When you need a Home Depot receipt template, it’s straightforward to create one that mirrors the original format. The key elements include the store name, address, date of purchase, list of items, individual prices, and the total amount. Each of these details must be presented clearly for clarity and accuracy.

Include the Home Depot logo at the top of the template, followed by the store’s location and contact information. Under this, provide the transaction date and time. Next, list the purchased items, showing the quantity, item description, unit price, and total price for each item. At the bottom, make sure to show the subtotal, applicable taxes, and the final total.

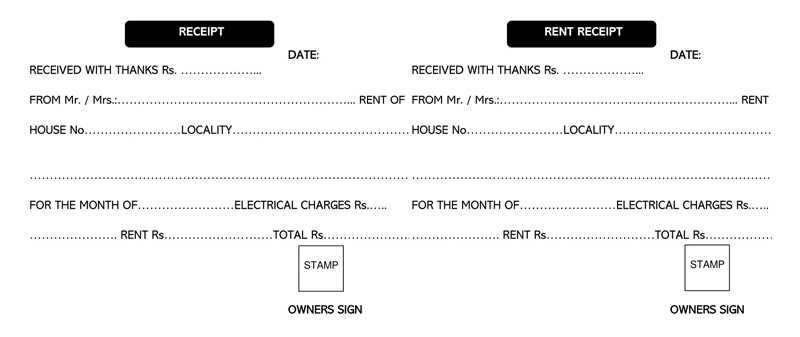

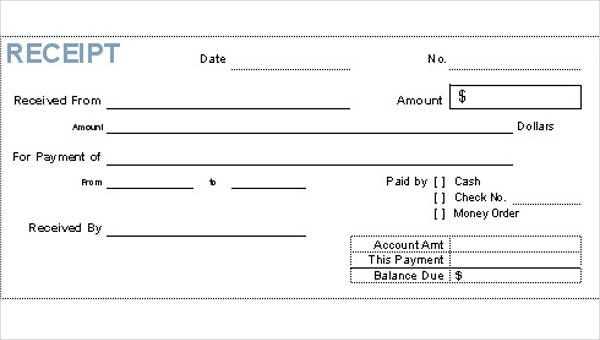

To make the template user-friendly, use a clean layout with sufficient space between sections. This ensures easy readability and helps mimic the format found in actual receipts. Ensure all numbers, especially totals and taxes, are aligned and formatted consistently.

Here’s a revised version, keeping the original meaning and avoiding repetition:

To improve the clarity and flow of your Home Depot receipt template, focus on the following key points:

- Ensure the receipt contains clear headings such as “Itemized List”, “Subtotal”, and “Total”, making it easy for customers to navigate.

- Include details like product names, quantities, prices, and taxes in a simple, consistent format.

- Provide a clear date and time of purchase, as well as the location and store number, to make the receipt traceable.

- Use bold text for important numbers such as the total amount to be paid and any discounts applied.

- Incorporate space for payment information (e.g., credit card or cash) for quick reference.

By implementing these changes, the template will present the necessary information in a clean, organized manner, helping customers understand the receipt easily.

- Template of a Home Depot Receipt

Receipt Layout: A typical Home Depot receipt includes several key sections. The store’s logo is prominently displayed at the top, followed by the store’s name, address, and contact information. Just below this, the receipt lists the date and time of the transaction, the cashier’s name or ID, and the transaction number.

Itemized List: Each item purchased is shown in a detailed list. The item description is followed by the quantity, price per unit, and total price. Sales tax is added, and the total cost is calculated at the bottom of this section.

Payment Details: After the itemized list, the payment method is noted. This section may include information about the card type, last four digits of the card number, or cash tendered. It also displays the total amount paid.

Return Policy & Customer Service: The bottom of the receipt often features a brief section outlining Home Depot’s return policy and providing customer service contact information for any inquiries or issues with the purchase.

Begin by looking at the top of the receipt. It contains the store’s name, location, and date of purchase. These details help verify the transaction and identify the specific store where you shopped.

Understanding the Itemized List

Each item on the receipt is listed with its name, quantity, price, and any discounts applied. Check for correct prices and quantities to ensure there are no errors in your purchase.

Tax Information

At the bottom of the receipt, you’ll find tax details. The total tax amount is calculated based on the subtotal, and sometimes, you may see itemized tax amounts depending on local regulations.

Finally, look at the total amount due. This includes all items, taxes, and discounts. Ensure the total matches what you expect before leaving the store or completing a return.

The itemized list on a Home Depot receipt breaks down every product and service purchased. Each item is listed separately with its price, making it easier to check the accuracy of your purchase. Look for the description of the item, the quantity, and the individual price. Discounts or promotions applied to specific items will be noted as well.

Verify product details to ensure you’ve been charged correctly. If any items appear with incorrect quantities or prices, contact customer service to resolve the issue. Each line also shows sales tax, which is calculated based on the subtotal of eligible items.

Keep an eye on the “total” section, which sums up the cost of all the items, including taxes and discounts. This ensures that you’re paying the right amount for everything purchased. Double-check if there are any additional fees or adjustments that affect the final price.

Find discount and coupon information towards the bottom of the receipt. Typically, it appears after the itemized list of products purchased. Look for sections labeled as “Coupons”, “Discounts”, or “Savings”. These areas highlight any applied discounts or coupon codes.

If you used a digital coupon or a special promotion, the receipt will usually display the discount percentage or the amount saved. Check for any additional messages such as “Applied Promo Code” or a similar reference to the discount method.

Some receipts also show a breakdown of the original price, the discount applied, and the final price, helping you track all discounts used during the transaction.

Locate the section labeled “Payment” or “Method of Payment” on the receipt. This section typically lists the payment methods used for the transaction, such as credit card, debit card, cash, or gift card. Look for lines indicating the last four digits of the card number or a description like “Cash” or “Gift Card” next to the payment amount. If the payment was split across multiple methods, each will be listed separately with the corresponding amount charged.

The total amount paid will be listed in the “Total” or “Amount Paid” section, usually at the bottom of the receipt. This amount includes any applicable taxes, discounts, and fees. In cases of multiple payment methods, check for any breakdown showing how much was paid with each method, ensuring all amounts add up to the total.

The Return and Refund section on a Home Depot receipt typically provides key details for processing returns or refunds. This includes the original purchase date, the items eligible for return, and the timeframe for returns. It often specifies any restocking fees and outlines the conditions under which the return can be accepted, such as product condition or packaging. If a refund was issued, the amount and payment method (e.g., credit card or gift card) are usually included. Look for a return authorization number or instructions for initiating the return process, which can help expedite the transaction.

Keep your Home Depot receipt handy when making a warranty claim. It serves as proof of purchase and verifies the item’s eligibility for a warranty. To proceed with the warranty claim, follow these steps:

- Check the Warranty Period: Look at the receipt for the purchase date. Ensure the item is still within the warranty period, which can range from 30 days to several years depending on the product.

- Verify Product Details: Cross-check the product details on the receipt, such as the model number, brand, and description, to make sure they match the item you’re claiming.

- Gather Required Information: Some manufacturers may request additional details, such as serial numbers or product codes. Make sure to collect this information, which is often printed on the receipt or product itself.

- Visit the Store or Manufacturer: Take the receipt and the faulty item to Home Depot or contact the product manufacturer. Home Depot staff will guide you through their claim process, while manufacturers typically have their own forms or websites to submit claims.

- Return or Repair: Depending on the warranty policy, you may be eligible for a repair, replacement, or refund. The receipt will be used to process your request quickly and correctly.

Ensure all receipts are stored safely to avoid delays or complications when filing a claim. If the receipt is lost, try to retrieve a digital version from your Home Depot account or credit card statements, though this may not always be accepted for warranty claims.

To format your Home Depot receipt template efficiently, ensure you structure all list items using the

- tag. This allows you to present the receipt data in a clear and organized manner. Each purchase item, total, tax, and any special discounts should be enclosed within

- tags inside the

- element.

Here’s an example of how you can structure the template:

Item Price Drill $49.99 Screws $5.99 Total $55.98 Tax $4.19 Grand Total $60.17 This method of organization is user-friendly and makes it easier to manage the items and amounts displayed on a receipt. It also improves accessibility for those reviewing the template in various formats, from HTML to PDFs.