Using template receipts streamlines your invoicing process and saves you time. These pre-designed formats allow you to quickly fill in necessary information, reducing errors and ensuring consistency in your business transactions.

Template receipts can be tailored to fit different types of businesses, whether you’re offering products or services. Adjust fields like item description, price, and taxes to meet your specific needs without creating a document from scratch each time.

Implementing a template also makes it easier to track payments and maintain organized records. With clear formatting and standardized fields, you can quickly reference any past transaction, saving you from potential confusion in the future.

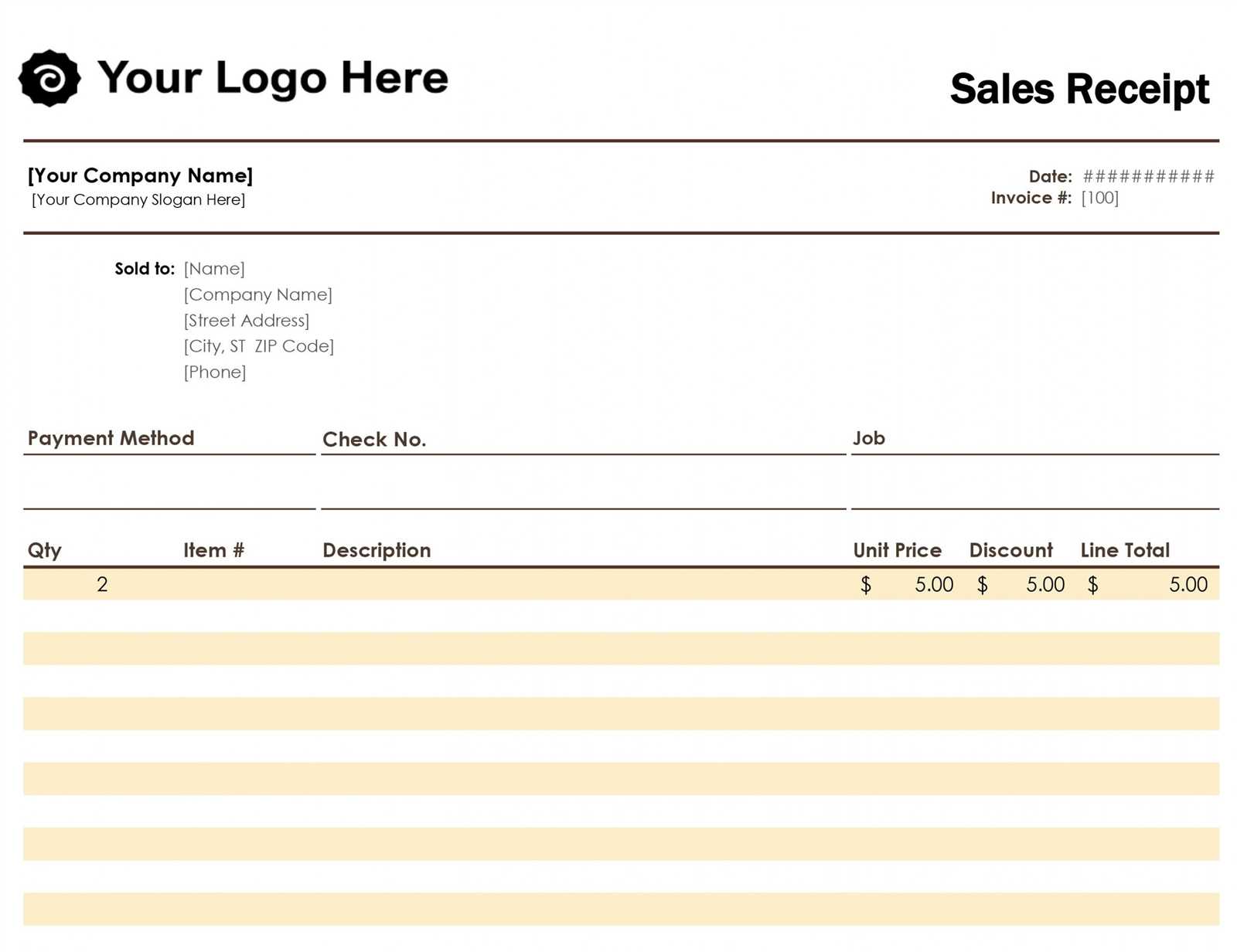

For businesses with frequent transactions, template receipts help maintain professionalism while making the process more efficient. Customize your templates with your business logo, contact info, and other branding elements for a polished look.

Template Receipts: A Practical Guide

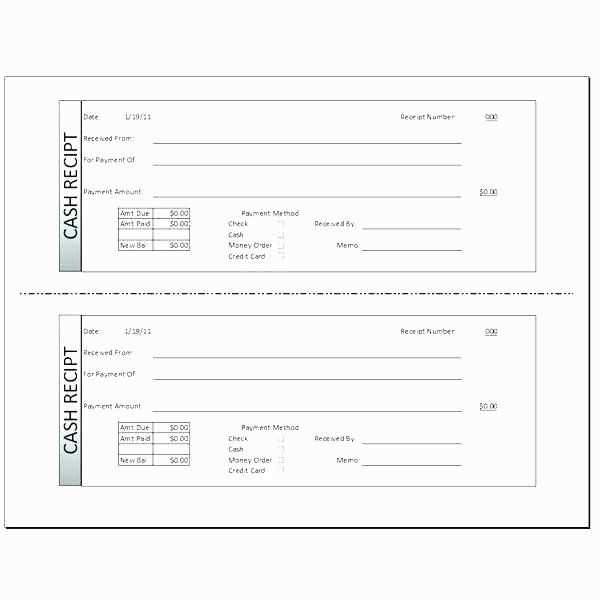

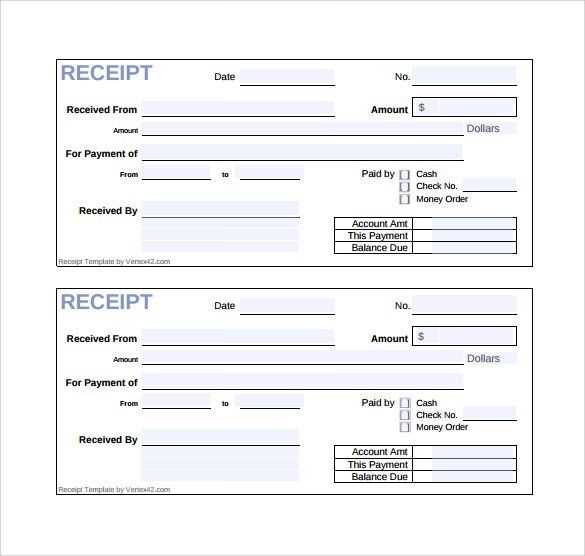

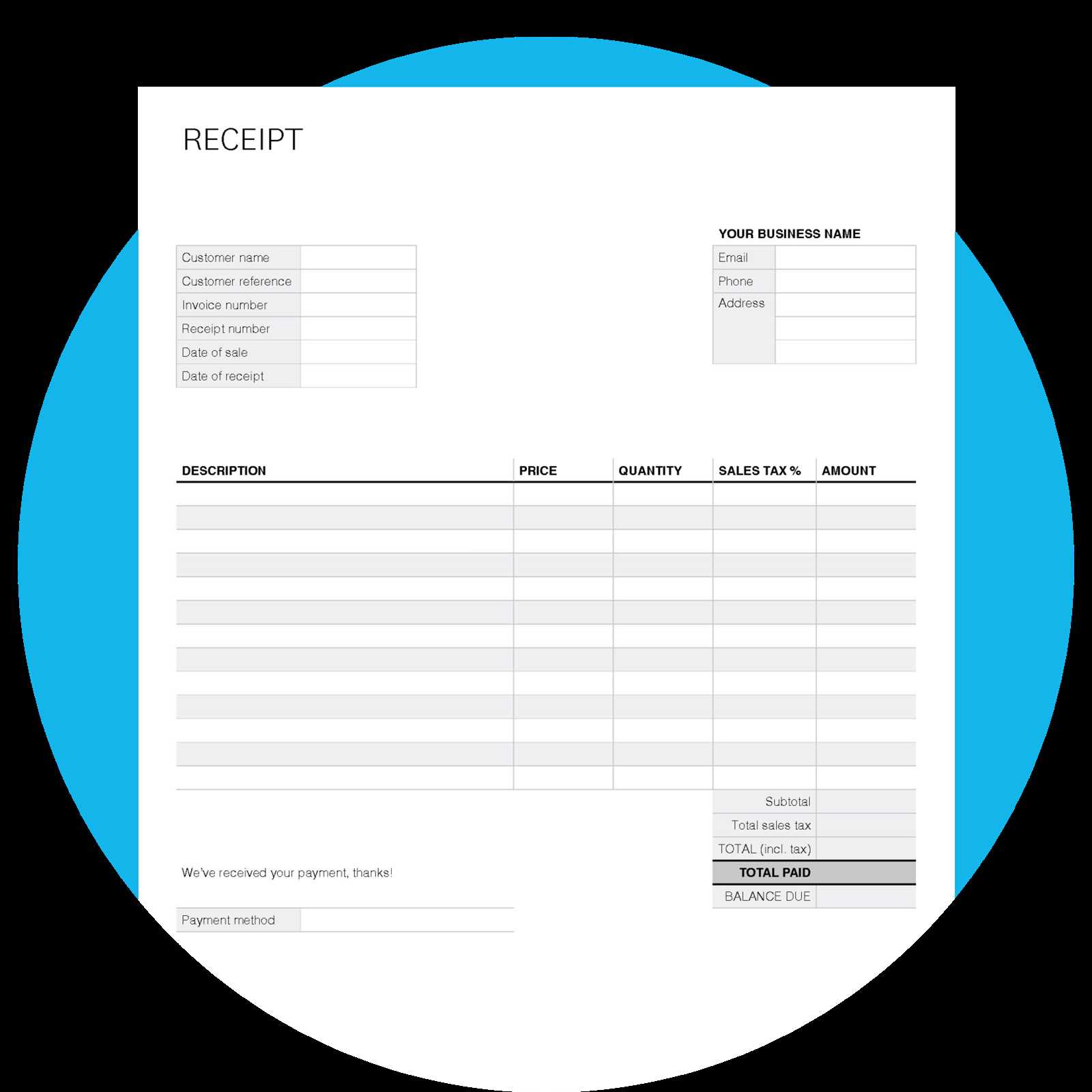

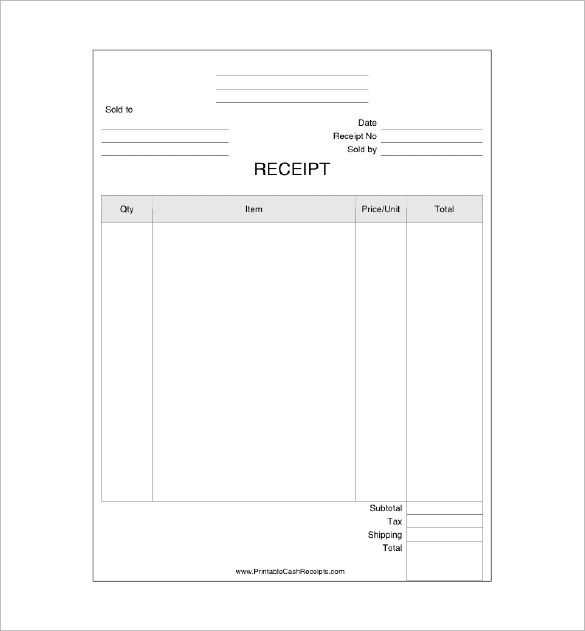

Use a template receipt to streamline your process, ensuring consistency and professionalism in every transaction. A well-designed template helps maintain clarity for both you and your customers, saving time and avoiding errors. Start by including key information: business name, address, contact details, date, and a unique transaction or invoice number. Also, list items clearly with corresponding prices, quantities, and totals.

When selecting a template, consider including customizable fields to suit different payment types and transaction scenarios. For example, if you offer discounts, make space for discount details. For better tracking, incorporate tax rates and breakdowns for transparency.

Consistency matters. Maintain the same format for every receipt to create a unified experience for customers. Ensure the template is mobile-friendly if you’re sharing it electronically. It should look just as professional on a screen as it does on paper.

Test your template by entering sample data. Adjust spacing, font size, and layout to enhance readability. Avoid cluttering the receipt with too much text, keeping only what’s necessary. This helps ensure your customer can easily understand the details of their transaction.

Finally, keep your templates stored securely. Using a cloud-based system allows easy access and editing when needed. Always back up important data to avoid loss or corruption of your templates.

Creating Custom Templates for Different Types of Transactions

Customize your receipt templates based on the transaction type to ensure clarity and consistency. Start by considering the specific information each type of transaction requires. For example, a sale receipt should focus on the items purchased, prices, and taxes, while a refund receipt will need to highlight the returned products and refunded amount.

- For retail sales, include product descriptions, quantities, individual prices, total cost, and applicable taxes. You may also want to add a payment method section to confirm whether the payment was made by card, cash, or another method.

- Refund transactions should have sections for the original purchase details, including the date, item(s) returned, and refund amount. Clearly indicate the refund policy and whether the refund is processed to the original payment method or as store credit.

- For service-based transactions, templates should highlight service details like time spent, hourly rates, and total service charges. Add space for service-specific terms and conditions if necessary.

- For donations or charity transactions, focus on donor information, the amount donated, and relevant tax-deductible details. Add the charity’s contact information and tax-exempt status for transparency.

Always design templates with space for custom notes or messages, which can vary depending on the transaction type. You may want to include customer feedback requests or thank-you messages, depending on the context.

Finally, ensure that your templates are adaptable. It’s helpful to build a framework that allows for quick edits or changes depending on the type of transaction. This flexibility will help avoid the need to create new templates for each individual case.

Integrating Template Receipts with Accounting Software

Link your template receipts directly with accounting software to save time and reduce errors in data entry. This integration allows automated data transfers, reducing manual work and enhancing accuracy in financial reporting. Choose accounting software that offers API connections or third-party integrations with receipt management tools. By setting up seamless synchronization, you can ensure that every receipt entered into the system automatically updates the corresponding ledger or expense category in the accounting software.

Ensure the format of your template receipts matches the software’s input requirements. Some systems may require specific fields like tax identification numbers, expense categories, or date formats. Double-check that your template includes all necessary data to avoid missing entries or errors during the import process.

Automating data imports from receipts into your accounting system allows faster reconciliation and simplifies auditing. It’s also helpful to customize templates to categorize expenses based on the needs of your business. For example, you can create templates for different expense types, such as travel or office supplies, that align with your accounting system’s chart of accounts.

Finally, regularly review and update the integration settings to accommodate any changes in accounting software features or tax laws. This ensures your workflow remains efficient and compliant with any regulatory changes that could affect your records.

Ensuring Legal Compliance and Tax Requirements in Templates

When creating receipt templates, it’s critical to include specific details that comply with tax laws and legal regulations. Always ensure that each template contains the business’s official name, address, and tax identification number (TIN). This helps establish legitimacy and aligns with requirements in many jurisdictions.

Make sure the template includes clear information on the transaction, such as the items or services provided, the price, applicable taxes, and the total amount due. Tax rates should be accurately calculated according to local laws. For instance, some regions may require a breakdown of VAT (Value Added Tax), while others may have different sales tax rules.

Incorporate a section that identifies the payment method, whether it’s by credit card, cash, or another method. This can support both consumer rights and tax auditing processes. Keep records of all receipts generated from templates to ensure your business stays compliant in case of future audits or legal inspections.

Regularly update your templates to reflect changes in tax laws, including new tax rates or adjustments. Failure to keep templates up-to-date can lead to discrepancies that may trigger penalties or legal issues.

Finally, consider consulting with a legal or tax professional to ensure full compliance with local regulations. While templates provide convenience, they must also adhere to the applicable legal and financial requirements for businesses and consumers alike.