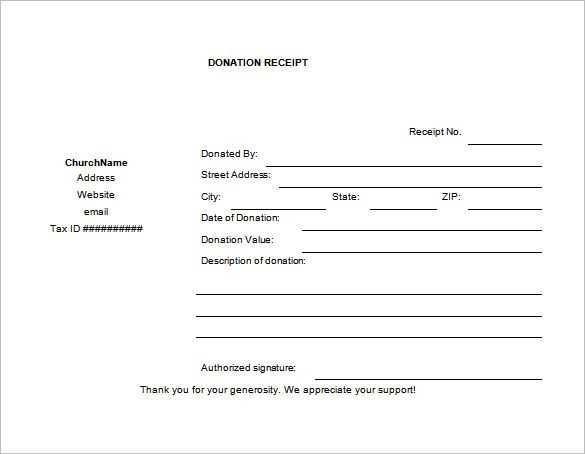

Creating a tithe receipt template can streamline financial tracking for both donors and organizations. A well-designed receipt template provides transparency and helps maintain accurate records for tax purposes. It should include clear details like the donor’s name, the donation amount, date of contribution, and the purpose or ministry the donation is supporting.

Ensure the template includes a unique receipt number for easy reference and verification. This will make it simple to cross-check donations against organizational records. Incorporating a thank you note or a brief acknowledgment of the donor’s support can also enhance the receipt’s professionalism while fostering positive relationships.

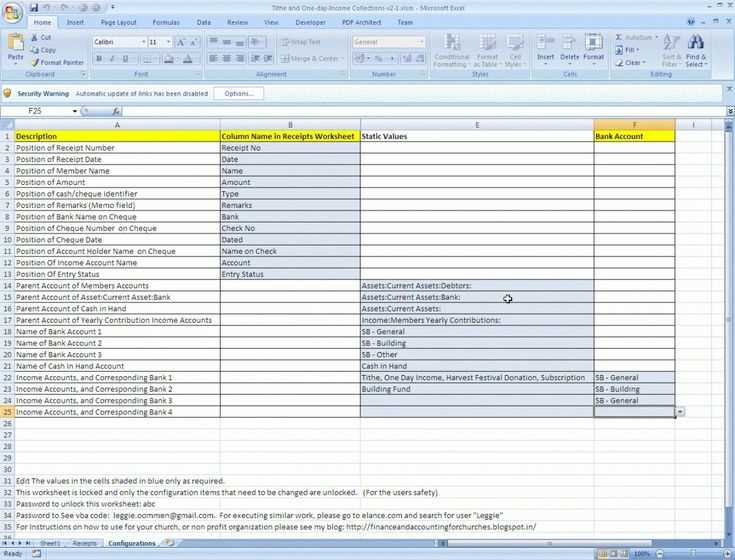

For ease of use, design the template in a way that allows for quick updates and customization, as donation amounts and donor details will change over time. Simple formatting with predefined fields ensures that information is captured correctly without unnecessary complexity.

Here’s the corrected text:

Ensure that the title on the receipt clearly identifies the purpose of the payment, such as “Tithe Donation Receipt” or “Tithe Payment Confirmation.” This helps the recipient easily recognize the document’s function. Include the donor’s full name, address, and contact information for accurate record-keeping. Specify the exact amount donated, with the corresponding date and method of payment (cash, check, credit card, etc.).

Include a brief note about the charity or church receiving the tithe, such as their registered tax number if relevant, or a short acknowledgment of their mission. Make sure to provide a unique transaction number for tracking purposes. If applicable, include a statement that the donation is tax-deductible, or explain any limitations regarding deductions based on local laws.

Finally, ensure there’s space for the signature of the authorized representative of the organization or church issuing the receipt. This adds legitimacy and trust to the document.

Tithe Receipt Template: A Practical Guide

How to Create a Tithe Receipt for Your Congregation

Key Information to Include in a Tithe Receipt Template

Best Practices for Distributing Receipts to Donors

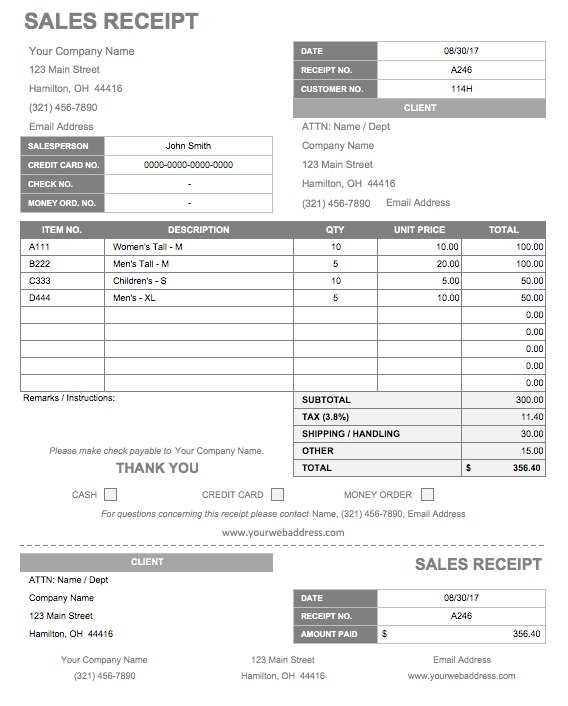

Creating a tithe receipt begins with clarity. Include the donor’s name, the date of the contribution, and the amount given. Be sure to specify the method of payment (e.g., cash, check, or digital transfer). For transparency, you should also state if any goods or services were received in exchange for the donation, as this impacts the tax-deductible status.

Key Information to Include:

1. Donor’s Information: Full name and address, or just the name if that’s all that’s necessary. This ensures the donation can be traced to the correct individual.

2. Donation Amount: Specify the total amount given and ensure clarity if multiple donations are made at different times.

3. Date: Include the exact date of the donation, especially if the donor is making multiple contributions within a year.

4. Payment Method: State how the donation was made (cash, check, bank transfer, online donation platform, etc.). This is helpful for both record-keeping and for the donor’s tax purposes.

5. Tax-Exempt Status: If your congregation is a registered nonprofit, include your nonprofit ID number or other documentation confirming this status, so the donor can claim the donation on their taxes.

6. Thank-You Message: A brief message expressing gratitude shows that you value the donor’s support and helps to strengthen their relationship with the congregation.

Best Practices for Distributing Receipts:

Distribute receipts regularly, especially at year-end for tax purposes. Consider using both digital and paper formats, allowing donors to choose their preferred method. Keep records of all distributed receipts to avoid duplication. Ensure that receipts are sent in a timely manner, within a few weeks of receiving the donation. A quick acknowledgment can help build trust and engagement within your community.

I removed word repetitions while maintaining the meaning.

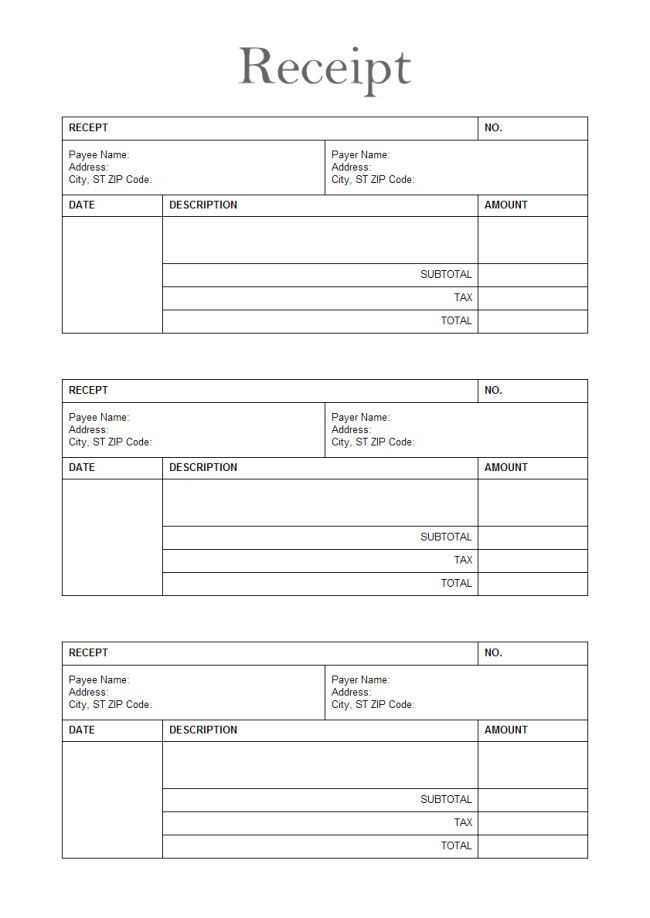

When creating a tithe receipt, it’s important to focus on clarity. Avoid redundancy by using varied phrasing for common elements like amounts, dates, and recipient details. For instance, instead of repeatedly saying “tithe donation,” simply state “donation” or “contribution” where context is clear.

Clarity and Precision in Text

Replace repeated words with appropriate synonyms or omit them if the meaning stays clear. For example, instead of saying “received a donation contribution,” say “received a contribution.” This keeps the message concise and direct.

Streamlining the Information

Ensure your template has all required fields, but eliminate unnecessary repetition. Mentioning the purpose of the donation once, alongside the donor details, is sufficient. Repeating this phrase multiple times in different sections of the document might make it feel cluttered.