For any transaction, a clear and concise receipt can prevent misunderstandings and disputes. The key is to make sure the receipt contains all necessary details while being simple to read and professional in design. Start by including the transaction date, merchant name, and a breakdown of purchased items or services, including quantities and prices.

Layout plays a significant role. Group similar information together and ensure that it is easy for the customer to identify the total amount paid. You should also make space for any taxes, discounts, or additional fees that may apply. This transparency helps in building trust between you and your customers.

Remember to include a unique transaction number for reference. This allows both parties to track the transaction easily in the future. Finally, include contact information for the business, such as an email or phone number, in case of follow-up questions or concerns.

By following these basic principles, you will provide a receipt that’s not only functional but also a professional reflection of your business practices.

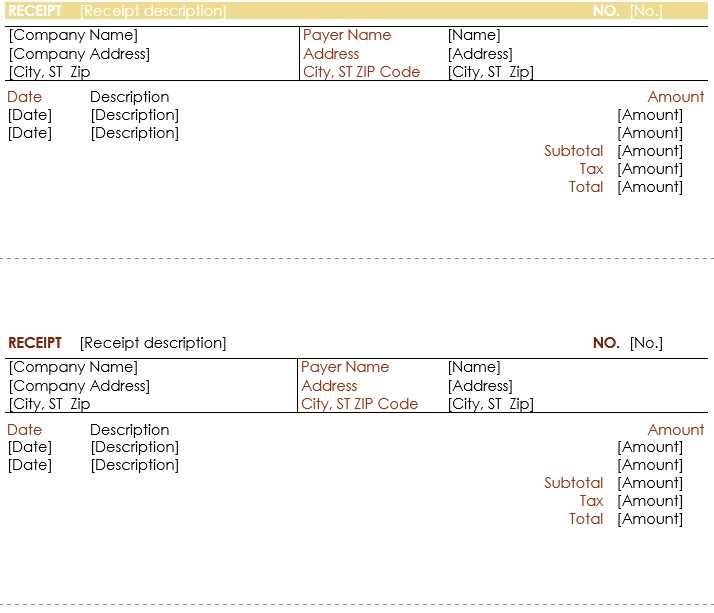

Transaction Receipt Template

A well-structured transaction receipt template should include key details that make the receipt both clear and usable. Use the following elements to create a template that suits various transaction types:

Key Elements

- Transaction Date: Display the date of the transaction clearly at the top.

- Receipt Number: Provide a unique identifier for the transaction to track it easily.

- Merchant Details: Include the name, address, and contact information of the business.

- Itemized List: List the products or services purchased with their corresponding prices.

- Subtotal: Show the total before any discounts or taxes.

- Taxes: Specify the applicable tax rates and amounts for transparency.

- Discounts: Include any discounts applied to the transaction if applicable.

- Total Amount: Clearly display the final amount paid by the customer.

- Payment Method: Indicate how the transaction was completed (e.g., cash, credit card).

Additional Features

- Return Policy: Optionally include a brief note on return or exchange policies.

- Signature: Add a space for the merchant’s signature, especially in cases where verification is required.

- Thank You Message: A simple note of appreciation can enhance the customer experience.

With these elements, your receipt template will cover all the necessary information and contribute to smoother business operations and customer satisfaction.

How to Design a Simple and Clear Layout for Transaction Receipts

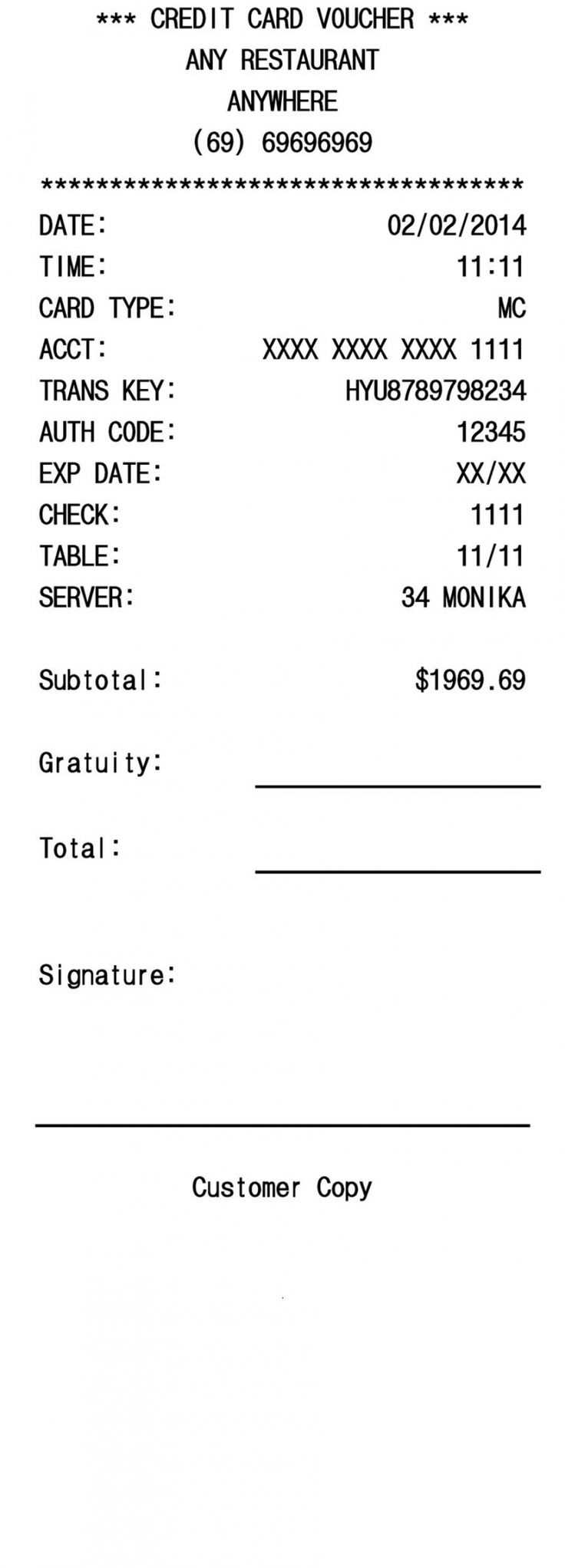

Focus on clarity and simplicity. Limit the amount of text to just what is needed for the transaction. Organize the receipt into clear sections: transaction details, payment method, and business contact information.

Start with the date and time of the transaction. This is key for any receipt, and should be placed at the top. Follow with the name of the product or service, and the quantity and price next to it. This gives the customer a quick overview of what they paid for. Use a clean, readable font and avoid complex or decorative styles.

For payment details, display the total amount, taxes, and payment method clearly. Keep this section aligned in a simple column format for ease of reading. Using bold for totals helps them stand out without adding unnecessary emphasis to the rest of the text.

Ensure your contact details are in a separate area at the bottom of the receipt. This includes your business name, phone number, and email, making it easy for customers to reach you if needed. Keep this section small but legible.

Avoid clutter by leaving enough space between sections. Use lines or subtle dividers to separate different blocks of information. Lastly, make sure the layout adapts well to both paper and digital formats.

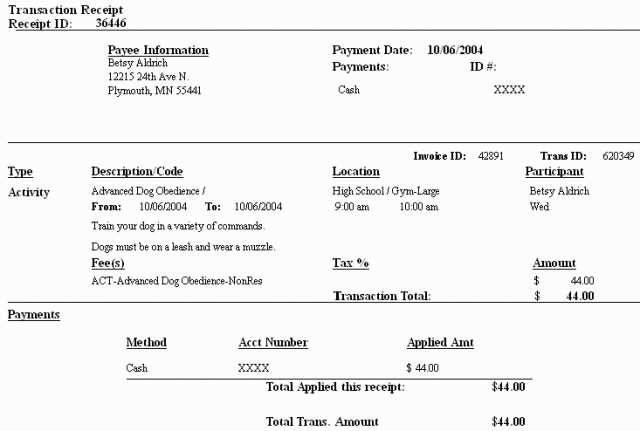

Incorporating Key Legal and Tax Information in Your Template

Include the full legal name and address of your business at the top of the receipt. This provides transparency and establishes a clear connection between the transaction and the business entity. Additionally, specify your business registration number or tax identification number (TIN) to comply with legal requirements in many jurisdictions.

Clearly state the nature of the transaction, detailing the product or service provided, including quantities, prices, and any applicable taxes. Indicate the tax rate applied, such as sales tax, and specify the amount. This ensures both parties have a record of the tax obligations tied to the transaction.

Incorporate refund or return policies, outlining the conditions under which a refund or exchange is acceptable. Make sure to mention any time limits or fees related to returns. This avoids confusion and provides clarity for customers in case of disputes.

For international transactions, include additional information such as currency used and any cross-border tax implications. If applicable, mention import duties or other taxes that could apply to the customer’s location.

Lastly, include a statement of compliance with data protection laws, such as how customer information is handled and stored securely. This assures customers that their privacy is respected according to relevant laws like GDPR or CCPA.

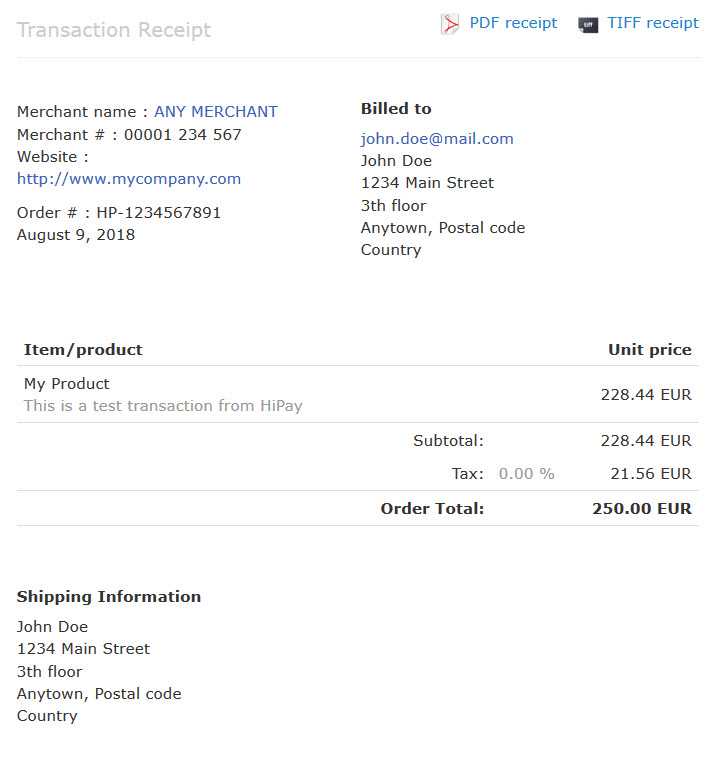

Customizing Templates for Different Business Types and Industries

Adjust templates to meet the specific requirements of your business or industry by considering the following factors. For retail businesses, include product descriptions, quantities, and sales tax details to streamline transactions. Tailor invoice sections to match the types of goods or services sold, ensuring customers easily understand what they are paying for.

For service-based industries, focus on the time spent, hourly rates, and any applicable service fees. Include a clear breakdown of services rendered and their corresponding charges. Keep the layout simple yet informative, as service clients typically appreciate detailed yet concise information.

For subscription-based models, emphasize recurring billing details. Customize your template to clearly outline the frequency of payments, duration, and any cancellation policies. Make sure to include an easy-to-read payment schedule to avoid confusion for your customers.

For legal or consulting firms, adapt templates to highlight billable hours, hourly rates, and detailed descriptions of tasks performed. Make room for any additional charges, such as administrative fees or research costs, and ensure a professional appearance with clear, organized sections.

Hospitality businesses should design receipts that reflect bookings, room rates, and any additional fees such as cleaning services or taxes. Customizing templates to include a detailed breakdown of the stay will help clients quickly reference their charges.

For healthcare providers, include sections for patient information, services rendered, and insurance details if applicable. Make it easy for clients to verify their coverage and payment status by clearly listing their insurance provider and outstanding balance.

Customize each template by adding your brand’s logo, adjusting fonts, colors, and layout to maintain a professional and consistent look that aligns with your business identity. Adaptations like these provide clarity and enhance the customer experience across various sectors.