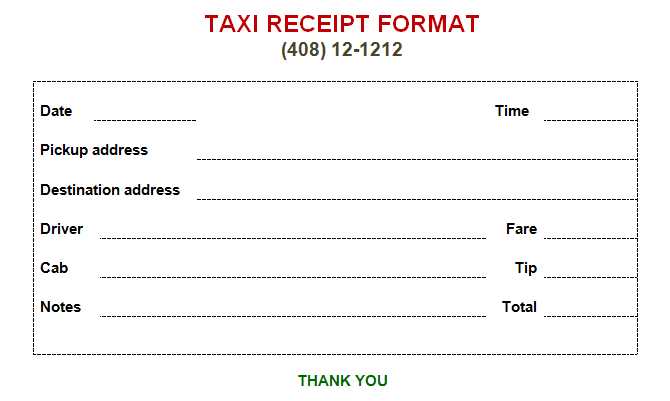

Use a structured trip receipt template to keep expense tracking simple. A well-designed format helps organize transportation costs, accommodation fees, and other travel-related expenses without confusion. Ensure every detail, from date and amount to payment method, is clearly documented.

Include essential details: Date of travel, names of travelers, destinations, itemized costs, and total amount paid. A dedicated section for payment confirmation, such as cash, card, or reimbursement status, prevents misunderstandings.

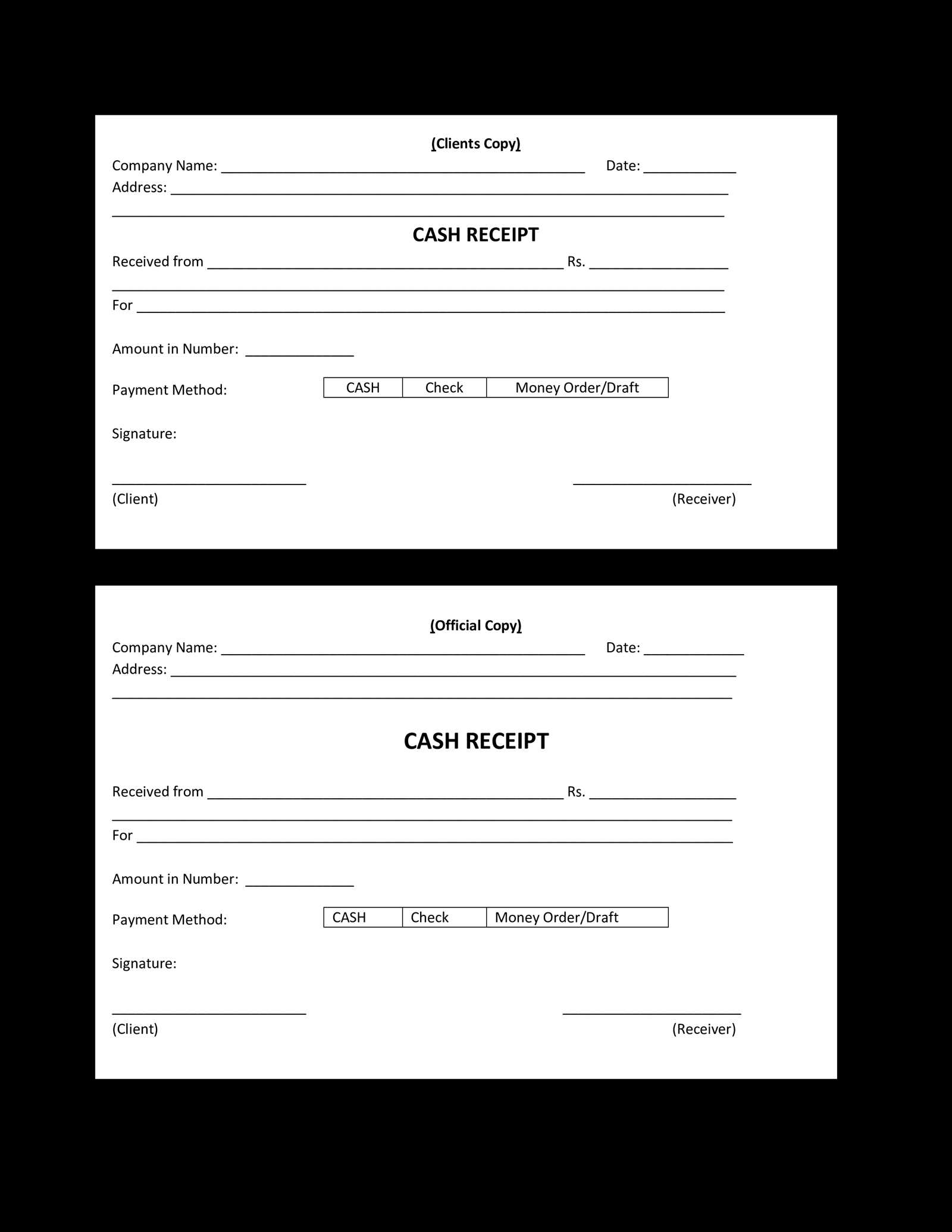

Choose a format that suits your needs: Printable PDFs work well for official records, while spreadsheets allow easy adjustments. Digital templates with auto-calculations streamline expense reporting, reducing manual entry errors.

For added convenience, customize the layout with company branding or personal notes. A clear, professional receipt enhances credibility, ensuring smooth financial reporting for personal and business travel.

Trip Receipt Template: A Comprehensive Guide

Use a structured receipt to simplify expense tracking and reimbursement. Ensure the document includes all necessary details, such as travel dates, costs, and payment information.

Key Elements of a Trip Receipt

A clear and well-formatted receipt should contain the following details:

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for record-keeping |

| Date of Travel | Departure and return dates |

| Traveler’s Name | Full name of the person or company representative |

| Destination | City or location of the trip |

| Expense Breakdown | List of costs, including transportation, accommodation, and meals |

| Payment Method | Credit card, cash, or company account |

| Issuer Details | Company name, contact information, and tax ID if applicable |

Best Practices for Accuracy

Ensure each receipt includes itemized expenses to prevent discrepancies. Verify dates, payment confirmation, and legibility. If digital receipts are used, store them in a secure and accessible location for future reference.

A well-documented receipt helps streamline financial reporting and minimizes disputes. Standardize templates within your organization to maintain consistency across all records.

Key Components to Include in a Travel Expense Receipt

Date and Time: Specify the exact date and time of the transaction to ensure clarity for record-keeping.

Business Name and Contact Information: Include the name, address, and phone number of the vendor or service provider. This confirms the legitimacy of the expense.

Traveler’s Name: List the individual’s full name, especially if the receipt is used for reimbursement or tax purposes.

Detailed Description of Expenses: Break down costs such as transportation, lodging, meals, or other travel-related purchases. Each item should be clearly labeled.

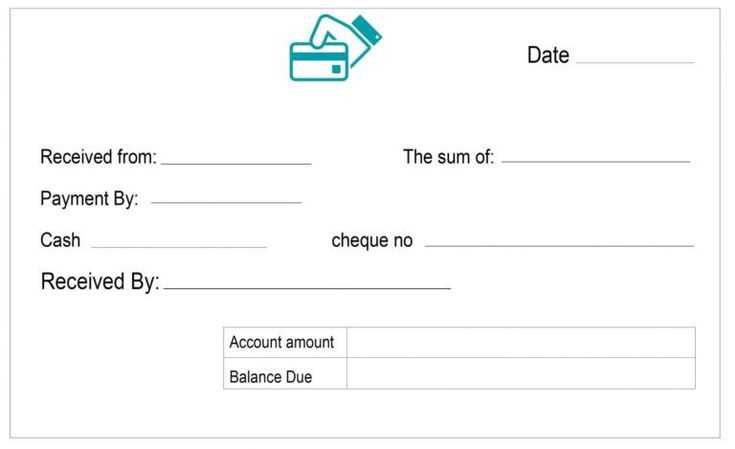

Payment Method: Indicate whether the payment was made via credit card, cash, or another method. If a card was used, include the last four digits for reference.

Subtotal, Taxes, and Total Amount: Display a clear breakdown of the base cost, applicable taxes, and the final total.

Currency: Mention the currency used for the transaction to avoid confusion in international travel records.

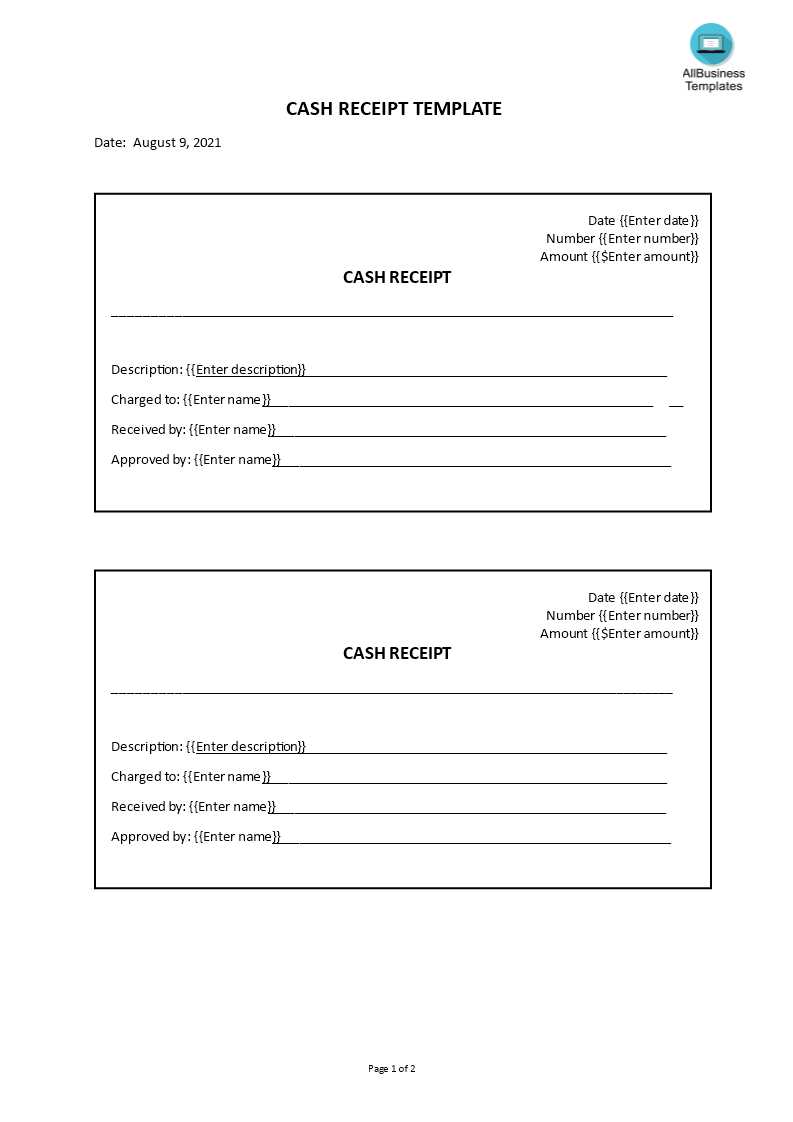

Unique Receipt Number: Assign a reference number for tracking and verification.

Company Policy Notes (if applicable): If the receipt aligns with corporate travel policies, include a brief note confirming compliance.

Signature or Stamp (if required): Some receipts may require an official stamp or signature to be valid for reimbursement.

Formatting Guidelines for Clear and Professional Documentation

Use a consistent font size and style throughout the document. Stick to easy-to-read fonts like Arial or Times New Roman, keeping the size between 10pt and 12pt for body text.

Maintain Logical Structure

Organize sections with clear headings and subheadings. Keep paragraphs concise, limiting each to a single idea. Use bullet points or numbered lists when presenting multiple items.

Ensure Proper Alignment and Spacing

Align text to the left for readability. Use adequate spacing between sections and paragraphs to avoid clutter. Keep margins uniform to maintain a clean appearance.

Highlight key details using bold or italics sparingly. Avoid excessive capitalization or underlining, as they can reduce readability. Use tables for structured data instead of long text descriptions.

Common Mistakes to Avoid When Creating a Trip Receipt

Omitting essential details makes a receipt useless. Always include the trip date, time, total cost, payment method, and service provider’s name. Without these, tracking expenses becomes difficult.

Inconsistent formatting leads to confusion. Align text properly, use clear headings, and maintain uniform spacing. A well-structured receipt improves readability and avoids misunderstandings.

Failing to specify the purpose of charges can cause disputes. Break down costs, such as fares, tolls, or additional fees, so recipients understand what they paid for.

Skipping unique identifiers creates problems in record-keeping. Add a receipt number to make retrieval easier and prevent duplicate submissions.

Using vague or unclear descriptions results in errors. Avoid generic labels like “Service Fee” without context. Provide clear explanations to ensure accuracy.

Neglecting to double-check calculations leads to discrepancies. Verify all amounts before issuing the receipt to prevent overcharges or missing expenses.

Forgetting contact information makes follow-ups difficult. Include a phone number or email so customers can reach out if needed.

Ignoring local tax regulations can cause compliance issues. Apply the correct tax rates and mention them separately to maintain transparency.

Digital vs. Paper Templates: Choosing the Right Format

Choose a digital template if you need fast access, automated calculations, and seamless sharing. A paper version works better when a physical copy is mandatory or preferred for record-keeping.

When Digital Works Best

Use digital templates for expense tracking, instant backups, and integrations with accounting software. Apps and spreadsheets minimize errors, offer customization, and ensure receipts remain readable over time.

When Paper is the Right Choice

Some businesses require printed receipts for compliance or signatures. If your workflow relies on handwritten approvals or physical documentation, a structured paper template ensures clarity and standardization.

Hybrid approaches also exist–fill out receipts digitally, then print when needed. The best option depends on how you store, share, and process trip records.

Customization Options for Different Business and Personal Needs

Tailoring a trip receipt to fit specific requirements starts with defining the key details. Businesses may need branded templates with company logos, tax identification numbers, and structured itemization, while personal receipts might focus on simplicity and clarity.

Branding and Formatting

Incorporating a company logo and adjusting fonts, colors, and layout creates a professional appearance. Adding a unique reference number improves tracking, and digital signatures enhance authenticity.

Itemization and Cost Breakdown

For expense reports, including fields for date, service description, mileage, and taxes ensures clarity. If the receipt covers multiple expenses, a structured table with subtotals and totals improves readability.

Personal receipts benefit from a simplified format with essential details, such as names, amounts, and payment methods. Adding optional notes helps clarify expenses, making records easier to understand.

Verification and Compliance Considerations for Reimbursement

Ensure the accuracy of all information provided in trip receipts to prevent delays in reimbursement. Double-check that every entry, such as dates, amounts, and purpose of expenses, aligns with your company’s policies. All expenses must be justified with corresponding receipts or invoices. If any discrepancies arise, be prepared to provide additional documentation or clarification.

Document Verification

- Ensure that each receipt is legible, displaying clear details like merchant name, date, and total cost.

- Only include expenses directly related to business activities and avoid personal items.

- Confirm that amounts match the reported figures. Any missing or unclear information should be clarified before submission.

Compliance with Company Policies

- Verify that all expenses adhere to the company’s reimbursement guidelines, which may include travel class limits, meal allowances, and acceptable purchase categories.

- Reimbursements for non-compliant expenses may be rejected, so check the company’s reimbursement policy regularly for updates.

- Ensure the trip purpose aligns with the reported expenses. Misclassification of expenses can result in rejection.

Finally, submitting timely receipts that follow these guidelines will help streamline the reimbursement process and reduce the chance of complications.