A well-structured furniture receipt ensures clear documentation of each transaction. It should include essential details such as the buyer’s and seller’s information, a detailed description of the furniture, payment terms, and date of purchase. Without these elements, disputes may arise, leading to unnecessary complications.

To create a clear and professional receipt, use a structured template. Include a unique receipt number for tracking, itemized furniture details with dimensions or materials, and the total cost, including taxes and discounts. If a warranty applies, mention its duration and conditions to avoid misunderstandings.

Digital and printable templates offer flexibility. A PDF format maintains consistency, while an editable document allows for quick adjustments. Choose a layout that highlights key details and keeps formatting clean for readability. A structured template streamlines transactions and enhances trust between buyers and sellers.

Here’s a refined version without redundant wording while preserving the meaning:

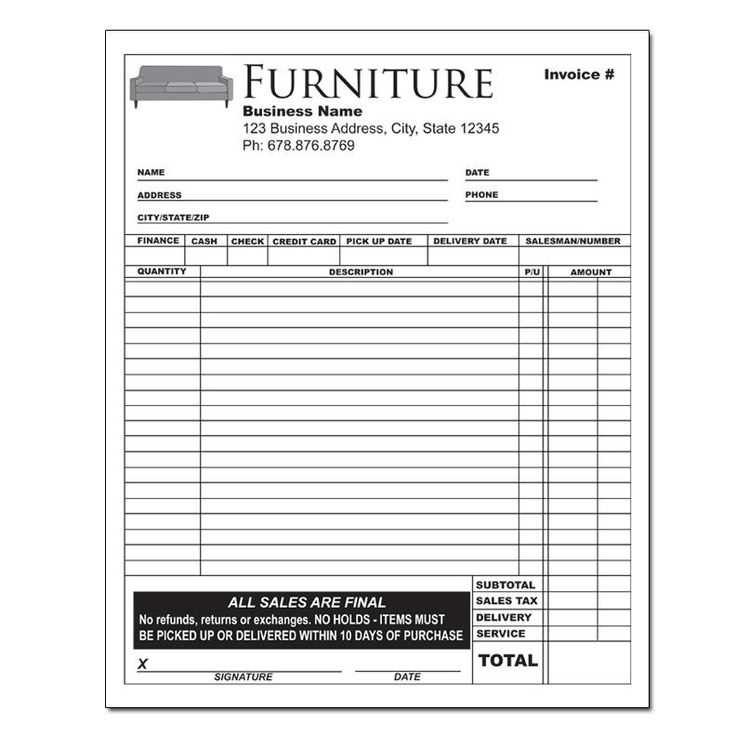

Use a clear and structured layout for furniture receipts to ensure readability and accuracy. Include these key elements:

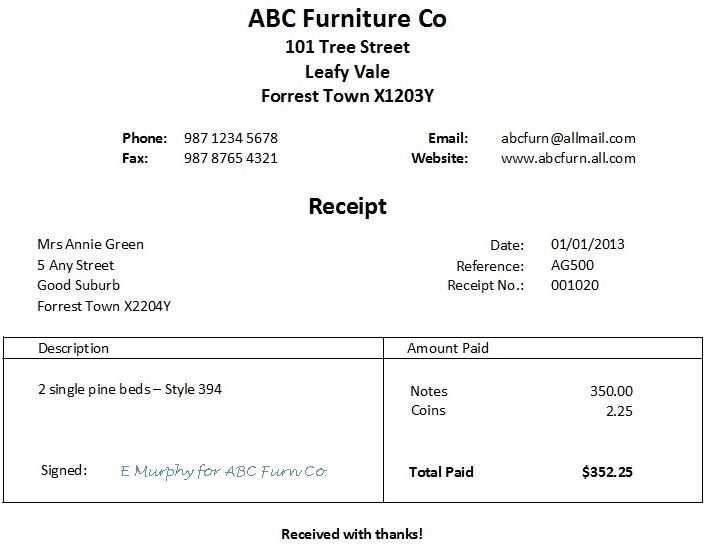

- Business Information: Name, address, contact details, and tax identification number.

- Customer Details: Name, address, and contact information.

- Receipt Number: Unique identifier for tracking and record-keeping.

- Transaction Date: Clearly state when the purchase was made.

- Itemized List: Describe each piece of furniture, including quantity, price per unit, and total cost.

- Payment Details: Specify the method (cash, card, transfer) and any installment terms.

- Taxes and Discounts: Break down applicable taxes and any applied discounts.

- Grand Total: Summarize the final amount due or paid.

- Terms and Conditions: Outline return policies, warranties, and other relevant agreements.

- Authorized Signatures: Spaces for signatures of both seller and buyer if required.

Keep the format simple and legible by using consistent fonts and spacing. Digital receipts should be easy to download and print, while paper receipts should use durable, fade-resistant ink.

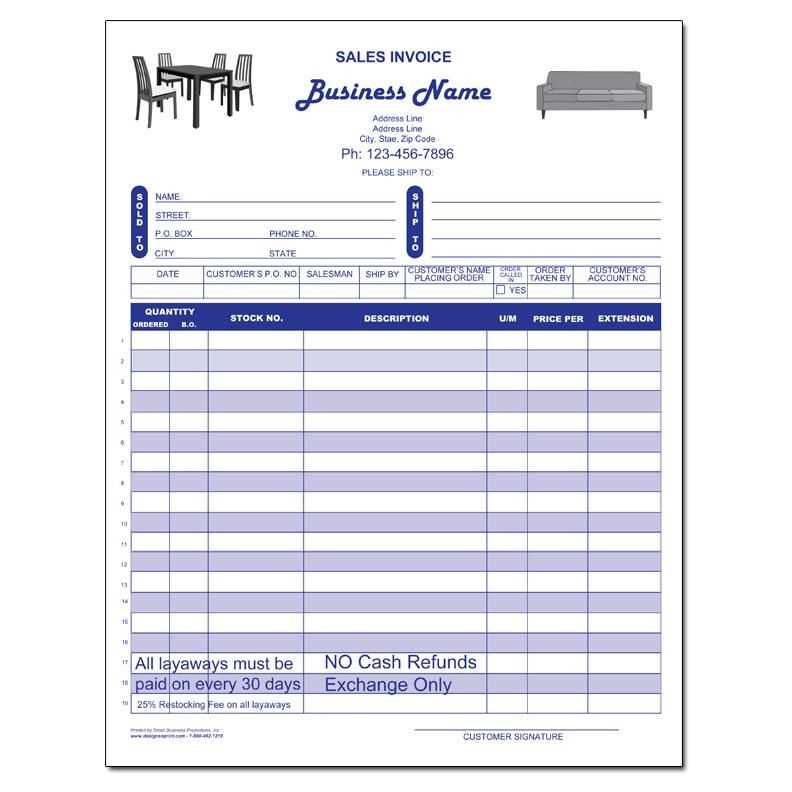

- Templates for Furniture Receipts

Choose a template that includes all key details: seller and buyer information, item descriptions, prices, payment method, and date. A structured format ensures clarity and prevents disputes.

| Template Type | Best For | Key Features |

|---|---|---|

| Basic Receipt | Simple transactions | Item list, price, total, date |

| Detailed Invoice | Business sales | Tax, discounts, buyer details |

| Handwritten Form | Personal sales | Customizable fields, signatures |

Use digital templates for professional presentation and easy storage. Printable versions work well for in-person transactions. Ensure every receipt includes a unique reference number for tracking.

A sales receipt template should include the following key elements to ensure clarity and accuracy in any transaction:

1. Business Information

The template must clearly display the business name, address, phone number, and email. This helps customers easily contact the business for any inquiries or follow-ups. Make sure to add the company logo for branding consistency.

2. Receipt Number and Date

Each receipt should have a unique number to avoid confusion in case of returns or audits. Including the date of purchase adds an additional layer of reference for both the business and the customer.

Including these details will streamline processes and build customer trust.

Customizing your purchase receipt can help make it more tailored to your business needs and customer expectations. Start by focusing on key details that are relevant for both you and your clients. Here’s how you can adjust your receipt for clarity and better presentation:

1. Include Business Information

Ensure that your receipt clearly displays your business name, address, phone number, and email. This helps customers get in touch with you easily if needed. You can also add your website URL if applicable.

2. Add Personalized Items

Incorporate specific items related to the purchased furniture, such as model numbers, colors, sizes, or styles. This ensures customers have all necessary details for their records. You can also customize the product descriptions to reflect any special features or benefits.

| Item | Description | Price |

|---|---|---|

| Wooden Coffee Table | Oak finish, 48×24 inches | $150 |

| Sofa Set | Leather, 3-seater, Grey | $750 |

This level of detail can make the receipt not only informative but also a reference for future interactions. It may also help resolve any potential confusion about the purchased items.

3. Provide Payment Methods

List the payment method(s) used by the customer–whether credit card, cash, or installment plan. If applicable, include transaction numbers, payment terms, and any applicable taxes. Clear payment records will benefit both you and the customer in case of returns or disputes.

The most practical formats for printable sales slips include PDF, Excel, and Word documents. Each has its advantages depending on your needs.

PDF Format

PDF files ensure the document appears the same across different devices. This format is ideal for official receipts that require a fixed layout. You can use free or paid tools to generate PDF sales slips with fields for product details, prices, and transaction data.

Excel Format

Excel sheets are perfect when you need to track multiple transactions, making it easy to update and calculate totals automatically. Custom templates for sales slips can be created, enabling automatic calculations of taxes and discounts.

Word Format

Word documents are flexible for businesses that prefer to customize each slip manually. You can design a template with spaces for all necessary details, such as item description, price, and customer info. This format also allows easy editing if changes are required.

- PDF: Best for fixed layouts and legal purposes

- Excel: Ideal for bulk sales and automatic calculations

- Word: Best for custom slip creation with flexibility

Transaction records must include specific details to comply with legal standards. Include clear identification of both buyer and seller, the date, and the agreed-upon terms. Make sure the record reflects the complete transaction amount, including taxes, fees, and any applicable discounts. Keep accurate descriptions of the items or services provided, ensuring no ambiguity in the details. Always use correct documentation for warranty or return policies if applicable. Retain copies of these records for a minimum period as specified by local laws, typically ranging from 3 to 7 years, depending on your region.

Ensure your system for storing records is secure, with accessible back-up methods in case of any data loss. Regularly review your practices to ensure they meet any updates in regulatory requirements. Penalties for failing to comply with these legal obligations can result in fines or legal complications, so it’s important to stay informed and maintain meticulous records.

Digital templates offer flexibility and quick updates. You can edit, share, and store them easily, ensuring your documents are always up-to-date. Paper templates, however, provide a tangible form that some users still prefer for physical records. These templates may require manual filing and are more prone to wear and tear over time.

Using digital templates allows for automatic calculations, reducing human error. In contrast, paper forms rely on manual data entry, which can increase the chances of mistakes. Digital templates can also integrate with inventory systems, providing real-time updates and easy access to past purchase records.

For those who prefer physical copies, paper templates work well for in-person transactions. On the flip side, digital templates are best suited for businesses that deal with a high volume of purchases, as they streamline the process and improve accuracy. It’s important to choose based on your specific needs, considering both accessibility and long-term convenience.

Ensure that all details on the sales receipt are accurate. Missing or incorrect information can cause confusion and even disputes. Verify that the item description matches what was sold, and double-check prices and totals. It’s also crucial to include the correct tax amount if applicable.

Inaccurate Item Descriptions

One common mistake is using vague or incorrect descriptions for items. Always use clear, precise terms to describe each product or service. If necessary, include model numbers, color details, and other distinguishing characteristics to avoid ambiguity.

Omitting Contact Details

Don’t forget to include the business’s contact information. This should include the address, phone number, and email. Missing contact details can make it difficult for customers to reach you in case of an issue or return.

To create a clear and useful furniture receipt template, follow these simple steps:

- Start with the basic details: Include the date, name of the buyer, seller, and the description of the furniture item(s).

- Specify the condition: Clearly state whether the items are new, used, or refurbished, with any important remarks about wear and tear.

- Itemize the prices: Break down each piece, listing the price individually, along with any discounts or taxes that apply.

- Include payment information: Note the payment method (e.g., cash, card, installment plan) and any payment terms, if applicable.

- Provide return policy: Briefly outline any conditions for returns, exchanges, or warranties on the items purchased.

- Offer space for signatures: Leave space for both buyer and seller to sign, acknowledging the transaction details.