Key Elements to Include

A paid receipt should include specific details to confirm the transaction. Ensure you list the following components:

- Receipt Number: A unique identifier for tracking purposes.

- Transaction Date: The exact date when the payment was received.

- Payment Method: Whether it was made by cash, credit, debit, or another method.

- Amount Paid: The total payment received for the transaction.

- Goods or Services Provided: A description of the items or services purchased.

- Payee Information: Name and contact details of the entity or person receiving the payment.

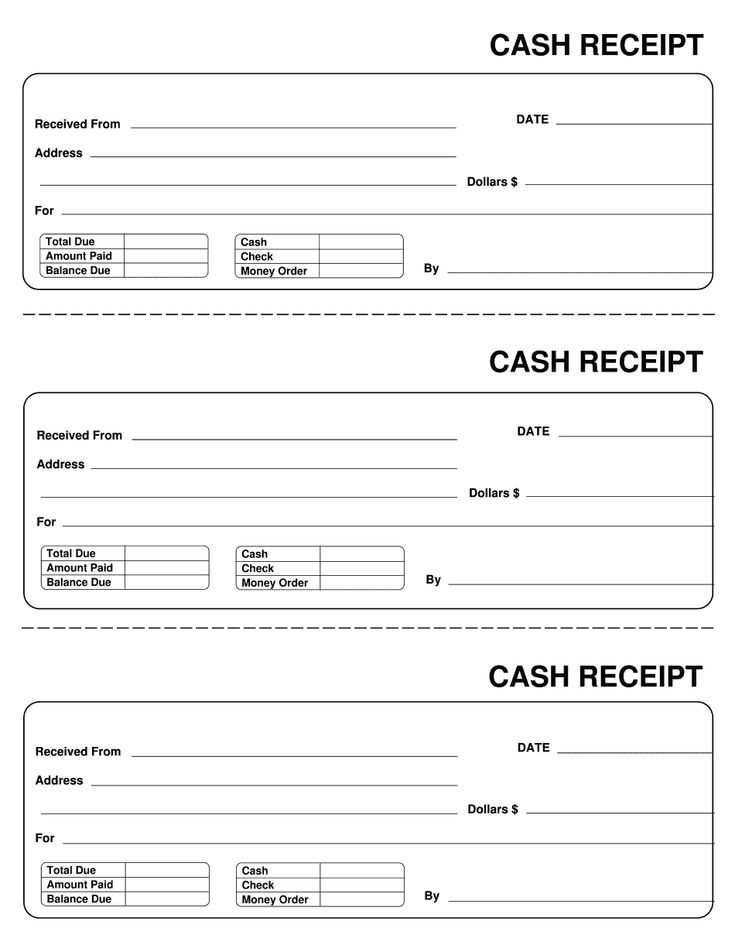

Template Example

Here’s a simple structure for a paid receipt:

Receipt No: [Unique Number] Date of Payment: [MM/DD/YYYY] Payee: [Company Name / Individual] Contact: [Phone Number / Email Address] Payment Method: [Cash / Credit / Debit] Amount Paid: $[Amount] Goods/Services Provided: [Description of Purchase]

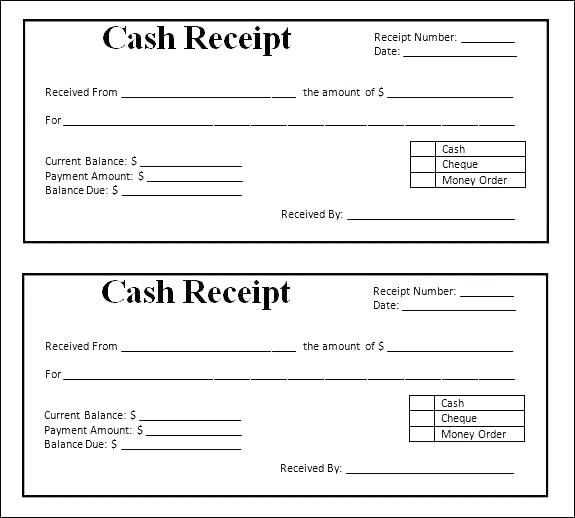

Adding Additional Details

Consider adding the following details, depending on the nature of the transaction:

- Taxes: If applicable, show the tax amount separately.

- Discounts: List any discounts applied to the transaction.

- Invoice Reference: Link to the original invoice if relevant.

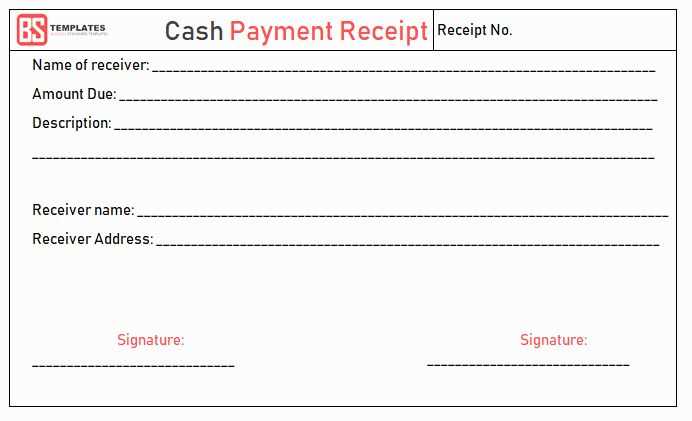

Customizing for Your Business

For businesses, it’s helpful to include your logo, business name, and physical address for a professional touch. This helps reinforce your branding while keeping receipts functional and clear.

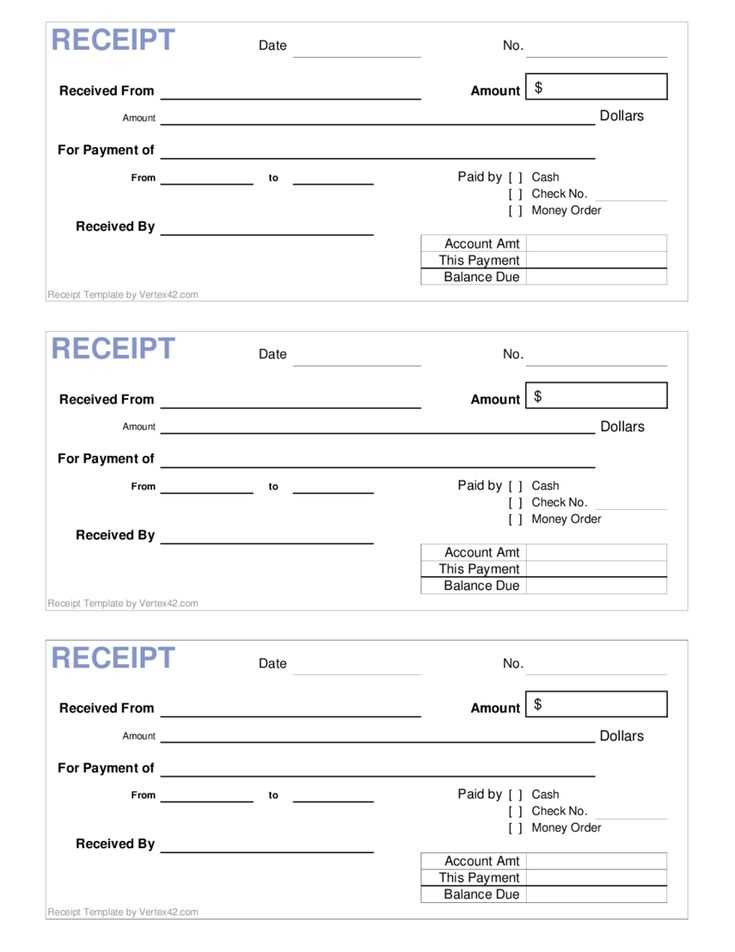

Template of Paid Receipt

Creating a paid receipt template requires attention to several key components. Ensure it includes the name and contact details of your business, the recipient’s information, and a clear description of the goods or services provided. Always include the total amount paid, the payment method, and the date of transaction. A unique receipt number helps in organizing records.

The format of the receipt should be simple and structured, listing the items or services individually with prices, taxes, and any discounts applied. If applicable, include the transaction ID or invoice number for cross-reference.

From a legal perspective, ensure that the receipt complies with the local regulations, which may require specific information such as tax identification numbers or business registration details. Providing clear terms regarding refund or exchange policies can also be beneficial.