A Template in Kind Receipt is a document that confirms the donation of goods or services, as opposed to cash. This type of receipt is crucial for maintaining clear records for both the donor and the recipient. It serves as proof of the transaction, which is often necessary for tax purposes and internal accounting. When drafting such a receipt, it’s important to include specific details to ensure clarity and transparency.

Begin by including the donor’s name and contact information, as well as the description of the donated items or services. This ensures the receipt is tied directly to the specific goods provided. Clearly note any agreed-upon value of the items or services, even if this is an estimate based on fair market value, which may be required for tax deductions.

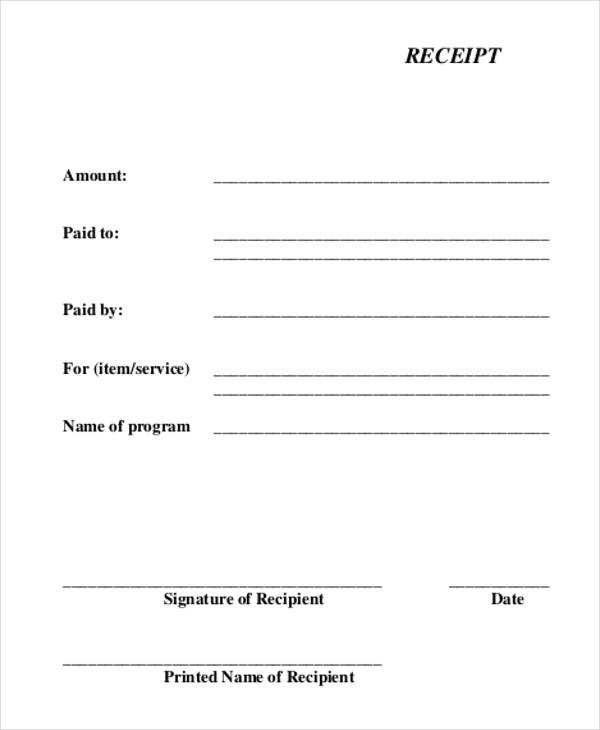

Additionally, include the date of donation and any terms or conditions associated with the contribution. It’s also helpful to add a statement confirming that no goods or services were provided in return for the donation, which may be necessary for tax deduction eligibility. Finally, both the donor and recipient should sign the document, confirming the transaction details.

Here’s the corrected text:

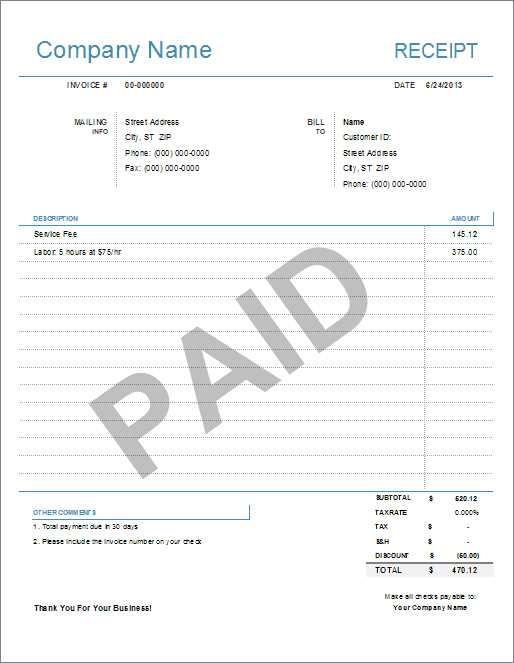

Ensure that your template clearly specifies the items being received and the corresponding quantities. Include accurate dates to avoid confusion. The recipient’s name and contact information should be updated to reflect the current details. If there are any special conditions or notes, make sure these are included to prevent misunderstandings. Double-check all fields for errors before finalizing the receipt to ensure a smooth transaction.

It’s crucial to record both the sender and recipient’s signature to confirm the receipt. This provides a reliable way to verify that the items were successfully received. Always make sure to keep a copy of the document for your records, either digitally or in print, for future reference.

When filling out the receipt, use clear and concise language. Avoid ambiguous terms that might lead to misinterpretation. If applicable, specify any expected delivery times or special instructions, and make sure that the template includes space for any additional comments or discrepancies that need to be noted.

Template for an In-Kind Receipt

How to Create an In-Kind Receipt Template

Legal Requirements for In-Kind Donations

Key Information to Include in an In-Kind Acknowledgment

Common Mistakes to Avoid When Issuing Receipts

Best Practices for Documenting Donated Items

Using In-Kind Receipts for Tax Benefits

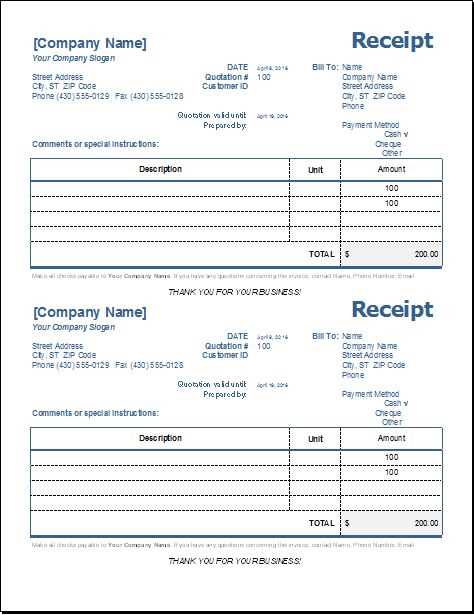

To create an accurate in-kind receipt, ensure it includes the donor’s name, address, and contact details, the description of the donated items, their estimated fair market value, and the date of the donation. The receipt should also state whether any goods were provided in exchange for the donation. Keep the format simple, clearly listing the donation information.

Legal guidelines require a written acknowledgment for any in-kind donation over $250 in value. This acknowledgment should specify the donated goods, confirm no goods or services were provided in return, and include a statement of the donor’s understanding of this. For donations under $250, a simple receipt can suffice, but it’s still a good idea to include similar details as a best practice.

Acknowledging donations must include these key elements: donor’s name and contact information, description of the item(s), estimated value, and date of receipt. For tax purposes, it’s necessary to include a statement that no goods or services were exchanged. It’s also helpful to provide an option for the donor to claim the value of the donation when possible.

Avoid common mistakes like failing to specify the donation’s fair market value, not including the donor’s information, or neglecting to mention the absence of goods or services provided. Ensure the donation is described accurately, with clear details that align with the donor’s statement.

To document donations correctly, always record the exact details of each item, its condition, and an accurate valuation. For items like clothing or electronics, provide a brief description of the brand, model, and condition to avoid confusion. When applicable, request the donor’s help in determining the fair market value.

In-kind receipts can be helpful for tax purposes. Donors can claim the fair market value of items donated to a qualified nonprofit organization. Ensure your receipt provides all the details needed for the donor to substantiate their tax deduction, including the acknowledgment of no goods or services exchanged and the estimated value of the donation.