Creating a clear and professional tax receipt is crucial for businesses of any size. Whether you’re issuing receipts for donations, services, or purchases, a well-structured template ensures accuracy and saves time. Make sure the receipt includes all necessary details such as the amount paid, date, and a clear description of the transaction.

Start with basic information: The template should have spaces for the recipient’s name, address, and tax identification number (if applicable). Include the transaction date, payment method, and a breakdown of services or goods provided. The more specific you are, the better.

Include tax information: A key element of a tax receipt is the tax amount. Clearly outline the tax rate applied and the total tax charged. This ensures compliance with local tax laws and helps recipients track their expenses accurately.

End with a professional signature or statement: A formal closing on the receipt adds credibility and reinforces the professionalism of your business. A signature, or a simple statement indicating the receipt is official, works well.

Here are the corrected lines:

To ensure clarity and accuracy in your tax receipt template, make sure the following adjustments are made:

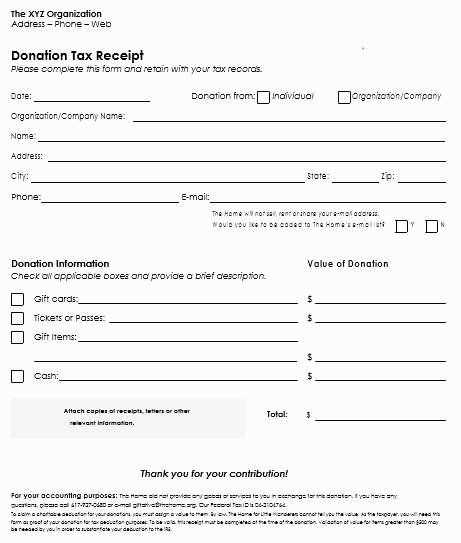

- Invoice Number: Verify that each receipt includes a unique invoice number to help both parties track transactions easily.

- Date of Issue: Always include the exact date the receipt is issued. This helps with record-keeping and audit trails.

- Amount Paid: Clearly state the total amount paid, including any applicable taxes, fees, or discounts.

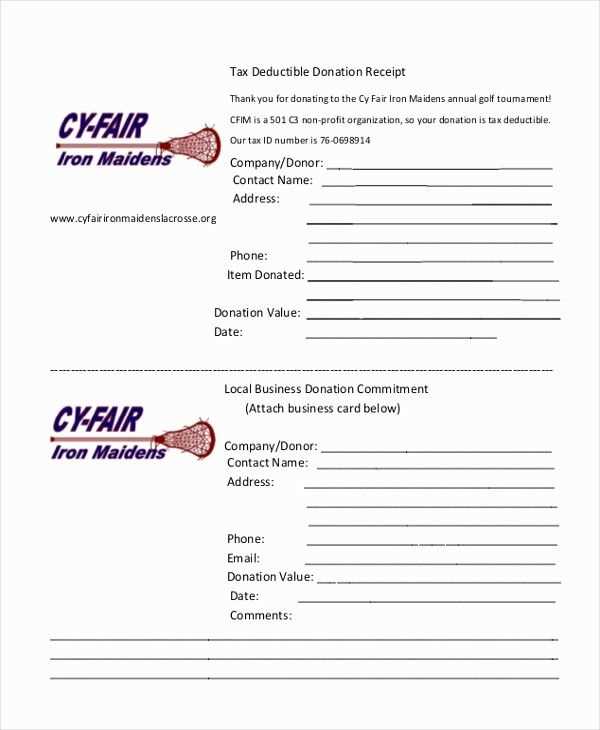

- Donor Information: Ensure the donor’s full name and contact details are correct, as this is required for tax reporting purposes.

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, bank transfer). This helps with verifying transactions.

- Purpose of Donation: If applicable, include a brief description of the purpose for which the payment was made (e.g., charitable donation).

- Legal Disclaimer: Include any necessary disclaimers or legal statements related to tax-deductible donations, as required by local laws.

Each of these elements will make your receipt more precise and user-friendly for both your records and the donor’s tax filing needs.

- Template Tax Receipt: Practical Guide

To create a clear and legally compliant tax receipt, follow these key steps:

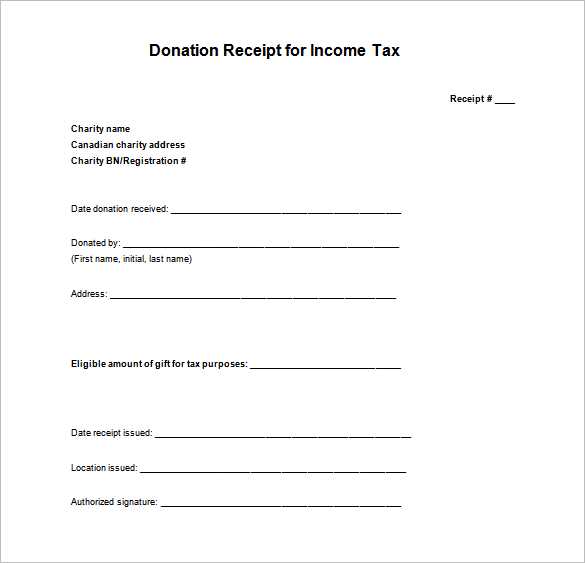

1. Start with Header Information: Include the name, address, and contact details of the organization issuing the receipt. Ensure the tax identification number (TIN or EIN) is clearly stated. This helps both the donor and tax authorities confirm the authenticity of the document.

2. Date of Donation: Always specify the exact date the donation was received. This helps establish the timeline for tax reporting purposes.

3. Donor Details: List the full name and address of the donor. If the donor is an individual, include any relevant identification, such as a donor ID, for additional reference. If it’s a business donation, include the business name and tax ID number.

4. Description of the Donation: Provide a clear description of the item(s) donated or the total monetary value. If goods were donated, include the condition and a brief summary of the items. For cash donations, specify the exact amount given. If services were donated, a description of the nature and scope of the service should be included.

5. Value of Donation: For non-cash gifts, either the donor should provide an estimated value, or your organization must estimate it. Be specific about how the value was determined, as it may be questioned later. Keep detailed records of how the value was calculated for transparency.

6. Statement of No Goods or Services Provided: If no goods or services were exchanged for the donation, clearly state this. A sample phrase could be: “No goods or services were provided in exchange for this donation.” This statement is crucial for the donor’s tax deduction eligibility.

7. Signature: Sign the receipt or include a section for an authorized representative of your organization to sign. This ensures the authenticity of the receipt and verifies that it’s issued by an authorized entity.

8. Formatting and Clarity: Keep the receipt professional and easy to read. Organize the content logically and use bullet points, headings, or bold text where appropriate to enhance readability. Avoid any complicated jargon, and ensure all information is accurate and verifiable.

By following these steps, you can create a straightforward and compliant tax receipt that helps donors claim deductions while protecting your organization from any future issues with tax authorities.

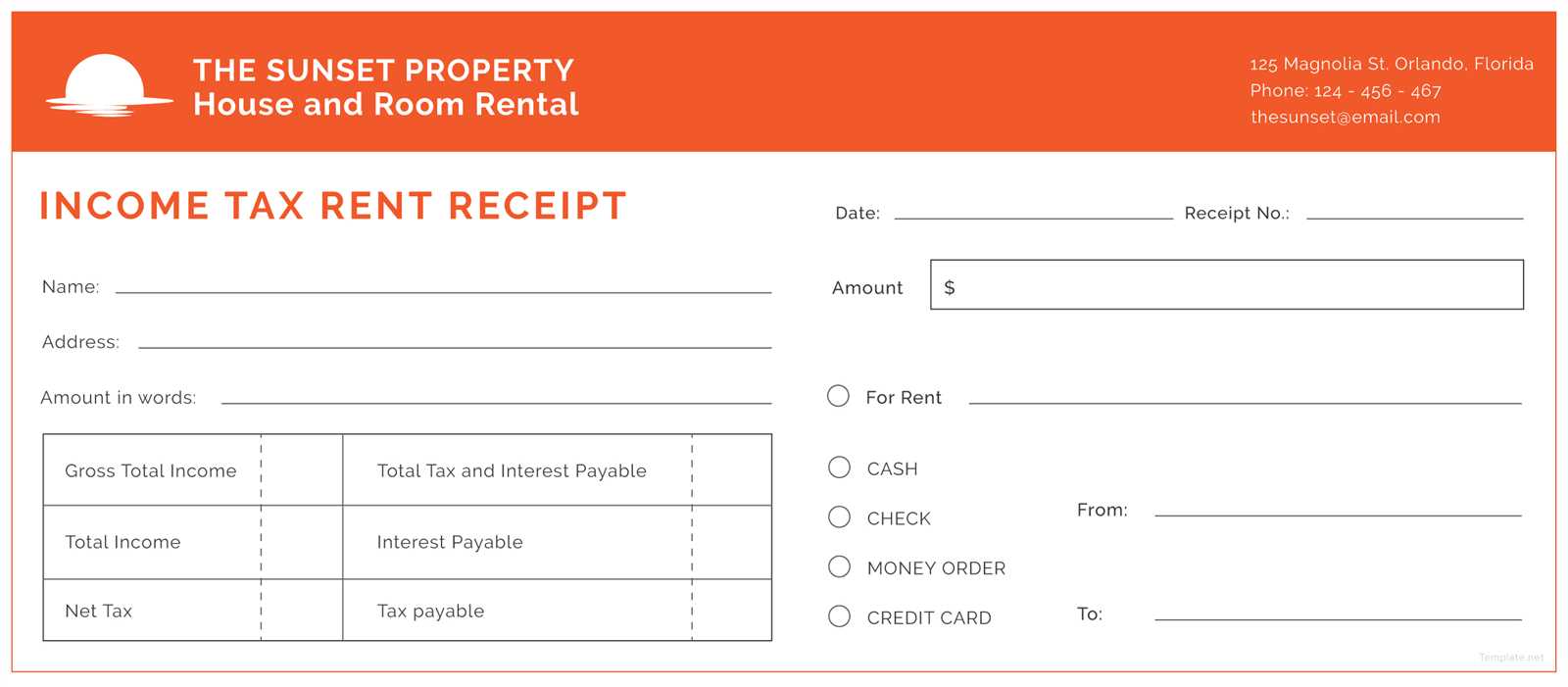

To create a tax receipt template for your business, include key details such as the company name, address, and tax identification number (TIN). These components make it easy for both you and your customers to track the transaction for tax purposes.

Start with a clean and simple layout. Ensure that your template is easy to fill out manually or automatically. Include the following fields:

| Field | Description |

|---|---|

| Receipt Number | Assign a unique number to each receipt for easy reference. |

| Date of Transaction | Include the exact date the transaction took place. |

| Customer Name | Record the name of the person or business making the purchase. |

| Amount Paid | Include the total amount paid, along with any applicable taxes. |

| Description of Goods/Services | Describe the products or services sold in the transaction. |

| Tax Rate | Indicate the tax rate applied to the purchase. |

| Payment Method | Specify whether the payment was made by cash, card, or another method. |

| Signature | Provide space for signatures from both parties, if necessary. |

Once you have all the fields, ensure your logo and business contact information are at the top. This not only builds brand recognition but also makes the document official. Add a disclaimer or additional legal language if required by local laws.

To ensure uniformity, use the same template for every transaction. Consider using a word processing or spreadsheet software to create an easily editable version. If your business is online, you can set up an automated system to generate receipts with minimal input.

Finally, store the receipts electronically or in print for future reference and compliance with tax regulations.

Tax receipts must meet specific legal standards to be valid. Each receipt must include essential details, such as the date of the transaction, the amount paid, and the name or business of the payer. Be sure to also include the business’s tax identification number, which validates the legitimacy of the receipt. This helps both the payer and recipient during tax reporting and audits.

Transaction Information

The receipt must clearly state the nature of the transaction. This means that the product or service provided should be described, along with the quantity, price, and any applicable taxes. For donations or charitable contributions, the receipt should specify whether any goods or services were provided in exchange for the donation.

Compliance with Local Regulations

Make sure the tax receipt adheres to the tax laws specific to the jurisdiction. This includes ensuring that any applicable sales tax, VAT, or other taxes are properly calculated and displayed. A failure to comply can result in penalties or challenges when filing taxes.

One of the most frequent mistakes in receipt template design is overloading the layout with unnecessary information. Stick to the essentials: transaction details, product or service description, and the total amount. Keep your template clean and organized.

- Poor Font Selection: Using hard-to-read fonts can lead to confusion. Stick to simple, legible fonts like Arial or Times New Roman.

- Ignoring White Space: A cluttered receipt makes it hard for customers to find key information. Use margins and spacing to create a balanced, readable design.

- Inconsistent Formatting: Varying font sizes, colors, or text alignments can make your receipt look unprofessional. Maintain consistency across the document to enhance readability.

- Lack of Clear Branding: Your company’s name, logo, and contact details should be prominently displayed. Don’t bury them in small text or in hard-to-find places.

- Failure to Include Necessary Legal Information: Ensure that your template includes any legally required details, such as tax identification numbers or disclaimers. Not doing so could lead to compliance issues.

- Not Accounting for Tax Rates: Be clear about the tax rate applied to the transaction. Incorrect tax calculations or missing tax information could confuse customers and lead to disputes.

- Overcrowding with Extras: Avoid adding too many optional details like promotions or secondary information. Focus on what’s necessary for the transaction record.

- Using Poor Quality Graphics: Low-resolution logos or images can negatively impact the professionalism of your receipt. Ensure that graphics are sharp and clear, and avoid excessive imagery that distracts from the key information.

- Missing Contact Information: Always include your customer service phone number, email, or website address for inquiries or issues with the transaction.

By focusing on clarity and simplicity, you can avoid these common mistakes and create a more effective and professional receipt template.

Thus, the lines have become more diverse, but the meaning remains unchanged.

The recent shift in tax receipt templates reflects a change in format, yet the core purpose remains the same. What once was a simple document now includes more specific categories, such as itemized breakdowns and clearer explanations of fees. While the appearance has evolved, the fundamental goal of providing transparent and traceable financial information continues unchanged.

These updates ensure that both businesses and individuals can easily access, understand, and manage tax-related data. For example, new sections may clarify tax exemptions or deductions that were previously overlooked or ambiguous. This change helps in reducing errors during the filing process and increases overall clarity in tax reporting.

Despite the new design trends, the focus remains on compliance, accuracy, and accountability. Tax receipts are not just for record-keeping; they’re vital documents that contribute to smooth financial audits. This emphasis on precision reflects the ongoing need for clear documentation, irrespective of the stylistic changes introduced.