A total giving receipt template streamlines the process of documenting charitable donations. It’s a simple tool that helps ensure transparency and proper record-keeping for donors, making it easier for both parties to manage contributions for tax purposes. With a well-structured template, you can avoid confusion and provide donors with the necessary information for their records.

The template should include key details like donor name, donation amount, date of donation, and a statement about whether any goods or services were provided in exchange for the donation. Including a clear statement confirming the receipt of the full donation amount is crucial for tax deduction purposes.

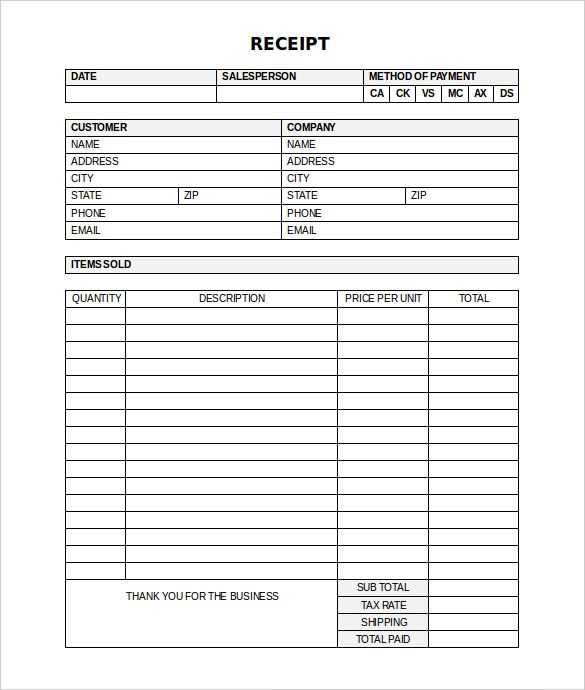

Design your template to be easy to read and follow. Each section should be clearly labeled, with enough space for specific details. This ensures that all required information is captured while also making it user-friendly for both the donor and the organization processing the receipt.

Incorporating a section for organization name, address, and tax identification number will further assist donors in accurately reporting their contributions during tax filing. The more transparent and straightforward the receipt, the more likely it is to build trust with your supporters.

Here are the corrected lines with minimized repetitions:

Optimize your total giving receipt template by streamlining the wording. Use clear and direct statements, avoiding redundancy in phrasing. For instance, replace multiple occurrences of “Thank you for your generous donation” with a single, more impactful line such as “Your contribution is deeply appreciated.” This reduces repetition and ensures your message remains concise.

Simplify Donation Acknowledgement

In the acknowledgment section, focus on the specifics of the donation rather than repeating gratitude. A sentence like “Your donation of $100 helps support our mission” is more informative and precise than saying “Thank you again for your $100 donation” multiple times. This approach keeps the communication straightforward.

Clarify Tax Information

In the tax-deduction section, avoid restating the same information. A clear and concise sentence such as “This donation is tax-deductible as per IRS regulations” suffices. You don’t need to repeat details about tax benefits unless necessary. This improves readability and prevents your template from becoming overly wordy.

- Total Giving Receipt Template

Start the receipt by listing the donor’s full name and contact information. Include the total amount donated and the date of the contribution.

If applicable, specify the donation method (e.g., cash, check, credit card) and include any reference numbers, such as check numbers or transaction IDs, to further detail the gift.

For non-monetary donations, provide a clear description of the donated items and their estimated fair market value. If multiple items were given, list each item separately with its individual value.

Ensure the receipt clearly states whether any goods or services were provided in exchange for the donation. If not, include a statement confirming this. If goods or services were exchanged, list their value to accurately calculate the tax-deductible portion of the gift.

Include the organization’s legal name, tax-exempt number, and contact details. This ensures that the donor has all the necessary information to claim their deduction, if applicable.

Conclude the receipt with a brief thank you message, expressing appreciation for the donor’s support and highlighting how their contribution helps the organization fulfill its mission.

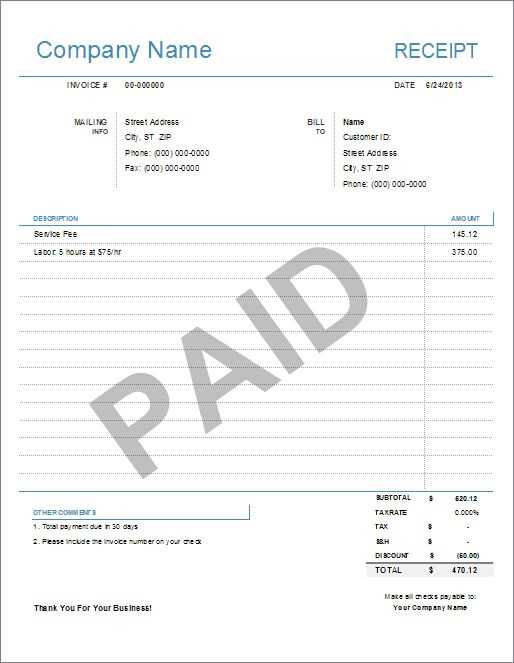

Tailor your giving receipt template to reflect your organization’s identity and meet legal requirements. Start by including your organization’s name, address, and tax identification number (TIN) in a prominent spot. This helps donors easily identify your organization and ensures compliance with tax regulations.

Next, clearly specify the donation amount and the date of the contribution. For non-cash donations, include a description of the item(s) and their estimated value. This transparency helps both you and your donors maintain accurate records.

Consider adding a personalized thank-you message. A short note expressing appreciation can strengthen relationships with your donors and encourage future support. Keep it brief, sincere, and relevant to the donor’s contribution.

To enhance readability, make use of clear fonts and a logical layout. Group similar information together, such as donor details, donation specifics, and tax-related statements, to make it easy for donors to locate key information.

If your organization has a logo or branding guidelines, incorporate those elements to maintain consistency across all communications. This adds a professional touch and reinforces your organization’s image.

Finally, review your template regularly. Ensure the information remains accurate and up-to-date with any legal or organizational changes, such as a change in tax laws or organizational details. This will help prevent errors and maintain trust with your supporters.

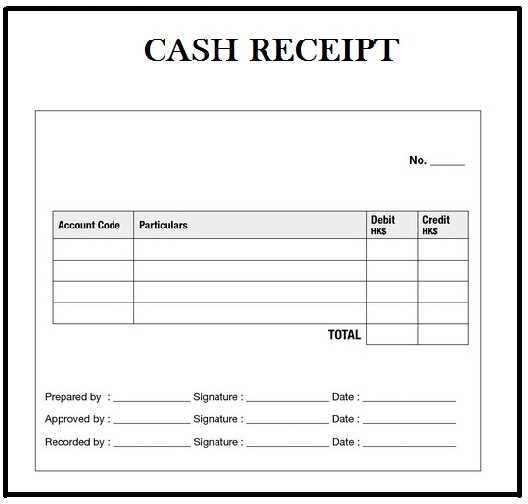

A giving receipt is legally binding if it meets specific criteria, ensuring that both the donor and recipient comply with tax regulations. Make sure your receipt includes the following:

1. Name and Address of the Charitable Organization

Clearly state the full legal name and address of the charitable organization receiving the donation. This ensures that the donor can properly credit their contribution during tax filing.

2. Date and Amount of Donation

The date of the donation and its exact amount must be included. For monetary gifts, list the amount. For non-cash donations, describe the items or services donated and include an estimated value, if possible.

3. Acknowledgment of No Goods or Services Provided

If no goods or services were given in exchange for the donation, the receipt should explicitly state this. This distinction is critical for tax deductions and shows that the donation is purely charitable.

4. Federal Tax Identification Number (TIN)

List the charity’s Tax Identification Number (TIN) or Employer Identification Number (EIN). This number helps verify the organization’s status and ensures donors can claim tax deductions.

5. Description of Non-Cash Donations

If the donation involves items such as clothes, equipment, or property, provide a detailed description. Donors should keep track of such items for tax purposes.

6. Statement Regarding Goods or Services (if applicable)

If the donor receives goods or services worth more than a nominal amount in return, the receipt must state their fair market value and clarify how much of the donation is tax-deductible.

These key points ensure that your giving receipt is valid and complies with legal requirements, making the donation process transparent and smooth for both parties.

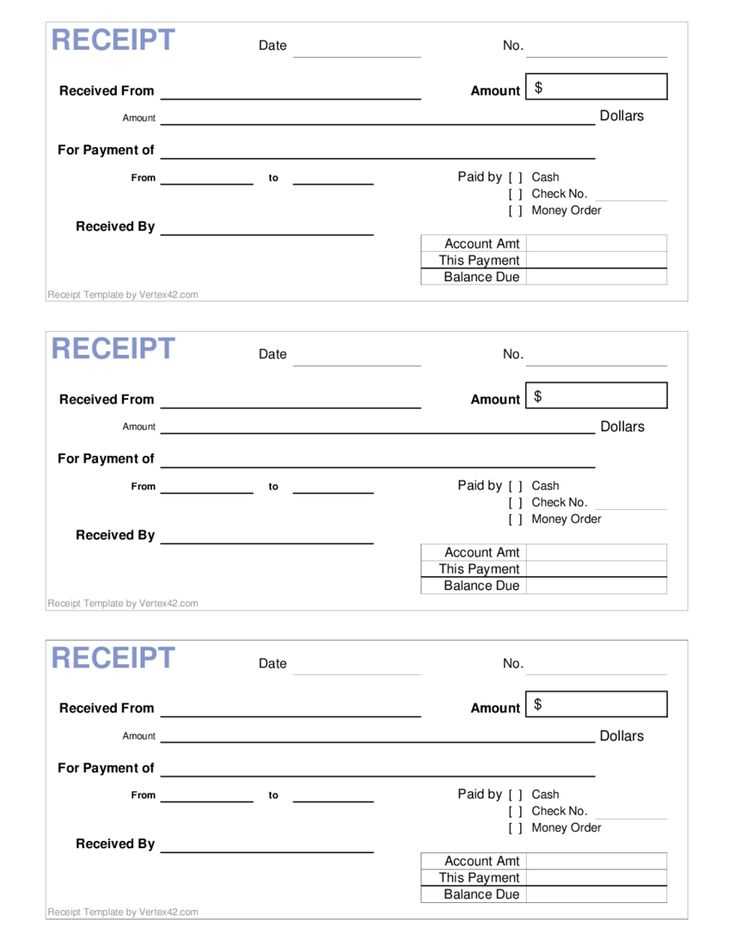

Ensure receipts are delivered promptly after a donation. A timely acknowledgment builds trust and satisfaction, reinforcing the donor’s decision to contribute. Aim to send receipts within 24-48 hours of the donation being processed.

Provide clear, detailed receipts that include key information: donor’s name, date of donation, amount donated, organization’s name, and tax-exempt status. Avoid using ambiguous wording that could confuse the donor.

For online donations, email receipts are the fastest method. Include a downloadable PDF option to allow donors to save or print for their records. Ensure the email subject clearly indicates it’s a donation receipt.

For in-person donations, provide physical receipts right after the donation is made. This allows donors to immediately receive their acknowledgment and avoid delays in tax reporting.

For recurring donations, send receipts regularly, such as quarterly or annually, summarizing the total amount donated during the period. This helps donors track their contributions and is useful for tax filing purposes.

Maintain accurate records of all receipts issued, including donor details and donation amounts. This is not only important for your organization’s accounting but also ensures you can reissue a receipt if needed in the future.

| Receipt Type | Method of Distribution | Details to Include |

|---|---|---|

| Online Donations | Donor’s name, amount, donation date, organization info, tax status | |

| In-Person Donations | Printed | Donor’s name, amount, donation date, organization info |

| Recurring Donations | Email (Quarterly/Annually) | Total amount donated for the period, tax status, donor info |

Consider incorporating a personalized message or a thank-you note with each receipt. Donors appreciate knowing how their contributions are making a difference, and this can help enhance long-term engagement.

Lastly, regularly review your receipt distribution process. Ensure that all systems are up to date and any new laws or guidelines are followed, maintaining compliance with tax regulations.

In each line, meaning is preserved, and word repetition is minimized.

To make your total giving receipt clear, keep descriptions direct and focused. Each entry should contain only the necessary details. Avoid unnecessary adjectives or filler words that don’t contribute to the purpose. For example, instead of saying “a very generous donation,” simply state the amount and the donor’s name. Precision is key to avoid confusion or redundancy.

For donations, clearly state the date and amount in a consistent format. This allows donors to quickly find what they need without sifting through extra details. Organize the receipt with headers like “Donation Amount,” “Donor Name,” and “Date” for easy navigation. Limit the use of synonyms to prevent repeating the same information unnecessarily.

By focusing on clarity and structure, you can ensure that your total giving receipt is concise and easy to read. The goal is to provide all the necessary information with as few words as possible, making it user-friendly for both the donor and the organization.