specify whether the payment was made with cash, card, or another method.

- Item or Service Details: Break down the purchased items or services, with quantities and prices, for clarity.

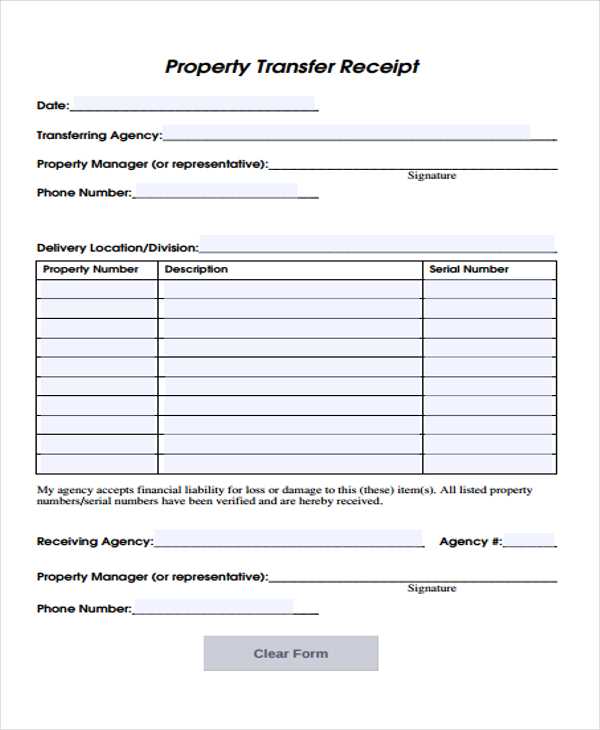

Templates for Various Scenarios

For specific purposes, create separate templates that focus on particular aspects, like tax reports or reimbursement requests. This helps to streamline record-keeping and simplifies accessing relevant information later.

Making Use of Templates

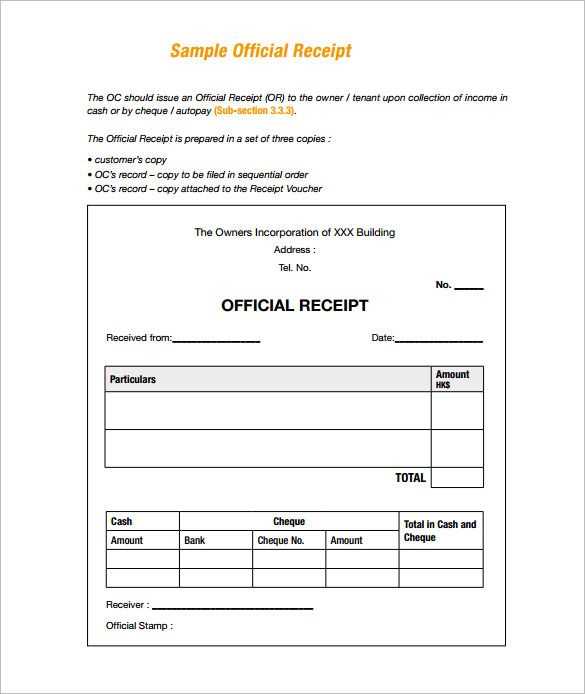

Standardize the format by using pre-made templates or custom forms that align with your specific needs. Whether it’s for business expenses, personal budgeting, or tax preparation, a structured template speeds up data entry and ensures consistency.

File Formats

Choose a format that works best for your needs–spreadsheets, PDFs, or even cloud-based tools. Spreadsheets are great for tracking multiple receipts over time, while PDFs are better suited for fixed, official receipts.

Tracking and Storing

- Physical Storage: Use folders or filing systems to keep paper receipts organized by date, type, or vendor.

- Digital Storage: Scan and store receipts in cloud storage services, making them easily accessible from any device.

- Tagging and Categorization: Add tags to receipts to make them easier to search and organize in your files.

Template for Managing Receipts

Creating a Standardized Format for Your Business

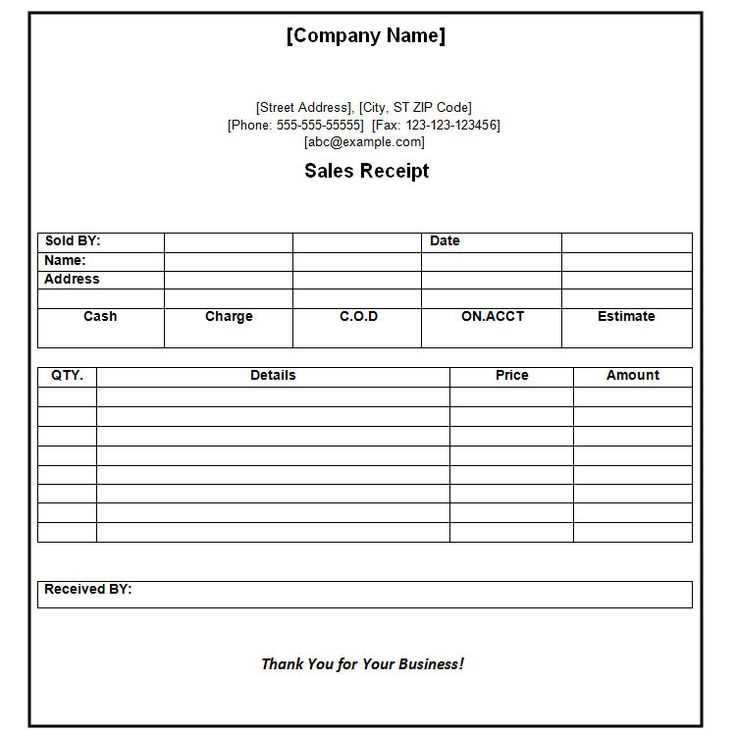

Designing the Layout: Essential Fields to Include in Each Receipt

Automating the Generation Process of Receipts

Integrating Receipt Templates with Accounting Systems

Tracking and Storing Receipts Digitally for Easy Access

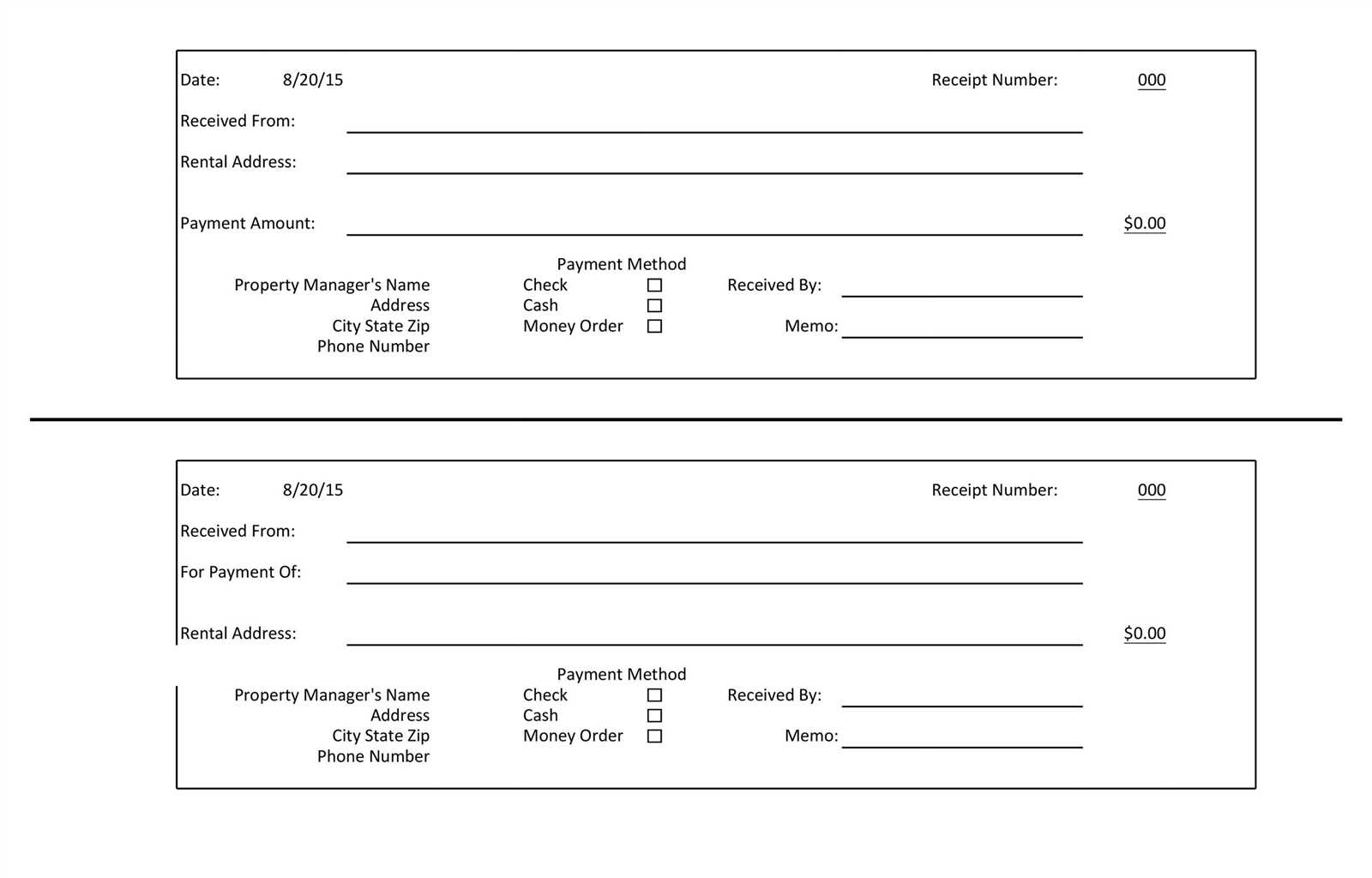

Customizing Receipts for Various Transaction Types

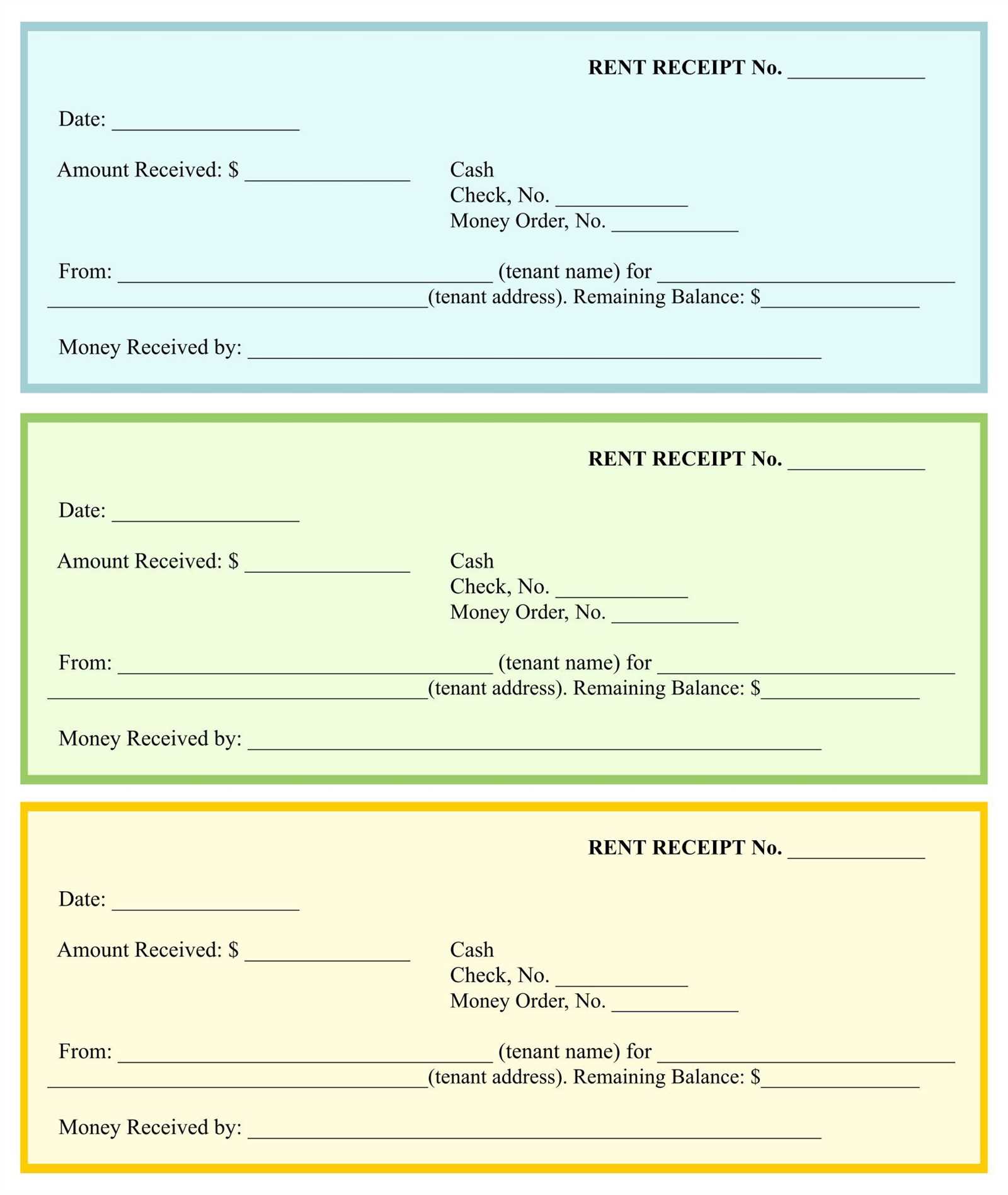

Standardizing the format for receipts streamlines your business operations. The key fields to include in any receipt template are: transaction date, receipt number, customer details, list of purchased items with prices, applicable taxes, total amount due, payment method, and the signature or confirmation of the transaction. This structured approach ensures clarity and consistency, minimizing errors in record-keeping.

Automating the Generation Process of Receipts

To speed up the process, use receipt-generation software that can auto-fill customer details, item lists, and tax calculations. Integration with your sales system allows for real-time receipt creation after each transaction, reducing manual input. Set up your system to automatically email or print receipts immediately after payment is completed. This minimizes customer wait time and eliminates human error.

Integrating Receipt Templates with Accounting Systems

Integrating your receipt template with accounting software ensures seamless financial record-keeping. Automate the process by syncing receipts with your accounting system to eliminate the need for manual data entry. Each receipt should be recorded under its respective transaction category and linked to specific customer accounts for easy tracking during audits and reporting periods.

Digitally storing receipts is a practical solution for quick access and long-term organization. Use cloud storage or dedicated software to save each receipt in a digital format. This prevents clutter and makes it simple to retrieve receipts anytime for customer inquiries or tax filing. Implement a search function to quickly locate receipts by date, amount, or customer name.

Customize your receipts for different transaction types. Sales receipts may require more detail, including item descriptions and quantities, while refund receipts should highlight the reversal of charges. Service-based transactions might need a breakdown of labor charges, and digital transactions could benefit from a payment confirmation or transaction ID to ensure completeness and clarity.